Form 540 ES Estimated Tax for Individuals Form 540 ES Estimated Tax for Individuals 2023-2026

What is the Form 540 ES Estimated Tax for Individuals?

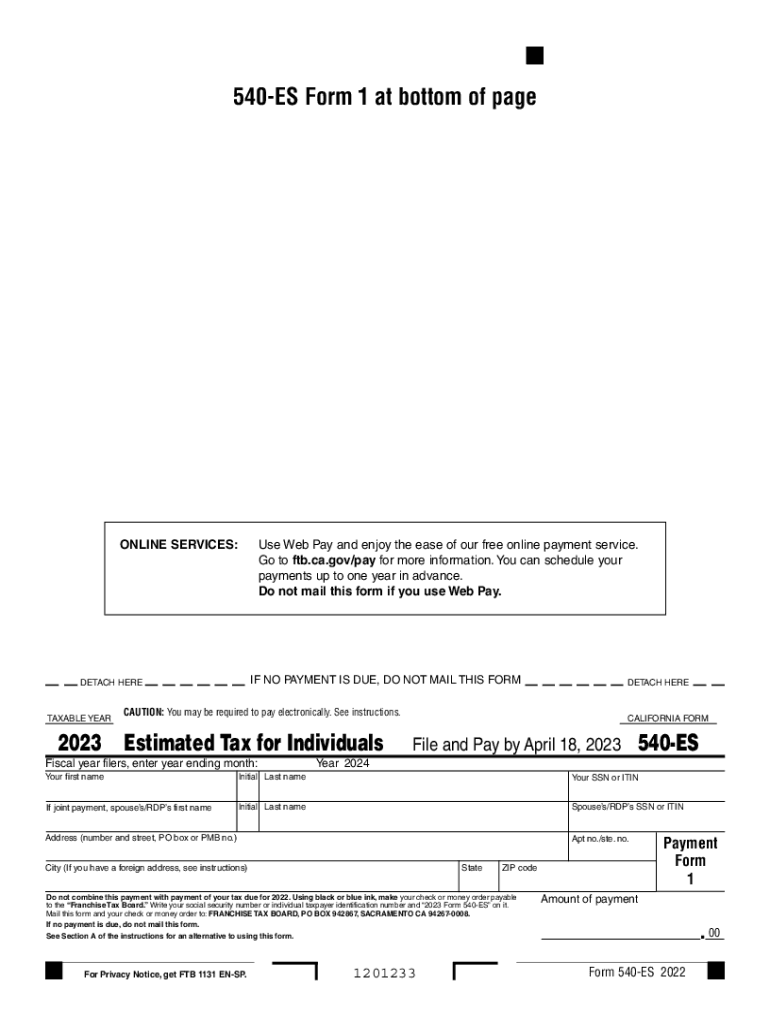

The Form 540 ES is the Estimated Tax for Individuals form used by California residents to report estimated tax payments. This form is essential for individuals who expect to owe tax of $500 or more when filing their California state tax return. It helps taxpayers avoid penalties by ensuring they pay enough tax throughout the year, rather than in a lump sum at tax time.

Steps to Complete the Form 540 ES Estimated Tax for Individuals

Completing the Form 540 ES involves several key steps:

- Gather necessary financial documents, including income statements and prior year tax returns.

- Calculate your expected taxable income for the year, considering any deductions or credits.

- Use the California tax rate schedule to determine your estimated tax liability.

- Divide your total estimated tax liability by four to find the quarterly payment amount.

- Fill out the Form 540 ES with your personal information, including your name, address, and Social Security number.

- Submit the completed form along with your estimated tax payment by the due date.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines for the Form 540 ES. The deadlines for estimated tax payments are typically:

- April 15 for the first quarter

- June 15 for the second quarter

- September 15 for the third quarter

- January 15 of the following year for the fourth quarter

Meeting these deadlines helps avoid penalties and interest on late payments.

Legal Use of the Form 540 ES Estimated Tax for Individuals

The Form 540 ES is legally binding when filled out correctly and submitted on time. It is important to ensure that all information provided is accurate and complete to comply with California tax laws. Failure to file or pay estimated taxes can result in penalties imposed by the California Franchise Tax Board.

Key Elements of the Form 540 ES Estimated Tax for Individuals

When filling out the Form 540 ES, several key elements must be included:

- Taxpayer Information: Name, address, and Social Security number.

- Estimated Tax Calculation: Total estimated income, deductions, and tax liability.

- Payment Amount: The amount due for each quarter based on your estimated tax liability.

- Signature: A signature is required to validate the form.

How to Obtain the Form 540 ES Estimated Tax for Individuals

The Form 540 ES can be obtained from the California Franchise Tax Board's website or by visiting their local offices. It is also available in various tax preparation software that supports California tax filings. Ensure you have the most current version of the form to comply with any recent tax law changes.

Quick guide on how to complete 2023 form 540 es estimated tax for individuals 2023 form 540 es estimated tax for individuals

Prepare Form 540 ES Estimated Tax For Individuals Form 540 ES Estimated Tax For Individuals effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed papers, allowing you to locate the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents swiftly and without holdups. Manage Form 540 ES Estimated Tax For Individuals Form 540 ES Estimated Tax For Individuals on any device with the airSlate SignNow applications for Android or iOS and enhance any document-centric process today.

How to modify and electronically sign Form 540 ES Estimated Tax For Individuals Form 540 ES Estimated Tax For Individuals with ease

- Locate Form 540 ES Estimated Tax For Individuals Form 540 ES Estimated Tax For Individuals and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of the documents or redact sensitive details with tools specifically designed by airSlate SignNow for that task.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal significance as a traditional wet ink signature.

- Review all the details and then click on the Done button to save your modifications.

- Select how you wish to send your form—via email, SMS, or invitation link— or download it to your computer.

Eliminate concerns over lost or misplaced files, tedious form searches, or mistakes that necessitate printing new copies of documents. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and electronically sign Form 540 ES Estimated Tax For Individuals Form 540 ES Estimated Tax For Individuals to ensure excellent communication at every step of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2023 form 540 es estimated tax for individuals 2023 form 540 es estimated tax for individuals

Create this form in 5 minutes!

How to create an eSignature for the 2023 form 540 es estimated tax for individuals 2023 form 540 es estimated tax for individuals

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 2024 California estimated tax worksheet?

The 2024 California estimated tax worksheet is a tool that helps individuals and businesses calculate their estimated tax payments for the upcoming year. It includes key calculations for determining your tax liability, ensuring you stay compliant with state tax regulations. By using this worksheet, you can strategically plan your finances for 2024.

-

How can airSlate SignNow assist with the 2024 California estimated tax worksheet?

airSlate SignNow simplifies the process of filling out and eSigning the 2024 California estimated tax worksheet. Our platform allows you to securely send and receive documents, making it easy to collaborate with tax professionals. This eliminates delays and ensures your tax documentation is processed efficiently.

-

What features does airSlate SignNow offer for handling tax worksheets?

With airSlate SignNow, you can easily create, edit, eSign, and share the 2024 California estimated tax worksheet. Our user-friendly interface includes customizable templates and robust security features, providing a comprehensive solution for your tax documentation needs. You can also track document status and receive reminders for important deadlines.

-

Is airSlate SignNow cost-effective for small businesses managing tax documents?

Yes, airSlate SignNow is designed to be a cost-effective solution for small businesses managing tax documents, including the 2024 California estimated tax worksheet. Our pricing plans are affordable and scalable, ensuring that businesses of all sizes can access essential eSigning features without breaking the bank. Plus, the time saved on document handling translates into additional financial benefits.

-

Will airSlate SignNow integrate with accounting software to help with tax worksheets?

Absolutely! airSlate SignNow seamlessly integrates with popular accounting software, making it easier to manage your 2024 California estimated tax worksheet and other financial documents. This integration allows for automatic data transfer and eliminates duplication, ensuring your financial records are up to date and accurate.

-

Can I store my completed 2024 California estimated tax worksheet securely with airSlate SignNow?

Yes, airSlate SignNow provides secure cloud storage for your completed 2024 California estimated tax worksheet and other important documents. Our advanced security measures ensure that your sensitive information is protected against unauthorized access. You can access your documents anytime, anywhere, with peace of mind.

-

What benefits does airSlate SignNow provide for eSigning tax worksheets?

airSlate SignNow offers numerous benefits for eSigning tax worksheets, including speed, security, and convenience. By eSigning the 2024 California estimated tax worksheet electronically, you can expedite the approval process and reduce the need for physical paperwork. This not only saves time but also contributes to a more sustainable and organized approach to tax management.

Get more for Form 540 ES Estimated Tax For Individuals Form 540 ES Estimated Tax For Individuals

Find out other Form 540 ES Estimated Tax For Individuals Form 540 ES Estimated Tax For Individuals

- How Can I eSignature Kentucky Co-Branding Agreement

- How Can I Electronic signature Alabama Declaration of Trust Template

- How Do I Electronic signature Illinois Declaration of Trust Template

- Electronic signature Maryland Declaration of Trust Template Later

- How Can I Electronic signature Oklahoma Declaration of Trust Template

- Electronic signature Nevada Shareholder Agreement Template Easy

- Electronic signature Texas Shareholder Agreement Template Free

- Electronic signature Mississippi Redemption Agreement Online

- eSignature West Virginia Distribution Agreement Safe

- Electronic signature Nevada Equipment Rental Agreement Template Myself

- Can I Electronic signature Louisiana Construction Contract Template

- Can I eSignature Washington Engineering Proposal Template

- eSignature California Proforma Invoice Template Simple

- eSignature Georgia Proforma Invoice Template Myself

- eSignature Mississippi Proforma Invoice Template Safe

- eSignature Missouri Proforma Invoice Template Free

- Can I eSignature Mississippi Proforma Invoice Template

- eSignature Missouri Proforma Invoice Template Simple

- eSignature Missouri Proforma Invoice Template Safe

- eSignature New Hampshire Proforma Invoice Template Mobile