Form 2210 F, Underpayment of Estimated Tax by Farmers and 2021

What is the Form 2210 F, Underpayment Of Estimated Tax By Farmers

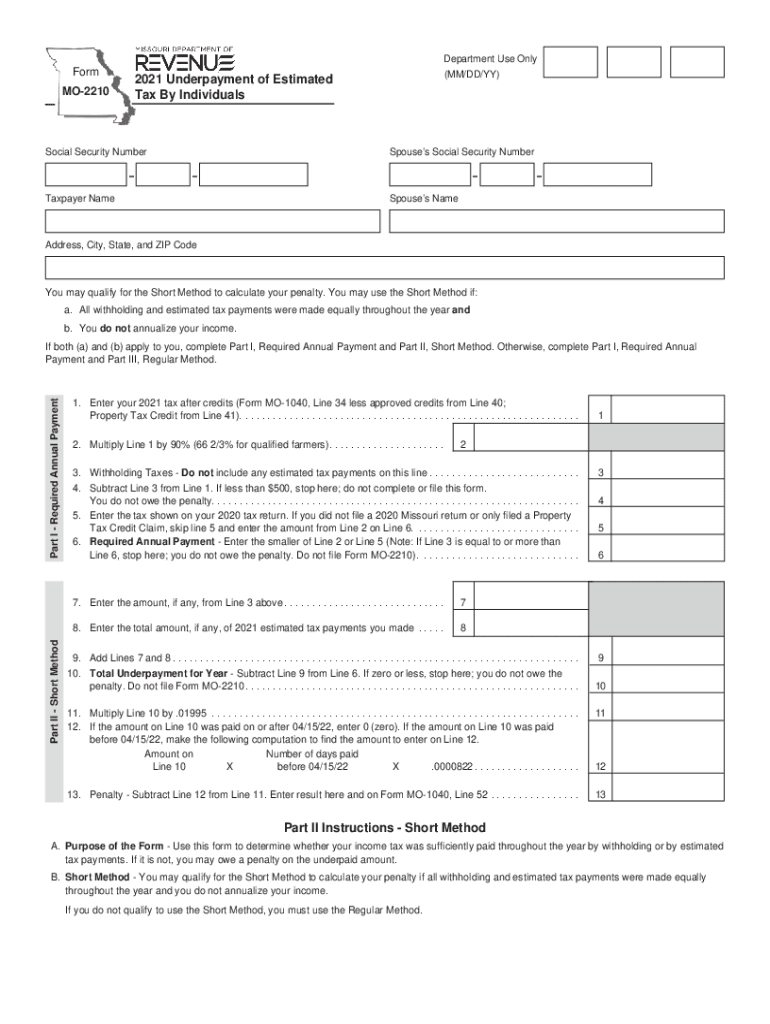

The Form 2210 F is specifically designed for farmers and fishermen to address underpayment of estimated taxes. This form allows eligible individuals to calculate their tax liability and determine if they owe a penalty for underpayment. Farmers and fishermen often have unique income patterns due to the seasonal nature of their work, making this form essential for accurately reporting their tax obligations. By using Form 2210 F, taxpayers can ensure compliance with IRS regulations while potentially avoiding unnecessary penalties.

How to use the Form 2210 F, Underpayment Of Estimated Tax By Farmers

Using the Form 2210 F involves several key steps. First, taxpayers must gather their income information for the tax year, including any earnings from farming or fishing activities. Next, they should calculate their total expected tax liability for the year. The form provides specific instructions for determining the amount of estimated tax payments required. Once the calculations are complete, taxpayers can fill out the form, ensuring all sections are accurately completed. It is crucial to review the form for any errors before submission to avoid delays or penalties.

Steps to complete the Form 2210 F, Underpayment Of Estimated Tax By Farmers

Completing the Form 2210 F involves a systematic approach:

- Gather all relevant income documents, including records of earnings from farming or fishing.

- Calculate your total expected tax liability for the year.

- Determine the amount of estimated tax payments made during the year.

- Fill out the form by entering the required information in the appropriate sections.

- Review the completed form for accuracy and completeness.

- Submit the form to the IRS by the designated deadline.

Penalties for Non-Compliance

Failure to comply with the requirements of Form 2210 F can result in significant penalties. If taxpayers do not make the required estimated tax payments, they may face an underpayment penalty. This penalty is calculated based on the amount of underpayment and the duration of the underpayment period. It is essential for farmers and fishermen to understand these penalties to avoid unexpected financial burdens. By accurately completing and submitting Form 2210 F, taxpayers can mitigate the risk of incurring these penalties.

IRS Guidelines

The IRS provides specific guidelines for using Form 2210 F, which include eligibility criteria, calculation methods, and submission procedures. Taxpayers should familiarize themselves with these guidelines to ensure compliance. The IRS outlines the necessary documentation and steps required to complete the form accurately. Adhering to these guidelines not only helps in avoiding penalties but also ensures that taxpayers can take advantage of any available tax benefits related to their farming or fishing activities.

Filing Deadlines / Important Dates

Filing deadlines for Form 2210 F are crucial to avoid penalties. Generally, this form must be submitted by the tax return due date, which is typically April 15 for individual taxpayers. However, farmers and fishermen may have different deadlines based on their income cycles. It is important to stay informed about any changes to these dates to ensure timely submission. Marking important dates on a calendar can help taxpayers manage their tax obligations effectively.

Quick guide on how to complete form 2210 f underpayment of estimated tax by farmers and

Effortlessly prepare Form 2210 F, Underpayment Of Estimated Tax By Farmers And on any device

The management of documents online has gained traction among businesses and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow provides all the tools required to create, modify, and electronically sign your documents swiftly without delays. Manage Form 2210 F, Underpayment Of Estimated Tax By Farmers And on any device using the airSlate SignNow Android or iOS applications and simplify any document-related tasks today.

The easiest way to modify and electronically sign Form 2210 F, Underpayment Of Estimated Tax By Farmers And without stress

- Locate Form 2210 F, Underpayment Of Estimated Tax By Farmers And and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of the documents or redact sensitive information using tools specifically provided by airSlate SignNow for this purpose.

- Generate your eSignature with the Sign tool, which takes only seconds and has the same legal validity as a traditional handwritten signature.

- Review all information thoroughly and click on the Done button to save your modifications.

- Decide how you want to send your form, whether by email, text message (SMS), an invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you choose. Modify and electronically sign Form 2210 F, Underpayment Of Estimated Tax By Farmers And while ensuring effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 2210 f underpayment of estimated tax by farmers and

Create this form in 5 minutes!

How to create an eSignature for the form 2210 f underpayment of estimated tax by farmers and

The way to generate an e-signature for a PDF in the online mode

The way to generate an e-signature for a PDF in Chrome

How to create an e-signature for putting it on PDFs in Gmail

The best way to generate an e-signature right from your smart phone

The way to create an e-signature for a PDF on iOS devices

The best way to generate an e-signature for a PDF on Android OS

People also ask

-

What is Form 2210 and who needs to file it?

Form 2210 is used by taxpayers to calculate whether they owe a penalty for underpayment of estimated tax. If you expect to owe tax of $1,000 or more when you file your return, you may need to file Form 2210 to determine your penalty amount. It's essential for those who don't pay enough tax throughout the year.

-

How can airSlate SignNow help me with Form 2210?

airSlate SignNow simplifies the process of signing and sending Form 2210 electronically. Our platform allows users to securely eSign and manage this form, ensuring compliance and timely submission. With our easy-to-use interface, you can complete the form quickly and efficiently.

-

What are the pricing plans for using airSlate SignNow for Form 2210?

airSlate SignNow offers various pricing plans tailored to fit different business needs. You can choose from monthly or annual subscriptions, with options that include advanced features for managing Form 2210 and other documents. Each plan is designed to be cost-effective, providing great value for your eSigning requirements.

-

Are there specific features in airSlate SignNow for managing Form 2210?

Yes, airSlate SignNow includes features that are particularly useful for managing Form 2210. These features include customizable templates, the ability to set signing order, and automatic reminders for signers. Additionally, you can track the status of forms in real time for better management.

-

Can I integrate airSlate SignNow with other software for Form 2210 processing?

Absolutely! airSlate SignNow seamlessly integrates with a variety of popular software applications, making Form 2210 processing easy and efficient. Whether you're using CRM systems, document management tools, or accounting software, our integration capabilities ensure a smooth workflow.

-

What benefits do I gain by using airSlate SignNow for Form 2210?

Using airSlate SignNow for Form 2210 provides numerous benefits, including saving time, reducing paperwork, and ensuring compliance. With our electronic signature solution, you can sign the form securely from anywhere, which speeds up the filing process. This efficiency helps you focus on more important business tasks.

-

Is airSlate SignNow secure for signing Form 2210?

Yes, airSlate SignNow prioritizes security for signing Form 2210. We implement robust encryption protocols and provide a secure environment to ensure that your sensitive information remains protected. Our platform is compliant with industry standards for data security.

Get more for Form 2210 F, Underpayment Of Estimated Tax By Farmers And

- Insulation contractor package minnesota form

- Paving contractor package minnesota form

- Site work contractor package minnesota form

- Siding contractor package minnesota form

- Refrigeration contractor package minnesota form

- Drainage contractor package minnesota form

- Tax free exchange package minnesota form

- Landlord tenant sublease package minnesota form

Find out other Form 2210 F, Underpayment Of Estimated Tax By Farmers And

- How Can I Sign Utah House rent agreement format

- Sign Alabama House rental lease agreement Online

- Sign Arkansas House rental lease agreement Free

- Sign Alaska Land lease agreement Computer

- How Do I Sign Texas Land lease agreement

- Sign Vermont Land lease agreement Free

- Sign Texas House rental lease Now

- How Can I Sign Arizona Lease agreement contract

- Help Me With Sign New Hampshire lease agreement

- How To Sign Kentucky Lease agreement form

- Can I Sign Michigan Lease agreement sample

- How Do I Sign Oregon Lease agreement sample

- How Can I Sign Oregon Lease agreement sample

- Can I Sign Oregon Lease agreement sample

- How To Sign West Virginia Lease agreement contract

- How Do I Sign Colorado Lease agreement template

- Sign Iowa Lease agreement template Free

- Sign Missouri Lease agreement template Later

- Sign West Virginia Lease agreement template Computer

- Sign Nevada Lease template Myself