PDF AMENDED TAX RETURN Comptroller of Maryland 2021

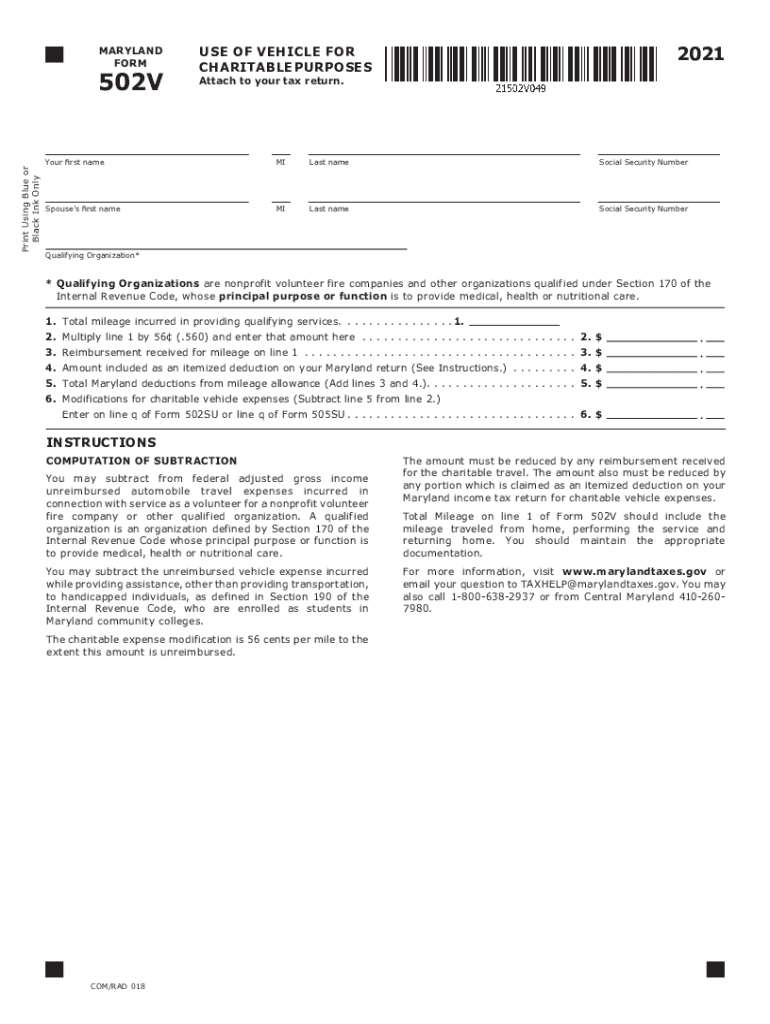

What is the Maryland 502v Form?

The Maryland 502v form is an amended tax return used by individuals and businesses in Maryland to correct previously filed tax returns. This form allows taxpayers to make adjustments to their income, deductions, and credits, ensuring accurate reporting to the Comptroller of Maryland. By filing the 502v, taxpayers can rectify errors or omissions, which may result in a tax refund or additional tax liability.

Steps to Complete the Maryland 502v Form

Completing the Maryland 502v form involves several key steps:

- Gather necessary documents, including your original tax return and any supporting documentation for the changes you wish to make.

- Clearly indicate the changes on the form, specifying the original amounts and the corrected figures.

- Provide a detailed explanation for each change in the designated section of the form.

- Review the completed form for accuracy to avoid further complications.

- Submit the form either electronically or by mail, following the submission guidelines provided by the Comptroller of Maryland.

Legal Use of the Maryland 502v Form

The Maryland 502v form is legally recognized as a valid means to amend tax returns, provided it is completed accurately and submitted within the designated time frames. It complies with state tax laws and regulations, ensuring that any adjustments made are officially recorded. Taxpayers must adhere to the guidelines set forth by the Comptroller to maintain compliance and avoid penalties.

Filing Deadlines for the Maryland 502v Form

Timely filing of the Maryland 502v form is crucial. Generally, taxpayers must submit the amended return within three years from the original filing date or within two years from the date the tax was paid, whichever is later. It is essential to be aware of these deadlines to ensure that any potential refunds or adjustments are processed efficiently.

Form Submission Methods for the Maryland 502v

The Maryland 502v form can be submitted through various methods:

- Electronically via the Maryland Comptroller's online services, which offers a streamlined process for submitting amendments.

- By mail, where taxpayers can send the completed form to the appropriate address provided by the Comptroller.

- In-person at designated Comptroller offices, allowing for direct submission and immediate assistance if needed.

Key Elements of the Maryland 502v Form

Understanding the key elements of the Maryland 502v form is essential for accurate completion. The form includes sections for:

- Identifying information, such as the taxpayer's name, address, and Social Security number.

- Details of the original tax return, including income, deductions, and credits.

- Specific changes being made, with clear explanations and supporting documentation.

- Signature and date, confirming the taxpayer's acknowledgment of the information provided.

Examples of Using the Maryland 502v Form

There are various scenarios in which a taxpayer might need to use the Maryland 502v form:

- Correcting an error in reported income, such as additional income that was not included in the original return.

- Adjusting deductions, like claiming a missed charitable contribution or business expense.

- Updating personal information, such as a change in filing status or dependents.

Quick guide on how to complete pdf amended tax return comptroller of maryland

Effortlessly Prepare PDF AMENDED TAX RETURN Comptroller Of Maryland on Any Device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, as you can access the necessary form and securely keep it online. airSlate SignNow equips you with all the resources needed to create, alter, and eSign your documents swiftly without hold-ups. Manage PDF AMENDED TAX RETURN Comptroller Of Maryland on any platform using airSlate SignNow's Android or iOS applications and enhance any document-focused process today.

The Simplest Way to Edit and eSign PDF AMENDED TAX RETURN Comptroller Of Maryland with Ease

- Obtain PDF AMENDED TAX RETURN Comptroller Of Maryland and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important parts of your documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose your preferred method of sharing your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills your document management requirements in just a few clicks from any device you prefer. Modify and eSign PDF AMENDED TAX RETURN Comptroller Of Maryland and ensure outstanding communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct pdf amended tax return comptroller of maryland

Create this form in 5 minutes!

How to create an eSignature for the pdf amended tax return comptroller of maryland

The best way to generate an e-signature for a PDF document online

The best way to generate an e-signature for a PDF document in Google Chrome

How to generate an e-signature for signing PDFs in Gmail

The way to create an e-signature from your smart phone

How to create an e-signature for a PDF document on iOS

The way to create an e-signature for a PDF file on Android OS

People also ask

-

What is a 502v form and how is it used?

The 502v form is a specific document used for various business and administrative purposes. It is commonly employed for tax or financial transactions, enabling parties to provide necessary information in a standardized format. airSlate SignNow allows you to create, send, and eSign 502v forms easily.

-

How can I eSign a 502v form using airSlate SignNow?

To eSign a 502v form with airSlate SignNow, simply upload the document to our platform. From there, you can add your signature or send it to other signers for their signatures. The process is user-friendly, ensuring the 502v form is signed securely and efficiently.

-

Is there a fee to use airSlate SignNow for 502v forms?

airSlate SignNow offers various pricing plans tailored to different business needs. Our affordable rates make it cost-effective to manage the signing and sending of 502v forms without hidden fees. You can choose a plan that best suits your requirements for handling documents.

-

What features are available for managing 502v forms?

Our platform provides robust features to enhance your management of 502v forms, including document templates, customizable workflows, and real-time tracking. You can ensure prompt completion of necessary signatures and maintain a comprehensive record of all transactions involving the 502v form.

-

Can I integrate airSlate SignNow with other applications for handling 502v forms?

Yes, airSlate SignNow seamlessly integrates with many popular business applications, making it easy to manage 502v forms alongside your existing tools. This includes CRMs, cloud storage services, and collaboration platforms, allowing for a more streamlined process.

-

What benefits does airSlate SignNow offer for electronically signing 502v forms?

The primary benefit of using airSlate SignNow for electronically signing 502v forms is convenience. You can sign documents from anywhere, on any device, reducing the time and costs associated with traditional signing methods. Moreover, it enhances security and compliance for your signed documents.

-

Are there any security measures in place for 502v forms at airSlate SignNow?

Absolutely, security is a top priority at airSlate SignNow. We implement advanced encryption and authentication protocols to ensure that your 502v forms and other documents are protected. You can trust that your data is safe while using our eSigning services.

Get more for PDF AMENDED TAX RETURN Comptroller Of Maryland

Find out other PDF AMENDED TAX RETURN Comptroller Of Maryland

- Sign South Dakota Non-Profit Business Plan Template Myself

- Sign Rhode Island Non-Profit Residential Lease Agreement Computer

- Sign South Carolina Non-Profit Promissory Note Template Mobile

- Sign South Carolina Non-Profit Lease Agreement Template Online

- Sign Oregon Life Sciences LLC Operating Agreement Online

- Sign Texas Non-Profit LLC Operating Agreement Online

- Can I Sign Colorado Orthodontists Month To Month Lease

- How Do I Sign Utah Non-Profit Warranty Deed

- Help Me With Sign Colorado Orthodontists Purchase Order Template

- Sign Virginia Non-Profit Living Will Fast

- How To Sign Virginia Non-Profit Lease Agreement Template

- How To Sign Wyoming Non-Profit Business Plan Template

- How To Sign Wyoming Non-Profit Credit Memo

- Sign Wisconsin Non-Profit Rental Lease Agreement Simple

- Sign Wisconsin Non-Profit Lease Agreement Template Safe

- Sign South Dakota Life Sciences Limited Power Of Attorney Mobile

- Sign Alaska Plumbing Moving Checklist Later

- Sign Arkansas Plumbing Business Plan Template Secure

- Sign Arizona Plumbing RFP Mobile

- Sign Arizona Plumbing Rental Application Secure