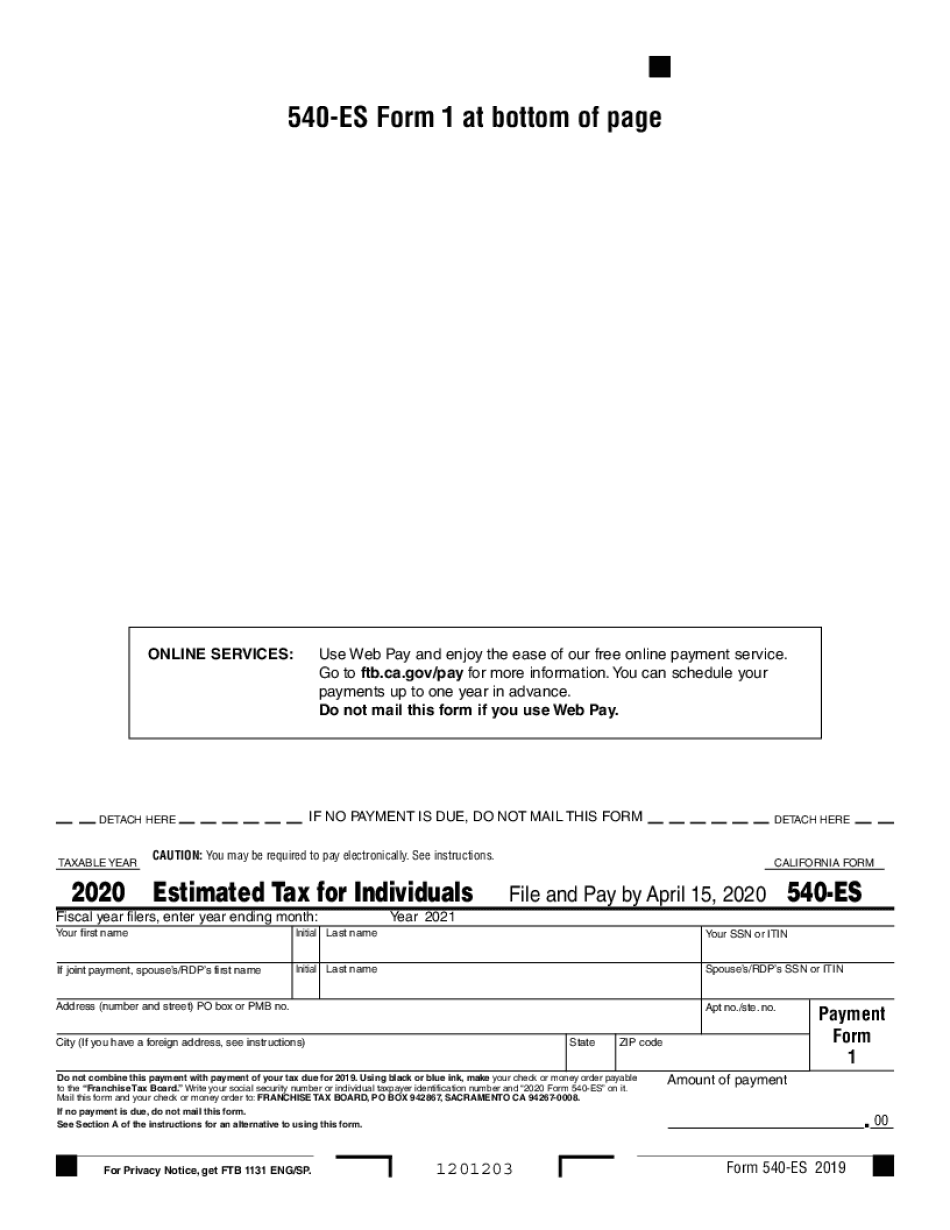

Fillable Online 540 ES Form 1 at Bottom of Page Sutter Tax Fax 2020

Understanding the CA Franchise Tax Board Estimated Taxes Form 580

The CA Franchise Tax Board Estimated Taxes Form 580 is essential for individuals and businesses in California who need to report and pay their estimated state income taxes. This form is typically used by taxpayers who expect to owe $500 or more in state taxes for the year. It allows taxpayers to calculate their estimated tax liability based on their expected income, deductions, and credits. Completing this form accurately is crucial to avoid penalties and ensure compliance with state tax laws.

Steps to Complete the CA Franchise Tax Board Estimated Taxes Form 580

Filling out the Form 580 involves several key steps:

- Gather necessary financial documents, including income statements and previous tax returns.

- Calculate your expected income for the year, considering all sources of income.

- Determine your allowable deductions and credits that may reduce your taxable income.

- Use the form to estimate your tax liability based on your calculations.

- Submit the completed form to the CA Franchise Tax Board by the specified deadlines.

Filing Deadlines for Form 580

It is important to be aware of the filing deadlines associated with the CA Franchise Tax Board Estimated Taxes Form 580. Typically, estimated tax payments are due in four installments throughout the year. The deadlines for these payments are usually April 15, June 15, September 15, and January 15 of the following year. Missing these deadlines can result in penalties and interest on unpaid taxes.

Required Documents for Form 580

To accurately complete the CA Franchise Tax Board Estimated Taxes Form 580, you will need several documents:

- Income statements, such as W-2s or 1099s.

- Previous year’s tax return for reference.

- Documentation of any deductions or credits you plan to claim.

- Records of any estimated payments made in the previous year.

Digital vs. Paper Version of Form 580

The CA Franchise Tax Board offers both digital and paper versions of the Estimated Taxes Form 580. The digital version can be filled out and submitted online, providing a convenient option for taxpayers. The paper version can be downloaded, printed, and mailed to the tax board. Both versions are legally valid, but the digital submission may offer faster processing times and confirmation of receipt.

Penalties for Non-Compliance with Estimated Tax Payments

Failing to submit the CA Franchise Tax Board Estimated Taxes Form 580 or underpaying your estimated taxes can lead to penalties. The state may impose a penalty of up to 10 percent of the unpaid tax amount. Additionally, interest may accrue on any unpaid balance. It is crucial to stay informed about your tax obligations to avoid these financial repercussions.

Quick guide on how to complete fillable online 540 es form 1 at bottom of page sutter tax fax

Complete Fillable Online 540 ES Form 1 At Bottom Of Page Sutter Tax Fax effortlessly on any device

Managing documents online has gained popularity among businesses and individuals. It serves as an excellent eco-friendly substitute for traditional printed and signed documents, allowing you to access the right form and securely store it online. airSlate SignNow provides you with all the necessary tools to create, modify, and electronically sign your documents quickly and without delays. Handle Fillable Online 540 ES Form 1 At Bottom Of Page Sutter Tax Fax on any device using the airSlate SignNow apps for Android or iOS and enhance your document-related processes today.

How to modify and electronically sign Fillable Online 540 ES Form 1 At Bottom Of Page Sutter Tax Fax with ease

- Obtain Fillable Online 540 ES Form 1 At Bottom Of Page Sutter Tax Fax and then click Get Form to begin.

- Utilize the features we offer to finalize your document.

- Emphasize important sections of your documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and holds the same legal significance as a conventional ink signature.

- Review the information and then click the Done button to store your changes.

- Select your preferred method for delivering your form, either via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious document searches, or errors that require reprinting new copies. airSlate SignNow meets all your document management needs with just a few clicks from any device you choose. Edit and electronically sign Fillable Online 540 ES Form 1 At Bottom Of Page Sutter Tax Fax to ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct fillable online 540 es form 1 at bottom of page sutter tax fax

Create this form in 5 minutes!

How to create an eSignature for the fillable online 540 es form 1 at bottom of page sutter tax fax

How to create an electronic signature for your PDF in the online mode

How to create an electronic signature for your PDF in Chrome

How to generate an electronic signature for putting it on PDFs in Gmail

The way to create an eSignature straight from your smart phone

How to create an electronic signature for a PDF on iOS devices

The way to create an eSignature for a PDF document on Android OS

People also ask

-

What is the CA Franchise Tax Board Estimated Taxes Form 580?

The CA Franchise Tax Board Estimated Taxes Form 580 is used by individuals and businesses in California to report estimated income tax payments. It helps taxpayers calculate their estimated taxes for the year, ensuring compliance with state tax laws. Utilizing this form accurately can assist in avoiding penalties for underpayment.

-

How can airSlate SignNow assist with the CA Franchise Tax Board Estimated Taxes Form 580?

airSlate SignNow provides a platform to easily prepare and eSign the CA Franchise Tax Board Estimated Taxes Form 580. With its user-friendly interface, you can quickly complete the form and ensure that all required information is properly documented. The solution simplifies the signing process while maintaining compliance and security.

-

What are the pricing options for using airSlate SignNow?

airSlate SignNow offers various pricing plans that cater to different businesses, from startups to larger enterprises. Each plan includes features that enhance document preparation and eSigning, including support for the CA Franchise Tax Board Estimated Taxes Form 580. You can choose a plan that best meets your needs and budget.

-

Are there any integrations available with airSlate SignNow?

Yes, airSlate SignNow offers several integrations with popular business applications such as Google Workspace, Microsoft Office, and Salesforce. This allows for streamlined workflows, particularly when working with documents like the CA Franchise Tax Board Estimated Taxes Form 580. Integrating these tools can enhance your overall efficiency in handling tax-related documents.

-

What are the security features of airSlate SignNow?

airSlate SignNow prioritizes your document security through robust encryption and authentication measures. These features ensure that your CA Franchise Tax Board Estimated Taxes Form 580 and other sensitive documents are protected against unauthorized access. You can confidently eSign and share documents, knowing that your data is secure.

-

Can I access airSlate SignNow on mobile devices?

Absolutely! airSlate SignNow is available on both iOS and Android devices, allowing you to access and manage your CA Franchise Tax Board Estimated Taxes Form 580 on the go. The mobile app provides a seamless experience for signing documents and keeping your workflows moving efficiently.

-

What benefits can I expect from using airSlate SignNow for tax documents?

Using airSlate SignNow for tax documents like the CA Franchise Tax Board Estimated Taxes Form 580 enhances efficiency and reduces the time spent on paperwork. The digital signing process speeds up approvals, reduces errors, and increases compliance, ensuring you meet all deadlines with ease. This not only saves time but also streamlines your business operations.

Get more for Fillable Online 540 ES Form 1 At Bottom Of Page Sutter Tax Fax

Find out other Fillable Online 540 ES Form 1 At Bottom Of Page Sutter Tax Fax

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement

- eSignature New Hampshire High Tech Lease Agreement Template Mobile

- eSignature Montana Insurance Lease Agreement Template Online

- eSignature New Hampshire High Tech Lease Agreement Template Free

- How To eSignature Montana Insurance Emergency Contact Form

- eSignature New Jersey High Tech Executive Summary Template Free

- eSignature Oklahoma Insurance Warranty Deed Safe

- eSignature Pennsylvania High Tech Bill Of Lading Safe

- eSignature Washington Insurance Work Order Fast

- eSignature Utah High Tech Warranty Deed Free

- How Do I eSignature Utah High Tech Warranty Deed

- eSignature Arkansas Legal Affidavit Of Heirship Fast

- Help Me With eSignature Colorado Legal Cease And Desist Letter

- How To eSignature Connecticut Legal LLC Operating Agreement

- eSignature Connecticut Legal Residential Lease Agreement Mobile

- eSignature West Virginia High Tech Lease Agreement Template Myself

- How To eSignature Delaware Legal Residential Lease Agreement