DR845320190 PDF Colorado Department of Revenue 2021-2026

What is the DR 8453 form?

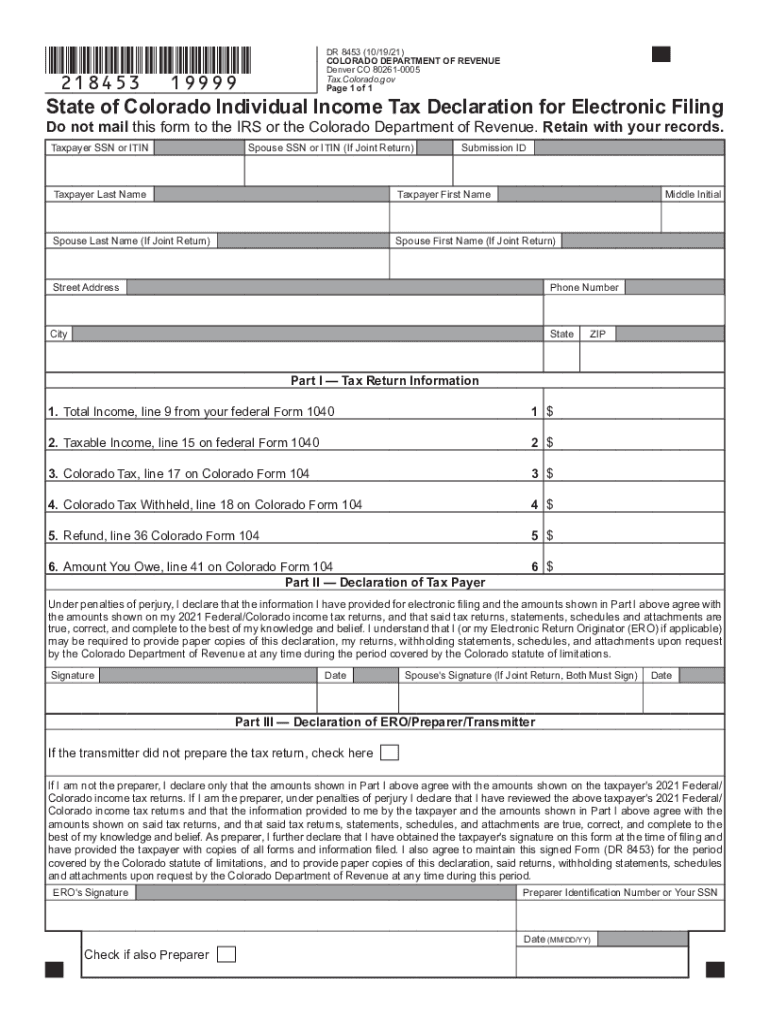

The DR 8453 form is a crucial document used by taxpayers in Colorado to submit their income tax returns electronically. This form serves as a declaration of the taxpayer's identity and verifies the authenticity of the electronic submission. It is essential for ensuring that the submitted tax return is valid and compliant with state regulations. The form captures important taxpayer information, including the name, address, and Social Security number, which helps the Colorado Department of Revenue process tax returns accurately.

Steps to complete the DR 8453 form

Completing the DR 8453 form involves several straightforward steps to ensure accuracy and compliance. First, gather all necessary personal information, including your Social Security number and income details. Next, access the form through the Colorado Department of Revenue's website or a trusted tax software. Fill in your information carefully, ensuring that all fields are completed accurately. After filling out the form, review it for any errors or omissions. Finally, sign the form electronically using a secure eSignature solution to confirm your submission.

Filing deadlines for the DR 8453 form

Timely submission of the DR 8453 form is essential to avoid penalties and ensure compliance with Colorado tax regulations. The typical deadline for filing individual income tax returns in Colorado is April 15. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. It is advisable to check for any updates or changes to filing deadlines each tax year to ensure your submission is timely.

Legal use of the DR 8453 form

The DR 8453 form has legal significance as it acts as a binding document when submitting electronic tax returns. For the form to be legally valid, it must be signed electronically, adhering to the requirements set forth by the Electronic Signatures in Global and National Commerce (ESIGN) Act and the Uniform Electronic Transactions Act (UETA). This legal framework ensures that electronic signatures are recognized as valid and enforceable, providing security and legitimacy to the electronic filing process.

Required documents for the DR 8453 form

To successfully complete the DR 8453 form, certain documents are required to provide accurate information. These include your W-2 forms, 1099 forms, and any other income statements. Additionally, you may need documentation related to deductions and credits, such as receipts for charitable contributions or mortgage interest statements. Having these documents readily available will streamline the completion process and help ensure that your tax return is accurate and complete.

Form submission methods for the DR 8453

The DR 8453 form can be submitted electronically through approved e-filing software or through the Colorado Department of Revenue's online portal. This method ensures a faster processing time compared to traditional mail. Alternatively, if you choose to file a paper return, you can print the completed DR 8453 form and submit it by mail. However, electronic submission is encouraged for its efficiency and security.

Quick guide on how to complete dr845320190pdf colorado department of revenue

Easily prepare DR845320190 pdf Colorado Department Of Revenue on any device

Managing documents online has become increasingly popular among businesses and individuals alike. It offers an excellent eco-friendly substitute for conventional printed and signed paperwork, enabling you to obtain the proper form and securely keep it online. airSlate SignNow provides all the resources necessary to create, modify, and eSign your documents quickly and efficiently. Manage DR845320190 pdf Colorado Department Of Revenue on any device using airSlate SignNow's Android or iOS applications and enhance any document-related task today.

The easiest way to modify and eSign DR845320190 pdf Colorado Department Of Revenue effortlessly

- Obtain DR845320190 pdf Colorado Department Of Revenue and click Get Form to start.

- Use the tools we offer to complete your document.

- Highlight important sections of your documents or redact sensitive information with the tools that airSlate SignNow offers specifically for this purpose.

- Create your signature using the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Stop worrying about lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and eSign DR845320190 pdf Colorado Department Of Revenue and guarantee effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct dr845320190pdf colorado department of revenue

Create this form in 5 minutes!

How to create an eSignature for the dr845320190pdf colorado department of revenue

The way to make an electronic signature for your PDF file online

The way to make an electronic signature for your PDF file in Google Chrome

The best way to make an e-signature for signing PDFs in Gmail

The best way to make an e-signature right from your mobile device

The way to generate an electronic signature for a PDF file on iOS

The best way to make an e-signature for a PDF on Android devices

People also ask

-

What is DR 8453 and how is it used in airSlate SignNow?

DR 8453 is a crucial IRS form used for electronic signatures in tax-related documents. With airSlate SignNow, streamlining the signing process of DR 8453 becomes seamless, allowing you to ensure compliance while enhancing efficiency in document management.

-

How can airSlate SignNow help with the completion of DR 8453?

airSlate SignNow provides an intuitive platform that simplifies the process of completing DR 8453. By using our electronic signature features, you can sign and send DR 8453 securely, speeding up your document turnaround time while maintaining compliance.

-

What are the costs associated with using airSlate SignNow for DR 8453?

airSlate SignNow offers various pricing plans tailored to fit different business needs. These plans provide access to essential features for managing documents like DR 8453, ensuring you get a cost-effective solution without compromising on functionality.

-

What features does airSlate SignNow offer for managing DR 8453?

With airSlate SignNow, you can take advantage of advanced features such as customizable templates, in-app collaboration, and real-time tracking for DR 8453. These tools not only enhance document management but also create a smoother signing experience.

-

Are there any integrations available for airSlate SignNow when handling DR 8453?

Yes, airSlate SignNow offers a variety of integrations with popular business applications, making it easy to manage DR 8453 alongside your other workflows. This connectivity helps streamline your processes, allowing for a more integrated approach to document management.

-

What benefits does airSlate SignNow provide for businesses needing DR 8453?

Utilizing airSlate SignNow for processing DR 8453 yields numerous benefits, including enhanced efficiency, reduced paper use, and improved compliance tracking. By digitizing your workflows with our platform, you can focus on what matters most—growing your business.

-

Is airSlate SignNow secure for signing DR 8453?

Absolutely! airSlate SignNow prioritizes security to protect your documents. When signing DR 8453, you can trust that our platform employs advanced encryption and authentication measures to ensure that your information remains safe and confidential.

Get more for DR845320190 pdf Colorado Department Of Revenue

Find out other DR845320190 pdf Colorado Department Of Revenue

- Sign Montana Lawers LLC Operating Agreement Free

- Sign Montana Lawers LLC Operating Agreement Fast

- Can I Sign Nevada Lawers Letter Of Intent

- Sign Minnesota Insurance Residential Lease Agreement Fast

- How Do I Sign Ohio Lawers LLC Operating Agreement

- Sign Oregon Lawers Limited Power Of Attorney Simple

- Sign Oregon Lawers POA Online

- Sign Mississippi Insurance POA Fast

- How Do I Sign South Carolina Lawers Limited Power Of Attorney

- Sign South Dakota Lawers Quitclaim Deed Fast

- Sign South Dakota Lawers Memorandum Of Understanding Free

- Sign South Dakota Lawers Limited Power Of Attorney Now

- Sign Texas Lawers Limited Power Of Attorney Safe

- Sign Tennessee Lawers Affidavit Of Heirship Free

- Sign Vermont Lawers Quitclaim Deed Simple

- Sign Vermont Lawers Cease And Desist Letter Free

- Sign Nevada Insurance Lease Agreement Mobile

- Can I Sign Washington Lawers Quitclaim Deed

- Sign West Virginia Lawers Arbitration Agreement Secure

- Sign Wyoming Lawers Lease Agreement Now