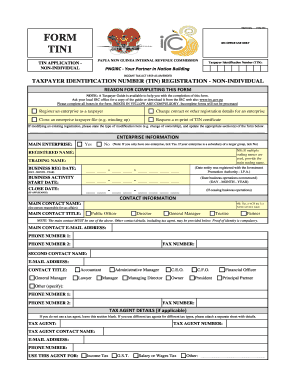

Tin 1 Application Form Download

What is the TIN Application Form?

The TIN application form, also known as the TIN registration form, is a crucial document used to apply for a Taxpayer Identification Number (TIN) in the United States. This number is essential for individuals and businesses to comply with tax regulations. The TIN can be an individual's Social Security Number (SSN), Employer Identification Number (EIN), or Individual Taxpayer Identification Number (ITIN). The form serves as the official request to the IRS for the issuance of a TIN, which is necessary for tax reporting and identification purposes.

Steps to Complete the TIN Application Form

Completing the TIN application form involves several key steps to ensure accuracy and compliance. First, gather the necessary personal information, including your name, address, and identification details. Next, fill out the form accurately, ensuring that all sections are completed. It is important to double-check the information for any errors before submission. Finally, submit the completed form to the appropriate IRS office, either online or via mail, depending on the specific requirements outlined for the form.

Legal Use of the TIN Application Form

The TIN application form is legally binding and must be filled out in accordance with IRS regulations. When submitting the form, it is essential to provide truthful and accurate information to avoid penalties or delays in processing. The form must be signed and dated, and it is advisable to keep a copy for your records. Compliance with the legal requirements surrounding the TIN application ensures that the issued TIN is valid and can be used for tax purposes without complications.

Required Documents for TIN Application

When applying for a TIN, certain documents are required to verify your identity and eligibility. These may include:

- A valid government-issued photo ID, such as a driver's license or passport.

- Proof of residency, such as a utility bill or lease agreement.

- Any previous tax documents, if applicable, to establish your tax history.

Having these documents ready can streamline the application process and help ensure that your TIN is issued without unnecessary delays.

Form Submission Methods

The TIN application form can be submitted through various methods to accommodate different preferences. The primary submission methods include:

- Online: Use the IRS website to fill out and submit the form electronically.

- Mail: Print the completed form and send it to the designated IRS address.

- In-Person: Visit a local IRS office for assistance with the application process.

Choosing the right submission method can depend on your specific situation and preference for processing speed.

IRS Guidelines for TIN Application

The IRS provides specific guidelines for completing and submitting the TIN application form. It is important to follow these guidelines closely to ensure compliance. Key points include:

- Ensure that all information is accurate and up-to-date.

- Submit the application by the deadline to avoid delays in receiving your TIN.

- Keep a copy of the submitted form for your records.

Following these guidelines can help facilitate a smooth application process and reduce the likelihood of issues arising with your TIN.

Quick guide on how to complete tin 1 application form download

Effortlessly Prepare Tin 1 Application Form Download on Any Device

Digital document management has become increasingly favored by organizations and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, enabling you to obtain the necessary form and securely archive it online. airSlate SignNow equips you with all the resources needed to create, modify, and electronically sign your documents swiftly without delays. Manage Tin 1 Application Form Download on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related procedure today.

The easiest way to modify and electronically sign Tin 1 Application Form Download effortlessly

- Locate Tin 1 Application Form Download and click on Get Form to begin.

- Use the tools we provide to fill out your document.

- Emphasize pertinent sections of the documents or redact sensitive data with utilities specifically offered by airSlate SignNow for that purpose.

- Create your electronic signature using the Sign tool, which takes moments and carries the same legal validity as a conventional handwritten signature.

- Review the information and click on the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Tin 1 Application Form Download and ensure seamless communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the tin 1 application form download

The best way to create an electronic signature for a PDF document online

The best way to create an electronic signature for a PDF document in Google Chrome

How to generate an e-signature for signing PDFs in Gmail

The way to generate an e-signature from your smart phone

The way to create an e-signature for a PDF document on iOS

The way to generate an e-signature for a PDF file on Android OS

People also ask

-

What is a tin form and how does it work with airSlate SignNow?

A tin form is a standardized format for tax identification numbers, commonly used in various business transactions. With airSlate SignNow, users can easily create, send, and eSign tin forms to ensure compliance and streamline their processing. Our platform simplifies the management of these forms, making it easier to track and store them securely.

-

Are there any costs associated with using airSlate SignNow for tin forms?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs, including those specifically for managing tin forms. Our plans are designed to be cost-effective, ensuring you only pay for the features you need. Check our pricing page for detailed information on what’s included in each plan.

-

What features does airSlate SignNow offer for managing tin forms?

airSlate SignNow offers a range of features for managing tin forms, including customizable templates, secure electronic signatures, and real-time tracking of document status. Additionally, our platform allows you to automate workflows, reducing manual errors and saving time for your team. These features greatly enhance the efficiency of handling tin forms.

-

Is it easy to integrate airSlate SignNow with other applications for tin form management?

Absolutely! airSlate SignNow easily integrates with several popular applications such as Google Drive, Salesforce, and Microsoft Office. This functionality allows businesses to manage their tin forms seamlessly across different platforms. Our API also enables custom integrations tailored to your specific workflow needs.

-

What are the benefits of using airSlate SignNow for eSigning tin forms?

Using airSlate SignNow for eSigning tin forms provides numerous benefits, including increased speed and efficiency in document processing. It also enhances security through encrypted signatures and ensures compliance with legal standards. Additionally, our platform allows for easy access to signed documents, improving record-keeping processes.

-

Can I customize tin forms on airSlate SignNow?

Yes, you can customize tin forms on airSlate SignNow to meet your specific requirements. Our intuitive interface allows you to modify templates easily, add fields, and include your branding elements. This ensures that your tin forms not only serve their purpose but also reflect your company’s identity.

-

How does airSlate SignNow ensure the security of my tin forms?

airSlate SignNow prioritizes the security of your tin forms by employing advanced encryption techniques to protect your documents. We also offer secure access controls and audit trails to track document activity. These measures safeguard sensitive information and ensure that your eSigned tin forms remain confidential.

Get more for Tin 1 Application Form Download

- Identity theft by known imposter package michigan form

- Organizing your personal assets package michigan form

- Essential documents for the organized traveler package michigan form

- Essential documents for the organized traveler package with personal organizer michigan form

- Postnuptial agreements package michigan form

- Letters of recommendation package michigan form

- Storage business package michigan form

- Child care services package michigan form

Find out other Tin 1 Application Form Download

- eSignature Ohio Prenuptial Agreement Template Safe

- eSignature Oklahoma Prenuptial Agreement Template Safe

- eSignature Kentucky Child Custody Agreement Template Free

- eSignature Wyoming Child Custody Agreement Template Free

- eSign Florida Mortgage Quote Request Online

- eSign Mississippi Mortgage Quote Request Online

- How To eSign Colorado Freelance Contract

- eSign Ohio Mortgage Quote Request Mobile

- eSign Utah Mortgage Quote Request Online

- eSign Wisconsin Mortgage Quote Request Online

- eSign Hawaii Temporary Employment Contract Template Later

- eSign Georgia Recruitment Proposal Template Free

- Can I eSign Virginia Recruitment Proposal Template

- How To eSign Texas Temporary Employment Contract Template

- eSign Virginia Temporary Employment Contract Template Online

- eSign North Dakota Email Cover Letter Template Online

- eSign Alabama Independent Contractor Agreement Template Fast

- eSign New York Termination Letter Template Safe

- How To eSign West Virginia Termination Letter Template

- How To eSign Pennsylvania Independent Contractor Agreement Template