How to Use Keyboard as Mouse Enable Mouse Keys and Move Use Mouse Keys to Move the Mouse PointerHow to Control Your Mouse Using 2020

IRS Guidelines

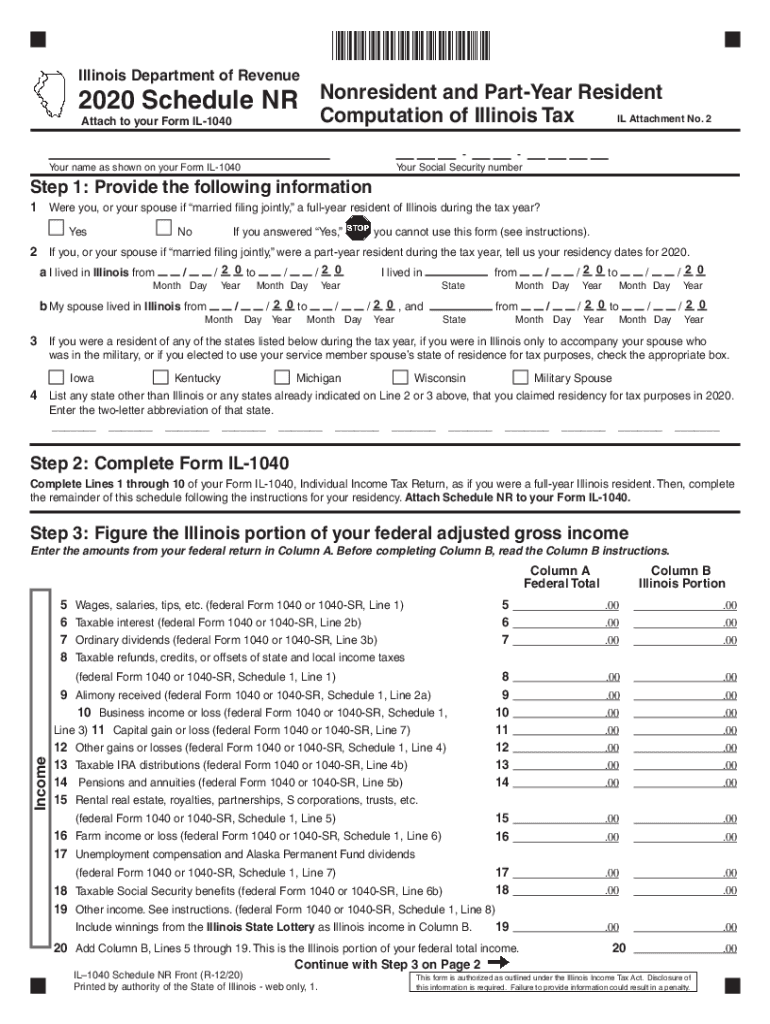

The Schedule NR tax form is designed for non-resident aliens who need to report their income to the IRS. It is essential to follow the IRS guidelines to ensure accurate reporting and compliance. The IRS provides detailed instructions for completing the form, which include information on what types of income must be reported, how to calculate tax liability, and the necessary documentation to accompany the form. Understanding these guidelines helps prevent errors that could lead to penalties or delays in processing.

Filing Deadlines / Important Dates

Filing deadlines for the Schedule NR tax form are crucial for compliance. Generally, non-resident aliens must file their tax returns by April 15 of the year following the tax year. However, if you are a non-resident alien who is not required to file a return, you may still need to file if you have income that is subject to U.S. tax. It is important to keep track of any extensions or specific dates that may apply to your situation, as failing to meet these deadlines can result in penalties.

Required Documents

To complete the Schedule NR tax form, certain documents are necessary. These typically include:

- Form 1040-NR, the main tax return for non-resident aliens.

- W-2 forms from employers showing income earned in the U.S.

- 1099 forms for other types of income, such as freelance work or interest.

- Any relevant tax treaties that may affect your tax obligations.

Gathering these documents in advance can streamline the filing process and ensure that all income is accurately reported.

Form Submission Methods (Online / Mail / In-Person)

The Schedule NR tax form can be submitted through various methods. Non-resident aliens have the option to file their forms electronically or by mail. Electronic filing is often faster and can reduce processing times. However, if you choose to file by mail, ensure that you send your forms to the correct IRS address based on your location. In-person submissions are not typically available for this form, so understanding the electronic and mail options is key.

Penalties for Non-Compliance

Failing to file the Schedule NR tax form or submitting it late can lead to significant penalties. The IRS may impose fines based on the amount of tax owed and the length of time the return is overdue. Additionally, interest may accrue on any unpaid taxes. It is important to be aware of these potential consequences to avoid financial repercussions and ensure compliance with U.S. tax laws.

Taxpayer Scenarios (e.g., self-employed, retired, students)

Different taxpayer scenarios may impact how the Schedule NR tax form is completed. For instance:

- Self-employed individuals must report all income earned from their business activities, including any deductions they may qualify for.

- Retired individuals may need to report pension or retirement distributions received from U.S. sources.

- Students studying in the U.S. on a visa may have specific tax treaty benefits that apply to their income.

Understanding these scenarios can help ensure that each taxpayer accurately completes the form according to their unique circumstances.

Quick guide on how to complete how to use keyboard as mouse enable mouse keys and move use mouse keys to move the mouse pointerhow to control your mouse using

Facilitate How To Use Keyboard As Mouse Enable Mouse Keys And Move Use Mouse Keys To Move The Mouse PointerHow To Control Your Mouse Using effortlessly on any gadget

Digital document administration has gained traction among businesses and individuals alike. It offers a suitable environmentally friendly alternative to traditional printed and signed paperwork, as you can locate the desired form and securely keep it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly without delays. Manage How To Use Keyboard As Mouse Enable Mouse Keys And Move Use Mouse Keys To Move The Mouse PointerHow To Control Your Mouse Using on any device with airSlate SignNow's Android or iOS applications, simplifying any document-related task today.

The simplest method to alter and electronically sign How To Use Keyboard As Mouse Enable Mouse Keys And Move Use Mouse Keys To Move The Mouse PointerHow To Control Your Mouse Using effortlessly

- Locate How To Use Keyboard As Mouse Enable Mouse Keys And Move Use Mouse Keys To Move The Mouse PointerHow To Control Your Mouse Using and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method for sending your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate the worry of lost or misfiled documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets your requirements in document management in just a few clicks from the device of your choice. Modify and electronically sign How To Use Keyboard As Mouse Enable Mouse Keys And Move Use Mouse Keys To Move The Mouse PointerHow To Control Your Mouse Using and guarantee outstanding communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct how to use keyboard as mouse enable mouse keys and move use mouse keys to move the mouse pointerhow to control your mouse using

Create this form in 5 minutes!

How to create an eSignature for the how to use keyboard as mouse enable mouse keys and move use mouse keys to move the mouse pointerhow to control your mouse using

The best way to create an eSignature for your PDF document online

The best way to create an eSignature for your PDF document in Google Chrome

The best way to make an electronic signature for signing PDFs in Gmail

The best way to make an eSignature from your smart phone

The way to generate an electronic signature for a PDF document on iOS

The best way to make an eSignature for a PDF file on Android OS

People also ask

-

What is the schedule nr tax form and why is it important?

The schedule nr tax form is used by taxpayers in the United States to report their non-resident income. Understanding how to fill out this form is crucial for compliance with tax laws. Accurate use of the schedule nr tax form can help avoid penalties and ensure that you pay the correct tax amount.

-

How can airSlate SignNow help with the schedule nr tax form?

AirSlate SignNow streamlines the process of signing and sending the schedule nr tax form. With its easy-to-use platform, you can quickly upload, eSign, and send your documents securely. This ensures you stay compliant without the hassle of traditional paper processes.

-

What features does airSlate SignNow offer for handling tax forms?

AirSlate SignNow provides features like document templates, customizable workflows, and real-time tracking for your schedule nr tax form. These tools simplify the process of document management, making it efficient for users to handle their tax paperwork seamlessly. Plus, you can easily invite others to sign, ensuring all stakeholders are included.

-

Is airSlate SignNow a cost-effective solution for managing tax documents?

Yes, airSlate SignNow is a cost-effective solution for managing documents, including the schedule nr tax form. With flexible pricing plans and no hidden fees, businesses can save money while ensuring efficient document handling. It offers great value compared to traditional methods or other eSignature solutions.

-

Can airSlate SignNow integrate with other software for tax management?

Absolutely! AirSlate SignNow offers integrations with various tax software and platforms, making it easier to manage the schedule nr tax form. This interoperability allows users to streamline their workflows and maintain accurate records without switching between different applications.

-

Is airSlate SignNow secure for handling sensitive tax documents?

Yes, security is a top priority for airSlate SignNow. The platform employs encryption and complies with industry standards to protect your schedule nr tax form and other sensitive documents. You can rest assured that your information remains confidential and secure throughout the signing process.

-

What support options are available for users needing help with the schedule nr tax form?

AirSlate SignNow offers comprehensive support options, including a knowledge base, tutorials, and customer service assistance. Users can access resources to help them navigate the schedule nr tax form and other features efficiently. This ensures you have the help you need when preparing your documents.

Get more for How To Use Keyboard As Mouse Enable Mouse Keys And Move Use Mouse Keys To Move The Mouse PointerHow To Control Your Mouse Using

Find out other How To Use Keyboard As Mouse Enable Mouse Keys And Move Use Mouse Keys To Move The Mouse PointerHow To Control Your Mouse Using

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement

- eSignature New Hampshire High Tech Lease Agreement Template Mobile

- eSignature Montana Insurance Lease Agreement Template Online

- eSignature New Hampshire High Tech Lease Agreement Template Free

- How To eSignature Montana Insurance Emergency Contact Form

- eSignature New Jersey High Tech Executive Summary Template Free

- eSignature Oklahoma Insurance Warranty Deed Safe

- eSignature Pennsylvania High Tech Bill Of Lading Safe

- eSignature Washington Insurance Work Order Fast

- eSignature Utah High Tech Warranty Deed Free

- How Do I eSignature Utah High Tech Warranty Deed

- eSignature Arkansas Legal Affidavit Of Heirship Fast

- Help Me With eSignature Colorado Legal Cease And Desist Letter

- How To eSignature Connecticut Legal LLC Operating Agreement