Schedule NR, Nonresident and PartYear Resident Computation of Illinois Tax 2022

What is the Schedule NR, Nonresident And Part-Year Resident Computation Of Illinois Tax

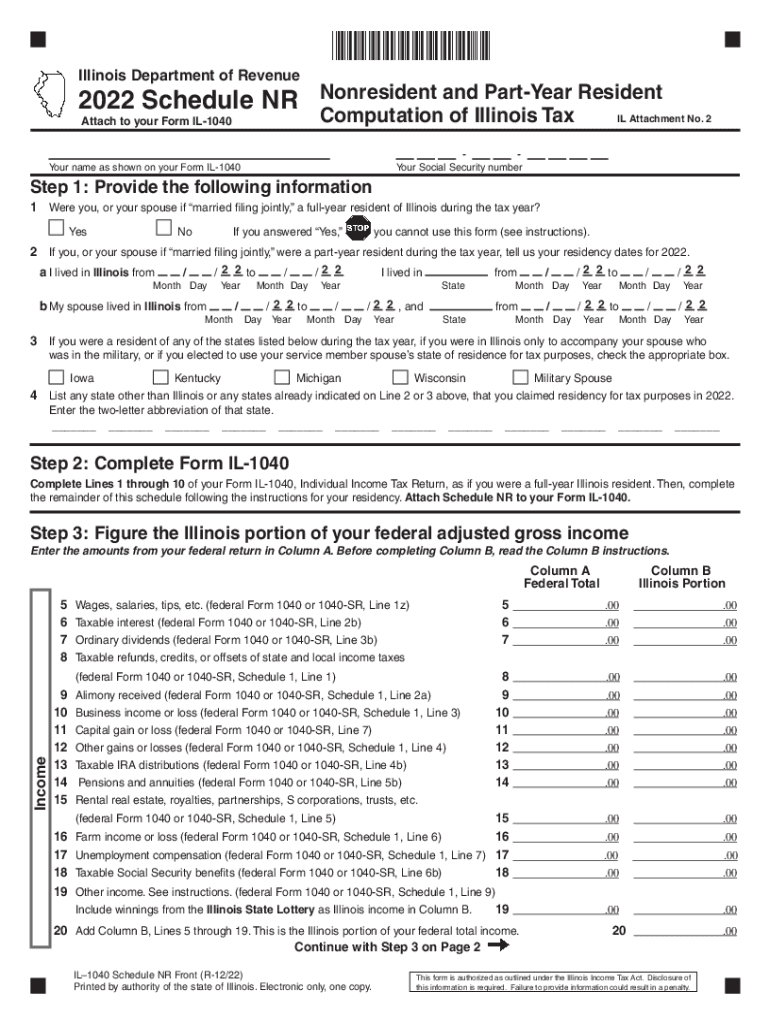

The Schedule NR, or Nonresident and Part-Year Resident Computation of Illinois Tax, is a crucial form for individuals who do not reside in Illinois for the entire tax year but earn income from Illinois sources. This form allows nonresidents and part-year residents to calculate their Illinois tax obligations based on the income they earned while in the state. It ensures that taxpayers only pay taxes on income sourced from Illinois, rather than their total income. This distinction is vital for compliance with Illinois tax laws and for avoiding overpayment of taxes.

How to use the Schedule NR, Nonresident And Part-Year Resident Computation Of Illinois Tax

To effectively use the Schedule NR, taxpayers must first gather all relevant income documents, including W-2s and 1099s, that detail income earned in Illinois. The form requires the taxpayer to report total income, Illinois income, and any deductions applicable to nonresidents. It is essential to follow the instructions carefully, as errors can lead to delays in processing or incorrect tax assessments. Taxpayers can complete the form either manually or through electronic means, ensuring that all calculations are accurate to facilitate a smooth filing process.

Steps to complete the Schedule NR, Nonresident And Part-Year Resident Computation Of Illinois Tax

Completing the Schedule NR involves several key steps:

- Gather all necessary income documentation, including forms that report earnings from Illinois sources.

- Fill out your total income on the form, ensuring to include only the income earned while in Illinois.

- Calculate the Illinois income by applying any relevant adjustments or deductions that pertain to nonresidents.

- Complete the tax computation section, which will determine your tax liability based on the income sourced from Illinois.

- Review the form for accuracy before submission to avoid any potential issues with the Illinois Department of Revenue.

Key elements of the Schedule NR, Nonresident And Part-Year Resident Computation Of Illinois Tax

Several key elements are essential to understanding the Schedule NR. These include:

- Income Reporting: Taxpayers must accurately report all income earned within Illinois.

- Deductions: Nonresidents may be eligible for specific deductions that can reduce their taxable income.

- Tax Rates: The form applies Illinois tax rates to the income reported, which may differ from federal rates.

- Filing Status: The taxpayer's filing status can affect the calculations on the Schedule NR.

Filing Deadlines / Important Dates

Filing deadlines for the Schedule NR align with the general tax filing deadlines in Illinois. Typically, the deadline for filing individual income tax returns is April 15 of the following year. However, if this date falls on a weekend or holiday, the deadline may be extended. It is crucial for taxpayers to be aware of these dates to avoid penalties for late filing. Additionally, if an extension is filed, the taxpayer must still pay any estimated taxes owed by the original deadline to avoid interest and penalties.

Penalties for Non-Compliance

Failure to file the Schedule NR or inaccuracies in the information provided can result in significant penalties. The Illinois Department of Revenue may impose fines for late filing, which can accumulate daily until the form is submitted. Additionally, underreporting income can lead to back taxes owed, along with interest and further penalties. It is essential for taxpayers to ensure compliance with all filing requirements to avoid these financial repercussions.

Quick guide on how to complete 2021 schedule nr nonresident and partyear resident computation of illinois tax

Effortlessly Prepare Schedule NR, Nonresident And PartYear Resident Computation Of Illinois Tax on Any Gadget

Digital document management has grown increasingly favored among companies and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, as it allows you to locate the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents swiftly without holdups. Manage Schedule NR, Nonresident And PartYear Resident Computation Of Illinois Tax on any device with airSlate SignNow Android or iOS applications and enhance any document-centric task today.

How to Modify and eSign Schedule NR, Nonresident And PartYear Resident Computation Of Illinois Tax with Ease

- Obtain Schedule NR, Nonresident And PartYear Resident Computation Of Illinois Tax and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize key sections of the documents or redact sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Bid farewell to lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Alter and eSign Schedule NR, Nonresident And PartYear Resident Computation Of Illinois Tax and ensure excellent communication at every stage of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2021 schedule nr nonresident and partyear resident computation of illinois tax

Create this form in 5 minutes!

How to create an eSignature for the 2021 schedule nr nonresident and partyear resident computation of illinois tax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Illinois Schedule NR, and who needs to use it?

The Illinois Schedule NR is a tax form used by non-residents of Illinois to report income earned in the state. If you are earning income from Illinois sources but are not a resident, you will need to complete this form to accurately report your tax obligations.

-

How can airSlate SignNow assist in completing the Illinois Schedule NR?

With airSlate SignNow, you can easily prepare and eSign your Illinois Schedule NR online. The platform’s intuitive interface makes it convenient to fill out all necessary fields and ensure accurate submissions, streamlining your tax filing process.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers a variety of pricing plans suitable for different business needs, starting with a free trial for users to test the features. These plans include options that allow for unlimited eSigning, which can facilitate the completion of forms like the Illinois Schedule NR without extra fees.

-

What features does airSlate SignNow provide for tax document handling?

airSlate SignNow features include secure document storage, customizable templates, and real-time collaboration on documents. These features are especially beneficial for managing tax forms, such as the Illinois Schedule NR, helping ensure accuracy and compliance.

-

Is airSlate SignNow compliant with Illinois tax regulations for the Schedule NR?

Yes, airSlate SignNow is compliant with electronic signature laws and regulations, ensuring that your Illinois Schedule NR is signed and submitted legally. Our platform prioritizes security and compliance to help you confidently manage your tax documentation.

-

Can I track the status of my Illinois Schedule NR submission using airSlate SignNow?

Absolutely! airSlate SignNow allows you to track the status of your submissions and get notifications when your Illinois Schedule NR has been viewed or signed. This feature helps you stay organized and ensures you don’t miss any important deadlines.

-

What integrations does airSlate SignNow offer that can help with tax forms like the Schedule NR?

airSlate SignNow seamlessly integrates with popular applications such as Google Drive and Salesforce, enhancing your workflow when dealing with tax documents like the Illinois Schedule NR. These integrations allow you to easily manage and access your tax forms alongside your other business documents.

Get more for Schedule NR, Nonresident And PartYear Resident Computation Of Illinois Tax

Find out other Schedule NR, Nonresident And PartYear Resident Computation Of Illinois Tax

- How Can I Electronic signature New Jersey Sports Purchase Order Template

- How Can I Electronic signature Louisiana Courts LLC Operating Agreement

- How To Electronic signature Massachusetts Courts Stock Certificate

- Electronic signature Mississippi Courts Promissory Note Template Online

- Electronic signature Montana Courts Promissory Note Template Now

- Electronic signature Montana Courts Limited Power Of Attorney Safe

- Electronic signature Oklahoma Sports Contract Safe

- Electronic signature Oklahoma Sports RFP Fast

- How To Electronic signature New York Courts Stock Certificate

- Electronic signature South Carolina Sports Separation Agreement Easy

- Electronic signature Virginia Courts Business Plan Template Fast

- How To Electronic signature Utah Courts Operating Agreement

- Electronic signature West Virginia Courts Quitclaim Deed Computer

- Electronic signature West Virginia Courts Quitclaim Deed Free

- Electronic signature Virginia Courts Limited Power Of Attorney Computer

- Can I Sign Alabama Banking PPT

- Electronic signature Washington Sports POA Simple

- How To Electronic signature West Virginia Sports Arbitration Agreement

- Electronic signature Wisconsin Sports Residential Lease Agreement Myself

- Help Me With Sign Arizona Banking Document