Tax Year 502V Use of Vehicle for Charitable Purposes 2023-2026

Understanding the Tax Year 502V Use of Vehicle for Charitable Purposes

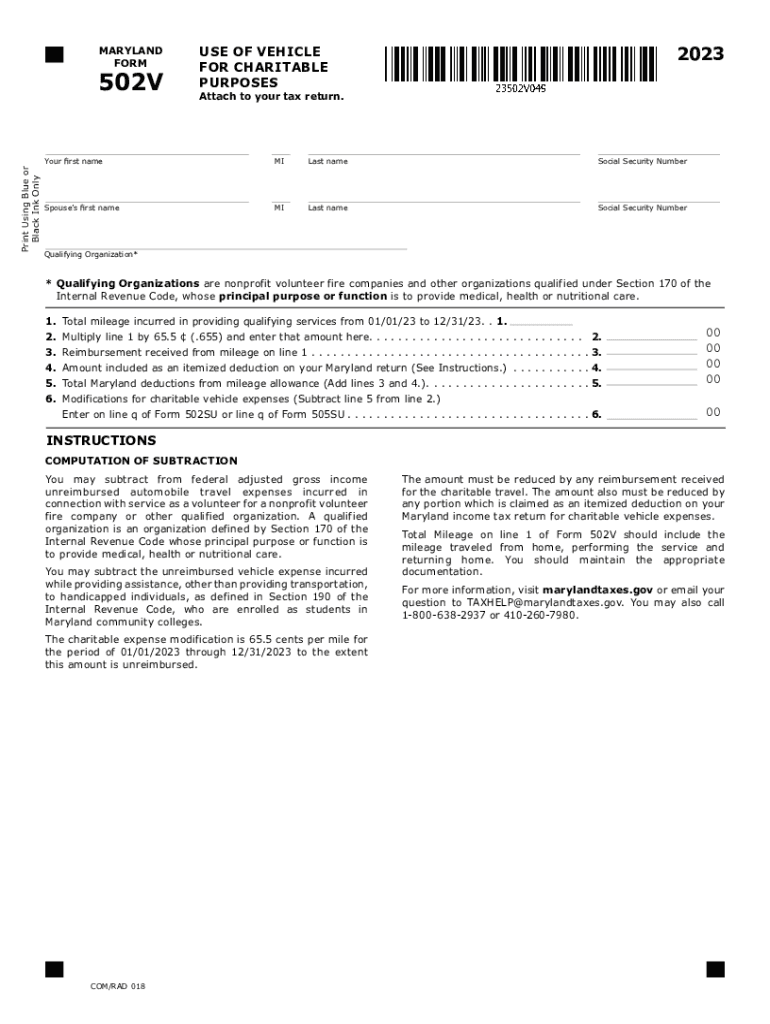

The Tax Year 502V form is specifically designed for individuals who use their vehicles for charitable purposes. This form allows taxpayers to report the mileage driven for charitable activities, which can potentially lead to tax deductions. It is essential to accurately track and report this information to comply with IRS regulations and maximize potential tax benefits.

Steps to Complete the Tax Year 502V Use of Vehicle for Charitable Purposes

Completing the Tax Year 502V form involves several key steps:

- Gather documentation of all charitable activities, including the dates and purposes of each trip.

- Calculate the total mileage driven for charitable purposes during the tax year.

- Fill out the form by entering your total mileage and any additional required information.

- Review the completed form for accuracy before submission.

Eligibility Criteria for the Tax Year 502V Use of Vehicle for Charitable Purposes

To qualify for deductions using the Tax Year 502V form, taxpayers must meet specific eligibility criteria. The vehicle must be used primarily for charitable activities, and the taxpayer should be able to provide documentation supporting the mileage claimed. Additionally, the charitable organization must be recognized by the IRS as a qualified charity.

IRS Guidelines for the Tax Year 502V Use of Vehicle for Charitable Purposes

The IRS provides clear guidelines on how to use the Tax Year 502V form. Taxpayers should refer to IRS publications for detailed instructions on allowable deductions, record-keeping requirements, and the types of charitable organizations that qualify. Adhering to these guidelines helps ensure compliance and maximizes potential deductions.

Filing Deadlines for the Tax Year 502V Use of Vehicle for Charitable Purposes

It is crucial to be aware of the filing deadlines associated with the Tax Year 502V form. Generally, the form must be submitted along with your annual tax return by the standard tax filing deadline, which is typically April 15. However, taxpayers should verify specific dates for each tax year, as they may vary.

Form Submission Methods for the Tax Year 502V Use of Vehicle for Charitable Purposes

The Tax Year 502V form can be submitted through various methods. Taxpayers have the option to file online using tax preparation software, submit the form by mail, or deliver it in person to their local IRS office. Each method has its own advantages, so individuals should choose the one that best suits their needs.

Quick guide on how to complete tax year 502v use of vehicle for charitable purposes

Complete Tax Year 502V Use Of Vehicle For Charitable Purposes effortlessly on any device

Managing documents online has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly substitute for conventional printed and signed paperwork, allowing you to access the correct form and securely save it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Handle Tax Year 502V Use Of Vehicle For Charitable Purposes on any platform using airSlate SignNow's Android or iOS applications and simplify any document-centric task today.

How to modify and eSign Tax Year 502V Use Of Vehicle For Charitable Purposes with ease

- Locate Tax Year 502V Use Of Vehicle For Charitable Purposes and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Mark relevant sections of the documents or redact sensitive information using tools provided by airSlate SignNow specifically for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal significance as a traditional wet ink signature.

- Verify all the information and click on the Done button to save your modifications.

- Select your preferred method to send your form, via email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced documents, monotonous form searching, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and eSign Tax Year 502V Use Of Vehicle For Charitable Purposes and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct tax year 502v use of vehicle for charitable purposes

Create this form in 5 minutes!

How to create an eSignature for the tax year 502v use of vehicle for charitable purposes

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a 502v form and how is it used?

The 502v form is a specific document used for various administrative purposes, particularly within financial and tax contexts. It is crucial for businesses that need to submit changes or updates to their information to the appropriate authorities. Using airSlate SignNow, you can easily create, send, and eSign the 502v form to streamline the process.

-

How can I electronically sign a 502v form using airSlate SignNow?

With airSlate SignNow, signing a 502v form is straightforward. You simply upload your document, add the necessary fields for signatures, and invite the required signers to eSign. The platform ensures that all signatures are legally binding and securely stored.

-

What are the pricing plans for using airSlate SignNow for the 502v form?

airSlate SignNow offers various pricing plans that cater to businesses of different sizes. Whether you need basic features for occasional use or advanced options for high-volume signing of documents like the 502v form, you can find a plan that fits your needs and budget. Visit our pricing page for detailed information.

-

Can I integrate airSlate SignNow with other applications for managing the 502v form?

Yes, airSlate SignNow provides seamless integrations with various other applications, enhancing the management of your 502v form and other documents. You can connect it with platforms like Google Drive, Salesforce, and others to automate workflows and ensure your data is aligned across systems.

-

What are the benefits of using airSlate SignNow for the 502v form?

Using airSlate SignNow for your 502v form offers several benefits, including improved efficiency, cost savings, and enhanced security. The platform simplifies the signing process, reduces the need for paper, and ensures compliance with legal requirements, making it an ideal solution for businesses.

-

Is airSlate SignNow secure for signing sensitive documents like the 502v form?

Absolutely! airSlate SignNow prioritizes security by employing advanced encryption and authentication protocols to protect your sensitive documents, including the 502v form. Rest assured that your information is safe and compliant with industry standards.

-

How does airSlate SignNow help in tracking the status of my 502v form?

airSlate SignNow offers real-time tracking of your 502v form, allowing you to see who has signed and who still needs to take action. This feature helps you stay organized and ensure that important documents are processed promptly.

Get more for Tax Year 502V Use Of Vehicle For Charitable Purposes

- In the district court of the first circuit form1dc57

- D plaintiff d defendant d atty for plaintiff d atty for defendant form

- How to file an llc amendment with the hawaii department of form

- Filing partyiesfiling partyies attorney name attorney form

- Proof of service california form

- G plaintiff s g defendant s form 2dc38 motion g to g

- Declaration notice of motion certificate form

- Alaska legal form titles legal documentsus legal forms

Find out other Tax Year 502V Use Of Vehicle For Charitable Purposes

- How To Sign Wyoming Real Estate Operating Agreement

- Sign Massachusetts Police Quitclaim Deed Online

- Sign Police Word Missouri Computer

- Sign Missouri Police Resignation Letter Fast

- Sign Ohio Police Promissory Note Template Easy

- Sign Alabama Courts Affidavit Of Heirship Simple

- How To Sign Arizona Courts Residential Lease Agreement

- How Do I Sign Arizona Courts Residential Lease Agreement

- Help Me With Sign Arizona Courts Residential Lease Agreement

- How Can I Sign Arizona Courts Residential Lease Agreement

- Sign Colorado Courts LLC Operating Agreement Mobile

- Sign Connecticut Courts Living Will Computer

- How Do I Sign Connecticut Courts Quitclaim Deed

- eSign Colorado Banking Rental Application Online

- Can I eSign Colorado Banking Medical History

- eSign Connecticut Banking Quitclaim Deed Free

- eSign Connecticut Banking Business Associate Agreement Secure

- Sign Georgia Courts Moving Checklist Simple

- Sign Georgia Courts IOU Mobile

- How Can I Sign Georgia Courts Lease Termination Letter