PDF Taxpayer E File Opt Out Election Form Alabama Department of Revenue 2021

What is the PDF Taxpayer E-file Opt Out Election Form?

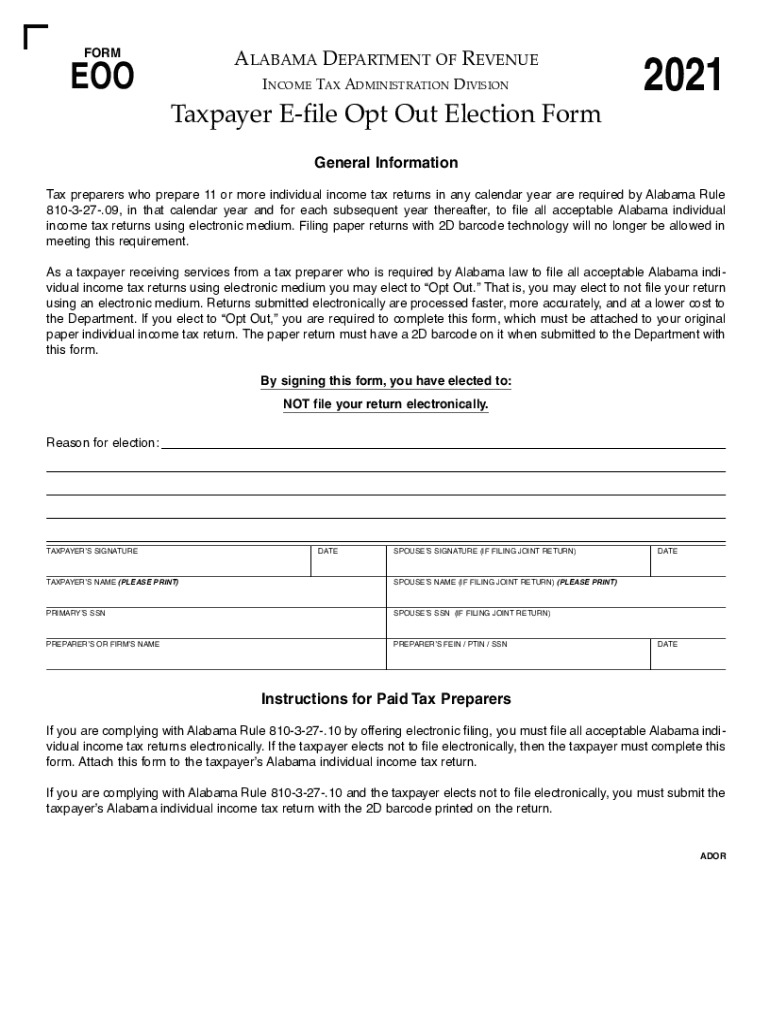

The PDF Taxpayer E-file Opt Out Election Form is a document provided by the Alabama Department of Revenue that allows taxpayers to opt out of electronic filing for their state tax returns. This form is essential for individuals or businesses that prefer to submit their tax information in a paper format rather than electronically. By completing this form, taxpayers can ensure that their filing preferences are officially recognized by the state tax authority.

How to use the PDF Taxpayer E-file Opt Out Election Form

Using the PDF Taxpayer E-file Opt Out Election Form involves several straightforward steps. First, download the form from the Alabama Department of Revenue's official website. Next, fill out the required fields, including your personal information and the reasons for opting out of electronic filing. Once completed, submit the form according to the instructions provided, ensuring it reaches the appropriate department before the tax filing deadline.

Steps to complete the PDF Taxpayer E-file Opt Out Election Form

Completing the PDF Taxpayer E-file Opt Out Election Form requires careful attention to detail. Follow these steps:

- Download the form from the Alabama Department of Revenue website.

- Provide your name, address, and Social Security number or tax identification number.

- Indicate your reason for opting out of electronic filing.

- Sign and date the form to validate your request.

- Submit the form via mail or in person to the designated department.

Key elements of the PDF Taxpayer E-file Opt Out Election Form

The PDF Taxpayer E-file Opt Out Election Form includes several key elements that are crucial for its validity. These elements typically encompass taxpayer identification details, a clear statement of the request to opt out, and a signature line for the taxpayer. Additionally, it may require a date to confirm when the request was made, ensuring that it is processed in a timely manner.

Eligibility Criteria

To be eligible to use the PDF Taxpayer E-file Opt Out Election Form, taxpayers must meet specific criteria set by the Alabama Department of Revenue. Generally, this includes individuals or businesses that have previously filed tax returns electronically but wish to revert to paper filing. It is essential to review the eligibility requirements outlined by the department to ensure compliance and proper processing of the form.

Form Submission Methods

The PDF Taxpayer E-file Opt Out Election Form can be submitted through various methods. Taxpayers can choose to mail the completed form to the Alabama Department of Revenue or deliver it in person at designated offices. It is important to follow the submission guidelines provided with the form to avoid any delays in processing.

Quick guide on how to complete pdf taxpayer e file opt out election form alabama department of revenue

Effortlessly Prepare PDF Taxpayer E file Opt Out Election Form Alabama Department Of Revenue on Any Device

Managing documents online has become increasingly favored by businesses and individuals. It offers an ideal eco-friendly substitute to traditional printed and signed papers, as you can access the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents quickly without delays. Handle PDF Taxpayer E file Opt Out Election Form Alabama Department Of Revenue on any platform using the airSlate SignNow apps for Android or iOS and streamline any document-related process today.

How to Edit and Electronically Sign PDF Taxpayer E file Opt Out Election Form Alabama Department Of Revenue with Ease

- Find PDF Taxpayer E file Opt Out Election Form Alabama Department Of Revenue and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize relevant sections of your documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your electronic signature using the Sign feature, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your changes.

- Select how you would like to send your form, by email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form navigation, or errors that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and electronically sign PDF Taxpayer E file Opt Out Election Form Alabama Department Of Revenue to ensure effective communication at any stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct pdf taxpayer e file opt out election form alabama department of revenue

Create this form in 5 minutes!

How to create an eSignature for the pdf taxpayer e file opt out election form alabama department of revenue

The best way to create an e-signature for your PDF in the online mode

The best way to create an e-signature for your PDF in Chrome

The best way to generate an electronic signature for putting it on PDFs in Gmail

The best way to make an e-signature right from your smart phone

The way to generate an electronic signature for a PDF on iOS devices

The best way to make an e-signature for a PDF on Android OS

People also ask

-

What is the provider code 4420 in airSlate SignNow?

The provider code 4420 is a specific identifier used within airSlate SignNow to enhance document management capabilities. This code helps users effectively streamline their electronic signature processes, ensuring that all documents comply with industry standards and regulations. By recognizing provider code 4420, businesses can benefit from a seamless experience in managing signed documents.

-

How can I integrate airSlate SignNow with other tools using provider code 4420?

Integrating airSlate SignNow using provider code 4420 allows businesses to connect with various applications effortlessly. This integration supports popular platforms such as CRM systems and marketing tools, enabling a more cohesive workflow. As a result, users can automate document signing processes and enhance overall efficiency through this code.

-

What pricing plans are available for airSlate SignNow under provider code 4420?

airSlate SignNow offers competitive pricing plans that accommodate businesses of all sizes utilizing provider code 4420. These plans include features tailored to your organization's needs, making it a cost-effective solution for managing electronic signatures. You can choose from various subscription options, ensuring you select the right service level for your operations.

-

What features are included with the provider code 4420 in airSlate SignNow?

The features associated with provider code 4420 in airSlate SignNow include robust eSignature capabilities, document templates, and real-time collaboration tools. These functionalities enhance the signing experience and improve document turnaround time. Users can customize their workflows to ensure efficient document handling tailored to their specific requirements.

-

What benefits does the provider code 4420 offer for businesses?

Utilizing the provider code 4420 offers several benefits for businesses, including increased efficiency, reduced document turnaround time, and enhanced compliance. By leveraging the capabilities of airSlate SignNow, organizations can streamline their operations and improve customer satisfaction with a smoother signing experience. Ultimately, this leads to better productivity and a more professional interface.

-

Is there customer support available for issues related to provider code 4420?

Yes, airSlate SignNow provides comprehensive customer support for all inquiries related to provider code 4420. Users can access various support channels, including email, live chat, and a detailed help center. This ensures that any issues or questions regarding the use of the provider code are resolved promptly, allowing for uninterrupted workflow.

-

Can I customize document workflows using provider code 4420?

Absolutely! The provider code 4420 in airSlate SignNow allows businesses to customize their document workflows to meet their unique needs. Users can set up automated workflows, designate signers, and establish approval processes, tailoring the experience to align with their operational processes and improve efficiency in document management.

Get more for PDF Taxpayer E file Opt Out Election Form Alabama Department Of Revenue

- Maryland terminate form

- Notice terminate lease tenant form

- Maryland holder 497310293 form

- Maryland deed trust 497310294 form

- Notice of default in payment of rent as warning prior to demand to pay or terminate for residential property maryland form

- Notice of default in payment of rent as warning prior to demand to pay or terminate for nonresidential or commercial property 497310297 form

- Notice of intent to vacate at end of specified lease term from tenant to landlord for residential property maryland form

- Notice of intent to vacate at end of specified lease term from tenant to landlord nonresidential maryland form

Find out other PDF Taxpayer E file Opt Out Election Form Alabama Department Of Revenue

- How To eSignature Michigan Banking Job Description Template

- eSignature Missouri Banking IOU Simple

- eSignature Banking PDF New Hampshire Secure

- How Do I eSignature Alabama Car Dealer Quitclaim Deed

- eSignature Delaware Business Operations Forbearance Agreement Fast

- How To eSignature Ohio Banking Business Plan Template

- eSignature Georgia Business Operations Limited Power Of Attorney Online

- Help Me With eSignature South Carolina Banking Job Offer

- eSignature Tennessee Banking Affidavit Of Heirship Online

- eSignature Florida Car Dealer Business Plan Template Myself

- Can I eSignature Vermont Banking Rental Application

- eSignature West Virginia Banking Limited Power Of Attorney Fast

- eSignature West Virginia Banking Limited Power Of Attorney Easy

- Can I eSignature Wisconsin Banking Limited Power Of Attorney

- eSignature Kansas Business Operations Promissory Note Template Now

- eSignature Kansas Car Dealer Contract Now

- eSignature Iowa Car Dealer Limited Power Of Attorney Easy

- How Do I eSignature Iowa Car Dealer Limited Power Of Attorney

- eSignature Maine Business Operations Living Will Online

- eSignature Louisiana Car Dealer Profit And Loss Statement Easy