PDF DARE COUNTY BOARD of COMMISSIONERS Form

What is the 407 K-1 Form?

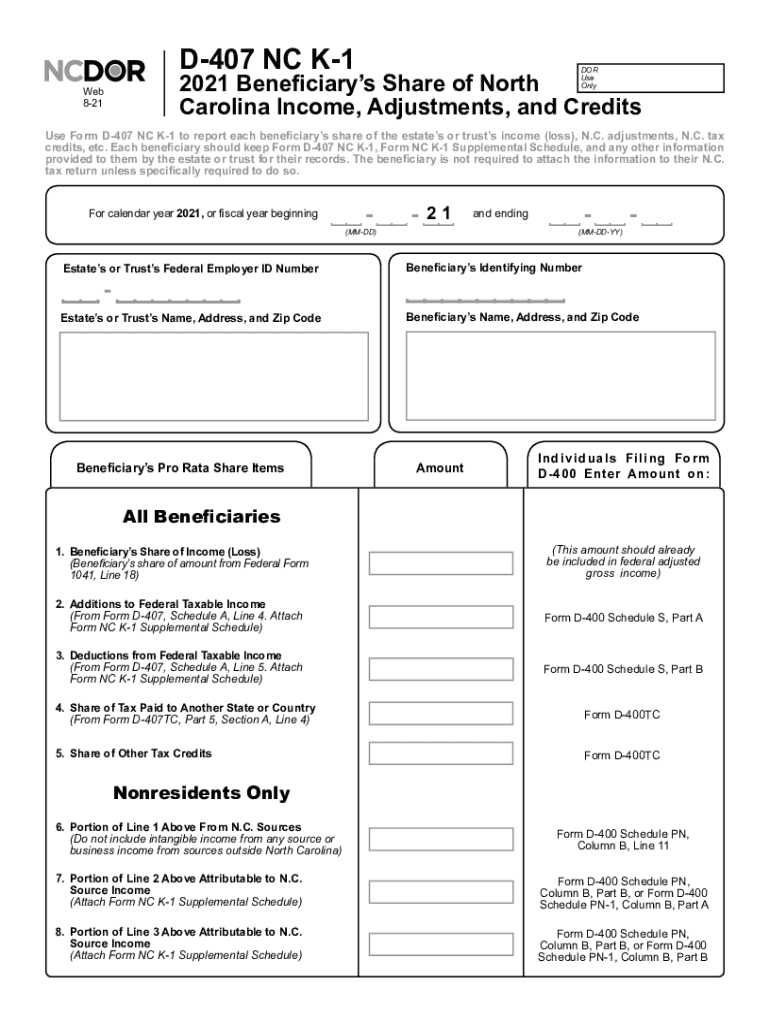

The 407 K-1 form, also known as the 2021 407nc form, is a tax document used primarily for reporting income, deductions, and credits from partnerships, S corporations, estates, and trusts. This form is essential for individuals who receive income from these entities, as it provides a detailed breakdown of their share of the income and any related tax obligations. Understanding the components of the 407 K-1 form is crucial for accurate tax reporting and compliance with IRS regulations.

Steps to Complete the 407 K-1 Form

Completing the 407 K-1 form involves several key steps:

- Gather all necessary financial documents related to your partnership or S corporation.

- Ensure you have the correct tax year information, as the 407 K-1 form is specific to each tax year.

- Fill in your personal information, including your name, address, and taxpayer identification number.

- Report your share of income, deductions, and credits as provided by the entity.

- Review the completed form for accuracy before submission.

Legal Use of the 407 K-1 Form

The 407 K-1 form is legally binding and must be filed with the IRS as part of your tax return. It is essential to ensure that the information reported on the form is accurate and complete, as discrepancies can lead to penalties or audits. The form must be provided to all partners or shareholders by the entity, and it plays a critical role in determining individual tax liabilities.

Filing Deadlines / Important Dates

For the 2021 tax year, the deadline for filing the 407 K-1 form is typically aligned with the tax return deadline for partnerships and S corporations. Generally, this means that the form should be issued to partners by March 15 of the following year. It is important to stay aware of these dates to ensure timely filing and avoid any potential penalties.

Who Issues the 407 K-1 Form?

The 407 K-1 form is issued by partnerships, S corporations, estates, and trusts to their partners or shareholders. These entities are responsible for accurately reporting the income, deductions, and credits attributable to each partner or shareholder. It is crucial for the issuing entity to ensure that the information on the form is correct to facilitate proper tax reporting by the recipients.

Key Elements of the 407 K-1 Form

Key elements of the 407 K-1 form include:

- Partner or Shareholder Information: This section includes the name, address, and taxpayer identification number of the individual receiving the K-1.

- Income Reporting: The form details the share of income, losses, and deductions allocated to the partner or shareholder.

- Entity Information: This includes the name and tax identification number of the partnership or S corporation.

- Tax Year: The form specifies the tax year for which the income is reported.

Digital vs. Paper Version of the 407 K-1 Form

The 407 K-1 form can be completed and submitted in both digital and paper formats. The digital version offers advantages such as ease of access, the ability to store and share documents securely, and faster processing times. However, some individuals may prefer the traditional paper format for its tangible nature. Regardless of the format chosen, it is important to ensure that all information is accurate and compliant with IRS regulations.

Quick guide on how to complete pdf dare county board of commissioners

Prepare PDF DARE COUNTY BOARD OF COMMISSIONERS effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed papers, allowing you to obtain the proper form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents quickly and without delays. Manage PDF DARE COUNTY BOARD OF COMMISSIONERS on any device with airSlate SignNow's Android or iOS applications and enhance any document-related task today.

The easiest way to modify and eSign PDF DARE COUNTY BOARD OF COMMISSIONERS without hassle

- Obtain PDF DARE COUNTY BOARD OF COMMISSIONERS and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize important sections of the documents or obscure sensitive information with tools specifically offered by airSlate SignNow for this purpose.

- Create your signature using the Sign tool, which takes moments and carries the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Decide how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your preference. Modify and eSign PDF DARE COUNTY BOARD OF COMMISSIONERS and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the pdf dare county board of commissioners

The best way to generate an electronic signature for your PDF in the online mode

The best way to generate an electronic signature for your PDF in Chrome

The way to generate an electronic signature for putting it on PDFs in Gmail

The best way to make an electronic signature from your smart phone

The way to make an electronic signature for a PDF on iOS devices

The best way to make an electronic signature for a PDF file on Android OS

People also ask

-

What is a 407 k 1 form and why is it important?

The 407 k 1 form is an essential tax document for partnerships and LLCs, providing critical information about income and deductions. Understanding its significance helps businesses ensure compliance and accurately file taxes. Using tools like airSlate SignNow can streamline the process of managing and signing these documents.

-

How does airSlate SignNow help with 407 k 1 document management?

airSlate SignNow offers a user-friendly platform for sending and signing 407 k 1 forms electronically. This streamline process eliminates the hassle of paper documentation and ensures secure, timely submissions. By utilizing our solution, you can enhance efficiency and reduce administrative burdens.

-

What pricing options are available for airSlate SignNow users?

airSlate SignNow provides various pricing plans tailored to fit different business needs, including options for managing 407 k 1 forms. Our competitive pricing allows businesses of all sizes to leverage eSigning capabilities without breaking the bank. Review our plans to find the perfect match for your budget and requirements.

-

Can I integrate airSlate SignNow with other software tools?

Yes, airSlate SignNow seamlessly integrates with popular software tools, enhancing its utility for managing documents like the 407 k 1 form. Integrations with platforms like Google Drive and Salesforce streamline workflows, making it easier to access and manage your documents. Leverage these integrations to boost productivity and collaboration.

-

What features does airSlate SignNow offer for eSigning 407 k 1 documents?

airSlate SignNow provides essential features for eSigning 407 k 1 documents, including customizable templates, real-time tracking, and mobile signing options. These features enhance user experience and security while ensuring compliance with eSignature laws. Take advantage of these tools to make the signing process smoother and more efficient.

-

How can airSlate SignNow benefit my business?

By using airSlate SignNow, businesses can streamline their document workflows, including the management of 407 k 1 forms. The platform reduces turnaround time, improves compliance, and enhances customer satisfaction. These benefits collectively drive productivity and contribute to business growth.

-

Is airSlate SignNow secure for handling sensitive documents like 407 k 1?

Absolutely! airSlate SignNow employs top-notch security measures to protect sensitive documents, including 407 k 1 forms. With data encryption, user authentication, and audit trails, you can confidently manage and eSign your documents while ensuring compliance with industry standards.

Get more for PDF DARE COUNTY BOARD OF COMMISSIONERS

- Maryland affidavit occupancy form

- Complex will with credit shelter marital trust for large estates maryland form

- Md marital form

- Marital domestic separation and property settlement agreement minor children no joint property or debts where divorce action 497310402 form

- Marital domestic separation and property settlement agreement minor children no joint property or debts effective immediately 497310403 form

- Marital domestic separation and property settlement agreement minor children parties may have joint property or debts where 497310404 form

- Marital domestic separation and property settlement agreement minor children parties may have joint property or debts effective form

- Marital domestic separation and property settlement agreement for persons with no children no joint property or debts effective 497310406 form

Find out other PDF DARE COUNTY BOARD OF COMMISSIONERS

- Electronic signature California Government POA Simple

- Electronic signature Illinois Education Business Plan Template Secure

- How Do I Electronic signature Colorado Government POA

- Electronic signature Government Word Illinois Now

- Can I Electronic signature Illinois Government Rental Lease Agreement

- Electronic signature Kentucky Government Promissory Note Template Fast

- Electronic signature Kansas Government Last Will And Testament Computer

- Help Me With Electronic signature Maine Government Limited Power Of Attorney

- How To Electronic signature Massachusetts Government Job Offer

- Electronic signature Michigan Government LLC Operating Agreement Online

- How To Electronic signature Minnesota Government Lease Agreement

- Can I Electronic signature Minnesota Government Quitclaim Deed

- Help Me With Electronic signature Mississippi Government Confidentiality Agreement

- Electronic signature Kentucky Finance & Tax Accounting LLC Operating Agreement Myself

- Help Me With Electronic signature Missouri Government Rental Application

- Can I Electronic signature Nevada Government Stock Certificate

- Can I Electronic signature Massachusetts Education Quitclaim Deed

- Can I Electronic signature New Jersey Government LLC Operating Agreement

- Electronic signature New Jersey Government Promissory Note Template Online

- Electronic signature Michigan Education LLC Operating Agreement Myself