Indian Passport Form Eapx 1 04

What is the Indian Passport Form Eapx 1 04

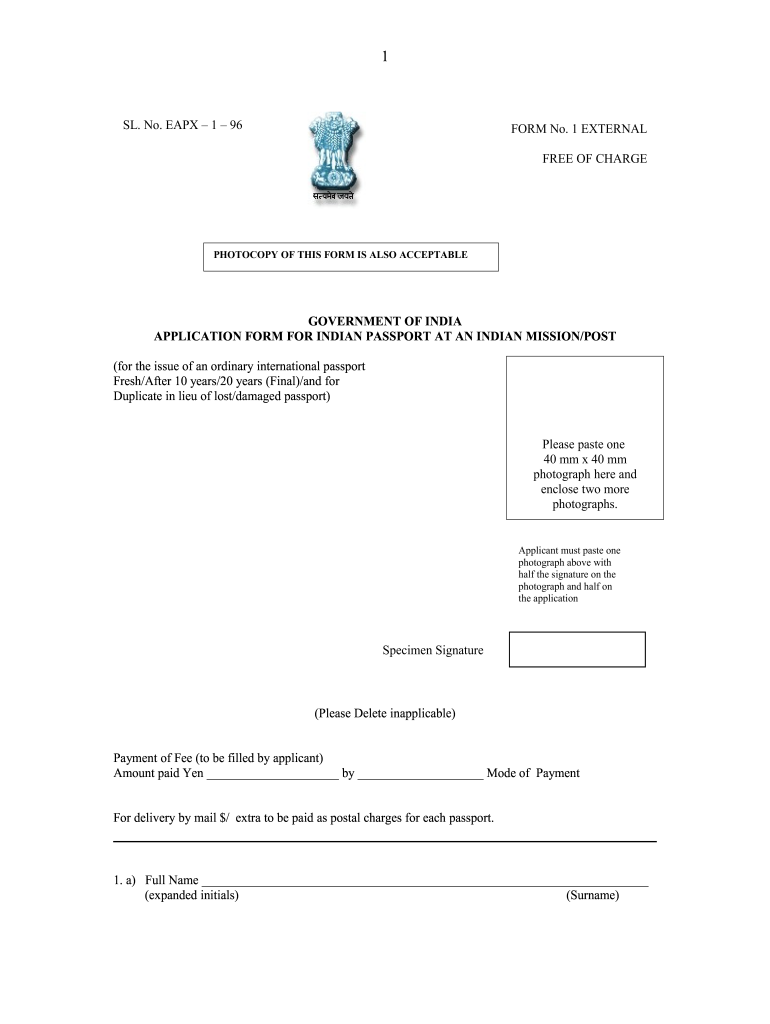

The Indian Passport Form Eapx 1 04 is an essential document required for applying for an Indian passport. This form is specifically designed for Indian citizens and serves as a formal application to obtain a passport. It collects vital information such as personal details, address, and identification documents. The accuracy of the information provided in this form is crucial, as it directly impacts the processing of the passport application.

Steps to complete the Indian Passport Form Eapx 1 04

Completing the Indian Passport Form Eapx 1 04 involves several important steps:

- Gather all necessary documents, including proof of identity and address.

- Fill out the form with accurate personal information, ensuring no fields are left blank.

- Review the form for any errors or omissions before submission.

- Sign the form to validate your application.

- Submit the completed form along with required documents either online or in person at the designated passport office.

How to use the Indian Passport Form Eapx 1 04

The Indian Passport Form Eapx 1 04 can be used in several contexts, primarily for applying for a new passport or renewing an existing one. Users must ensure they are using the correct version of the form, as variations may exist for different types of applications. When filling out the form, it is essential to follow the instructions carefully to avoid delays in processing.

Legal use of the Indian Passport Form Eapx 1 04

The legal use of the Indian Passport Form Eapx 1 04 is governed by regulations set forth by the Indian government. This form must be filled out truthfully and accurately, as providing false information can lead to legal repercussions, including denial of the passport application. Compliance with these legal requirements is essential for the application to be considered valid and processed appropriately.

Required Documents

To successfully complete the Indian Passport Form Eapx 1 04, applicants must provide several supporting documents. These typically include:

- Proof of identity, such as a government-issued ID.

- Proof of address, like a utility bill or lease agreement.

- Passport-sized photographs that meet specific criteria.

- Any additional documents required for special cases, such as name changes or minors applying for a passport.

Form Submission Methods

The Indian Passport Form Eapx 1 04 can be submitted through various methods, depending on the applicant's preference and local regulations. Common submission methods include:

- Online submission through the official passport application portal.

- Mailing the completed form and documents to the appropriate passport office.

- In-person submission at designated passport application centers.

Quick guide on how to complete sl no eapx 1 04 online form

Complete Indian Passport Form Eapx 1 04 seamlessly on any device

Managing documents online has gained popularity among both organizations and individuals. It offers an ideal eco-friendly substitute to traditional printed and signed papers, allowing you to access the right form and securely store it in the cloud. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents swiftly without delays. Manage Indian Passport Form Eapx 1 04 on any platform using the airSlate SignNow mobile applications for Android or iOS and streamline any document-related process today.

The easiest way to alter and eSign Indian Passport Form Eapx 1 04 effortlessly

- Find Indian Passport Form Eapx 1 04 and click on Get Form to begin.

- Utilize the tools provided to fill out your form.

- Emphasize relevant sections of the documents or obscure sensitive information with the tools specifically offered by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which only takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click the Done button to save your modifications.

- Choose how you would like to send your form, via email, text message (SMS), invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs with just a few clicks from your preferred device. Edit and eSign Indian Passport Form Eapx 1 04 and guarantee effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

How do I fill out Address Line 1 on an Online Form?

(street number) (street name) (street suffix)101 Main StreetYou can query the post office on your address, best as you know it, for the “standard” way of presenting your address. USPS.com® - ZIP Code Lookup or whatever service is offered in your country. That will tell you the standard way to fill out address lines.

-

What will be the appropriate section to choose while filling out the ITR 1 form online?

Please find details of return filed under sectionSection 139(1) – Original return filed before the last due date for filing returnOriginal returnfiling for the first time in an assessment yearSection 139(4) – Belated returnOriginal returnFiling for the first time after the due date of filing the return for the assessment yearSection 139(5) – Revised returnRevised return filed subsequent to original returnThis will be revised returnVoluntarily filing the revised returnInfo needed is:Acknowledgement numberdate of filing originalSection 139(9) – Defective returnWhen due to an error, the return is considered as defective (as if no return has been filed)The department may issue notice to correct the errors and file the returnSo the return filed subsequent to the intimation u/s 139(9) will be original returnYou have to provide following info while filing the return in response to noticeReceipt No: i.e Acknowledgement number of Original (Defective in this case) returnDate of filing the original (Defective in this case) returnNotice no. (Eg. CPC/1415/G5/1421417689)Date of NoticeSection 142(1) – Notice to assessee for filing the returnWhen a person has not filed the return, he may receive notice u/s 142(1) asking him to file the returnThis will be the original returnYou need to mention the notice date only while filing the return subsequent to the notice u/s 142(1)Section 148 – Issue of notice for reassessment (Income escaping assessment)Department can issue a notice to a person for filing the income tax return u/s 148This will be the original returnYou need to mention the notice date only while filing the return subsequent to the notice u/s 148Section 153A – Fresh assessment pursuance of an orderDepartment can issue a notice u/s 153A to a person for filing the income tax returnThis will be the original returnYou need to mention the notice date only while filing the return subsequent to the notice u/s 153ASection 153C – Fresh assessment pursuance of an orderDepartment can issue a notice u/s 153C to a person for filing the income tax returnThis will be the original returnYou need to mention the notice date only while filing the return subsequent to the notice u/s 153CBe Peaceful !!!

-

How do I fill taxes online?

you can file taxes online by using different online platforms. by using this online platform you can easily submit the income tax returns, optimize your taxes easily.Tachotax provides the most secure, easy and fast way of tax filing.

-

How do I fill out the income tax for online job payment? Are there any special forms to fill it?

I am answering to your question with the UNDERSTANDING that you are liableas per Income Tax Act 1961 of Republic of IndiaIf you have online source of Income as per agreement as an employer -employee, It will be treated SALARY income and you will file ITR 1 for FY 2017–18If you are rendering professional services outside India with an agreement as professional, in that case you need to prepare Financial Statements ie. Profit and loss Account and Balance sheet for FY 2017–18 , finalize your income and pay taxes accordingly, You will file ITR -3 for FY 2017–1831st Dec.2018 is last due date with minimum penalty, grab that opportunity and file income tax return as earliest

Create this form in 5 minutes!

How to create an eSignature for the sl no eapx 1 04 online form

How to generate an electronic signature for the Sl No Eapx 1 04 Online Form in the online mode

How to create an eSignature for your Sl No Eapx 1 04 Online Form in Google Chrome

How to create an eSignature for putting it on the Sl No Eapx 1 04 Online Form in Gmail

How to create an eSignature for the Sl No Eapx 1 04 Online Form right from your mobile device

How to make an electronic signature for the Sl No Eapx 1 04 Online Form on iOS

How to create an eSignature for the Sl No Eapx 1 04 Online Form on Android

People also ask

-

What is the Indian Passport Form Eapx 1 04?

The Indian Passport Form Eapx 1 04 is a crucial document required for various passport-related applications in India. It is designed to streamline the process of obtaining or renewing a passport, ensuring that all necessary information is collected efficiently. By using airSlate SignNow, you can easily eSign and submit this form online, saving time and effort.

-

How can airSlate SignNow help with the Indian Passport Form Eapx 1 04?

airSlate SignNow provides a user-friendly platform that allows you to fill out and eSign the Indian Passport Form Eapx 1 04 digitally. This eliminates the need for physical paperwork and enhances the overall application experience. With features like templates and secure storage, your application process becomes faster and more efficient.

-

Is there a cost associated with using airSlate SignNow for the Indian Passport Form Eapx 1 04?

While airSlate SignNow offers various pricing plans, the cost of using the platform for the Indian Passport Form Eapx 1 04 will depend on the specific features you need. We provide affordable solutions designed to meet different business requirements. You can choose a plan that best suits your needs and budget.

-

Can I integrate airSlate SignNow with other applications when filling the Indian Passport Form Eapx 1 04?

Yes, airSlate SignNow allows seamless integration with various applications to enhance your workflow while handling the Indian Passport Form Eapx 1 04. This means you can connect with tools you already use, streamlining document management and ensuring that your processes remain efficient and organized.

-

What are the benefits of eSigning the Indian Passport Form Eapx 1 04 with airSlate SignNow?

eSigning the Indian Passport Form Eapx 1 04 with airSlate SignNow provides several benefits, including faster processing times and enhanced security. You can complete your application from anywhere, at any time, without the hassle of printing or mailing documents. Additionally, our platform ensures that your signatures are legally binding and secure.

-

Is it easy to use airSlate SignNow for the Indian Passport Form Eapx 1 04?

Absolutely! airSlate SignNow is designed to be intuitive and user-friendly, making it easy for anyone to fill out and eSign the Indian Passport Form Eapx 1 04. With step-by-step guidance and helpful tools, you’ll find that completing your passport application online is a straightforward and hassle-free process.

-

What security features does airSlate SignNow offer for the Indian Passport Form Eapx 1 04?

airSlate SignNow prioritizes the security of your documents, including the Indian Passport Form Eapx 1 04. We utilize advanced encryption technologies and secure storage solutions to protect your sensitive information. You can trust that your data is safe while using our platform for all your eSigning needs.

Get more for Indian Passport Form Eapx 1 04

Find out other Indian Passport Form Eapx 1 04

- How Can I Electronic signature Oklahoma Doctors Document

- How Can I Electronic signature Alabama Finance & Tax Accounting Document

- How To Electronic signature Delaware Government Document

- Help Me With Electronic signature Indiana Education PDF

- How To Electronic signature Connecticut Government Document

- How To Electronic signature Georgia Government PDF

- Can I Electronic signature Iowa Education Form

- How To Electronic signature Idaho Government Presentation

- Help Me With Electronic signature Hawaii Finance & Tax Accounting Document

- How Can I Electronic signature Indiana Government PDF

- How Can I Electronic signature Illinois Finance & Tax Accounting PPT

- How To Electronic signature Maine Government Document

- How To Electronic signature Louisiana Education Presentation

- How Can I Electronic signature Massachusetts Government PDF

- How Do I Electronic signature Montana Government Document

- Help Me With Electronic signature Louisiana Finance & Tax Accounting Word

- How To Electronic signature Pennsylvania Government Document

- Can I Electronic signature Texas Government PPT

- How To Electronic signature Utah Government Document

- How To Electronic signature Washington Government PDF