Use Tax Questions and Answers 2023-2026

Understanding the Illinois Schedule NR

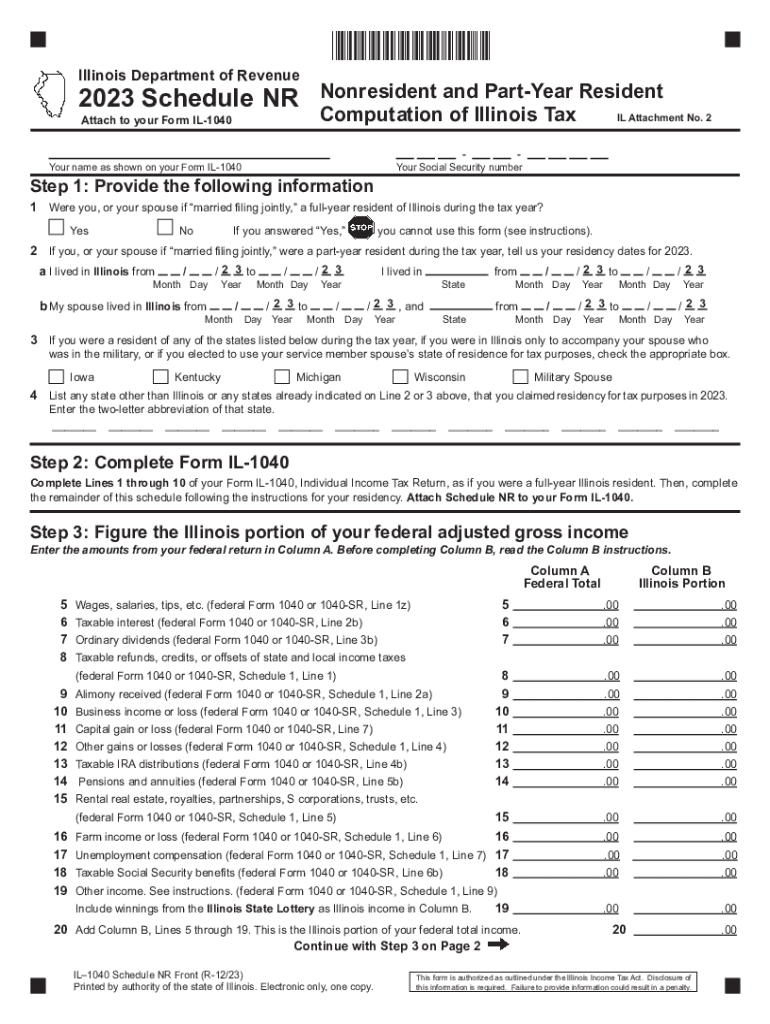

The Illinois Schedule NR is a crucial tax form for nonresidents who earn income in Illinois. This form allows individuals to report their Illinois-source income and calculate the appropriate tax owed. Nonresidents must file this form alongside their Illinois 1040 to ensure compliance with state tax laws. The Schedule NR is specifically designed for individuals who do not reside in Illinois but have income derived from Illinois sources, such as wages, rental income, or business profits.

Steps to Complete the Illinois Schedule NR

Completing the Illinois Schedule NR involves several straightforward steps. First, gather all relevant financial documents, including W-2s and 1099s that report your Illinois income. Next, complete the form by entering your total income, adjusting for any deductions or credits applicable to nonresidents. Be sure to calculate your tax liability based on the Illinois tax rates. Finally, review your entries for accuracy before submitting the form along with your Illinois 1040.

Filing Deadlines for the Illinois Schedule NR

The filing deadline for the Illinois Schedule NR typically aligns with the federal tax deadline, which is usually April 15. If this date falls on a weekend or holiday, the deadline may be extended. It is essential to file your Schedule NR on time to avoid penalties and interest. Additionally, if you require more time, you may apply for an extension, but ensure that any taxes owed are paid by the original deadline to minimize penalties.

Required Documents for Filing

When preparing to file the Illinois Schedule NR, it is important to have several key documents on hand. These include:

- W-2 forms from employers indicating Illinois wages

- 1099 forms for any freelance or contract work performed in Illinois

- Records of any rental income from properties located in Illinois

- Documentation of any deductions or credits you plan to claim

Having these documents ready will streamline the filing process and help ensure that your tax return is accurate.

Penalties for Non-Compliance

Failing to file the Illinois Schedule NR or inaccurately reporting your income can lead to significant penalties. The state may impose fines based on the amount of tax owed and the duration of the delay. Additionally, interest will accrue on any unpaid taxes from the original due date until the balance is settled. To avoid these consequences, it is advisable to file on time and ensure all information is correct.

Examples of Taxpayer Scenarios

Understanding how the Illinois Schedule NR applies to different taxpayer scenarios can clarify its importance. For instance, a self-employed individual who provides services in Illinois but resides in another state must file this form to report their earnings. Similarly, a student attending college in Illinois who works part-time will also need to complete the Schedule NR to report their income accurately. Each scenario highlights the necessity of this form for nonresidents earning income in the state.

Quick guide on how to complete use tax questions and answers

Prepare Use Tax Questions And Answers effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the tools you need to create, modify, and eSign your documents swiftly without delays. Manage Use Tax Questions And Answers on any platform via the airSlate SignNow Android or iOS applications and enhance any document-related process today.

The easiest way to edit and eSign Use Tax Questions And Answers with ease

- Obtain Use Tax Questions And Answers and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your signature using the Sign tool, which takes no time and carries the same legal validity as a traditional wet ink signature.

- Verify all the details and click on the Done button to save your modifications.

- Select your preferred method of delivering your form, via email, SMS, or invitation link, or download it to your computer.

No more worrying about lost or misplaced documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and eSign Use Tax Questions And Answers and ensure exceptional communication at any point of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct use tax questions and answers

Create this form in 5 minutes!

How to create an eSignature for the use tax questions and answers

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Illinois Schedule NR used for?

The Illinois Schedule NR is used by non-residents to report income earned in Illinois. It allows individuals to calculate their state tax obligations accurately, ensuring compliance with Illinois tax laws. Using airSlate SignNow can simplify the process of signing and submitting this important document.

-

How does airSlate SignNow support the completion of the Illinois Schedule NR?

airSlate SignNow provides a user-friendly platform to eSign and send documents, making it easy to handle the Illinois Schedule NR. The platform allows for secure signatures, ensuring that your tax documentation is processed quickly and effectively. It's designed to streamline the filing process for both individuals and accountants.

-

What features does airSlate SignNow offer for document management?

AirSlate SignNow offers a robust set of features including customizable templates, document tracking, and secure storage. These features ensure that your Illinois Schedule NR and other documents are easily organized and accessible. Additionally, the platform allows multiple users to collaborate seamlessly.

-

Is airSlate SignNow affordable for individual users preparing an Illinois Schedule NR?

Yes, airSlate SignNow offers different pricing plans suited for individual users, making it accessible for anyone needing to prepare their Illinois Schedule NR. The cost-effectiveness of the platform ensures that even small businesses or self-employed individuals can manage their document signing needs efficiently. Plus, there are no hidden fees.

-

Can I integrate airSlate SignNow with other software for tax filing?

Absolutely! airSlate SignNow integrates smoothly with various accounting and tax preparation software. This flexibility makes it easy to manage your Illinois Schedule NR alongside your other financial documents, helping to streamline the entire filing process. Integration enhances productivity and saves valuable time.

-

What are the benefits of using airSlate SignNow for eSigning the Illinois Schedule NR?

Using airSlate SignNow for eSigning the Illinois Schedule NR provides benefits such as enhanced security and faster processing times. You can easily track the status of your documents, ensuring that nothing gets lost in the shuffle. The convenience of signing from anywhere also makes it ideal for busy individuals.

-

Is my information secure when using airSlate SignNow for the Illinois Schedule NR?

Yes, security is a top priority for airSlate SignNow. The platform utilizes advanced encryption and complies with industry standards to keep your information safe when completing the Illinois Schedule NR. You can trust that your tax documents are handled with the highest level of security.

Get more for Use Tax Questions And Answers

Find out other Use Tax Questions And Answers

- Help Me With eSignature North Carolina Bookkeeping Contract

- eSignature Georgia Gym Membership Agreement Mobile

- eSignature Michigan Internship Contract Computer

- Can I eSignature Nebraska Student Data Sheet

- How To eSignature Michigan Application for University

- eSignature North Carolina Weekly Class Evaluation Now

- eSignature Colorado Medical Power of Attorney Template Fast

- Help Me With eSignature Florida Medical Power of Attorney Template

- eSignature Iowa Medical Power of Attorney Template Safe

- eSignature Nevada Medical Power of Attorney Template Secure

- eSignature Arkansas Nanny Contract Template Secure

- eSignature Wyoming New Patient Registration Mobile

- eSignature Hawaii Memorandum of Agreement Template Online

- eSignature Hawaii Memorandum of Agreement Template Mobile

- eSignature New Jersey Memorandum of Agreement Template Safe

- eSignature Georgia Shareholder Agreement Template Mobile

- Help Me With eSignature Arkansas Cooperative Agreement Template

- eSignature Maryland Cooperative Agreement Template Simple

- eSignature Massachusetts Redemption Agreement Simple

- eSignature North Carolina Redemption Agreement Mobile