PDF Form 990 T Internal Revenue Service 2020

What is the PDF Form 990 T Internal Revenue Service

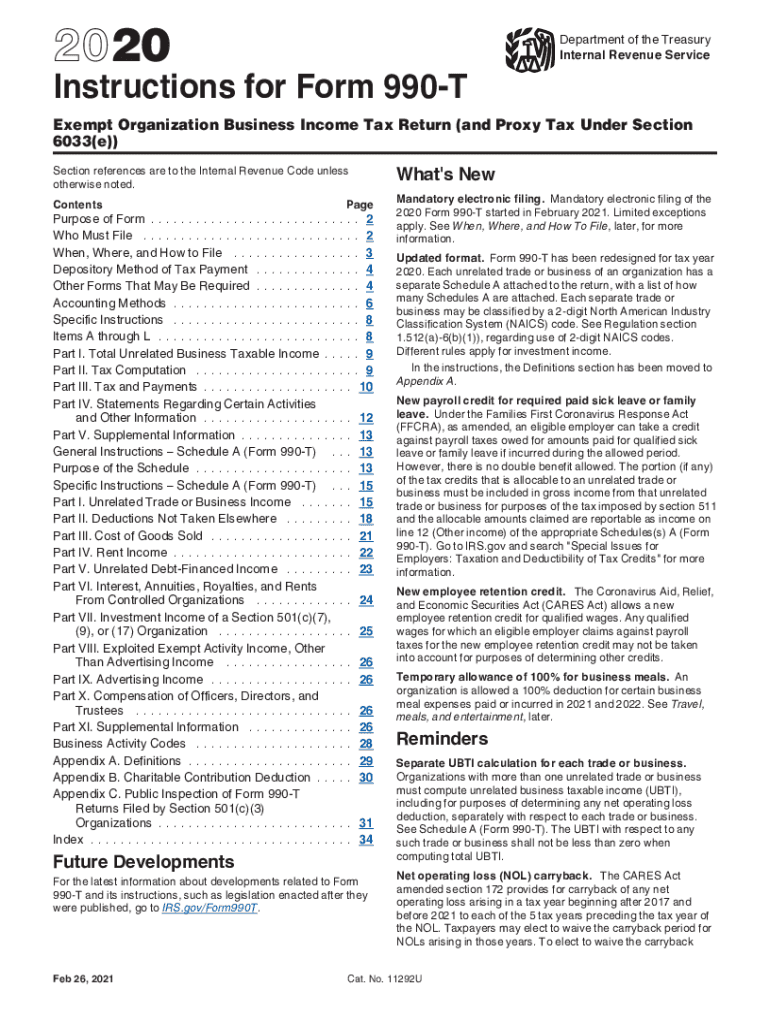

The PDF Form 990 T is a tax form used by organizations to report unrelated business income to the Internal Revenue Service (IRS). This form is essential for tax-exempt organizations, including charities and non-profits, that generate income from activities not directly related to their primary purpose. By filing Form 990 T, these organizations ensure compliance with federal tax regulations and accurately report their income, which may be subject to taxation. Understanding this form is crucial for maintaining tax-exempt status and fulfilling legal obligations.

Steps to complete the PDF Form 990 T Internal Revenue Service

Completing the PDF Form 990 T involves several key steps that ensure accurate reporting of unrelated business income. Begin by gathering all necessary financial information related to the income-generating activities. This includes revenue from sales, expenses incurred, and any applicable deductions. Next, fill out the form by providing detailed information about the organization, including its name, address, and Employer Identification Number (EIN). Report the unrelated business income and calculate the tax owed based on the applicable tax rates. Finally, review the completed form for accuracy before submitting it to the IRS.

Filing Deadlines / Important Dates

Filing deadlines for Form 990 T are critical for compliance. Generally, the form must be filed on the fifteenth day of the fifth month after the end of the organization’s tax year. For organizations operating on a calendar year, this means the due date is May 15. If the deadline falls on a weekend or holiday, the form is due the next business day. It is essential for organizations to be aware of these dates to avoid penalties and ensure timely compliance with IRS regulations.

Legal use of the PDF Form 990 T Internal Revenue Service

The legal use of the PDF Form 990 T is governed by IRS regulations that dictate how tax-exempt organizations report unrelated business income. Organizations must ensure that the income reported is genuinely unrelated to their exempt purpose to maintain compliance with tax laws. Failure to accurately report this income can result in penalties, loss of tax-exempt status, or other legal repercussions. Understanding the legal implications of Form 990 T is essential for organizations to navigate their tax obligations effectively.

Key elements of the PDF Form 990 T Internal Revenue Service

Several key elements are integral to the PDF Form 990 T. These include the organization’s basic information, a detailed breakdown of unrelated business income, and the calculation of the tax owed. The form also requires organizations to disclose any deductions that may apply, such as operating expenses directly related to the income-generating activities. Understanding these elements helps organizations accurately complete the form and fulfill their reporting requirements.

Form Submission Methods (Online / Mail / In-Person)

Organizations have several options for submitting the PDF Form 990 T to the IRS. The form can be filed electronically through approved e-filing software, which offers a streamlined process and faster processing times. Alternatively, organizations may choose to mail a paper copy of the form to the appropriate IRS address, ensuring it is postmarked by the filing deadline. In-person submission is generally not available for this form, making electronic and mail options the primary methods for compliance.

Quick guide on how to complete pdf form 990 t internal revenue service

Accomplish PDF Form 990 T Internal Revenue Service effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers a perfect environmentally friendly substitute for traditional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly and without interruptions. Manage PDF Form 990 T Internal Revenue Service on any platform with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to edit and eSign PDF Form 990 T Internal Revenue Service with ease

- Find PDF Form 990 T Internal Revenue Service and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Create your signature with the Sign feature, which takes mere seconds and has the same legal validity as a conventional ink signature.

- Verify the details and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or errors that require printing new copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device you prefer. Edit and eSign PDF Form 990 T Internal Revenue Service and ensure effective communication throughout your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct pdf form 990 t internal revenue service

Create this form in 5 minutes!

How to create an eSignature for the pdf form 990 t internal revenue service

The best way to create an electronic signature for your PDF online

The best way to create an electronic signature for your PDF in Google Chrome

How to generate an electronic signature for signing PDFs in Gmail

The way to generate an eSignature straight from your smartphone

The way to create an electronic signature for a PDF on iOS

The way to generate an eSignature for a PDF document on Android

People also ask

-

What are the basic instructions t tax for using airSlate SignNow?

To get started with airSlate SignNow, simply sign up for an account, and you'll receive step-by-step instructions t tax for sending and eSigning documents. Our platform’s user-friendly interface ensures that you can easily navigate through the features, allowing you to focus on your business needs. Utilize our helpful tutorials and customer support for any additional guidance you may need.

-

How does airSlate SignNow ensure compliance with instructions t tax?

airSlate SignNow is designed to ensure that your documents meet all legal requirements, including adherence to instructions t tax guidelines. We use advanced encryption and authentication features to protect your data while maintaining compliance with global standards. Regular updates to our platform ensure that you stay current with any changes in laws affecting document signing.

-

What pricing plans does airSlate SignNow offer for access to instructions t tax features?

airSlate SignNow offers competitive pricing plans tailored to various business needs, making it accessible for all sizes of operations. Each plan provides comprehensive features, including those related to instructions t tax, ensuring that you get the most value for your investment. Try our free trial to explore how our platform can streamline your document signing processes.

-

What features are included in airSlate SignNow for following instructions t tax?

With airSlate SignNow, you will find features specifically designed to support instructions t tax, such as customizable templates, document workflows, and real-time tracking. These tools streamline the signing process, improve efficiency, and help your team stay organized. Users can also create reminders for document deadlines to ensure compliance with tax regulations.

-

Can airSlate SignNow integrate with other software for handling instructions t tax?

Yes, airSlate SignNow seamlessly integrates with a variety of third-party applications, enhancing your workflow regarding instructions t tax. Popular integrations include CRM systems, accounting software, and cloud storage solutions. These integrations enable you to manage documents and comply with tax requirements efficiently in one centralized system.

-

What benefits can businesses expect from using airSlate SignNow for instructions t tax?

By choosing airSlate SignNow, businesses can reduce the time spent on document management while ensuring compliance with instructions t tax. The platform allows for quick document turnaround, enhances collaboration, and reduces printing costs. Additionally, the electronic signature process is legally binding, providing peace of mind for all parties involved.

-

How secure is airSlate SignNow when dealing with sensitive instructions t tax information?

airSlate SignNow prioritizes security and employs advanced encryption methods to protect sensitive instructions t tax information. Our platform complies with industry standards and regulations, ensuring that your data is safe from unauthorized access. Regular security audits and updates further enhance the protection of your documents.

Get more for PDF Form 990 T Internal Revenue Service

Find out other PDF Form 990 T Internal Revenue Service

- Can I eSignature Oregon Orthodontists LLC Operating Agreement

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe