Form Dr8453 2016

What is the Form DR-8453

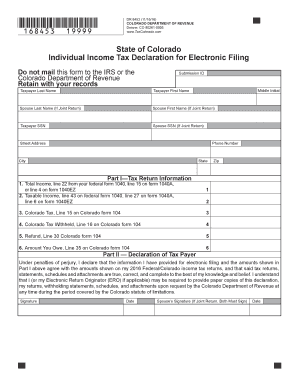

The Form DR-8453 is a tax form used in the state of Colorado, specifically designed for electronic filing of individual income tax returns. This form serves as a declaration that the taxpayer has electronically filed their return and provides the necessary signatures to validate the submission. It is essential for ensuring compliance with state tax laws and regulations.

How to Use the Form DR-8453

To use the Form DR-8453, taxpayers must first complete their income tax return electronically. Once the return is prepared, the DR-8453 must be signed electronically. This form acts as a signature document, confirming that the information provided in the electronic return is accurate and complete. After signing, the form should be submitted according to the instructions provided by the Colorado Department of Revenue.

Steps to Complete the Form DR-8453

Completing the Form DR-8453 involves several key steps:

- Prepare your Colorado income tax return electronically using approved software.

- Access the Form DR-8453 within the software after completing your return.

- Review the information on the form to ensure accuracy.

- Sign the form electronically, which may require a PIN or other verification method.

- Submit the signed form along with your electronic tax return.

Legal Use of the Form DR-8453

The legal use of the Form DR-8453 is governed by state tax regulations. By signing this form electronically, taxpayers affirm that the information provided is true and correct. The form must be retained for record-keeping purposes, as it may be required for future reference or audits. Compliance with the eSignature laws ensures that the electronic submission is legally binding.

IRS Guidelines

While the Form DR-8453 is specific to Colorado, it is important to be aware of the IRS guidelines regarding electronic filing. The IRS mandates that taxpayers must retain a copy of the signed Form DR-8453 as part of their records. This ensures that taxpayers can provide proof of submission if necessary. Additionally, the IRS provides specific instructions on how to handle electronic signatures and the requirements for e-filing.

Form Submission Methods

The Form DR-8453 can be submitted electronically as part of the e-filing process. Taxpayers must ensure that they follow the submission guidelines provided by their tax preparation software. In some cases, if the electronic filing is not possible, taxpayers may need to print and mail the form along with their tax return. However, electronic submission is the preferred method for efficiency and compliance.

Quick guide on how to complete state of colorado individual income tax declaration for electronic filing

Prepare Form Dr8453 effortlessly on any device

Digital document management has become increasingly favored by companies and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed papers, as you can find the necessary form and securely store it online. airSlate SignNow equips you with all the tools needed to create, modify, and eSign your documents swiftly without delays. Manage Form Dr8453 on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to edit and eSign Form Dr8453 with ease

- Obtain Form Dr8453 and then click Get Form to initiate.

- Utilize the tools we provide to fill out your form.

- Highlight pertinent sections of your documents or obscure sensitive information with tools offered by airSlate SignNow specifically for that purpose.

- Generate your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Verify the details and click on the Done button to save your alterations.

- Select your preferred method to send your form—via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors needing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Edit and eSign Form Dr8453 to ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct state of colorado individual income tax declaration for electronic filing

Create this form in 5 minutes!

How to create an eSignature for the state of colorado individual income tax declaration for electronic filing

How to create an electronic signature for the State Of Colorado Individual Income Tax Declaration For Electronic Filing in the online mode

How to create an eSignature for your State Of Colorado Individual Income Tax Declaration For Electronic Filing in Google Chrome

How to create an eSignature for signing the State Of Colorado Individual Income Tax Declaration For Electronic Filing in Gmail

How to create an eSignature for the State Of Colorado Individual Income Tax Declaration For Electronic Filing from your smartphone

How to generate an eSignature for the State Of Colorado Individual Income Tax Declaration For Electronic Filing on iOS devices

How to generate an electronic signature for the State Of Colorado Individual Income Tax Declaration For Electronic Filing on Android

People also ask

-

What is form dr 8453 and why is it important?

Form DR 8453 is a crucial document used by taxpayers to electronically file their tax returns. It serves as a declaration that the information submitted is accurate and complete. Understanding what is form dr 8453 helps ensure compliance with IRS regulations and streamlines the e-filing process.

-

How can airSlate SignNow assist with form dr 8453?

AirSlate SignNow simplifies the process of signing and submitting form dr 8453 by providing an electronic signature solution. This tool allows users to quickly eSign the form and send it securely without needing to print and scan. By using SignNow, you can enhance productivity while ensuring that your tax documents are handled securely.

-

Is there a cost associated with using airSlate SignNow for form dr 8453?

While airSlate SignNow offers various pricing plans, many users find it to be a cost-effective solution for managing documents like form dr 8453. The pricing structure is user-friendly, allowing businesses to choose a plan that fits their needs. Additionally, the benefits of streamlining document management can save time and resources.

-

What features does airSlate SignNow offer for form dr 8453 management?

AirSlate SignNow provides features that enhance the management of form dr 8453, such as customizable templates, secure storage, and multi-user access. These functionalities enable teams to collaborate efficiently while ensuring that documents are compliant and securely stored. Understanding these features can help businesses maximize their use of the platform.

-

Can I integrate airSlate SignNow with other applications for processing form dr 8453?

Yes, airSlate SignNow offers seamless integrations with popular applications such as Google Workspace, Dropbox, and Microsoft Office. These integrations enable efficient workflows when processing form dr 8453, making it easier to manage and share documents. This flexibility enhances productivity and streamlines your operations.

-

What are the benefits of using airSlate SignNow for form dr 8453 over traditional methods?

Using airSlate SignNow for form dr 8453 provides numerous benefits compared to traditional methods. It eliminates the need for printing, signing, and scanning, saving time and reducing paper waste. Plus, the platform ensures secure and reliable signatures, improving the overall integrity of your submission.

-

Is airSlate SignNow user-friendly for filing form dr 8453?

Absolutely! AirSlate SignNow is designed with user-friendliness in mind, making it easy for individuals to complete and file form dr 8453. The intuitive interface and step-by-step guidance ensure that even those unfamiliar with electronic signatures can navigate the platform confidently.

Get more for Form Dr8453

- Wine submission form

- Abortion paperwork florida form

- State bar of wisconsin form 1 2003 warranty deed wicticcom

- State bar of wisconsin form 2 2003 warranty deed wicticcom

- Pno certification form

- Idaho individual income tax return free ebooks download form

- Indiana form 50469 2012

- Adt alarm certificate template form

Find out other Form Dr8453

- Electronic signature Minnesota Legal LLC Operating Agreement Free

- Electronic signature Minnesota Legal LLC Operating Agreement Secure

- Electronic signature Louisiana Life Sciences LLC Operating Agreement Now

- Electronic signature Oregon Non-Profit POA Free

- Electronic signature South Dakota Non-Profit Business Plan Template Now

- Electronic signature South Dakota Non-Profit Lease Agreement Template Online

- Electronic signature Legal Document Missouri Online

- Electronic signature Missouri Legal Claim Online

- Can I Electronic signature Texas Non-Profit Permission Slip

- Electronic signature Missouri Legal Rental Lease Agreement Simple

- Electronic signature Utah Non-Profit Cease And Desist Letter Fast

- Electronic signature Missouri Legal Lease Agreement Template Free

- Electronic signature Non-Profit PDF Vermont Online

- Electronic signature Non-Profit PDF Vermont Computer

- Electronic signature Missouri Legal Medical History Mobile

- Help Me With Electronic signature West Virginia Non-Profit Business Plan Template

- Electronic signature Nebraska Legal Living Will Simple

- Electronic signature Nevada Legal Contract Safe

- How Can I Electronic signature Nevada Legal Operating Agreement

- How Do I Electronic signature New Hampshire Legal LLC Operating Agreement