Get the Form ** PUBLIC DISCLOSURE COPY ** 990 Return 2021

IRS Guidelines

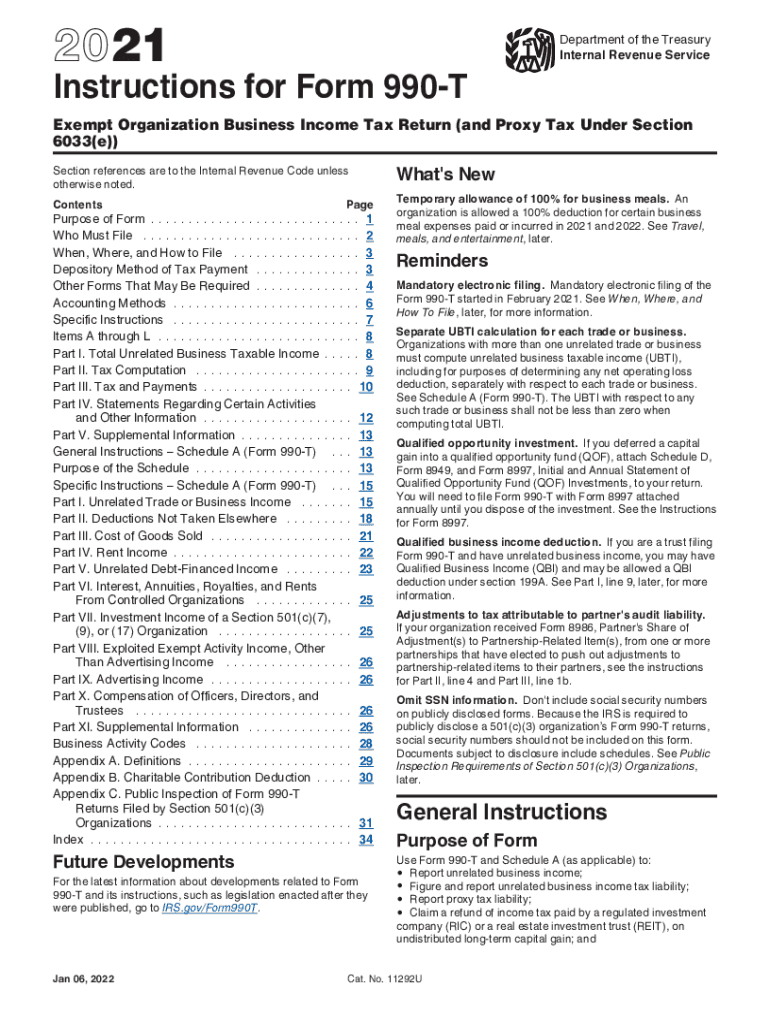

The IRS provides specific guidelines for completing the instructions 990T form, which is essential for tax-exempt organizations that have unrelated business income. Understanding these guidelines is crucial for ensuring compliance and avoiding potential penalties. The instructions detail how to report income, deductions, and calculate the tax owed on unrelated business income. It is important to follow these guidelines closely to maintain the organization's tax-exempt status.

Filing Deadlines / Important Dates

Timely filing of the instructions 990T form is critical. The deadline for filing is typically the fifteenth day of the fifth month after the end of the organization’s tax year. For organizations operating on a calendar year, this means May 15. If the deadline falls on a weekend or holiday, the due date is extended to the next business day. Organizations can apply for an extension, but it's essential to file the form within the extended timeframe to avoid penalties.

Required Documents

To complete the instructions 990T form accurately, organizations must gather several key documents. These include financial statements that detail unrelated business income, records of expenses directly related to that income, and any prior year tax returns that may provide context. Additionally, documentation supporting any deductions claimed must be maintained, as the IRS may request this information during an audit.

Form Submission Methods (Online / Mail / In-Person)

Organizations can submit the instructions 990T form through various methods. The IRS encourages electronic filing, which can expedite processing and reduce errors. Forms can also be mailed to the appropriate IRS address based on the organization's location. In-person submissions are not typically available for this form, but organizations should ensure they follow the correct procedures for their chosen submission method to avoid delays.

Penalties for Non-Compliance

Failure to file the instructions 990T form on time or accurately can result in significant penalties. The IRS imposes a penalty for each month the form is late, up to a maximum number of months. Additionally, inaccuracies or omissions can lead to further penalties, including interest on unpaid taxes. Organizations should prioritize compliance to avoid these financial repercussions and maintain their tax-exempt status.

Digital vs. Paper Version

Choosing between the digital and paper versions of the instructions 990T form can impact the filing process. The digital version allows for easier data entry, automatic calculations, and faster submission times. Conversely, the paper version may be preferred by those who are less comfortable with technology. Regardless of the choice, ensuring that all information is complete and accurate is vital for compliance with IRS regulations.

Quick guide on how to complete get the free form public disclosure copy 990 return

Manage Get The Form ** PUBLIC DISCLOSURE COPY ** 990 Return effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals alike. It offers an excellent environmentally friendly alternative to traditional printed and signed documents, allowing you to find the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents promptly without delays. Handle Get The Form ** PUBLIC DISCLOSURE COPY ** 990 Return on any device with airSlate SignNow's Android or iOS applications and streamline any document-related tasks today.

How to modify and electronically sign Get The Form ** PUBLIC DISCLOSURE COPY ** 990 Return with ease

- Find Get The Form ** PUBLIC DISCLOSURE COPY ** 990 Return and click on Get Form to begin.

- Leverage the tools we provide to complete your form.

- Emphasize important sections of your documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Craft your signature with the Sign tool, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose your method of sharing the form, via email, SMS, or an invitation link, or download it to your computer.

Forget about misplaced or lost files, tedious searches for forms, or mistakes that require reprinting new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Revise and electronically sign Get The Form ** PUBLIC DISCLOSURE COPY ** 990 Return to ensure effective communication at every step of the document preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct get the free form public disclosure copy 990 return

Create this form in 5 minutes!

How to create an eSignature for the get the free form public disclosure copy 990 return

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

The way to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

The way to create an e-signature for a PDF on Android

People also ask

-

What are the key features of airSlate SignNow related to IRS instructions t?

airSlate SignNow offers intuitive eSignature tools that streamline the process of managing documents related to IRS instructions t. Users can easily create, send, and sign documents electronically, ensuring compliance and accuracy. Additionally, the platform includes templates specifically designed for IRS forms.

-

How does airSlate SignNow ensure compliance with IRS instructions t?

To maintain compliance with IRS instructions t, airSlate SignNow implements secure encryption and offers audit trails. These features help users track document history and ensure that all signatures are legally binding. The platform also regularly updates its features to align with the latest IRS requirements.

-

What pricing plans does airSlate SignNow offer for users needing IRS instructions t?

airSlate SignNow provides several pricing plans designed to fit various business needs involving IRS instructions t. Plans include options for individuals, small businesses, and larger enterprises, all offering scalable solutions. Users can choose a plan that best suits their budget and frequency of use.

-

Can airSlate SignNow integrate with other applications for IRS instructions t?

Yes, airSlate SignNow offers seamless integrations with popular applications that can assist with IRS instructions t. These integrations help streamline workflows by allowing data transfer between platforms, ensuring that users can manage their documents more efficiently. Key integrations include CRM systems, project management tools, and accounting software.

-

What are the benefits of using airSlate SignNow for IRS instructions t?

Using airSlate SignNow for IRS instructions t simplifies document management and enhances efficiency. The platform reduces the time spent on paperwork, allowing businesses to focus on core activities. Additionally, users benefit from improved accuracy and the security of electronically signed documents.

-

Is airSlate SignNow user-friendly for those unfamiliar with IRS instructions t?

Absolutely! airSlate SignNow is designed with user-friendliness in mind, even for those unfamiliar with IRS instructions t. The intuitive interface, coupled with guidance and tutorials, makes it easy for anyone to navigate the eSignature process without prior experience.

-

How can businesses utilize airSlate SignNow in relation to IRS instructions t?

Businesses can utilize airSlate SignNow to streamline the signing process for documents associated with IRS instructions t. This includes efficient handling of tax forms and contracts that require signatures, thus minimizing delays and errors. Additionally, customizable templates help ensure standardization across multiple documents.

Get more for Get The Form ** PUBLIC DISCLOSURE COPY ** 990 Return

- Illinois affidavit status form

- Complex will with credit shelter marital trust for large estates illinois form

- Marital legal separation and property settlement agreement for persons with no children no joint property or debts where 497306332 form

- Marital legal separation and property settlement agreement minor children no joint property or debts where divorce action filed 497306333 form

- Marital legal separation and property settlement agreement minor children no joint property or debts effective immediately 497306334 form

- Marital legal separation and property settlement agreement minor children parties may have joint property or debts where 497306335 form

- Marital legal separation form

- Marital legal separation and property settlement agreement for persons with no children no joint property or debts effective 497306337 form

Find out other Get The Form ** PUBLIC DISCLOSURE COPY ** 990 Return

- eSignature Alabama Distributor Agreement Template Secure

- eSignature California Distributor Agreement Template Later

- eSignature Vermont General Power of Attorney Template Easy

- eSignature Michigan Startup Cost Estimate Simple

- eSignature New Hampshire Invoice for Services (Standard Format) Computer

- eSignature Arkansas Non-Compete Agreement Later

- Can I eSignature Arizona Non-Compete Agreement

- How Do I eSignature New Jersey Non-Compete Agreement

- eSignature Tennessee Non-Compete Agreement Myself

- How To eSignature Colorado LLC Operating Agreement

- Help Me With eSignature North Carolina LLC Operating Agreement

- eSignature Oregon LLC Operating Agreement Online

- eSignature Wyoming LLC Operating Agreement Online

- eSignature Wyoming LLC Operating Agreement Computer

- eSignature Wyoming LLC Operating Agreement Later

- eSignature Wyoming LLC Operating Agreement Free

- How To eSignature Wyoming LLC Operating Agreement

- eSignature California Commercial Lease Agreement Template Myself

- eSignature California Commercial Lease Agreement Template Easy

- eSignature Florida Commercial Lease Agreement Template Easy