Use Your Mouse or Tab Key to Move through the Fields Use 2021

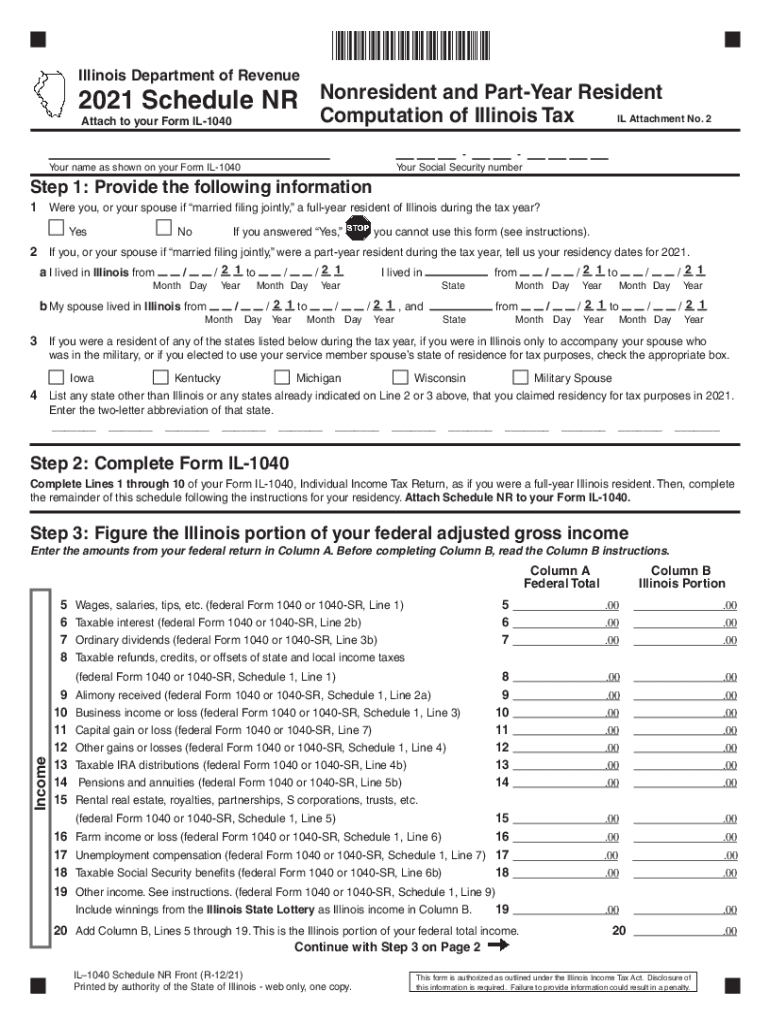

What is the Illinois Schedule NR?

The Illinois Schedule NR, also known as the Illinois Nonresident Income Tax Return, is a form used by individuals who earn income in Illinois but reside in another state. This form allows nonresidents to report their income earned in Illinois and calculate the appropriate tax owed to the state. It is essential for ensuring compliance with Illinois tax laws while allowing nonresidents to fulfill their tax obligations accurately.

Filing Deadlines for the Illinois Schedule NR

Understanding the filing deadlines for the Illinois Schedule NR is crucial to avoid penalties. Typically, the form must be submitted by the same deadline as the federal income tax return, which is usually April 15. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. It is advisable to check for any specific announcements from the Illinois Department of Revenue regarding changes in deadlines.

Required Documents for Completing the Illinois Schedule NR

To complete the Illinois Schedule NR, several documents are necessary. These include:

- Federal income tax return (Form 1040 or equivalent)

- W-2 forms from employers for income earned in Illinois

- 1099 forms for any additional income sources

- Records of any deductions or credits claimed on the federal return

Having these documents ready will streamline the process of filling out the form and ensure accuracy in reporting income.

Form Submission Methods for the Illinois Schedule NR

The Illinois Schedule NR can be submitted through various methods. Taxpayers have the option to file online using approved e-filing software, which can simplify the process and reduce errors. Alternatively, the form can be mailed directly to the Illinois Department of Revenue. For those who prefer a personal touch, in-person submissions may also be possible at designated state offices. Each method has its own benefits, and choosing the right one depends on individual preferences and circumstances.

Penalties for Non-Compliance with the Illinois Schedule NR

Failing to file the Illinois Schedule NR or submitting it late can result in significant penalties. The Illinois Department of Revenue may impose fines based on the amount of tax owed and the duration of the delay. Additionally, interest may accrue on any unpaid taxes, further increasing the total amount due. It is essential to adhere to filing requirements to avoid these financial repercussions.

Eligibility Criteria for the Illinois Schedule NR

To be eligible to file the Illinois Schedule NR, individuals must meet specific criteria. Primarily, they must be nonresidents of Illinois who have earned income within the state. This includes wages, salaries, and income from business activities conducted in Illinois. Additionally, nonresidents must ensure that they do not qualify as full-year residents of any other state during the tax year in question.

IRS Guidelines Related to the Illinois Schedule NR

While the Illinois Schedule NR is a state-specific form, it is important to be aware of IRS guidelines that govern income reporting. Nonresidents must accurately report all income earned, including that from Illinois, on their federal tax returns. The IRS provides instructions on how to report income from multiple states, which can be beneficial when completing the Illinois Schedule NR. Understanding these guidelines helps ensure compliance with both federal and state tax laws.

Quick guide on how to complete use your mouse or tab key to move through the fields use

Effortlessly complete Use Your Mouse Or Tab Key To Move Through The Fields Use on any device

The management of documents online has gained signNow traction among organizations and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed paperwork, allowing you to locate the appropriate form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents quickly and without delay. Handle Use Your Mouse Or Tab Key To Move Through The Fields Use on any platform using the airSlate SignNow Android or iOS applications and streamline any document-related process today.

The easiest way to edit and eSign Use Your Mouse Or Tab Key To Move Through The Fields Use with ease

- Obtain Use Your Mouse Or Tab Key To Move Through The Fields Use and click on Get Form to initiate the process.

- Utilize the tools we offer to complete your form.

- Highlight important sections of the documents or conceal sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes only seconds and holds the same legal validity as a traditional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select your preferred method to send your form, via email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and eSign Use Your Mouse Or Tab Key To Move Through The Fields Use and guarantee excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct use your mouse or tab key to move through the fields use

Create this form in 5 minutes!

How to create an eSignature for the use your mouse or tab key to move through the fields use

The way to generate an e-signature for your PDF in the online mode

The way to generate an e-signature for your PDF in Chrome

How to generate an electronic signature for putting it on PDFs in Gmail

The best way to generate an e-signature straight from your smart phone

The way to create an electronic signature for a PDF on iOS devices

The best way to generate an e-signature for a PDF document on Android OS

People also ask

-

What is the Illinois Schedule NR and how does it relate to airSlate SignNow?

The Illinois Schedule NR is a specific tax form required for non-resident income tax returns in Illinois. With airSlate SignNow, you can easily eSign and submit your Illinois Schedule NR, allowing for a seamless document management process.

-

How much does airSlate SignNow cost for filing documents like the Illinois Schedule NR?

Pricing for airSlate SignNow varies based on your subscription plan, but it is designed to be cost-effective. With affordable monthly rates, businesses can manage documents like the Illinois Schedule NR without breaking the bank.

-

What features does airSlate SignNow offer for completing the Illinois Schedule NR?

airSlate SignNow provides a user-friendly interface, customizable templates, and secure eSigning options. These features streamline the process of completing and submitting your Illinois Schedule NR, ensuring compliance and accuracy.

-

Can airSlate SignNow help with electronic signatures for the Illinois Schedule NR?

Yes, airSlate SignNow allows you to electronically sign the Illinois Schedule NR, making the process faster and more efficient. This feature not only saves time but also ensures that your documents are legally binding and secure.

-

Are there any integrations available with airSlate SignNow for tax forms like the Illinois Schedule NR?

Absolutely! airSlate SignNow integrates with various accounting and tax software, making it easy to sync your Illinois Schedule NR and other important documents. These integrations enhance workflow and simplify your document management.

-

How does airSlate SignNow improve the process of filing the Illinois Schedule NR?

By using airSlate SignNow, you can automate signatures and track the progress of your Illinois Schedule NR. This efficiency helps ensure that you meet deadlines and reduces the chances of errors in your filing process.

-

What are the benefits of using airSlate SignNow for handling the Illinois Schedule NR?

Using airSlate SignNow for your Illinois Schedule NR offers several benefits, including increased speed, convenience, and security. You can manage all document-related tasks in one platform, streamlining your filing process.

Get more for Use Your Mouse Or Tab Key To Move Through The Fields Use

- Contractors verified statement of labor and materials and amount due mechanic liens corporation or llc illinois form

- Illinois renunciation and disclaimer of real property interest illinois form

- Il disclosure form

- Quitclaim deed from individual to individual illinois form

- Il warranty deed form

- Quitclaim deed husband wife and an individual to husband and wife illinois form

- Il warranty deed 497306054 form

- Satisfaction of judgment or dismissal of cause of action illinois form

Find out other Use Your Mouse Or Tab Key To Move Through The Fields Use

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors