Form 540 ES Download Fillable PDF or Fill Online Estimated 2021

Understanding the CA Franchise Tax Board Estimated Taxes Form 580

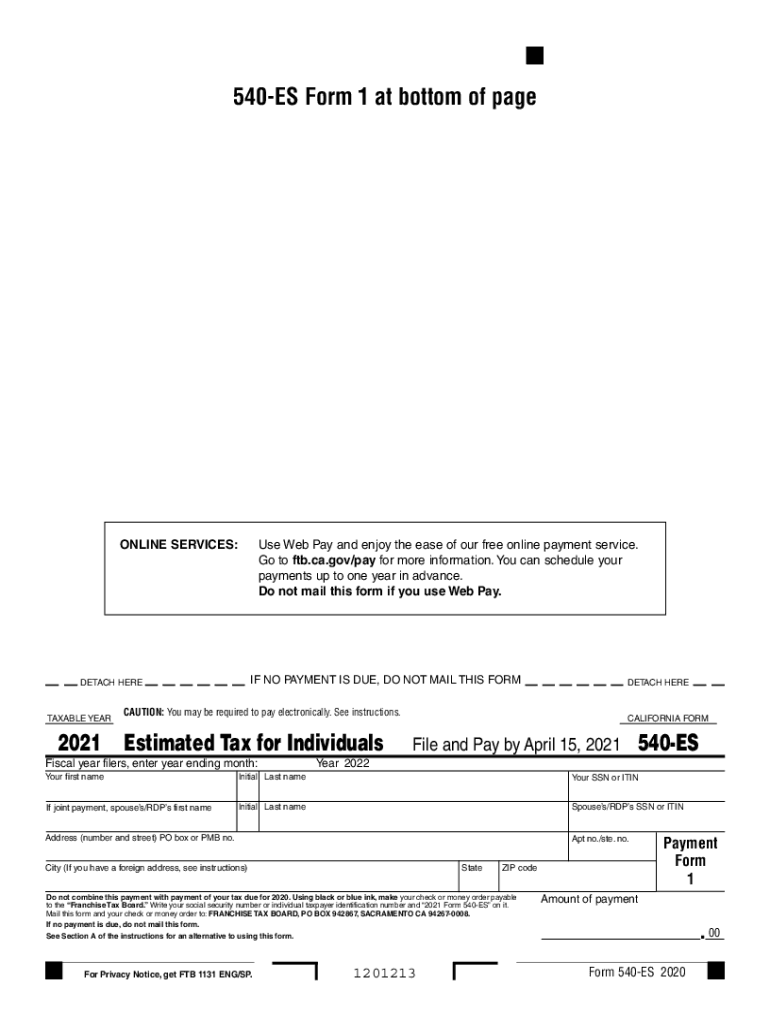

The CA Franchise Tax Board Estimated Taxes Form 580 is designed for individuals and businesses in California to report and pay estimated state income taxes. This form is essential for taxpayers who expect to owe tax of five hundred dollars or more when they file their annual tax return. By submitting Form 580, taxpayers can avoid penalties and interest that may arise from underpayment of taxes throughout the year. It is important to ensure that the information provided is accurate and reflects the taxpayer’s income and deductions appropriately.

Steps to Complete the CA Franchise Tax Board Estimated Taxes Form 580

Completing the Form 580 involves several steps to ensure accuracy and compliance. First, gather all necessary financial documents, including income statements and prior year tax returns. Next, calculate your expected income for the current tax year and determine your estimated tax liability based on California tax rates. Once you have this information, fill out the form by entering your personal details and estimated tax amounts. Review the completed form for any errors before submission. Finally, choose your preferred method for payment, whether online, by mail, or in person.

Filing Deadlines for the CA Franchise Tax Board Estimated Taxes Form 580

It is crucial to be aware of the filing deadlines associated with Form 580 to avoid penalties. Generally, estimated tax payments are due on the 15th day of April, June, September, and January of the following year. If these dates fall on a weekend or holiday, the due date is moved to the next business day. Taxpayers should mark their calendars to ensure timely submissions and payments, as failure to meet these deadlines may result in additional fees or interest charges.

Legal Use of the CA Franchise Tax Board Estimated Taxes Form 580

The legal validity of the Form 580 hinges on compliance with California tax laws and regulations. This form must be filled out accurately, reflecting the taxpayer's true financial situation. Electronic signatures are accepted, provided they meet the requirements set forth by the state. Using a reliable eSignature solution can enhance the security and legality of the submission process, ensuring that all parties involved are properly authenticated and that the form is legally binding.

Key Elements of the CA Franchise Tax Board Estimated Taxes Form 580

Several key elements must be included when completing Form 580. These include the taxpayer's name, address, Social Security number or Employer Identification Number, and the estimated tax amounts for each payment period. Additionally, taxpayers should provide a summary of their expected income, deductions, and credits that may affect their overall tax liability. Ensuring that all these elements are accurately reported will facilitate a smoother filing process and help avoid issues with the Franchise Tax Board.

Form Submission Methods for the CA Franchise Tax Board Estimated Taxes Form 580

Taxpayers have multiple options for submitting Form 580. The form can be filed online through the California Franchise Tax Board's official website, which offers a streamlined process for electronic submissions. Alternatively, taxpayers may choose to mail the completed form to the appropriate address specified by the Franchise Tax Board. In-person submissions are also possible at designated tax offices. Each method has its benefits, and taxpayers should select the one that best suits their needs for convenience and security.

Quick guide on how to complete form 540 es download fillable pdf or fill online estimated

Complete Form 540 ES Download Fillable PDF Or Fill Online Estimated effortlessly on any device

Web-based document management has become widely adopted by companies and individuals alike. It offers an ideal environmentally friendly substitute to traditional printed and signed documents, allowing you to obtain the appropriate form and safely keep it online. airSlate SignNow equips you with all the tools necessary to create, edit, and electronically sign your documents quickly and without issues. Manage Form 540 ES Download Fillable PDF Or Fill Online Estimated on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to modify and eSign Form 540 ES Download Fillable PDF Or Fill Online Estimated without hassle

- Obtain Form 540 ES Download Fillable PDF Or Fill Online Estimated and then click Get Form to begin.

- Make use of the tools we offer to fill out your document.

- Mark important sections of the documents or cover private information with tools that airSlate SignNow has specifically designed for that purpose.

- Create your signature using the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click the Done button to save your changes.

- Select how you wish to share your form, by email, SMS, or via an invite link, or download it to your computer.

Eliminate the hassle of lost or mislaid files, tedious document searches, or errors that necessitate printing new copies. airSlate SignNow addresses all your document management requirements in just a few clicks from any device of your choosing. Modify and eSign Form 540 ES Download Fillable PDF Or Fill Online Estimated and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 540 es download fillable pdf or fill online estimated

Create this form in 5 minutes!

How to create an eSignature for the form 540 es download fillable pdf or fill online estimated

The way to generate an electronic signature for a PDF file online

The way to generate an electronic signature for a PDF file in Google Chrome

The way to create an electronic signature for signing PDFs in Gmail

How to create an eSignature straight from your mobile device

The best way to make an eSignature for a PDF file on iOS

How to create an eSignature for a PDF document on Android devices

People also ask

-

What is the CA Franchise Tax Board estimated taxes form 580?

The CA Franchise Tax Board estimated taxes form 580 is required for California residents to report their estimated annual tax payments. This form helps taxpayers ensure they are paying the correct amount throughout the year, avoiding penalties and interest charges.

-

How can airSlate SignNow help with submitting form 580?

airSlate SignNow allows users to easily create, send, and eSign the CA Franchise Tax Board estimated taxes form 580. Our platform streamlines the document process, making it faster and more efficient for users to meet their tax obligations.

-

Is there a cost associated with using airSlate SignNow for form 580?

Yes, there is a subscription fee to use airSlate SignNow, but it is a cost-effective solution for managing documents like the CA Franchise Tax Board estimated taxes form 580. We offer various plans to fit different business needs and budgets.

-

What features does airSlate SignNow offer for tax document management?

airSlate SignNow provides features such as document templates, automated reminders, and secure eSigning which are beneficial for managing the CA Franchise Tax Board estimated taxes form 580. These features save time and enhance the accuracy of tax filings.

-

Can I integrate airSlate SignNow with other accounting software for form 580?

Absolutely! airSlate SignNow integrates seamlessly with many accounting and tax software solutions. This integration simplifies the process of filling out and submitting the CA Franchise Tax Board estimated taxes form 580, ensuring all information is correctly synchronized.

-

How can airSlate SignNow improve the efficiency of filing form 580?

With airSlate SignNow, users can quickly populate and eSign the CA Franchise Tax Board estimated taxes form 580 without needing to print or scan documents. This efficiency reduces administrative workload and speeds up the filing process.

-

What benefits does airSlate SignNow provide for small businesses handling form 580?

For small businesses, airSlate SignNow offers a user-friendly platform to manage the CA Franchise Tax Board estimated taxes form 580 with ease. Benefits include reduced paperwork, lower costs, and improved compliance with tax filing requirements.

Get more for Form 540 ES Download Fillable PDF Or Fill Online Estimated

- Quark medical form

- Strategic management competitiveness and globalization 12th edition pdf form

- Ri 030 form

- Pptc 057 form

- Igetc with uc limits 1415 glendale community college form

- Canteen order form queen39s university athletics

- Consent form for oral surgery

- Ocs form no 06 college of social sciences and philosophy web kssp upd edu

Find out other Form 540 ES Download Fillable PDF Or Fill Online Estimated

- eSignature Illinois House rental agreement Free

- How To eSignature Indiana House rental agreement

- Can I eSignature Minnesota House rental lease agreement

- eSignature Missouri Landlord lease agreement Fast

- eSignature Utah Landlord lease agreement Simple

- eSignature West Virginia Landlord lease agreement Easy

- How Do I eSignature Idaho Landlord tenant lease agreement

- eSignature Washington Landlord tenant lease agreement Free

- eSignature Wisconsin Landlord tenant lease agreement Online

- eSignature Wyoming Landlord tenant lease agreement Online

- How Can I eSignature Oregon lease agreement

- eSignature Washington Lease agreement form Easy

- eSignature Alaska Lease agreement template Online

- eSignature Alaska Lease agreement template Later

- eSignature Massachusetts Lease agreement template Myself

- Can I eSignature Arizona Loan agreement

- eSignature Florida Loan agreement Online

- eSignature Florida Month to month lease agreement Later

- Can I eSignature Nevada Non-disclosure agreement PDF

- eSignature New Mexico Non-disclosure agreement PDF Online