Help with Form 2210 to Figure Out Underpayment Penalty Rtax 2023-2026

Understanding the Missouri MO 2210 Form for Underpayment Penalties

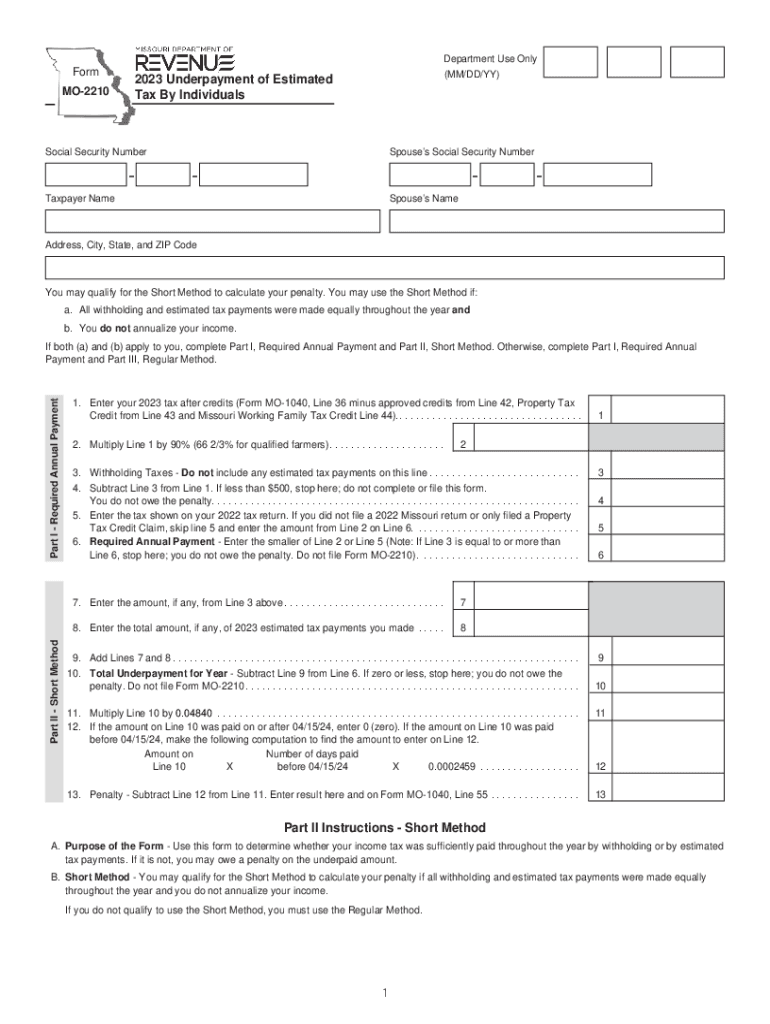

The Missouri MO 2210 form is designed to help taxpayers determine if they owe a penalty for underpayment of estimated tax. This form is essential for individuals and businesses who may not have paid enough tax throughout the year. The underpayment penalty can arise if the total tax owed exceeds a certain threshold and the taxpayer has not made sufficient estimated tax payments. Understanding the specifics of the MO 2210 form can help taxpayers avoid unnecessary penalties and ensure compliance with state tax regulations.

Steps to Complete the Missouri MO 2210 Form

Completing the Missouri MO 2210 form involves several key steps:

- Gather your financial documents, including income statements and previous tax returns.

- Calculate your total tax liability for the year to determine if you owe any underpayment penalties.

- Fill out the form by providing necessary information such as your income, tax payments made, and any credits applied.

- Review your calculations to ensure accuracy before submission.

- Submit the completed form to the Missouri Department of Revenue by the designated deadline.

Filing Deadlines for the Missouri MO 2210 Form

It is crucial to be aware of the filing deadlines associated with the Missouri MO 2210 form. Generally, the form must be submitted by the same date as your state income tax return. For most taxpayers, this deadline falls on April 15. However, if you file for an extension, ensure you submit the MO 2210 form by the extended due date. Missing these deadlines can result in additional penalties and interest on unpaid taxes.

Required Documents for the Missouri MO 2210 Form

To accurately complete the Missouri MO 2210 form, you will need several documents:

- Previous year’s tax return for reference.

- Income statements such as W-2s and 1099s.

- Records of estimated tax payments made throughout the year.

- Any relevant documentation for tax credits or deductions claimed.

Penalties for Non-Compliance with the Missouri MO 2210 Form

Failing to file the Missouri MO 2210 form or underpaying estimated taxes can lead to significant penalties. The Missouri Department of Revenue may impose an underpayment penalty based on the amount owed. Additionally, interest may accrue on any unpaid taxes. It is advisable to file the form even if you believe you will not owe a penalty, as this can help avoid complications and additional charges in the future.

Examples of Underpayment Scenarios Using the Missouri MO 2210 Form

Understanding how the Missouri MO 2210 form applies in different scenarios can clarify its importance. For instance:

- A self-employed individual who underestimates their income may find they owe a penalty when filing their taxes.

- A retiree who relies solely on pension income might not make sufficient estimated payments, leading to potential underpayment penalties.

- Taxpayers with fluctuating income, such as freelancers, may need to adjust their estimated payments based on their earnings throughout the year.

Quick guide on how to complete help with form 2210 to figure out underpayment penalty rtax

Effortlessly prepare Help With Form 2210 To Figure Out Underpayment Penalty Rtax on any device

Digital document management has become increasingly favored by businesses and individuals alike. It presents an ideal environmentally-friendly alternative to traditional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents quickly and without interruptions. Manage Help With Form 2210 To Figure Out Underpayment Penalty Rtax on any platform with the airSlate SignNow applications for Android or iOS and enhance any document-based procedure today.

Edit and electronically sign Help With Form 2210 To Figure Out Underpayment Penalty Rtax with ease

- Find Help With Form 2210 To Figure Out Underpayment Penalty Rtax and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Mark important sections of the documents or conceal sensitive information with tools designed specifically for that purpose by airSlate SignNow.

- Create your electronic signature using the Sign tool, which takes only seconds and holds the same legal significance as a traditional handwritten signature.

- Review the information and click on the Done button to save your changes.

- Choose your preferred method for sending your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searching, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and electronically sign Help With Form 2210 To Figure Out Underpayment Penalty Rtax to ensure excellent communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct help with form 2210 to figure out underpayment penalty rtax

Create this form in 5 minutes!

How to create an eSignature for the help with form 2210 to figure out underpayment penalty rtax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the dor 2210 form?

The dor 2210 form is a tax form used to calculate any underpayment penalties for your state taxes. It helps you to ensure compliance with state tax regulations and can be critical for avoiding penalties.

-

How can airSlate SignNow assist with the dor 2210 form?

airSlate SignNow streamlines the process of filling out the dor 2210 form by providing an easy-to-use eSignature solution. You can quickly send and receive signed documents, ensuring that your forms are submitted on time.

-

What are the pricing options for using airSlate SignNow with the dor 2210 form?

airSlate SignNow offers several pricing plans to fit your business needs when dealing with the dor 2210 form. Plans include essential features that streamline document management, all at competitive rates.

-

Are there any special features for managing the dor 2210 form in airSlate SignNow?

Yes, airSlate SignNow includes features like templates and automated reminders specifically designed to help you manage the dor 2210 form efficiently. Additionally, you can track the status of your document in real-time.

-

How does airSlate SignNow improve compliance with the dor 2210 form?

By using airSlate SignNow, you can ensure compliance with the dor 2210 form requirements with our secure and accurate document handling processes. The platform simplifies version control and maintains a clear audit trail for all actions taken on your documents.

-

Can I integrate airSlate SignNow with other tools for managing the dor 2210 form?

Absolutely! airSlate SignNow offers integrations with popular tools and platforms, allowing you to manage your dor 2210 form alongside your other business processes. This creates a seamless workflow and enhances efficiency.

-

What benefits does airSlate SignNow offer for small businesses using the dor 2210 form?

For small businesses, airSlate SignNow provides a cost-effective solution to handle the dor 2210 form. This approach saves time and reduces administrative overhead, letting you focus on more important tasks.

Get more for Help With Form 2210 To Figure Out Underpayment Penalty Rtax

Find out other Help With Form 2210 To Figure Out Underpayment Penalty Rtax

- How Can I Electronic signature Texas Electronic Contract

- How Do I Electronic signature Michigan General contract template

- Electronic signature Maine Email Contracts Later

- Electronic signature New Mexico General contract template Free

- Can I Electronic signature Rhode Island Email Contracts

- How Do I Electronic signature California Personal loan contract template

- Electronic signature Hawaii Personal loan contract template Free

- How To Electronic signature Hawaii Personal loan contract template

- Electronic signature New Hampshire Managed services contract template Computer

- Electronic signature Alabama Real estate sales contract template Easy

- Electronic signature Georgia Real estate purchase contract template Secure

- Electronic signature South Carolina Real estate sales contract template Mobile

- Can I Electronic signature Kentucky Residential lease contract

- Can I Electronic signature Nebraska Residential lease contract

- Electronic signature Utah New hire forms Now

- Electronic signature Texas Tenant contract Now

- How Do I Electronic signature Florida Home rental application

- Electronic signature Illinois Rental application Myself

- How Can I Electronic signature Georgia Rental lease form

- Electronic signature New York Rental lease form Safe