California Partial Sales Tax Exemption Form Agriculture

What is the California agricultural tax exemption form?

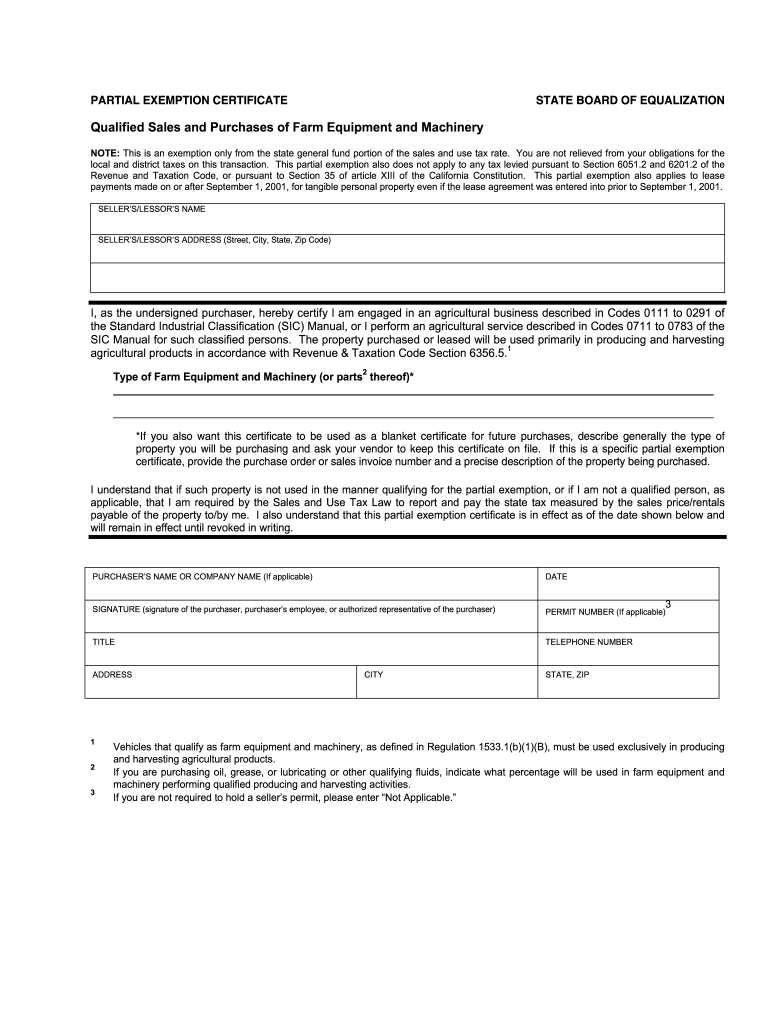

The California agricultural tax exemption form, often referred to as the California ag tax exemption form, is a document that allows eligible farmers and agricultural businesses to claim exemptions from certain sales taxes on qualifying purchases. This form is essential for those engaged in agricultural production, as it helps reduce the financial burden associated with purchasing equipment, supplies, and other necessary items for farming operations.

Steps to complete the California agricultural tax exemption form

Completing the California agricultural tax exemption form involves several key steps to ensure accuracy and compliance. First, gather all necessary information, including your business details, type of agricultural operation, and the specific items for which you are claiming the exemption. Next, accurately fill out the form, ensuring all required fields are completed. After filling out the form, review it for any errors or omissions. Finally, submit the completed form to the appropriate state authority, either online or via mail, depending on the submission methods available.

Eligibility criteria for the California agricultural tax exemption form

To qualify for the California agricultural tax exemption form, applicants must meet specific eligibility criteria. These criteria typically include being engaged in an agricultural business, such as farming or ranching, and using the purchased items primarily for agricultural production. Additionally, the applicant must have a valid seller's permit issued by the California Department of Tax and Fee Administration (CDTFA) and comply with all relevant state regulations regarding agricultural operations.

Required documents for the California agricultural tax exemption form

When applying for the California agricultural tax exemption form, certain documents are necessary to support your application. These may include a valid seller's permit, proof of agricultural production, such as crop reports or livestock records, and any other documentation that demonstrates your eligibility for the exemption. Ensuring that all required documents are submitted with the form can help expedite the approval process and reduce the likelihood of delays.

Form submission methods for the California agricultural tax exemption form

There are various methods available for submitting the California agricultural tax exemption form. Applicants can complete and submit the form online through the appropriate state agency's website, which often provides a user-friendly interface for electronic submissions. Alternatively, the form can be printed, completed manually, and mailed to the designated office. In some cases, in-person submissions may also be accepted, allowing applicants to discuss their forms directly with state representatives.

Legal use of the California agricultural tax exemption form

The legal use of the California agricultural tax exemption form is governed by state tax laws and regulations. It is crucial for applicants to understand that the form must be completed accurately and submitted in accordance with state guidelines. Misuse of the form, such as claiming exemptions for non-qualifying purchases or providing false information, can lead to penalties, including fines and potential legal action. Therefore, it is important to maintain thorough records and ensure compliance with all applicable laws when utilizing this form.

Quick guide on how to complete partial exemption certificate farm form

Discover how to effortlessly navigate the California Partial Sales Tax Exemption Form Agriculture completion with this simple guide

Online filing and signNowing forms is becoming more prevalent and is the preferred choice for many users. It presents numerous advantages over conventional printed documents, such as ease of use, time savings, enhanced precision, and security.

With tools like airSlate SignNow, you can locate, modify, sign, enhance, and send your California Partial Sales Tax Exemption Form Agriculture without being encumbered by endless printing and scanning. Follow this brief guide to begin and finalize your document.

Apply these steps to obtain and fill out California Partial Sales Tax Exemption Form Agriculture

- Begin by clicking the Get Form button to access your document in our editor.

- Refer to the green label on the left indicating required fields so you don’t miss them.

- Utilize our professional tools to annotate, edit, sign, secure, and improve your document.

- Safeguard your file or convert it into a fillable form using the appropriate panel tools.

- Review the document and check for any errors or inconsistencies.

- Click on DONE to complete your editing.

- Change the name of your document or keep it as is.

- Select the storage service where you wish to save your document, send it using USPS, or click the Download Now button to get your file.

If California Partial Sales Tax Exemption Form Agriculture is not what you were looking for, feel free to explore our vast collection of pre-made templates that you can fill out with minimal effort. Experience our platform today!

Create this form in 5 minutes or less

FAQs

-

Where can I get the form for migration certificate?

Migration is issued by the Universities themselves.The best way is to inquire your college they will guide you further.In case you happen to be from A.P.J Abdul Kalam Technical Universityhere is the link to get it issued online.Hope it helpsStudent Service (Dashboard) Dr. A.P.J. Abdul Kalam Technical University (Lucknow)Regards

Create this form in 5 minutes!

How to create an eSignature for the partial exemption certificate farm form

How to make an electronic signature for your Partial Exemption Certificate Farm Form online

How to generate an electronic signature for your Partial Exemption Certificate Farm Form in Chrome

How to make an electronic signature for putting it on the Partial Exemption Certificate Farm Form in Gmail

How to create an eSignature for the Partial Exemption Certificate Farm Form from your mobile device

How to create an electronic signature for the Partial Exemption Certificate Farm Form on iOS devices

How to generate an eSignature for the Partial Exemption Certificate Farm Form on Android OS

People also ask

-

What is the California Partial Sales Tax Exemption Form Agriculture?

The California Partial Sales Tax Exemption Form Agriculture is a specific document that allows agricultural businesses to claim exemptions on certain sales taxes. It is crucial for farmers and agricultural producers who wish to reduce their tax liabilities when purchasing qualifying equipment and supplies. Completing this form accurately can lead to signNow savings for eligible businesses.

-

How can airSlate SignNow help with the California Partial Sales Tax Exemption Form Agriculture?

airSlate SignNow streamlines the process of completing the California Partial Sales Tax Exemption Form Agriculture by providing an easy-to-use e-signature platform. With our solution, users can fill out, sign, and send this form electronically, ensuring compliance and reducing processing time. This feature makes it simple for agricultural businesses to manage their tax exemption claims efficiently.

-

Is there a cost associated with using airSlate SignNow for the California Partial Sales Tax Exemption Form Agriculture?

Yes, airSlate SignNow offers different pricing plans to accommodate various business needs. Our plans are designed to be cost-effective, especially for agricultural businesses looking to manage the California Partial Sales Tax Exemption Form Agriculture and other essential documents. You can choose a plan that fits your budget while gaining access to powerful features.

-

What features does airSlate SignNow offer for managing the California Partial Sales Tax Exemption Form Agriculture?

airSlate SignNow provides features such as customizable templates, automated workflows, and secure cloud storage, which are particularly useful for handling the California Partial Sales Tax Exemption Form Agriculture. Additionally, users can track document status in real-time and receive notifications when documents are signed, enhancing efficiency and transparency in the process.

-

Can I integrate airSlate SignNow with other software for the California Partial Sales Tax Exemption Form Agriculture?

Absolutely! airSlate SignNow seamlessly integrates with various business applications, allowing you to manage the California Partial Sales Tax Exemption Form Agriculture alongside your existing tools. Whether you use CRM systems, accounting software, or document management platforms, our integrations ensure a smooth workflow and improved productivity.

-

How does airSlate SignNow ensure the security of the California Partial Sales Tax Exemption Form Agriculture?

We take security seriously at airSlate SignNow. All documents, including the California Partial Sales Tax Exemption Form Agriculture, are protected with industry-standard encryption and secure access controls. This ensures that sensitive information remains confidential and that your transactions are safe from unauthorized access.

-

Can I use airSlate SignNow on mobile devices for the California Partial Sales Tax Exemption Form Agriculture?

Yes, airSlate SignNow is fully optimized for mobile devices, allowing you to complete the California Partial Sales Tax Exemption Form Agriculture on-the-go. With our mobile app, you can access your documents, send them for signatures, and manage your forms anytime and anywhere, making it convenient for busy agricultural professionals.

Get more for California Partial Sales Tax Exemption Form Agriculture

- Complaint new jersey form

- How to file a request to modify a non dissolution ampquotfdampquot court order previously issued by the court how to file a form

- Documents immigration new zealand form

- Inz 1198 partnership based temporary visa application 572267404 form

- Vat 484 form

- Ivari form fill out and sign printable pdf template

- Rp6 referee report medical council of new zealand form

- Vaf4a appendix 1 12 20 form

Find out other California Partial Sales Tax Exemption Form Agriculture

- How Do I Sign Rhode Island Real Estate Form

- Can I Sign Vermont Real Estate Document

- How To Sign Wyoming Orthodontists Document

- Help Me With Sign Alabama Courts Form

- Help Me With Sign Virginia Police PPT

- How To Sign Colorado Courts Document

- Can I eSign Alabama Banking PPT

- How Can I eSign California Banking PDF

- How To eSign Hawaii Banking PDF

- How Can I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- Help Me With eSign Hawaii Banking Document

- How To eSign Hawaii Banking Document

- Can I eSign Hawaii Banking Presentation

- Can I Sign Iowa Courts Form

- Help Me With eSign Montana Banking Form

- Can I Sign Kentucky Courts Document

- How To eSign New York Banking Word

- Can I eSign South Dakota Banking PPT