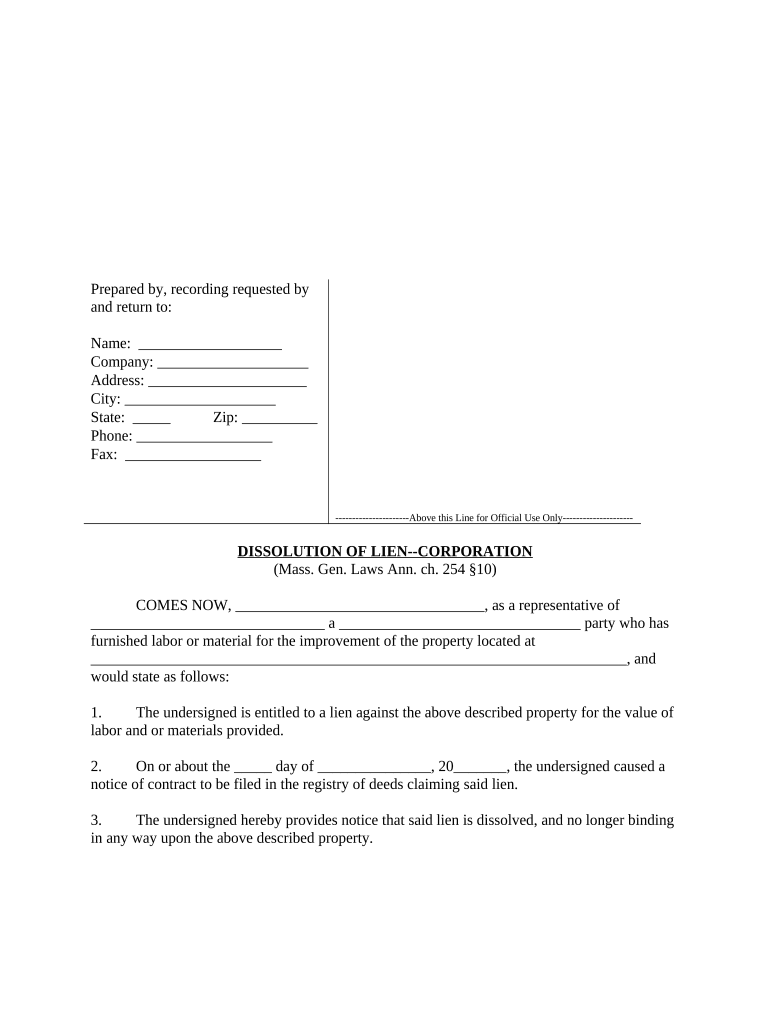

Massachusetts Lien Form

What is the Massachusetts dissolution form?

The Massachusetts dissolution form is a legal document used by businesses to formally terminate their existence in the state of Massachusetts. This form is essential for corporations, limited liability companies (LLCs), and partnerships that wish to dissolve their business entity. Completing this form ensures that the business is officially recognized as dissolved, which helps prevent future liabilities and obligations. The dissolution process involves filing the appropriate paperwork with the Massachusetts Secretary of the Commonwealth and may require settling any outstanding debts or obligations before the dissolution can be finalized.

Steps to complete the Massachusetts dissolution form

Completing the Massachusetts dissolution form involves several key steps to ensure compliance with state regulations. First, gather all necessary information about your business, including the name, address, and the date of formation. Next, check for any outstanding taxes or obligations that must be settled prior to filing. After that, fill out the dissolution form accurately, providing all required details. Once completed, submit the form to the Massachusetts Secretary of the Commonwealth, either online or by mail, along with any applicable fees. It is advisable to keep a copy of the submitted form for your records.

Required documents for Massachusetts dissolution

When filing the Massachusetts dissolution form, certain documents may be required to support the application. These typically include:

- A completed dissolution form specific to your business entity type.

- Proof of payment for any outstanding taxes or fees.

- Any additional documentation that may be specified by the Massachusetts Secretary of the Commonwealth.

Ensuring that all required documents are included can help facilitate a smoother dissolution process and prevent delays.

Legal use of the Massachusetts dissolution form

The legal use of the Massachusetts dissolution form is crucial for businesses to avoid ongoing liabilities. By properly filing the dissolution form, a business officially ceases to exist in the eyes of the law, which protects the owners from future legal claims related to the business. It is important to follow all state guidelines and ensure that the form is filled out correctly to maintain compliance with Massachusetts law. Failure to do so may result in penalties or continued liability for the business's debts.

Who issues the Massachusetts dissolution form?

The Massachusetts dissolution form is issued by the Massachusetts Secretary of the Commonwealth. This office oversees the filing and processing of business entity documents, including dissolution forms. Businesses must submit their completed forms to this office to ensure that their dissolution is officially recognized. It is important to verify that you are using the most current version of the form, as requirements may change over time.

Penalties for non-compliance with the Massachusetts dissolution process

Non-compliance with the Massachusetts dissolution process can lead to several penalties. If a business fails to properly file the dissolution form, it may continue to incur taxes and fees, as well as face potential legal actions from creditors. Additionally, the owners may remain personally liable for any debts or obligations incurred by the business. To avoid these consequences, it is essential to follow the dissolution process carefully and ensure all requirements are met before submitting the form.

Quick guide on how to complete massachusetts lien

Manage Massachusetts Lien easily on any device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to find the right template and securely store it online. airSlate SignNow equips you with all the resources you need to create, adjust, and electronically sign your documents quickly without delays. Handle Massachusetts Lien on any device using airSlate SignNow's Android or iOS applications and simplify any document-related tasks today.

Effortlessly modify and electronically sign Massachusetts Lien

- Obtain Massachusetts Lien and then click Access Form to begin.

- Leverage the tools provided to fill out your document.

- Emphasize important sections of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign feature, which only takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and then click on the Finish button to save your changes.

- Choose how you want to send your form, via email, SMS, an invitation link, or download it to your computer.

Eliminate the worries of lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from your preferred device. Modify and eSign Massachusetts Lien and guarantee excellent communication throughout your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Massachusetts dissolution form?

A Massachusetts dissolution form is a legal document used to officially dissolve a corporation or business entity in the state of Massachusetts. It outlines the intent to cease operations and ensures that all outstanding obligations are met before closure. This form is essential for ensuring compliance with state regulations when ending a business.

-

How can airSlate SignNow help with completing a Massachusetts dissolution form?

AirSlate SignNow provides a user-friendly platform that allows you to easily fill out and eSign your Massachusetts dissolution form. With its intuitive interface, you can navigate the form inputs effortlessly, ensuring all necessary information is accurately provided. Additionally, our platform helps you save time and reduce paperwork by allowing for digital submissions.

-

Are there any fees associated with filing a Massachusetts dissolution form?

Yes, there are fees associated with filing a Massachusetts dissolution form, which may vary depending on the type of entity you are dissolving. When using airSlate SignNow, you will also have access to transparent pricing, allowing you to budget effectively for any related costs. Our platform ensures that you know exactly what you’ll be paying upfront.

-

What features does airSlate SignNow offer for handling Massachusetts dissolution forms?

AirSlate SignNow offers several features tailored to streamline the processing of Massachusetts dissolution forms. These include customizable templates, secure electronic signatures, and document tracking capabilities. These features not only enhance productivity but also ensure your dissolution process is secure and hassle-free.

-

Can the Massachusetts dissolution form be completed on mobile devices?

Yes, the Massachusetts dissolution form can be easily completed on mobile devices through airSlate SignNow’s mobile app. This means you can manage your business dissolution on the go, accessing all the necessary features right from your smartphone or tablet. The mobile interface is optimized for ease of use, making document management flexible.

-

Is airSlate SignNow compliant with state regulations for Massachusetts dissolution forms?

Absolutely! AirSlate SignNow is designed to comply with all state regulations, including those for Massachusetts dissolution forms. Our platform is regularly updated to ensure you are using the most current forms and following the correct procedures, thereby minimizing legal risks associated with business dissolution.

-

What are the benefits of using airSlate SignNow for the Massachusetts dissolution form?

The primary benefits of using airSlate SignNow for the Massachusetts dissolution form include ease of use, cost-effectiveness, and reliability. Our platform simplifies the eSigning process, reduces the time spent on paperwork, and allows for secure document storage. By choosing airSlate SignNow, you ensure a smoother transition during the dissolution phase of your business.

Get more for Massachusetts Lien

Find out other Massachusetts Lien

- Electronic signature Virginia Prenuptial Agreement Template Free

- How Do I Electronic signature Maryland Affidavit of Residence

- Electronic signature Florida Child Support Modification Simple

- Electronic signature North Dakota Child Support Modification Easy

- Electronic signature Oregon Child Support Modification Online

- How Can I Electronic signature Colorado Cohabitation Agreement

- Electronic signature Arkansas Leave of Absence Letter Later

- Electronic signature New Jersey Cohabitation Agreement Fast

- Help Me With Electronic signature Alabama Living Will

- How Do I Electronic signature Louisiana Living Will

- Electronic signature Arizona Moving Checklist Computer

- Electronic signature Tennessee Last Will and Testament Free

- Can I Electronic signature Massachusetts Separation Agreement

- Can I Electronic signature North Carolina Separation Agreement

- How To Electronic signature Wyoming Affidavit of Domicile

- Electronic signature Wisconsin Codicil to Will Later

- Electronic signature Idaho Guaranty Agreement Free

- Electronic signature North Carolina Guaranty Agreement Online

- eSignature Connecticut Outsourcing Services Contract Computer

- eSignature New Hampshire Outsourcing Services Contract Computer