Instructions for Form 990 T Instructions for Form 990 T, Exempt Organization Business Income Tax Return and Proxy Tax under Sect 2023-2026

Understanding Form 990-T

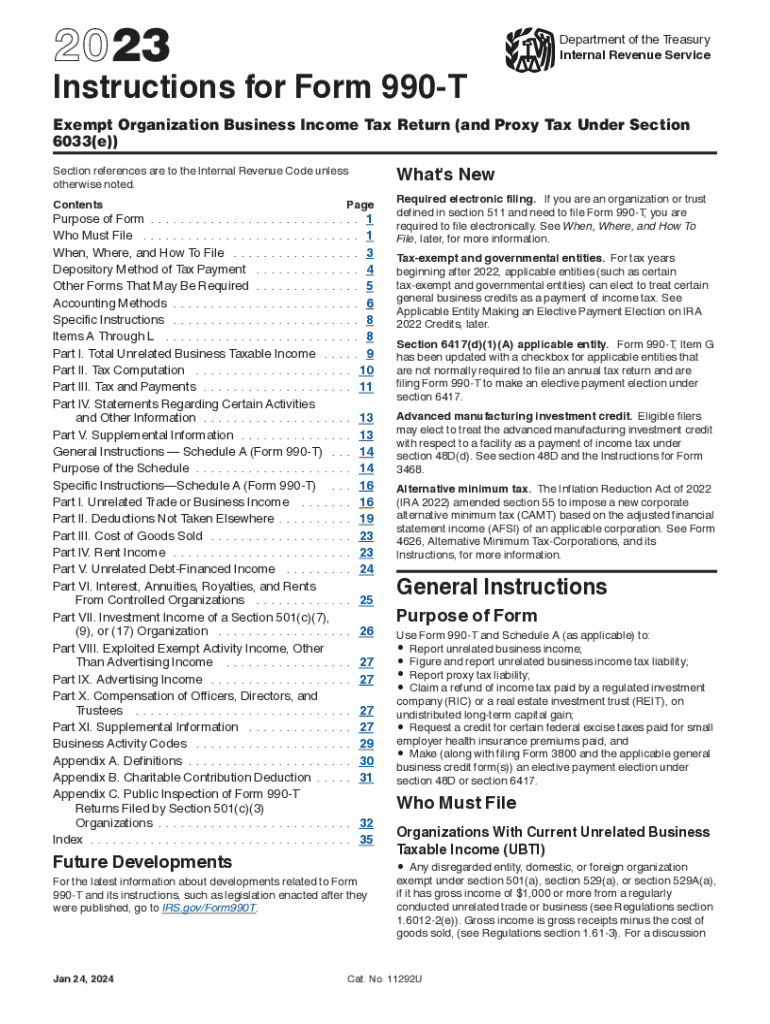

The Instructions for Form 990-T pertain to the Exempt Organization Business Income Tax Return. This form is essential for tax-exempt organizations that generate income from activities unrelated to their primary exempt purpose. It is important to recognize that even if an organization is tax-exempt, it may still be liable for taxes on this unrelated business income. The form also covers the proxy tax under Section 6033(e), which applies to certain organizations that fail to meet disclosure requirements.

Steps to Complete Form 990-T

Completing Form 990-T involves several key steps to ensure accuracy and compliance. First, gather all necessary financial records related to the unrelated business activities. This includes income statements, expense reports, and any relevant documentation. Next, fill out the form by reporting the total income generated from these activities, followed by the allowable deductions. It is vital to calculate the taxable income correctly, as this will determine the tax liability. Finally, review the completed form for any errors before submission.

Legal Use of Form 990-T

Form 990-T is legally required for tax-exempt organizations that engage in unrelated business activities. Failure to file this form can result in penalties and potential loss of tax-exempt status. Organizations must ensure compliance with IRS regulations by accurately reporting all unrelated business income. This form serves as a tool for the IRS to monitor the activities of tax-exempt organizations and ensure they adhere to the rules governing their tax-exempt status.

Filing Deadlines for Form 990-T

The filing deadline for Form 990-T is typically the fifteenth day of the fifth month after the end of the organization’s tax year. For organizations operating on a calendar year, this means the form is due by May fifteenth. If the deadline falls on a weekend or holiday, it is extended to the next business day. Organizations can apply for an extension, but it is crucial to file the extension request before the original deadline to avoid penalties.

Required Documents for Form 990-T

To complete Form 990-T, organizations need to prepare several documents. These include financial statements that detail the income and expenses related to unrelated business activities. Additionally, any prior year forms or correspondence with the IRS may be helpful for reference. Organizations should also gather documentation that supports the deductions claimed on the form, ensuring they can substantiate their claims if audited.

IRS Guidelines for Form 990-T

The IRS provides specific guidelines for completing Form 990-T, which organizations must follow closely. These guidelines include instructions on how to report different types of income and allowable deductions. It is important to refer to the most recent IRS publications and updates to ensure compliance with any changes in tax law. Understanding these guidelines helps organizations avoid common pitfalls and ensures accurate reporting of unrelated business income.

Create this form in 5 minutes or less

Find and fill out the correct instructions for form 990 t instructions for form 990 t exempt organization business income tax return and proxy tax under

Create this form in 5 minutes!

How to create an eSignature for the instructions for form 990 t instructions for form 990 t exempt organization business income tax return and proxy tax under

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the instructions 990 t for using airSlate SignNow?

The instructions 990 t for airSlate SignNow guide users through the process of sending and eSigning documents efficiently. These instructions provide step-by-step details on how to create, manage, and track your documents. Following these instructions ensures a smooth experience and maximizes the benefits of our platform.

-

How much does airSlate SignNow cost?

Pricing for airSlate SignNow varies based on the plan you choose, but it remains a cost-effective solution for businesses. We offer different tiers to accommodate various needs, and you can find detailed pricing information on our website. By following the instructions 990 t, you can easily select the plan that best fits your requirements.

-

What features are included in airSlate SignNow?

airSlate SignNow includes a variety of features designed to streamline document management, including eSigning, templates, and real-time tracking. The instructions 990 t detail how to utilize these features effectively to enhance your workflow. Our platform is built to simplify the signing process while ensuring security and compliance.

-

What are the benefits of using airSlate SignNow?

Using airSlate SignNow offers numerous benefits, such as increased efficiency, reduced paper usage, and enhanced security for your documents. The instructions 990 t highlight how these advantages can transform your business operations. By adopting our solution, you can save time and resources while improving your document management processes.

-

Can airSlate SignNow integrate with other software?

Yes, airSlate SignNow can seamlessly integrate with various software applications, enhancing its functionality. The instructions 990 t provide guidance on how to set up these integrations, allowing you to connect with tools you already use. This flexibility helps streamline your workflow and improve productivity.

-

Is airSlate SignNow secure for sensitive documents?

Absolutely, airSlate SignNow prioritizes the security of your documents with advanced encryption and compliance measures. The instructions 990 t explain the security features in detail, ensuring you understand how your data is protected. You can confidently use our platform for sensitive information without compromising security.

-

How can I get started with airSlate SignNow?

Getting started with airSlate SignNow is simple and straightforward. You can sign up for a free trial on our website, and the instructions 990 t will guide you through the setup process. Once you're set up, you can begin sending and eSigning documents right away.

Get more for Instructions For Form 990 T Instructions For Form 990 T, Exempt Organization Business Income Tax Return and Proxy Tax Under Sect

- Form it 370 application for automatic six month extension of time to file for individuals tax year

- Digital billboard advertis contract template form

- Digital market agency contract template form

- Digital market consultant contract template form

- Digital market contract template form

- Estate sale contract template form

- Orthodontic treatment contract template form

- Outsourc contract template form

Find out other Instructions For Form 990 T Instructions For Form 990 T, Exempt Organization Business Income Tax Return and Proxy Tax Under Sect

- eSign Iowa Legal Separation Agreement Easy

- How To eSign New Jersey Life Sciences LLC Operating Agreement

- eSign Tennessee Insurance Rental Lease Agreement Later

- eSign Texas Insurance Affidavit Of Heirship Myself

- Help Me With eSign Kentucky Legal Quitclaim Deed

- eSign Louisiana Legal Limited Power Of Attorney Online

- How Can I eSign Maine Legal NDA

- eSign Maryland Legal LLC Operating Agreement Safe

- Can I eSign Virginia Life Sciences Job Description Template

- eSign Massachusetts Legal Promissory Note Template Safe

- eSign West Virginia Life Sciences Agreement Later

- How To eSign Michigan Legal Living Will

- eSign Alabama Non-Profit Business Plan Template Easy

- eSign Mississippi Legal Last Will And Testament Secure

- eSign California Non-Profit Month To Month Lease Myself

- eSign Colorado Non-Profit POA Mobile

- How Can I eSign Missouri Legal RFP

- eSign Missouri Legal Living Will Computer

- eSign Connecticut Non-Profit Job Description Template Now

- eSign Montana Legal Bill Of Lading Free