Claim for Nyc School Tax Credit XpCourse 2021

Understanding the NYC 210 School Tax Credit Claim

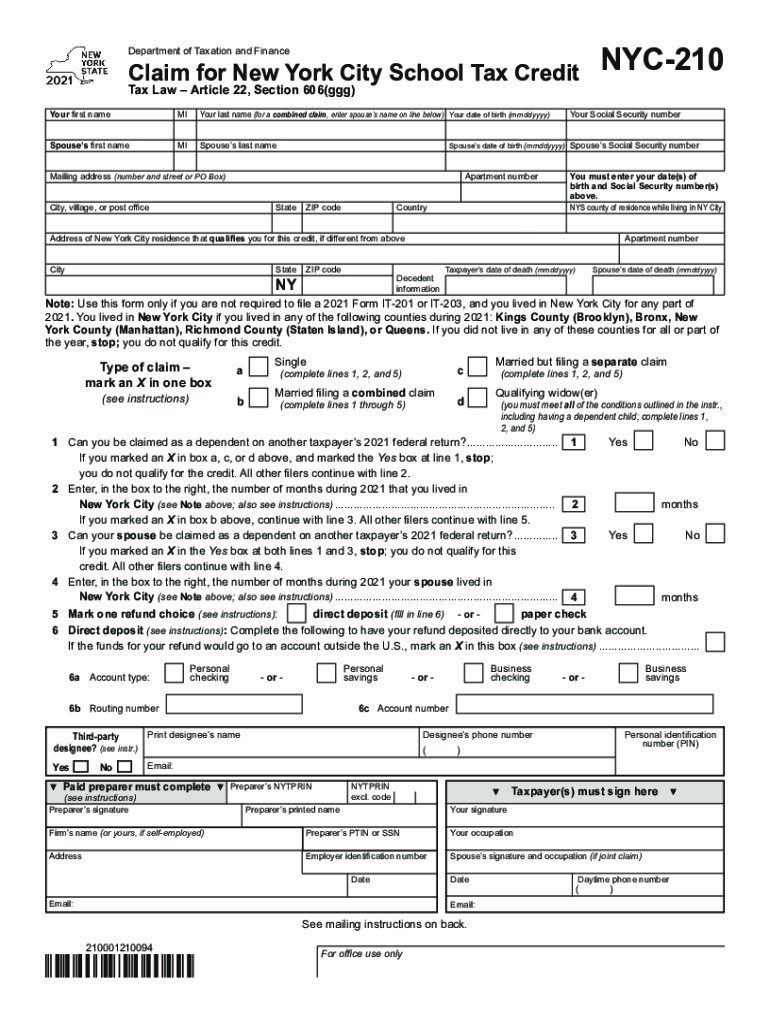

The NYC 210 school tax credit form is designed for New York City residents who are eligible for a school tax credit. This tax credit aims to provide financial relief to homeowners and renters who pay school taxes. The claim allows taxpayers to receive a credit based on their income and property taxes paid, which can significantly reduce their overall tax burden. Understanding the details of this claim is essential for maximizing potential benefits.

Eligibility Criteria for the NYC 210 School Tax Credit

To qualify for the NYC 210 school tax credit, applicants must meet specific criteria, including:

- Residency in New York City for the entire tax year.

- Ownership or rental of a property subject to school taxes.

- Income limits that vary based on household size.

- Filing the appropriate tax returns for the year in question.

Reviewing these criteria carefully ensures that applicants can accurately determine their eligibility before submitting the form.

Steps to Complete the NYC 210 School Tax Credit Form

Completing the NYC 210 school tax credit form involves several straightforward steps:

- Gather necessary documentation, including proof of income and property tax payments.

- Download the NYC 210 form from the official website or access it through a trusted digital platform.

- Fill out the form with accurate information, ensuring all required fields are completed.

- Review the form for any errors or omissions before submission.

- Submit the form electronically or via mail, following the submission guidelines provided.

By following these steps, applicants can ensure a smooth process when claiming their school tax credit.

Required Documents for the NYC 210 School Tax Credit

When submitting the NYC 210 school tax credit form, specific documents are required to support the claim. These documents typically include:

- Proof of residency, such as a utility bill or lease agreement.

- Income documentation, including W-2 forms or tax returns.

- Records of property tax payments, if applicable.

Having these documents ready can facilitate a quicker review and approval process for the tax credit claim.

Form Submission Methods for the NYC 210 School Tax Credit

The NYC 210 school tax credit form can be submitted through various methods, providing flexibility for applicants. These methods include:

- Online submission through a secure digital platform, which offers convenience and immediate processing.

- Mailing the completed form to the designated tax office, ensuring it is sent well before the deadline.

- In-person submission at local tax offices, allowing for direct interaction with tax officials.

Choosing the right submission method can enhance the efficiency of the application process.

Filing Deadlines for the NYC 210 School Tax Credit

It is crucial for applicants to be aware of the filing deadlines for the NYC 210 school tax credit. Typically, the form must be submitted by a specific date each tax year to be considered for that year's credit. Missing the deadline may result in the loss of potential benefits. Keeping track of these important dates ensures that applicants do not miss their opportunity to claim the credit.

Quick guide on how to complete claim for nyc school tax credit xpcourse

Complete Claim For Nyc School Tax Credit XpCourse effortlessly on any device

Digital document management has become increasingly favored among companies and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to find the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents quickly and without hassle. Manage Claim For Nyc School Tax Credit XpCourse on any device using the airSlate SignNow apps for Android or iOS and enhance any document-driven process today.

The simplest method to edit and eSign Claim For Nyc School Tax Credit XpCourse without any effort

- Locate Claim For Nyc School Tax Credit XpCourse and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight important sections of the documents or obscure sensitive information with the tools that airSlate SignNow specifically provides for that purpose.

- Generate your eSignature using the Sign tool, which takes just seconds and has the same legal validity as a traditional ink signature.

- Review the information and click on the Done button to save your modifications.

- Select how you want to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that require new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Alter and eSign Claim For Nyc School Tax Credit XpCourse to ensure excellent communication throughout the entire form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct claim for nyc school tax credit xpcourse

Create this form in 5 minutes!

How to create an eSignature for the claim for nyc school tax credit xpcourse

The best way to make an electronic signature for your PDF in the online mode

The best way to make an electronic signature for your PDF in Chrome

The best way to generate an electronic signature for putting it on PDFs in Gmail

The best way to generate an e-signature right from your smart phone

How to generate an electronic signature for a PDF on iOS devices

The best way to generate an e-signature for a PDF on Android OS

People also ask

-

What is the NYC 210 school tax credit form?

The NYC 210 school tax credit form is a document that allows eligible homeowners in New York City to claim a tax credit for educational expenses. This form is essential for individuals looking to reduce their tax liability while supporting local schools.

-

How can I access the NYC 210 school tax credit form?

You can easily access the NYC 210 school tax credit form through the official New York City Department of Finance website. Alternatively, airSlate SignNow can facilitate the process by allowing you to download and sign the form electronically.

-

What information do I need to fill out the NYC 210 school tax credit form?

To complete the NYC 210 school tax credit form, you will need your personal information, property details, and specifics about your educational expenses. Make sure to gather all relevant documents before starting the process for a smoother experience.

-

Is there a fee associated with using the NYC 210 school tax credit form?

There is no fee to obtain or submit the NYC 210 school tax credit form itself. However, using services like airSlate SignNow for eSigning may incur small costs, making it a cost-effective solution for document management.

-

Who is eligible to use the NYC 210 school tax credit form?

Eligibility for the NYC 210 school tax credit form generally includes homeowners in New York City who have children attending local schools. Verify specific conditions on the NYC Department of Finance website to ensure you qualify before applying.

-

How does airSlate SignNow help with the NYC 210 school tax credit form?

airSlate SignNow simplifies the process of filling out and submitting the NYC 210 school tax credit form by enabling electronic signatures and secure document sharing. This streamlines your workflow and ensures that your submissions are timely and efficient.

-

What are the benefits of using airSlate SignNow for the NYC 210 school tax credit form?

Using airSlate SignNow for the NYC 210 school tax credit form offers numerous benefits, including ease of use, time savings, and enhanced security. The platform allows you to sign and send documents from anywhere, making tax preparation much more convenient.

Get more for Claim For Nyc School Tax Credit XpCourse

- Motion status conference form

- Motion to fix case for trial with certificate of readiness for trial louisiana form

- Motion to fix case louisiana form

- Louisiana case 497308816 form

- Demand repayment form

- Affidavit regarding request for return of improperly seized property louisiana form

- Writ of fieri facias form

- Louisiana fieri form

Find out other Claim For Nyc School Tax Credit XpCourse

- How To eSign New Mexico Education Promissory Note Template

- eSign New Mexico Education Affidavit Of Heirship Online

- eSign California Finance & Tax Accounting IOU Free

- How To eSign North Dakota Education Rental Application

- How To eSign South Dakota Construction Promissory Note Template

- eSign Education Word Oregon Secure

- How Do I eSign Hawaii Finance & Tax Accounting NDA

- eSign Georgia Finance & Tax Accounting POA Fast

- eSign Georgia Finance & Tax Accounting POA Simple

- How To eSign Oregon Education LLC Operating Agreement

- eSign Illinois Finance & Tax Accounting Resignation Letter Now

- eSign Texas Construction POA Mobile

- eSign Kansas Finance & Tax Accounting Stock Certificate Now

- eSign Tennessee Education Warranty Deed Online

- eSign Tennessee Education Warranty Deed Now

- eSign Texas Education LLC Operating Agreement Fast

- eSign Utah Education Warranty Deed Online

- eSign Utah Education Warranty Deed Later

- eSign West Virginia Construction Lease Agreement Online

- How To eSign West Virginia Construction Job Offer