Nyc 210 Tax Form 2020

What is the NYC 210 Tax Form

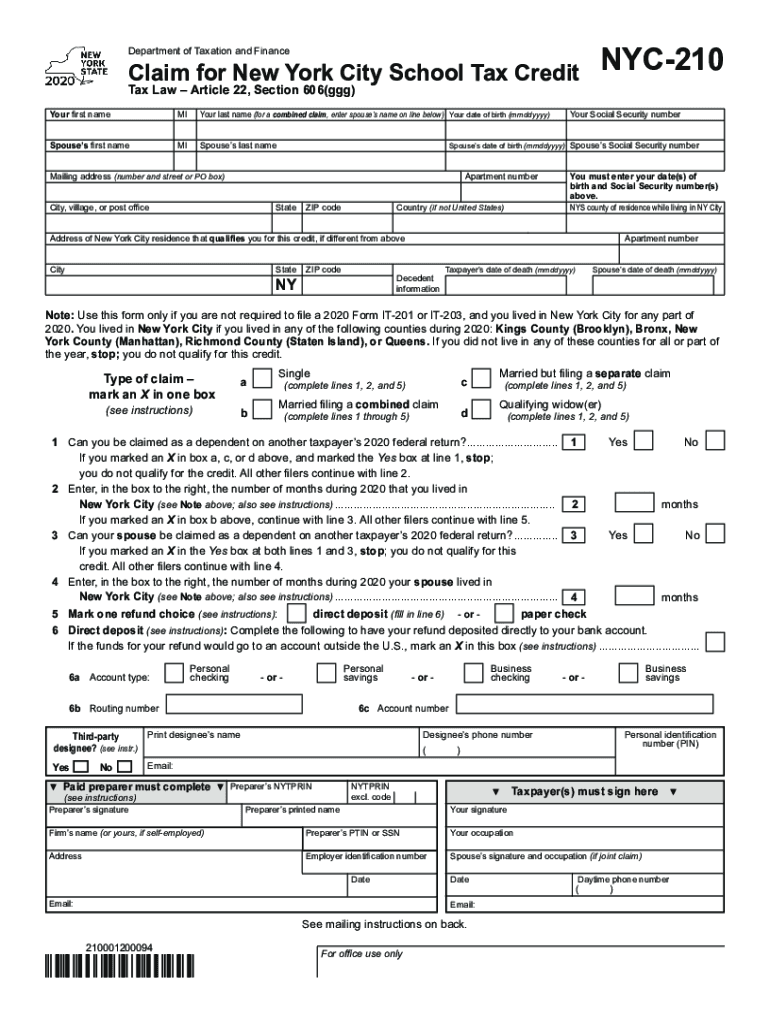

The NYC 210 tax form, also known as the NYC 210 school tax credit form, is a document used by eligible taxpayers in New York City to claim a school tax credit. This form is specifically designed for residents who meet certain criteria, allowing them to reduce their tax liability. The NYC 210 form is essential for those seeking financial relief related to their property taxes, particularly for homeowners and renters who qualify for this benefit.

How to Obtain the NYC 210 Tax Form

To obtain the NYC 210 tax form, taxpayers can visit the official New York City Department of Finance website, where the form is available for download. Additionally, individuals can request a physical copy by contacting their local tax office. It is important to ensure that you are using the most current version of the form to avoid any issues during submission.

Steps to Complete the NYC 210 Tax Form

Completing the NYC 210 tax form involves several key steps:

- Gather necessary information, including your personal details, property information, and income documentation.

- Fill out the form accurately, ensuring that all required fields are completed.

- Double-check your entries for any errors or omissions that could delay processing.

- Sign and date the form where indicated.

- Submit the completed form by the specified deadline, either online or by mail.

Legal Use of the NYC 210 Tax Form

The NYC 210 tax form is legally binding when completed and submitted according to the guidelines set forth by the New York City Department of Finance. It is crucial for taxpayers to provide accurate information to avoid penalties or legal repercussions. The form must be signed by the taxpayer, affirming that the information provided is true and correct.

Eligibility Criteria for the NYC 210 Tax Form

To qualify for the NYC 210 tax form, applicants must meet specific eligibility criteria, which typically include:

- Being a resident of New York City.

- Owning or renting a property that is eligible for the school tax credit.

- Meeting income limits set by the city.

- Filing the form within the designated timeframe.

Form Submission Methods

The NYC 210 tax form can be submitted through various methods, including:

- Online submission via the New York City Department of Finance website.

- Mailing the completed form to the appropriate address provided on the form.

- In-person submission at designated tax offices within New York City.

Quick guide on how to complete nyc 210 tax form

Complete Nyc 210 Tax Form seamlessly on any gadget

Digital document management has become increasingly favored by both businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to access the right format and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents quickly without interruptions. Handle Nyc 210 Tax Form on any gadget with airSlate SignNow's Android or iOS applications and simplify any document-related procedure today.

The simplest way to alter and eSign Nyc 210 Tax Form effortlessly

- Obtain Nyc 210 Tax Form and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Mark important sections of the documents or censor sensitive information with the tools that airSlate SignNow specifically offers for this purpose.

- Create your eSignature using the Sign feature, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to preserve your adjustments.

- Select how you wish to send your form, whether by email, text message (SMS), or an invitation link, or download it to your computer.

Eliminate the risk of lost or unfiled documents, tedious form navigation, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device you prefer. Alter and eSign Nyc 210 Tax Form and ensure effective communication at every stage of the form completion process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct nyc 210 tax form

Create this form in 5 minutes!

How to create an eSignature for the nyc 210 tax form

How to make an electronic signature for a PDF document in the online mode

How to make an electronic signature for a PDF document in Chrome

The best way to generate an e-signature for putting it on PDFs in Gmail

How to make an electronic signature straight from your mobile device

The best way to generate an e-signature for a PDF document on iOS devices

How to make an electronic signature for a PDF document on Android devices

People also ask

-

What is the NYC 210 tax form?

The NYC 210 tax form is a document used by New York City residents to report various types of income and claim tax credits. Understanding this form is crucial for accurately filing your taxes within the city. With airSlate SignNow, you can easily eSign and manage all related documents efficiently.

-

How can airSlate SignNow help with the NYC 210 tax form?

airSlate SignNow offers an easy-to-use platform for eSigning and managing the NYC 210 tax form. Our solution streamlines the document workflow, allowing you to send and sign this tax form securely and quickly. This helps ensure that you meet all filing deadlines with minimal hassle.

-

Is there a cost associated with using airSlate SignNow for the NYC 210 tax form?

Yes, there is a cost to use airSlate SignNow, but it is designed to be cost-effective for individuals and businesses. Pricing plans cater to different needs, ensuring that you can find an option that works for filing the NYC 210 tax form without breaking the bank. Explore our plans to see what fits your requirements best.

-

Can I integrate airSlate SignNow with my accounting software for the NYC 210 tax form?

Absolutely! airSlate SignNow integrates seamlessly with various accounting software, making it easy to manage the NYC 210 tax form alongside your financial documents. These integrations help streamline your workflow and ensure all your information is synced and accessible in one place.

-

What features does airSlate SignNow offer for eSigning the NYC 210 tax form?

airSlate SignNow provides advanced features such as customizable templates, secure storage, and real-time tracking for eSigning the NYC 210 tax form. These tools enhance your document management and improve collaboration with others involved in the signing process. Enjoy a smooth and efficient signing experience.

-

How secure is my information when using airSlate SignNow for the NYC 210 tax form?

Security is a top priority at airSlate SignNow. We use advanced encryption and secure servers to protect your information when completing the NYC 210 tax form. Your data remains confidential throughout the signing process, ensuring your peace of mind.

-

Can I use airSlate SignNow on mobile devices for the NYC 210 tax form?

Yes, airSlate SignNow is mobile-friendly, allowing you to manage the NYC 210 tax form from your smartphone or tablet. This flexibility ensures that you can send and eSign your documents anytime, anywhere, without the need for a desktop computer.

Get more for Nyc 210 Tax Form

Find out other Nyc 210 Tax Form

- Help Me With eSignature Washington IOU

- eSign Indiana Home Improvement Contract Myself

- eSign North Dakota Architectural Proposal Template Online

- How To eSignature Alabama Mechanic's Lien

- Can I eSign Alabama Car Insurance Quotation Form

- eSign Florida Car Insurance Quotation Form Mobile

- eSign Louisiana Car Insurance Quotation Form Online

- Can I eSign Massachusetts Car Insurance Quotation Form

- eSign Michigan Car Insurance Quotation Form Online

- eSign Michigan Car Insurance Quotation Form Mobile

- eSignature Massachusetts Mechanic's Lien Online

- eSignature Massachusetts Mechanic's Lien Free

- eSign Ohio Car Insurance Quotation Form Mobile

- eSign North Dakota Car Insurance Quotation Form Online

- eSign Pennsylvania Car Insurance Quotation Form Mobile

- eSignature Nevada Mechanic's Lien Myself

- eSign California Life-Insurance Quote Form Online

- How To eSignature Ohio Mechanic's Lien

- eSign Florida Life-Insurance Quote Form Online

- eSign Louisiana Life-Insurance Quote Form Online