MARYLAND USE of VEHICLE for FORM CHARITABLE 2022

What is the Maryland use of vehicle for charitable purposes form?

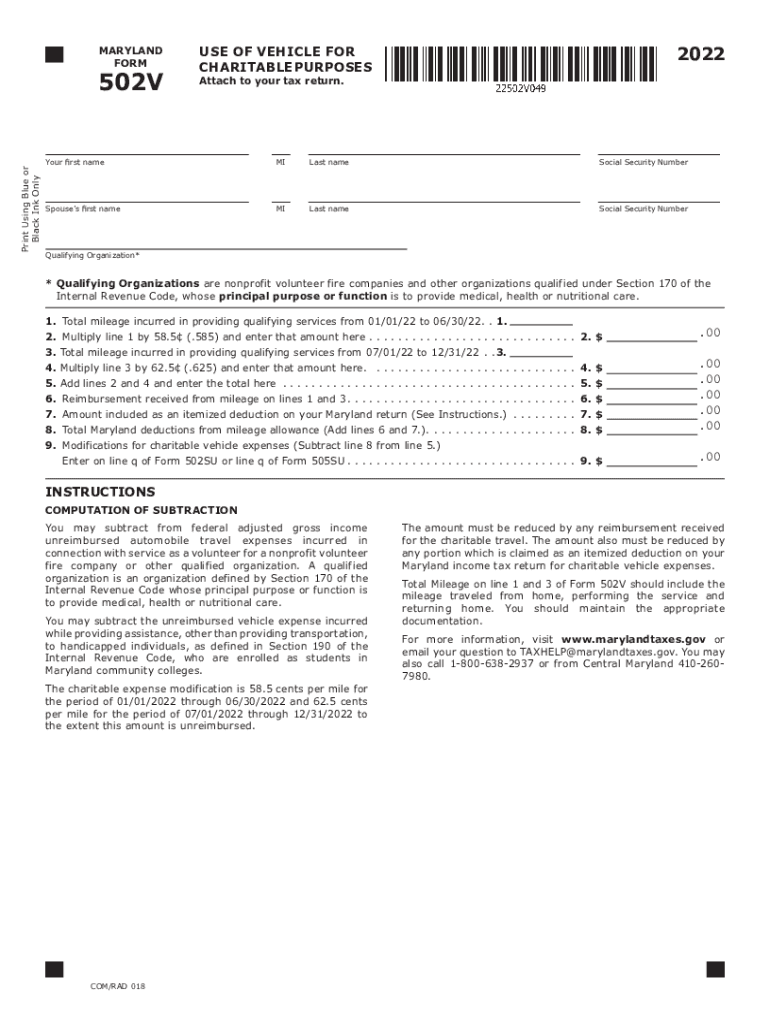

The Maryland 502v form is a document used to report the use of a vehicle for charitable purposes. This form is essential for individuals or organizations that wish to claim a tax deduction for the use of a vehicle when supporting charitable activities. By completing the 502v form, taxpayers can provide the necessary information to the Maryland State Department of Assessments and Taxation, ensuring compliance with state regulations regarding vehicle use for charitable contributions.

Steps to complete the Maryland use of vehicle for charitable purposes form

Completing the Maryland 502v form involves several key steps:

- Gather necessary information, including vehicle details, mileage, and the purpose of use.

- Fill out the form accurately, ensuring all fields are completed to avoid delays.

- Attach any required documentation, such as proof of charitable activities or mileage logs.

- Review the completed form for accuracy before submission.

- Submit the form either online or via mail, following the guidelines provided by the Maryland State Department of Assessments and Taxation.

Key elements of the Maryland use of vehicle for charitable purposes form

The Maryland 502v form includes several important elements that must be addressed:

- Vehicle Information: Details such as make, model, and year of the vehicle.

- Mileage: Total miles driven for charitable purposes during the reporting period.

- Purpose of Use: A clear description of how the vehicle was used for charitable activities.

- Signature: The form must be signed by the individual or authorized representative certifying the information is true.

Legal use of the Maryland use of vehicle for charitable purposes form

To ensure the legal validity of the Maryland 502v form, it is important to adhere to specific regulations. The form must be completed accurately, reflecting genuine charitable use of the vehicle. Misrepresentation can lead to penalties or disqualification from receiving tax deductions. Additionally, compliance with state laws regarding charitable contributions is essential to maintain the integrity of the claim.

Filing deadlines and important dates

Timely submission of the Maryland 502v form is crucial for tax compliance. Generally, the form should be filed by the tax return deadline, which is typically April fifteenth each year. However, if an extension is filed for the tax return, the 502v form should also be submitted by the extended deadline. Keeping track of these dates helps ensure that all necessary documentation is submitted on time.

Who issues the Maryland use of vehicle for charitable purposes form?

The Maryland 502v form is issued by the Maryland State Department of Assessments and Taxation. This department oversees the administration of various tax forms and ensures that taxpayers comply with state regulations regarding vehicle use for charitable purposes. It is advisable to consult their official resources for the most current version of the form and any updates to filing procedures.

Quick guide on how to complete maryland use of vehicle for form charitable

Prepare MARYLAND USE OF VEHICLE FOR FORM CHARITABLE effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can obtain the correct format and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents swiftly without any delays. Manage MARYLAND USE OF VEHICLE FOR FORM CHARITABLE on any platform with airSlate SignNow’s Android or iOS applications and simplify any document-related tasks today.

How to modify and eSign MARYLAND USE OF VEHICLE FOR FORM CHARITABLE without hassle

- Find MARYLAND USE OF VEHICLE FOR FORM CHARITABLE and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize signNow sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically offers for this purpose.

- Create your eSignature using the Sign tool, which takes just a few seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your modifications.

- Select how you would like to send your form, via email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from your chosen device. Modify and eSign MARYLAND USE OF VEHICLE FOR FORM CHARITABLE to ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct maryland use of vehicle for form charitable

Create this form in 5 minutes!

How to create an eSignature for the maryland use of vehicle for form charitable

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 502v form?

The 502v form is a crucial document used for various official purposes, particularly in healthcare and administrative settings. It ensures the accurate collection of essential data while facilitating electronic signatures. With airSlate SignNow, completing and signing the 502v form becomes streamlined and efficient.

-

How much does it cost to use airSlate SignNow for the 502v form?

airSlate SignNow offers flexible pricing plans to accommodate different business needs, making it affordable for users who need to manage the 502v form. The cost-effective solution includes various features that simplify document signing and management. Visit our pricing page to find the best plan for your organization.

-

What features does airSlate SignNow provide for managing the 502v form?

airSlate SignNow includes advanced features such as customizable templates, secure eSigning, and automated workflows specifically for the 502v form. These tools help you streamline your processes and ensure compliance. Additionally, you can track document status in real-time, enhancing your efficiency.

-

What are the benefits of using airSlate SignNow for the 502v form?

Using airSlate SignNow for the 502v form offers several benefits, including improved accuracy, faster turnaround times, and enhanced security. The platform is designed to reduce paperwork and minimize errors, making it an ideal choice for businesses. Furthermore, the ease of use ensures that all team members can efficiently manage document signing processes.

-

Can I integrate airSlate SignNow with other software to handle the 502v form?

Yes, airSlate SignNow allows integrations with various software applications, enabling you to streamline your workflows for the 502v form. This includes compatibility with CRM systems, cloud storage services, and productivity tools. Integration capabilities enhance your operational efficiency by connecting all your essential platforms.

-

Is airSlate SignNow legally compliant for processing the 502v form?

Absolutely! airSlate SignNow is fully compliant with eSignature laws, including the ESIGN Act and UETA, making it a trusted choice for processing the 502v form. You can rest assured that all your signed documents meet legal requirements. Our platform also provides audit trails to maintain records of the signing process.

-

How does airSlate SignNow improve the user experience for the 502v form?

airSlate SignNow enhances user experience by providing an intuitive interface for completing and signing the 502v form. The platform is designed for effortless document navigation, reducing time spent on tasks. With automated reminders and notifications, users stay informed throughout the signing process.

Get more for MARYLAND USE OF VEHICLE FOR FORM CHARITABLE

- Sc note form

- Notice of option for recording south carolina form

- Life documents planning package including will power of attorney and living will south carolina form

- General durable power of attorney for property and finances or financial effective upon disability south carolina form

- Essential legal life documents for baby boomers south carolina form

- General durable power of attorney for property and finances or financial effective immediately south carolina form

- Durable power attorney sc form

- Essential legal life documents for newlyweds south carolina form

Find out other MARYLAND USE OF VEHICLE FOR FORM CHARITABLE

- How Can I Electronic signature Alabama Finance & Tax Accounting Document

- How To Electronic signature Delaware Government Document

- Help Me With Electronic signature Indiana Education PDF

- How To Electronic signature Connecticut Government Document

- How To Electronic signature Georgia Government PDF

- Can I Electronic signature Iowa Education Form

- How To Electronic signature Idaho Government Presentation

- Help Me With Electronic signature Hawaii Finance & Tax Accounting Document

- How Can I Electronic signature Indiana Government PDF

- How Can I Electronic signature Illinois Finance & Tax Accounting PPT

- How To Electronic signature Maine Government Document

- How To Electronic signature Louisiana Education Presentation

- How Can I Electronic signature Massachusetts Government PDF

- How Do I Electronic signature Montana Government Document

- Help Me With Electronic signature Louisiana Finance & Tax Accounting Word

- How To Electronic signature Pennsylvania Government Document

- Can I Electronic signature Texas Government PPT

- How To Electronic signature Utah Government Document

- How To Electronic signature Washington Government PDF

- How Can I Electronic signature New Mexico Finance & Tax Accounting Word