Get the M Modifications to Adjusted Gross Income Form 2021-2026

What is the Get The M Modifications To Adjusted Gross Income Form

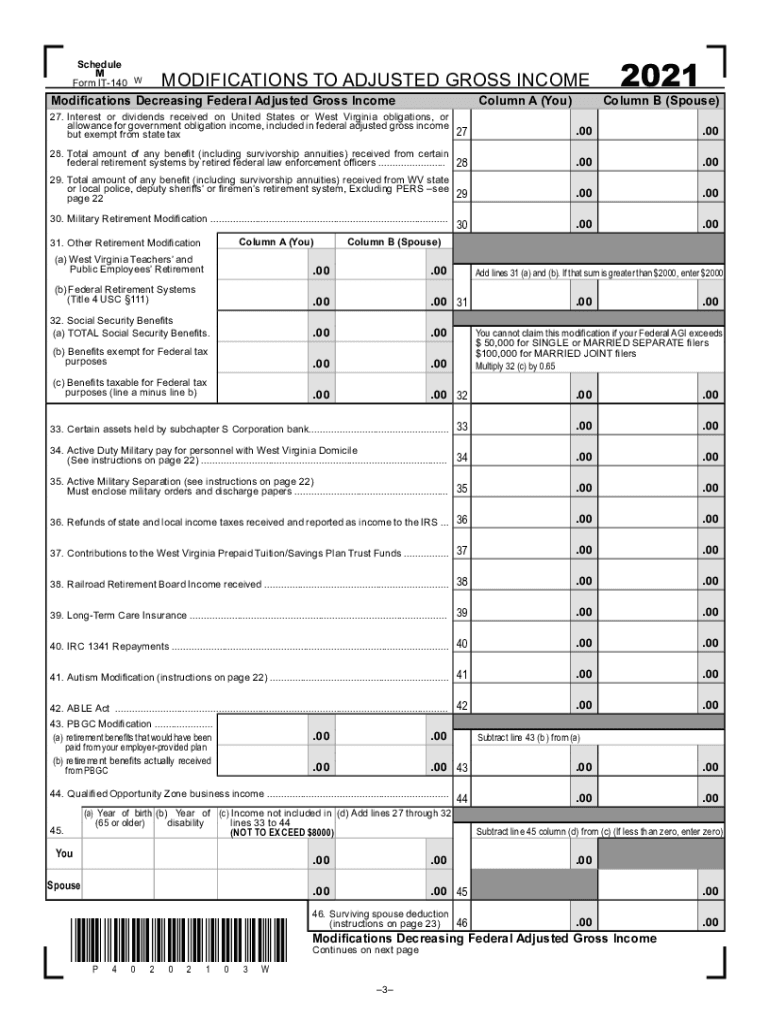

The Get The M Modifications To Adjusted Gross Income Form is a specific document used by taxpayers in West Virginia to adjust their federal adjusted gross income (AGI) for state tax purposes. This form allows individuals to account for certain modifications that can either increase or decrease their taxable income, ensuring that they comply with state tax regulations. Understanding the purpose and requirements of this form is essential for accurate tax filing and optimizing potential deductions.

How to use the Get The M Modifications To Adjusted Gross Income Form

To effectively use the Get The M Modifications To Adjusted Gross Income Form, taxpayers should first gather relevant financial documents, including their federal tax return. The form requires specific details about income adjustments, such as additions or subtractions to the AGI. After filling out the necessary information, ensure that all calculations are accurate. This form should be submitted alongside the West Virginia state tax return to reflect the adjusted income correctly.

Steps to complete the Get The M Modifications To Adjusted Gross Income Form

Completing the Get The M Modifications To Adjusted Gross Income Form involves several key steps:

- Obtain the form from the West Virginia State Tax Department website or a tax professional.

- Review your federal adjusted gross income as reported on your federal tax return.

- Identify any modifications that apply to your situation, such as specific deductions or income adjustments.

- Fill out the form accurately, providing all required information and calculations.

- Double-check your entries for accuracy and completeness.

- Submit the form with your West Virginia state tax return before the filing deadline.

Key elements of the Get The M Modifications To Adjusted Gross Income Form

Key elements of the Get The M Modifications To Adjusted Gross Income Form include:

- Taxpayer identification information, including name and Social Security number.

- Federal adjusted gross income as reported on your federal tax return.

- Specific modifications that apply, such as income exclusions or additional deductions.

- Signature and date to certify the accuracy of the information provided.

IRS Guidelines

While the Get The M Modifications To Adjusted Gross Income Form is specific to West Virginia, it is essential to adhere to IRS guidelines when preparing your federal tax return. The IRS provides comprehensive instructions for reporting income and deductions, which can impact the calculations on the state form. Ensure that all federal guidelines are followed to maintain compliance and avoid discrepancies between state and federal filings.

Filing Deadlines / Important Dates

Filing deadlines for the Get The M Modifications To Adjusted Gross Income Form align with the West Virginia state tax return deadlines. Typically, the deadline for filing state taxes is April fifteenth, unless extended. It is crucial to stay informed about any changes to these dates, as timely submission is necessary to avoid penalties and interest on unpaid taxes.

Quick guide on how to complete get the free m modifications to adjusted gross income form

Complete Get The M Modifications To Adjusted Gross Income Form effortlessly on any device

Digital document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents swiftly without delays. Manage Get The M Modifications To Adjusted Gross Income Form on any device using airSlate SignNow's Android or iOS applications and streamline your document-related tasks today.

The easiest method to edit and eSign Get The M Modifications To Adjusted Gross Income Form without hassle

- Find Get The M Modifications To Adjusted Gross Income Form and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Select important sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and possesses the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select how you want to deliver your form, via email, SMS, invitation link, or download it to your computer.

No more worrying about lost or misplaced files, tedious form searches, or errors that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Modify and eSign Get The M Modifications To Adjusted Gross Income Form to ensure seamless communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct get the free m modifications to adjusted gross income form

Create this form in 5 minutes!

How to create an eSignature for the get the free m modifications to adjusted gross income form

How to generate an electronic signature for your PDF file online

How to generate an electronic signature for your PDF file in Google Chrome

The way to make an e-signature for signing PDFs in Gmail

The way to generate an electronic signature from your mobile device

How to make an electronic signature for a PDF file on iOS

The way to generate an electronic signature for a PDF file on Android devices

People also ask

-

What is federal AGI and how does it impact my business?

Federal AGI, or Adjusted Gross Income, is a key financial metric that affects your tax returns and deductions. Understanding federal AGI can help your business optimize its tax strategy, ensuring you make informed decisions when using airSlate SignNow for document management.

-

How can I securely eSign documents related to federal AGI?

With airSlate SignNow, you can securely eSign documents that pertain to your federal AGI calculations. Our platform features advanced encryption and compliance with industry standards, ensuring your sensitive financial documents are protected at all times.

-

Does airSlate SignNow offer integrations that help manage federal AGI-related documents?

Yes, airSlate SignNow integrates seamlessly with various accounting and tax software tools to help you manage federal AGI-related documents. By connecting these tools, you can streamline your workflow and ensure all relevant information is accessible without hassle.

-

What is the pricing structure for airSlate SignNow services?

airSlate SignNow offers flexible pricing plans to accommodate various business needs. Whether you are managing documents related to federal AGI or other processes, our plans ensure you get the necessary features at an affordable rate.

-

Can airSlate SignNow help me track my federal AGI throughout the year?

While airSlate SignNow primarily focuses on document management and electronic signatures, it can assist in keeping your records organized. By storing all documents related to your federal AGI, you can easily track and access information when preparing for tax season.

-

What features support compliance for federal AGI documentation?

airSlate SignNow provides features like audit trails, timestamping, and secure backup options, ensuring compliance with federal AGI documentation requirements. These features are critical to keeping your business practices transparent and compliant with regulations.

-

What benefits does using airSlate SignNow provide for federal AGI processes?

Using airSlate SignNow simplifies the signing and management of documents related to federal AGI, saving you time and reducing errors. Our user-friendly interface allows for quick eSignatures and efficient document workflows, helping your business stay organized.

Get more for Get The M Modifications To Adjusted Gross Income Form

Find out other Get The M Modifications To Adjusted Gross Income Form

- How Do I Electronic signature Maryland Affidavit of Residence

- Electronic signature Florida Child Support Modification Simple

- Electronic signature North Dakota Child Support Modification Easy

- Electronic signature Oregon Child Support Modification Online

- How Can I Electronic signature Colorado Cohabitation Agreement

- Electronic signature Arkansas Leave of Absence Letter Later

- Electronic signature New Jersey Cohabitation Agreement Fast

- Help Me With Electronic signature Alabama Living Will

- How Do I Electronic signature Louisiana Living Will

- Electronic signature Arizona Moving Checklist Computer

- Electronic signature Tennessee Last Will and Testament Free

- Can I Electronic signature Massachusetts Separation Agreement

- Can I Electronic signature North Carolina Separation Agreement

- How To Electronic signature Wyoming Affidavit of Domicile

- Electronic signature Wisconsin Codicil to Will Later

- Electronic signature Idaho Guaranty Agreement Free

- Electronic signature North Carolina Guaranty Agreement Online

- eSignature Connecticut Outsourcing Services Contract Computer

- eSignature New Hampshire Outsourcing Services Contract Computer

- eSignature New York Outsourcing Services Contract Simple