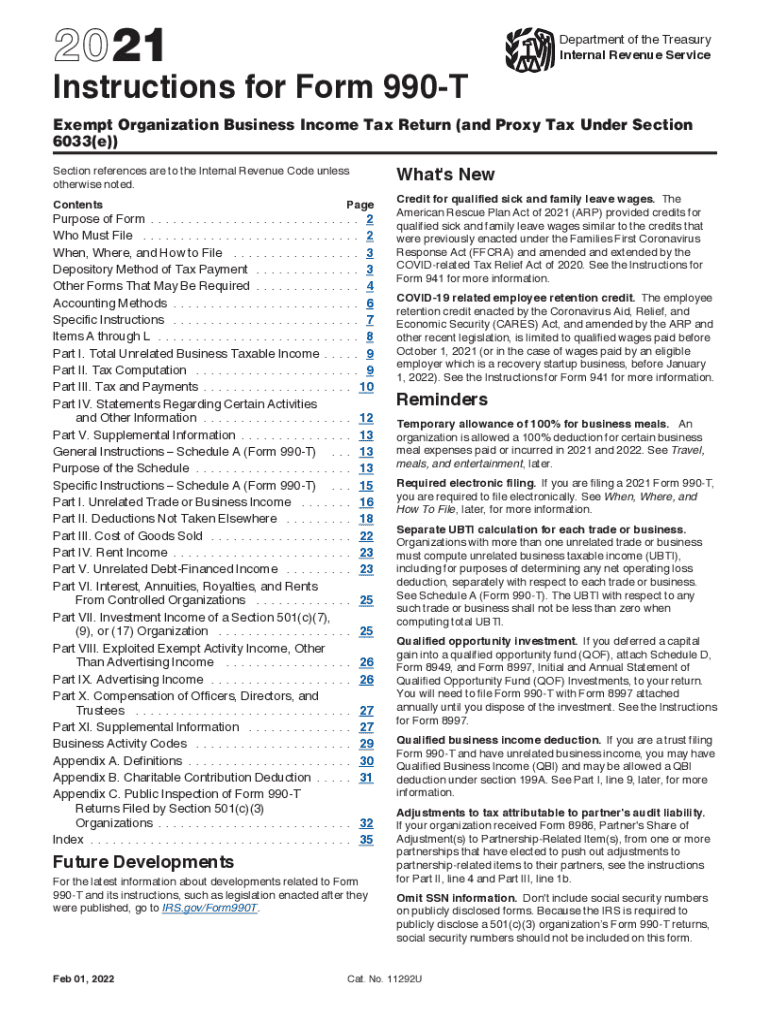

Instructions for Form 990 T Instructions for Form 990 T, Exempt Organization Business Income Tax Return and Proxy Tax under Sect 2021

Understanding the 2019 IRS Instructions for Form 990-T

The 2019 IRS Instructions for Form 990-T provide essential guidance for exempt organizations that generate unrelated business taxable income (UBTI). This form is crucial for reporting income from activities that are not substantially related to the organization's exempt purpose. The instructions detail how to calculate the taxable income, identify allowable deductions, and understand the implications of proxy tax under Section 6033(e). Familiarity with these instructions helps organizations ensure compliance with IRS regulations and avoid potential penalties.

Steps to Complete the 2019 IRS Instructions for Form 990-T

Completing the 2019 IRS Instructions for Form 990-T involves several key steps. First, organizations must gather all necessary financial information related to their unrelated business activities. This includes revenue generated and expenses incurred. Next, organizations should accurately complete the form by following the line-by-line instructions provided by the IRS. It is essential to ensure that all calculations are correct and that all required schedules are attached. Finally, organizations must review the completed form for accuracy before submitting it to the IRS.

Legal Use of the 2019 IRS Instructions for Form 990-T

The legal use of the 2019 IRS Instructions for Form 990-T is vital for compliance with federal tax laws. Organizations must adhere to the guidelines outlined in the instructions to ensure that their filings are valid and accepted by the IRS. This includes understanding the definitions of unrelated business income and the specific exemptions that may apply. Organizations should also be aware of the legal ramifications of failing to file or incorrectly filing this form, which could result in penalties or loss of tax-exempt status.

Filing Deadlines for the 2019 IRS Instructions for Form 990-T

Organizations must be aware of the filing deadlines associated with the 2019 IRS Instructions for Form 990-T. Generally, the form is due on the 15th day of the fifth month after the end of the organization’s tax year. For organizations operating on a calendar year, this means the form is due by May 15. It is important to note that extensions may be available, but organizations must file the appropriate request to avoid late penalties.

Key Elements of the 2019 IRS Instructions for Form 990-T

The key elements of the 2019 IRS Instructions for Form 990-T include definitions of unrelated business income, the calculation of taxable income, and the identification of allowable deductions. Organizations must also understand the significance of proxy tax under Section 6033(e), which applies to certain organizations that fail to disclose information regarding their unrelated business activities. These elements are crucial for ensuring accurate reporting and compliance with IRS regulations.

Examples of Using the 2019 IRS Instructions for Form 990-T

Examples of using the 2019 IRS Instructions for Form 990-T can provide clarity on how to apply the guidelines in real-world scenarios. For instance, an organization that operates a bookstore as part of its educational mission must determine if the income generated from book sales qualifies as unrelated business income. By following the instructions, the organization can assess its income sources and apply the relevant deductions, ensuring accurate reporting on the form.

Quick guide on how to complete 2021 instructions for form 990 t instructions for form 990 t exempt organization business income tax return and proxy tax under

Effortlessly Prepare Instructions For Form 990 T Instructions For Form 990 T, Exempt Organization Business Income Tax Return and Proxy Tax Under Sect on Any Device

Online document management has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute to traditional printed and signed documentation, allowing you to locate the correct form and securely store it online. airSlate SignNow provides all the necessary tools to create, modify, and electronically sign your documents swiftly without delays. Manage Instructions For Form 990 T Instructions For Form 990 T, Exempt Organization Business Income Tax Return and Proxy Tax Under Sect on any platform using airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to Modify and eSign Instructions For Form 990 T Instructions For Form 990 T, Exempt Organization Business Income Tax Return and Proxy Tax Under Sect with Ease

- Locate Instructions For Form 990 T Instructions For Form 990 T, Exempt Organization Business Income Tax Return and Proxy Tax Under Sect and click Get Form to initiate.

- Utilize the tools available to complete your form.

- Emphasize important sections of your documents or obscure sensitive information with tools provided by airSlate SignNow designed for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and then hit the Done button to save your alterations.

- Select your preferred method for delivering your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors necessitating the printing of new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and eSign Instructions For Form 990 T Instructions For Form 990 T, Exempt Organization Business Income Tax Return and Proxy Tax Under Sect while ensuring exceptional communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2021 instructions for form 990 t instructions for form 990 t exempt organization business income tax return and proxy tax under

Create this form in 5 minutes!

How to create an eSignature for the 2021 instructions for form 990 t instructions for form 990 t exempt organization business income tax return and proxy tax under

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 2019 IRS instructions 990 T form?

The 2019 IRS instructions 990 T form provide guidelines for tax-exempt organizations on how to report unrelated business income. These instructions are crucial for ensuring compliance with federal tax regulations. Understanding these guidelines can help organizations efficiently navigate their tax obligations.

-

How can I access the 2019 IRS instructions 990 T form?

You can access the 2019 IRS instructions 990 T form on the official IRS website. It's available for download in PDF format, making it easy to reference while completing your tax forms. Always ensure you are looking at the correct year’s instructions to stay compliant.

-

Why is it important to follow the 2019 IRS instructions 990 T form?

Following the 2019 IRS instructions 990 T form is critical to avoid penalties and ensure accurate reporting of unrelated business income. Noncompliance can lead to tax liabilities that could have been avoided with proper adherence to guidelines. Proper filing ensures your organization maintains its tax-exempt status.

-

What features does airSlate SignNow offer for e-signing the 2019 IRS instructions 990 T form?

airSlate SignNow offers advanced e-signature capabilities that simplify the signing process for documents, including the 2019 IRS instructions 990 T form. Users can securely sign, send, and manage these documents electronically, saving time and improving efficiency. The platform ensures compliance and security for all types of essential documents.

-

Are there costs associated with using airSlate SignNow for e-signing the 2019 IRS instructions 990 T form?

airSlate SignNow provides various pricing plans to meet different business needs, including a cost-effective option for organizations focusing on the 2019 IRS instructions 990 T form. Pricing is transparent, with no hidden fees, allowing users to choose the plan that fits their budget. Businesses can start with a free trial to experience the features before committing.

-

Can I integrate airSlate SignNow with other software for handling the 2019 IRS instructions 990 T form?

Yes, airSlate SignNow integrates seamlessly with popular apps, allowing you to enhance your workflow for handling the 2019 IRS instructions 990 T form. This integration helps keep all your critical documents organized and ensures smooth transitions between applications. Check the integration options on their website to find compatible tools.

-

What are the benefits of using airSlate SignNow for the 2019 IRS instructions 990 T form?

Using airSlate SignNow for the 2019 IRS instructions 990 T form streamlines the document signing process, reducing paperwork and enhancing efficiency. The platform offers signature tracking and automated reminders, ensuring timely completion of forms. These features help mitigate compliance risks associated with tax documentation.

Get more for Instructions For Form 990 T Instructions For Form 990 T, Exempt Organization Business Income Tax Return and Proxy Tax Under Sect

- Reading placement test pdf form

- Interspousal transfer deed new york form

- Bank of ireland salary certificate form

- Milliken publishing company mp3497 answer key form

- Time sample observation template form

- York home gym exercise chart form

- Panhellenic grade release and greek induction form

- Fraternity and sorority life grade release form involve

Find out other Instructions For Form 990 T Instructions For Form 990 T, Exempt Organization Business Income Tax Return and Proxy Tax Under Sect

- eSignature Idaho Education Lease Termination Letter Secure

- eSignature Colorado Doctors Business Letter Template Now

- eSignature Iowa Education Last Will And Testament Computer

- How To eSignature Iowa Doctors Business Letter Template

- Help Me With eSignature Indiana Doctors Notice To Quit

- eSignature Ohio Education Purchase Order Template Easy

- eSignature South Dakota Education Confidentiality Agreement Later

- eSignature South Carolina Education Executive Summary Template Easy

- eSignature Michigan Doctors Living Will Simple

- How Do I eSignature Michigan Doctors LLC Operating Agreement

- How To eSignature Vermont Education Residential Lease Agreement

- eSignature Alabama Finance & Tax Accounting Quitclaim Deed Easy

- eSignature West Virginia Education Quitclaim Deed Fast

- eSignature Washington Education Lease Agreement Form Later

- eSignature Missouri Doctors Residential Lease Agreement Fast

- eSignature Wyoming Education Quitclaim Deed Easy

- eSignature Alaska Government Agreement Fast

- How Can I eSignature Arizona Government POA

- How Do I eSignature Nevada Doctors Lease Agreement Template

- Help Me With eSignature Nevada Doctors Lease Agreement Template