PDF Schedule C Massachusetts Profit or Loss from Business Form

Understanding the PDF Schedule C Massachusetts Profit or Loss From Business

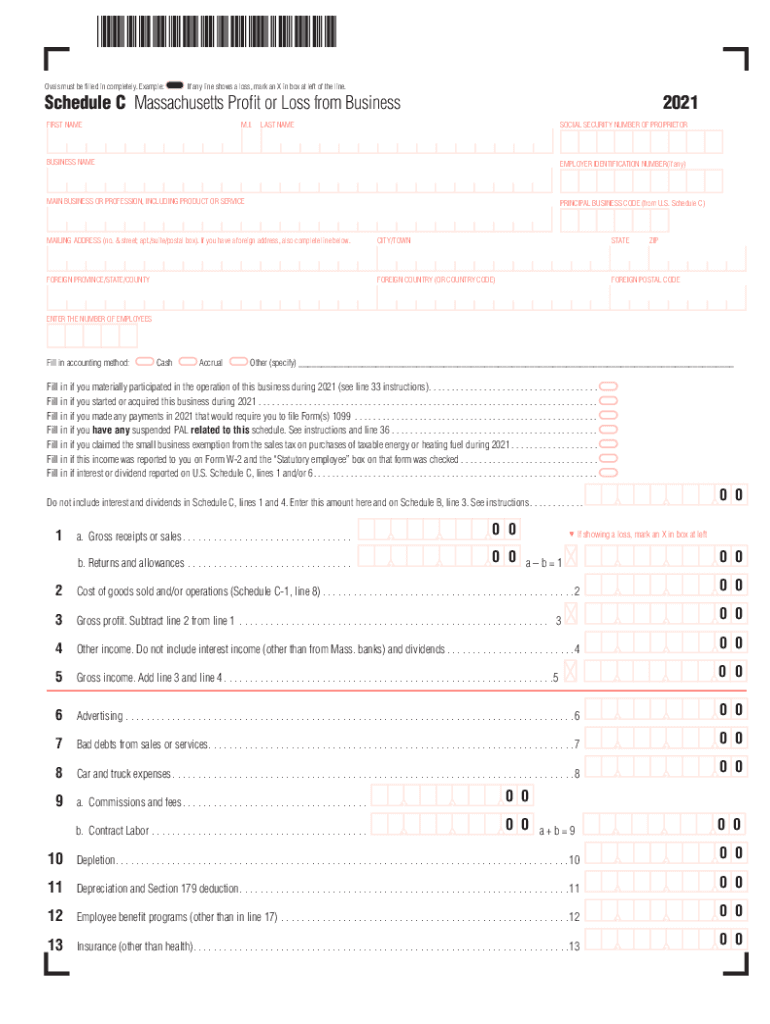

The PDF Schedule C is a crucial form for individuals in Massachusetts who are self-employed or operate a business as a sole proprietor. This form is used to report income or loss from a business, allowing taxpayers to calculate their net profit or loss. It is essential for accurately reporting business earnings to the IRS and state tax authorities. The Schedule C form includes sections for detailing income, expenses, and cost of goods sold, providing a comprehensive overview of a business's financial performance during the tax year.

Steps to Complete the PDF Schedule C Massachusetts Profit or Loss From Business

Completing the PDF Schedule C requires careful attention to detail. Here are the key steps:

- Gather Financial Records: Collect all relevant financial documents, including income statements, receipts for expenses, and any records of business-related transactions.

- Fill Out Business Information: Enter your business name, address, and the principal business activity. This section helps identify your business for tax purposes.

- Report Income: Document all sources of income earned from your business. This includes sales, services, and any other revenue streams.

- List Expenses: Detail all business expenses, such as rent, utilities, supplies, and wages. Accurate reporting of expenses can significantly impact your taxable income.

- Calculate Net Profit or Loss: Subtract total expenses from total income to determine your net profit or loss. This figure will be reported on your personal tax return.

Legal Use of the PDF Schedule C Massachusetts Profit or Loss From Business

The PDF Schedule C is legally recognized for reporting business income and expenses in Massachusetts. It must be filled out accurately to comply with IRS regulations. Failure to provide correct information can lead to penalties or audits. It is important to retain copies of the completed form and any supporting documents for your records. This ensures that you have evidence of your reported income and expenses if needed in the future.

Filing Deadlines and Important Dates

Understanding the filing deadlines for the PDF Schedule C is crucial for compliance. Typically, the deadline for submitting your Schedule C is the same as your personal tax return, which is usually April 15. However, if you need additional time, you can file for an extension, which typically extends the deadline to October 15. It is essential to keep track of these dates to avoid late fees or penalties.

Required Documents for the PDF Schedule C Massachusetts Profit or Loss From Business

To complete the PDF Schedule C, certain documents are necessary. These include:

- Income statements detailing all revenue sources.

- Receipts for business expenses, including utilities, supplies, and wages.

- Any 1099 forms received for freelance or contract work.

- Bank statements that reflect business transactions.

Having these documents organized will streamline the process of filling out the form and ensure accuracy.

Examples of Using the PDF Schedule C Massachusetts Profit or Loss From Business

Examples can illustrate how the PDF Schedule C is utilized in different scenarios. For instance, a freelance graphic designer would report income from various clients on the form, detailing expenses like software subscriptions and office supplies. Similarly, a small business owner operating a retail store would include sales revenue and expenses related to inventory purchases and rent. These examples highlight the form's versatility for various business types.

Quick guide on how to complete pdf schedule c massachusetts profit or loss from business 2021

Prepare PDF Schedule C Massachusetts Profit Or Loss From Business effortlessly on any device

Digital document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed papers, as you can obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools you need to create, modify, and electronically sign your documents quickly without delays. Manage PDF Schedule C Massachusetts Profit Or Loss From Business on any platform with airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to modify and electronically sign PDF Schedule C Massachusetts Profit Or Loss From Business with ease

- Find PDF Schedule C Massachusetts Profit Or Loss From Business and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and holds the same legal validity as a traditional handwritten signature.

- Verify the information and click on the Done button to save your changes.

- Select how you want to send your form, via email, text message (SMS), or invite link, or download it to your computer.

Eliminate the worries of lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and electronically sign PDF Schedule C Massachusetts Profit Or Loss From Business and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the pdf schedule c massachusetts profit or loss from business 2021

How to make an electronic signature for your PDF document online

How to make an electronic signature for your PDF document in Google Chrome

The best way to make an electronic signature for signing PDFs in Gmail

The best way to create an e-signature from your smart phone

The best way to generate an electronic signature for a PDF document on iOS

The best way to create an e-signature for a PDF file on Android OS

People also ask

-

What is a Massachusetts schedule loss?

A Massachusetts schedule loss refers to the permanent impairment of a body part that can affect your earnings or quality of life. Understanding this concept is crucial for those seeking compensation or benefits related to injuries. The airSlate SignNow platform can help streamline the documentation process for claims involving Massachusetts schedule loss.

-

How can airSlate SignNow assist with Massachusetts schedule loss claims?

airSlate SignNow offers a seamless eSigning solution that allows you to quickly send and sign documents related to Massachusetts schedule loss claims. With its user-friendly interface, you can easily gather necessary signatures, ensuring your claims are processed efficiently and accurately. This can signNowly speed up the timeline for receiving your benefits.

-

What features does airSlate SignNow provide for managing documents related to Massachusetts schedule loss?

airSlate SignNow features robust document management tools, including templates and secure storage, which are vital for handling Massachusetts schedule loss documents. These features ensure that all your important files are organized and accessible, allowing for easy collaboration and efficient processing of claims in a timely manner.

-

Are there integrations available for airSlate SignNow that ease Massachusetts schedule loss documentation?

Yes, airSlate SignNow integrates with popular tools such as Google Drive and Salesforce, which can streamline the documentation process for Massachusetts schedule loss claims. This ensures that all your documents are synced and easily accessible across platforms, enhancing productivity and collaboration as you manage your claims.

-

What benefits does airSlate SignNow offer for businesses dealing with Massachusetts schedule loss?

Businesses using airSlate SignNow benefit from its cost-effective solution that minimizes paperwork and simplifies the eSigning process for Massachusetts schedule loss claims. This efficiency not only saves time but also reduces the likelihood of errors, ensuring that claims can be submitted accurately and promptly.

-

Is airSlate SignNow suitable for individual use in Massachusetts schedule loss situations?

Absolutely! airSlate SignNow is user-friendly and designed for both individual and business needs, making it ideal for those dealing with Massachusetts schedule loss. Individuals can easily create, manage, and sign documents independently, giving them complete control over their claims process.

-

What is the pricing structure for airSlate SignNow when handling Massachusetts schedule loss documents?

airSlate SignNow offers flexible pricing plans tailored to meet different user needs, including those managing Massachusetts schedule loss documentation. You can select a plan that best fits your usage requirements, ensuring you have access to essential features at a cost-effective rate.

Get more for PDF Schedule C Massachusetts Profit Or Loss From Business

- Massachusetts last will testament form

- Mutual wills package with last wills and testaments for married couple with adult children massachusetts form

- Mutual wills package with last wills and testaments for married couple with no children massachusetts form

- Mutual wills package with last wills and testaments for married couple with minor children massachusetts form

- Massachusetts last will form

- Civil union partner form

- Massachusetts legal married form

- Ma will form

Find out other PDF Schedule C Massachusetts Profit Or Loss From Business

- Can I Sign Nevada Life Sciences PPT

- Help Me With Sign New Hampshire Non-Profit Presentation

- How To Sign Alaska Orthodontists Presentation

- Can I Sign South Dakota Non-Profit Word

- Can I Sign South Dakota Non-Profit Form

- How To Sign Delaware Orthodontists PPT

- How Can I Sign Massachusetts Plumbing Document

- How To Sign New Hampshire Plumbing PPT

- Can I Sign New Mexico Plumbing PDF

- How To Sign New Mexico Plumbing Document

- How To Sign New Mexico Plumbing Form

- Can I Sign New Mexico Plumbing Presentation

- How To Sign Wyoming Plumbing Form

- Help Me With Sign Idaho Real Estate PDF

- Help Me With Sign Idaho Real Estate PDF

- Can I Sign Idaho Real Estate PDF

- How To Sign Idaho Real Estate PDF

- How Do I Sign Hawaii Sports Presentation

- How Do I Sign Kentucky Sports Presentation

- Can I Sign North Carolina Orthodontists Presentation