Daycare Tax Statement Template Form

What is the daycare tax statement template?

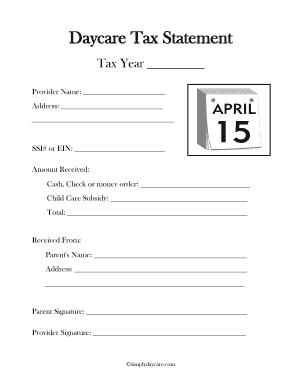

The daycare tax statement template is a standardized document used by parents to claim childcare expenses on their tax returns. This template provides essential information regarding the care provided, including the name and address of the daycare provider, the taxpayer's details, and the total amount paid for childcare services during the tax year. Utilizing this template ensures that parents have a clear and organized way to present their childcare expenses to the IRS, facilitating potential tax deductions.

Key elements of the daycare tax statement template

A well-structured daycare tax statement template includes several critical components to ensure compliance with IRS requirements. These elements typically consist of:

- Provider Information: Name, address, and tax identification number of the daycare provider.

- Parent Information: Name and Social Security number of the parent or guardian claiming the tax credit.

- Child Information: Names and ages of the children receiving care.

- Total Amount Paid: The total expenses incurred for childcare services during the tax year.

- Dates of Service: The periods during which care was provided.

Steps to complete the daycare tax statement template

Completing the daycare tax statement template involves several straightforward steps. To ensure accuracy and compliance, follow these steps:

- Gather all relevant information, including receipts and payment records for childcare services.

- Fill in the provider's information, ensuring the tax identification number is accurate.

- Provide your personal details, including your Social Security number.

- List the names and ages of your children who received care.

- Enter the total amount paid for childcare services and the specific dates of service.

- Review the completed form for accuracy before submission.

Legal use of the daycare tax statement template

The daycare tax statement template is legally recognized as a valid document for claiming childcare expenses on your tax return. For the statement to be considered valid, it must include all required information and be completed accurately. The IRS requires that parents retain this document along with supporting receipts in case of an audit. Using a reliable electronic signature solution, like signNow, can further ensure the document's integrity and compliance with eSignature laws.

Filing deadlines / important dates

When it comes to filing your taxes and claiming childcare expenses, being aware of important deadlines is crucial. Typically, the tax filing deadline for individuals in the United States is April fifteenth. If this date falls on a weekend or holiday, the deadline may be extended. It is advisable to submit your daycare tax statement along with your tax return by this deadline to ensure you receive any eligible tax benefits. Additionally, if you are filing for an extension, remember to check the specific dates associated with that process.

Who issues the form?

The daycare tax statement is generally issued by the daycare provider. Parents should request this statement from their childcare provider at the end of the tax year. It is the responsibility of the provider to ensure that the statement includes all necessary information required by the IRS. Parents should verify that the information is accurate and complete before using it to file their taxes.

Quick guide on how to complete daycare tax statement template

Complete Daycare Tax Statement Template effortlessly on any device

Digital document management has gained popularity among businesses and individuals alike. It serves as an ideal eco-friendly substitute for conventional printed and signed paperwork, allowing you to find the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents swiftly without hindrances. Manage Daycare Tax Statement Template on any device using airSlate SignNow's Android or iOS applications and enhance your document-related tasks today.

How to alter and electronically sign Daycare Tax Statement Template effortlessly

- Locate Daycare Tax Statement Template and then click Get Form to begin.

- Utilize the tools we provide to finalize your document.

- Emphasize important portions of your documents or redact sensitive information with tools specifically offered by airSlate SignNow for this purpose.

- Generate your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your changes.

- Choose how you wish to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, cumbersome form navigation, or errors necessitating the printing of new document copies. airSlate SignNow addresses your document management needs in just a few clicks from your chosen device. Edit and electronically sign Daycare Tax Statement Template and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the daycare tax statement template

The best way to make an electronic signature for your PDF document in the online mode

The best way to make an electronic signature for your PDF document in Chrome

The best way to make an electronic signature for putting it on PDFs in Gmail

How to generate an e-signature from your mobile device

How to generate an electronic signature for a PDF document on iOS devices

How to generate an e-signature for a PDF file on Android devices

People also ask

-

What is a daycare tax form and why is it important?

A daycare tax form is a document used by parents or guardians to claim childcare expenses on their taxes. It is essential because it provides the necessary information for tax credits or deductions that can alleviate financial burdens associated with daycare expenses.

-

How can airSlate SignNow help me with daycare tax forms?

AirSlate SignNow simplifies the process of completing and signing daycare tax forms electronically. With its user-friendly interface, you can easily fill out, sign, and send your daycare tax forms, ensuring compliance and efficiency.

-

Are there any costs associated with using airSlate SignNow for daycare tax forms?

AirSlate SignNow offers a cost-effective solution for managing daycare tax forms. Pricing varies based on the plan you choose, but it typically includes features that allow unlimited document signing and sending at a competitive rate.

-

What features does airSlate SignNow provide for daycare tax forms?

AirSlate SignNow offers a range of features for daycare tax forms, including customizable templates, secure cloud storage, and electronic signatures. These features make it easier to manage documents and ensure that your daycare tax forms are filled out correctly.

-

Is airSlate SignNow user-friendly for completing daycare tax forms?

Yes, airSlate SignNow is designed with user-friendliness in mind. It provides an intuitive interface that guides you through the process of filling out and signing your daycare tax forms, making it accessible for users of all tech levels.

-

Can I store my daycare tax forms securely in airSlate SignNow?

Absolutely! AirSlate SignNow ensures that your daycare tax forms and other documents are stored securely in the cloud. You can access them anytime and rest assured that your sensitive information is protected.

-

Does airSlate SignNow integrate with other tools for managing daycare tax forms?

Yes, airSlate SignNow integrates seamlessly with various applications to help you manage daycare tax forms. Whether you use accounting software or document management systems, these integrations enhance your overall productivity.

Get more for Daycare Tax Statement Template

- Notice of dishonored check civil and criminal keywords bad check bounced check minnesota form

- Minnesota certificate trust form

- Minnesota certificate trust 497312182 form

- Mutual wills containing last will and testaments for unmarried persons living together with no children minnesota form

- Mutual wills package of last wills and testaments for unmarried persons living together with adult children minnesota form

- Mutual wills or last will and testaments for unmarried persons living together with minor children minnesota form

- Minnesota non marital form

- Mn paternity form

Find out other Daycare Tax Statement Template

- Can I Electronic signature Maryland High Tech RFP

- Electronic signature Vermont Insurance Arbitration Agreement Safe

- Electronic signature Massachusetts High Tech Quitclaim Deed Fast

- Electronic signature Vermont Insurance Limited Power Of Attorney Easy

- Electronic signature Washington Insurance Last Will And Testament Later

- Electronic signature Washington Insurance Last Will And Testament Secure

- Electronic signature Wyoming Insurance LLC Operating Agreement Computer

- How To Electronic signature Missouri High Tech Lease Termination Letter

- Electronic signature Montana High Tech Warranty Deed Mobile

- Electronic signature Florida Lawers Cease And Desist Letter Fast

- Electronic signature Lawers Form Idaho Fast

- Electronic signature Georgia Lawers Rental Lease Agreement Online

- How Do I Electronic signature Indiana Lawers Quitclaim Deed

- How To Electronic signature Maryland Lawers Month To Month Lease

- Electronic signature North Carolina High Tech IOU Fast

- How Do I Electronic signature Michigan Lawers Warranty Deed

- Help Me With Electronic signature Minnesota Lawers Moving Checklist

- Can I Electronic signature Michigan Lawers Last Will And Testament

- Electronic signature Minnesota Lawers Lease Termination Letter Free

- Electronic signature Michigan Lawers Stock Certificate Mobile