Form Dr 8453 Colorado 2019

What is the Form Dr 8453 Colorado

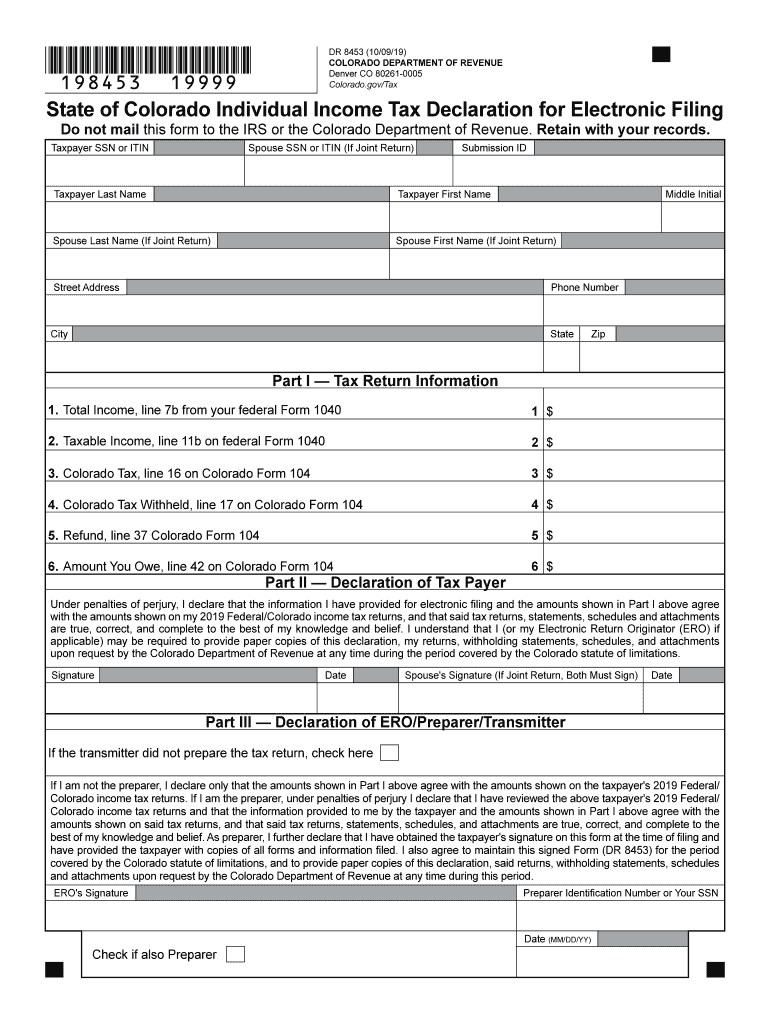

The Form Dr 8453 Colorado is a tax form used by taxpayers in Colorado to authorize the electronic filing of their state income tax return. This form serves as a declaration that the taxpayer has reviewed their return and confirms its accuracy. It is essential for ensuring that the electronic submission is legitimate and complies with state regulations. The form includes necessary information such as the taxpayer's name, Social Security number, and signature, which may be provided electronically.

How to use the Form Dr 8453 Colorado

To use the Form Dr 8453 Colorado, taxpayers must first complete their state income tax return. Once the return is finalized, the form must be filled out to authorize the electronic filing. This involves entering personal information and confirming the accuracy of the return. After completing the form, it can be submitted electronically alongside the tax return. It is crucial to retain a copy of the signed form for personal records, as it may be required for future reference or verification.

Steps to complete the Form Dr 8453 Colorado

Completing the Form Dr 8453 Colorado involves several straightforward steps:

- Gather necessary documents, including your completed state income tax return.

- Fill out the personal information section, including your name and Social Security number.

- Review your tax return to ensure all information is accurate and complete.

- Sign the form electronically, confirming your authorization for e-filing.

- Submit the form along with your state tax return through the designated electronic filing method.

Legal use of the Form Dr 8453 Colorado

The legal use of the Form Dr 8453 Colorado is governed by state tax laws, which require that taxpayers authorize electronic submissions of their returns. By signing the form, taxpayers affirm that they have reviewed their tax return and that it is accurate to the best of their knowledge. This legal acknowledgment is crucial for compliance with Colorado tax regulations and helps prevent fraudulent submissions.

Key elements of the Form Dr 8453 Colorado

Key elements of the Form Dr 8453 Colorado include:

- Taxpayer's full name and Social Security number.

- Signature of the taxpayer, indicating consent for electronic filing.

- Confirmation of the accuracy of the tax return being filed.

- Identification of the tax year for which the return is being submitted.

Filing Deadlines / Important Dates

Filing deadlines for the Form Dr 8453 Colorado typically align with the state income tax return deadlines. Taxpayers should ensure that their forms and returns are submitted by April 15 of the tax year, unless an extension has been granted. It is important to stay informed about any changes to deadlines, as they may vary from year to year.

Quick guide on how to complete colorado form dr 8453 instructions esmart tax

Complete Form Dr 8453 Colorado effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to locate the correct form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents quickly without delays. Handle Form Dr 8453 Colorado on any device with the airSlate SignNow Android or iOS applications and streamline any document-related task today.

The easiest way to modify and eSign Form Dr 8453 Colorado with minimal effort

- Obtain Form Dr 8453 Colorado and then click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional ink signature.

- Review all the details and then click the Done button to preserve your changes.

- Select how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or errors that require reprinting new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Modify and eSign Form Dr 8453 Colorado and ensure effective communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct colorado form dr 8453 instructions esmart tax

Create this form in 5 minutes!

How to create an eSignature for the colorado form dr 8453 instructions esmart tax

How to create an electronic signature for the Colorado Form Dr 8453 Instructions Esmart Tax in the online mode

How to create an eSignature for your Colorado Form Dr 8453 Instructions Esmart Tax in Google Chrome

How to create an eSignature for putting it on the Colorado Form Dr 8453 Instructions Esmart Tax in Gmail

How to create an eSignature for the Colorado Form Dr 8453 Instructions Esmart Tax straight from your mobile device

How to generate an eSignature for the Colorado Form Dr 8453 Instructions Esmart Tax on iOS

How to create an electronic signature for the Colorado Form Dr 8453 Instructions Esmart Tax on Android devices

People also ask

-

What is form DR 8453?

Form DR 8453 is a declaration for electronic filing of income tax returns. It serves as a signature document that allows taxpayers to authorize e-filed returns by confirming their identity. Understanding what is form DR 8453 is crucial for individuals filing their taxes electronically to ensure compliance with IRS requirements.

-

How does airSlate SignNow facilitate the use of form DR 8453?

airSlate SignNow simplifies the signing process for form DR 8453 by enabling users to eSign documents securely and quickly. With our platform, you can upload your form, send it for signatures, and track its status in real-time. This makes filing your taxes more efficient while ensuring that you comply with regulations regarding what is form DR 8453.

-

Is there a cost associated with using airSlate SignNow for form DR 8453?

Yes, airSlate SignNow offers various pricing plans that are cost-effective and tailored to different business needs. Whether you are an individual or a larger organization, our plans provide you with the flexibility to choose the right features for efficiently managing what is form DR 8453 and other documents.

-

What are the main benefits of using airSlate SignNow for form DR 8453?

Using airSlate SignNow for form DR 8453 streamlines the signing process, reducing the time it takes to complete tax filings. Our platform is user-friendly, secure, and compliant, ensuring that all your eSigned documents adhere to the necessary regulations. This boosts productivity and minimizes the risks associated with paper filing.

-

Can I integrate airSlate SignNow with other applications for form DR 8453?

Absolutely! airSlate SignNow offers seamless integrations with various applications such as Google Drive, Dropbox, and CRM systems. This allows you to manage your documents, including what is form DR 8453, in one central location, enhancing your workflow and minimizing the hassle of switching between platforms.

-

What types of documents can I eSign besides form DR 8453?

In addition to form DR 8453, you can eSign a wide range of documents using airSlate SignNow, including contracts, agreements, and other legal forms. Our platform supports various document types, making it versatile for both personal and business needs. This means you can manage all your important paperwork efficiently in one place.

-

Is airSlate SignNow secure for signing sensitive documents like form DR 8453?

Yes, airSlate SignNow prioritizes the security of your documents through advanced encryption and authentication measures. When you sign sensitive documents like what is form DR 8453 on our platform, you can rest assured that your information is protected against unauthorized access. This commitment to security helps users feel confident in their electronic filing process.

Get more for Form Dr 8453 Colorado

Find out other Form Dr 8453 Colorado

- Can I Sign Wyoming Finance & Tax Accounting Cease And Desist Letter

- Sign California Government Job Offer Now

- How Do I Sign Colorado Government Cease And Desist Letter

- How To Sign Connecticut Government LLC Operating Agreement

- How Can I Sign Delaware Government Residential Lease Agreement

- Sign Florida Government Cease And Desist Letter Online

- Sign Georgia Government Separation Agreement Simple

- Sign Kansas Government LLC Operating Agreement Secure

- How Can I Sign Indiana Government POA

- Sign Maryland Government Quitclaim Deed Safe

- Sign Louisiana Government Warranty Deed Easy

- Sign Government Presentation Massachusetts Secure

- How Can I Sign Louisiana Government Quitclaim Deed

- Help Me With Sign Michigan Government LLC Operating Agreement

- How Do I Sign Minnesota Government Quitclaim Deed

- Sign Minnesota Government Affidavit Of Heirship Simple

- Sign Missouri Government Promissory Note Template Fast

- Can I Sign Missouri Government Promissory Note Template

- Sign Nevada Government Promissory Note Template Simple

- How To Sign New Mexico Government Warranty Deed