Form NYC 210 Claim for New York City School Tax Credit Tax Year 2022-2026

What is the Form NYC 210 Claim For New York City School Tax Credit Tax Year

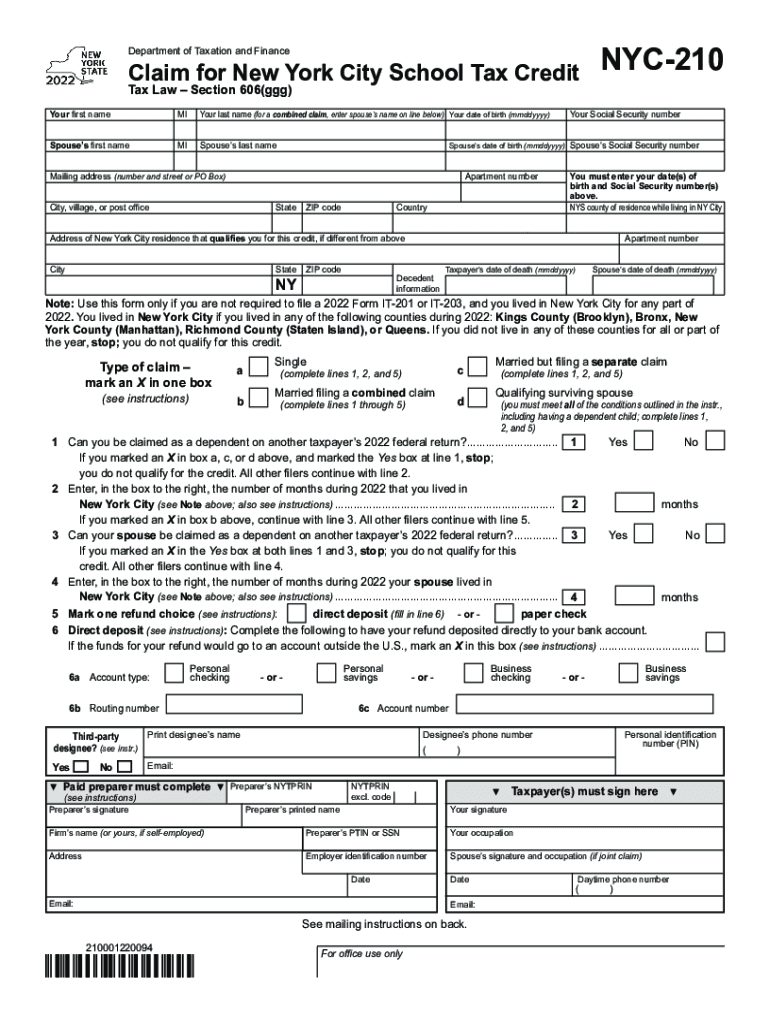

The NYC 210 form is a document used by eligible New York City residents to claim the School Tax Credit. This tax credit is designed to provide financial relief to homeowners who pay school taxes. The form must be completed accurately to ensure that taxpayers receive the appropriate credit for the tax year in question. The NYC 210 form for 2024 specifically addresses claims related to the 2024 tax year, allowing individuals to benefit from the credit as part of their overall tax filings.

How to use the Form NYC 210 Claim For New York City School Tax Credit Tax Year

Using the NYC 210 form involves several steps. First, taxpayers need to gather necessary information, such as proof of residency and school tax payments. Next, they should fill out the form with accurate details, ensuring all required fields are completed. After completing the form, it can be submitted either online or through traditional mail, depending on the taxpayer's preference. It is essential to keep a copy of the submitted form for personal records.

Steps to complete the Form NYC 210 Claim For New York City School Tax Credit Tax Year

Completing the NYC 210 form involves the following steps:

- Gather necessary documents, including proof of residency and tax payment receipts.

- Download the NYC 210 form 2024 PDF from a reliable source.

- Fill out the form carefully, ensuring all information is accurate and complete.

- Review the form for any errors or omissions before submission.

- Submit the form online or mail it to the designated address.

Eligibility Criteria

To qualify for the School Tax Credit using the NYC 210 form, applicants must meet specific eligibility criteria. Generally, this includes being a resident of New York City and having paid school taxes during the tax year for which the credit is being claimed. Homeowners must also provide proof of their residency and tax payments to substantiate their claims. It is important for applicants to review the eligibility requirements to ensure they can successfully file the form.

Filing Deadlines / Important Dates

Filing deadlines for the NYC 210 form are crucial for taxpayers to keep in mind. For the 2024 tax year, the form typically must be submitted by a specified date, often coinciding with the general tax filing deadline. Taxpayers should stay informed about any changes to deadlines and ensure that their forms are submitted on time to avoid penalties or loss of eligibility for the credit.

Required Documents

When completing the NYC 210 form, certain documents are required to support the claim. These may include:

- Proof of residency, such as a utility bill or lease agreement.

- Receipts or statements showing payment of school taxes.

- Identification documents, if necessary, to verify the applicant's identity.

Having these documents ready can streamline the completion and submission process of the NYC 210 form.

Quick guide on how to complete form nyc 210 claim for new york city school tax credit tax year 2021

Complete Form NYC 210 Claim For New York City School Tax Credit Tax Year effortlessly on any device

Online document management has become popular with businesses and individuals. It offers a perfect environmentally friendly alternative to traditional printed and signed paperwork, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the tools you need to create, modify, and eSign your documents promptly without any hold-ups. Manage Form NYC 210 Claim For New York City School Tax Credit Tax Year on any platform with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The most efficient way to modify and eSign Form NYC 210 Claim For New York City School Tax Credit Tax Year with ease

- Obtain Form NYC 210 Claim For New York City School Tax Credit Tax Year and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight relevant sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign feature, which takes seconds and holds the same legal validity as a traditional wet ink signature.

- Review the information and then click on the Done button to save your changes.

- Choose how you want to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate the risk of missing or lost documents, tedious form navigation, or errors that necessitate printing new document copies. airSlate SignNow fulfills your needs in document management in just a few clicks from a device of your choice. Modify and eSign Form NYC 210 Claim For New York City School Tax Credit Tax Year and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form nyc 210 claim for new york city school tax credit tax year 2021

Create this form in 5 minutes!

People also ask

-

What is the NYC 210 form 2024 PDF?

The NYC 210 form 2024 PDF is a tax form used by New York City residents to claim various tax credits and deductions. It is essential for those looking to ensure compliance with city tax regulations. By using the NYC 210 form 2024 PDF, taxpayers can streamline their filing process and avoid potential penalties.

-

How can airSlate SignNow help with the NYC 210 form 2024 PDF?

airSlate SignNow provides an efficient platform for electronically signing and sending the NYC 210 form 2024 PDF. This means you can complete your tax form online, ensuring that it is securely signed and submitted without the hassle of manual paperwork. Our solution simplifies the entire process, allowing you to focus on what matters most.

-

Is airSlate SignNow cost-effective for handling NYC 210 form 2024 PDF?

Yes, airSlate SignNow offers a cost-effective solution for businesses needing to manage the NYC 210 form 2024 PDF. Our pricing plans are designed to meet various business needs, ensuring you can access essential features without overspending. With our platform, you save time and resources, especially during tax season.

-

Can I integrate airSlate SignNow with my existing systems for the NYC 210 form 2024 PDF?

Absolutely! airSlate SignNow allows easy integration with various applications, making it seamless to handle the NYC 210 form 2024 PDF within your existing workflows. Whether you use CRM software or document management systems, our platform enhances productivity and efficiency.

-

What features does airSlate SignNow offer for the NYC 210 form 2024 PDF?

airSlate SignNow provides features such as e-signature capabilities, document templates, and secure cloud storage specifically tailored for documents like the NYC 210 form 2024 PDF. These features enhance collaboration and ensure your tax forms are managed securely and efficiently.

-

What are the benefits of using airSlate SignNow for the NYC 210 form 2024 PDF?

Using airSlate SignNow for the NYC 210 form 2024 PDF offers numerous benefits, including faster processing times, enhanced security, and ease of access. Our platform not only saves you time but also reduces the risk of errors associated with manual handling of tax forms.

-

Is airSlate SignNow user-friendly for completing the NYC 210 form 2024 PDF?

Yes, airSlate SignNow is designed to be user-friendly, making it easy for anyone to fill out and submit the NYC 210 form 2024 PDF. Our intuitive interface allows users to effortlessly navigate through the e-signing process, ensuring a smooth experience even for those less tech-savvy.

Get more for Form NYC 210 Claim For New York City School Tax Credit Tax Year

- Time share quitclaim deed llc to husband and wife nevada form

- Nv wife form

- Nevada request form

- Nevada deed 497320563 form

- Renunciation and disclaimer of joint tenant or tenancy interest nevada form

- Notice completion nevada form

- Quitclaim deed by two individuals to husband and wife nevada form

- Grant bargain sale deed two individuals to husband and wife nevada form

Find out other Form NYC 210 Claim For New York City School Tax Credit Tax Year

- Electronic signature Kentucky Affidavit of Service Mobile

- How To Electronic signature Connecticut Affidavit of Identity

- Can I Electronic signature Florida Affidavit of Title

- How Can I Electronic signature Ohio Affidavit of Service

- Can I Electronic signature New Jersey Affidavit of Identity

- How Can I Electronic signature Rhode Island Affidavit of Service

- Electronic signature Tennessee Affidavit of Service Myself

- Electronic signature Indiana Cease and Desist Letter Free

- Electronic signature Arkansas Hold Harmless (Indemnity) Agreement Fast

- Electronic signature Kentucky Hold Harmless (Indemnity) Agreement Online

- How To Electronic signature Arkansas End User License Agreement (EULA)

- Help Me With Electronic signature Connecticut End User License Agreement (EULA)

- Electronic signature Massachusetts Hold Harmless (Indemnity) Agreement Myself

- Electronic signature Oklahoma Hold Harmless (Indemnity) Agreement Free

- Electronic signature Rhode Island Hold Harmless (Indemnity) Agreement Myself

- Electronic signature California Toll Manufacturing Agreement Now

- How Do I Electronic signature Kansas Toll Manufacturing Agreement

- Can I Electronic signature Arizona Warranty Deed

- How Can I Electronic signature Connecticut Warranty Deed

- How To Electronic signature Hawaii Warranty Deed