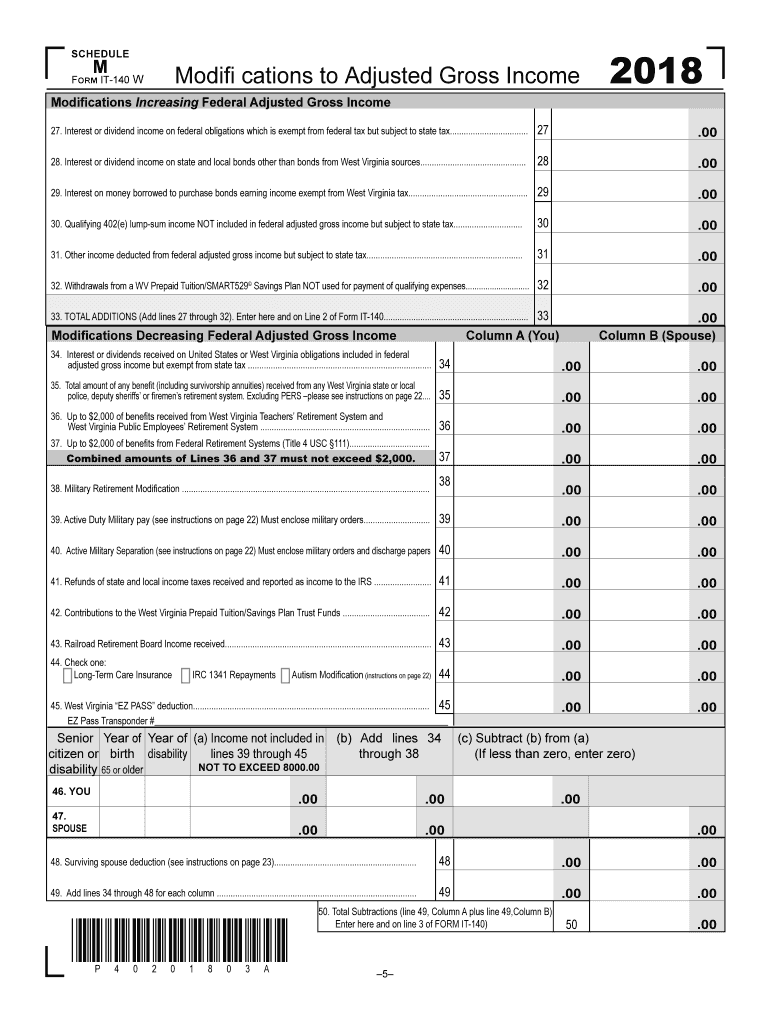

Wv it 140 2018

What is the WV IT 140?

The WV IT 140 is a state tax form used by individuals in West Virginia to report their income and calculate their tax liability. This form is essential for residents who need to file their state income taxes. It includes various sections where taxpayers can report their income, claim deductions, and determine their overall tax obligation. Understanding this form is crucial for ensuring compliance with state tax laws.

Steps to Complete the WV IT 140

Completing the WV IT 140 involves several key steps:

- Gather all necessary documents, including W-2s, 1099s, and any other income statements.

- Fill out personal information, such as your name, address, and Social Security number.

- Report your total income in the designated sections, ensuring accuracy to avoid issues.

- Claim any applicable deductions, which can lower your taxable income.

- Calculate your tax liability based on the tax tables provided with the form.

- Sign and date the form to validate your submission.

Legal Use of the WV IT 140

The WV IT 140 must be completed and submitted according to West Virginia state tax laws. This form is legally binding, and inaccuracies or omissions can lead to penalties. Taxpayers are encouraged to review the instructions carefully and ensure that all information is truthful and complete. Utilizing this form correctly ensures compliance with state regulations and helps avoid potential legal issues.

Filing Deadlines / Important Dates

Filing deadlines for the WV IT 140 typically align with federal tax deadlines. For most taxpayers, the deadline is April 15 of each year. However, if this date falls on a weekend or holiday, the deadline may be extended. It is important to stay informed about any changes to deadlines, especially during tax season, to ensure timely filing and avoid penalties.

Form Submission Methods

The WV IT 140 can be submitted through various methods, providing flexibility for taxpayers:

- Online: Many taxpayers prefer to file electronically through approved e-filing services.

- Mail: Completed forms can be printed and mailed to the West Virginia State Tax Department.

- In-Person: Taxpayers may also choose to submit their forms in person at designated tax offices.

Required Documents

When completing the WV IT 140, certain documents are essential to ensure accurate reporting:

- W-2 forms from employers showing wages earned.

- 1099 forms for any additional income, such as freelance work.

- Documentation for any deductions claimed, such as receipts for charitable contributions.

- Previous year’s tax return for reference.

Quick guide on how to complete wv schedule m 2018 2019 form

Your assistance manual on how to prepare your Wv It 140

If you’re eager to learn how to create and submit your Wv It 140, here are some straightforward instructions on how to simplify tax processing.

To start, you simply need to sign up for your airSlate SignNow profile to revolutionize how you manage documents online. airSlate SignNow is an incredibly user-friendly and powerful document tool that allows you to edit, draft, and finalize your tax papers effortlessly. With its editor, you can toggle between text, check boxes, and eSignatures and return to modify details as necessary. Streamline your tax handling with advanced PDF editing, eSigning, and convenient sharing options.

Follow the instructions below to finish your Wv It 140 in just a few minutes:

- Create your account and start working on PDFs in no time.

- Utilize our directory to find any IRS tax form; browse through versions and schedules.

- Click Obtain form to access your Wv It 140 in our editor.

- Complete the necessary fillable fields with your information (text, numbers, check marks).

- Employ the Sign Tool to add your legally-recognized eSignature (if necessary).

- Review your document and correct any mistakes.

- Save changes, print your version, send it to your recipient, and download it to your device.

Refer to this manual to file your taxes electronically with airSlate SignNow. Keep in mind that submitting in paper form can increase errors and delay refunds. Certainly, before e-filing your taxes, check the IRS website for filing regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct wv schedule m 2018 2019 form

FAQs

-

Which ITR form should an NRI fill out for AY 2018–2019 to claim the TDS deducted by banks only?

ITR form required to be submitted depends upon nature of income. As a NRI shall generally have income from other sources like interest, rental income therefore s/he should file ITR 2.

-

Which ITR form should an NRI fill out for AY 2018–2019 for salary income?

File ITR 2 and for taking credit of foreign taxes fill form 67 before filling ITR.For specific clarifications / legal advice feel free to write to dsssvtax[at]gmail or call/WhatsApp: 9052535440.

-

Can I fill the form for the SSC CGL 2018 which will be held in June 2019 and when will the form for 2019 come out?

No, you can’t fill the form for SSC CGL 2018 as application process has been long over.SSC CGL 2019 : No concrete information at this time. Some update should come by August-September 2019.Like Exambay on facebook for all latest updates on SSC CGL 2018 , SSC CGL 2019 and other upcoming exams

-

How do I fill out a CLAT 2019 application form?

Hi thereFirst of all, let me tell you some important points:CLAT 2019 has gone OFFLINE this yearBut the application forms for CLAT 2019 have to be filled ONLINEThe payment of the application fees also should be made onlineNow, kindly note the important dates:Note the details regarding the application fees:Here, if you want the Previous Year Question papers, Rs.500 would be added to the application fees.Apart from this, there would be bank transaction charges added to the application fees.The application fees is non-refundable.Note one important point here that before you fill the application form, check for your eligibility.To know the complete details of filling the application form along with other information like the eligibility - in terms of age, educational qualification, list of NLUs participating and the seats offered under each category, CLAT Reservation policies, CLAT exam pattern, marking scheme, syllabus, important documents required to be kept ready before filling the form, kindly go to the link below:How to fill CLAT 2019 Application form? Registration OPEN | All you need to knowTo know how to prepare for one of the very important section of CLAT exam, GK and Current Affairs, kindly go to the link below:How to prepare GK & Current Affairs for CLAT 2019To practice, daily MCQs on Current Affairs, kindly go to the link below:#CLAT2019 | #AILET2019 | #DULLB2019 | GK and Current Affairs Series: 5 in 10 Series: Day 12For any other queries, kindly write to us at mailateasyway@gmail.comThanks & Regards!

Create this form in 5 minutes!

How to create an eSignature for the wv schedule m 2018 2019 form

How to make an eSignature for your Wv Schedule M 2018 2019 Form online

How to make an electronic signature for the Wv Schedule M 2018 2019 Form in Google Chrome

How to create an electronic signature for signing the Wv Schedule M 2018 2019 Form in Gmail

How to generate an eSignature for the Wv Schedule M 2018 2019 Form from your mobile device

How to create an eSignature for the Wv Schedule M 2018 2019 Form on iOS devices

How to make an electronic signature for the Wv Schedule M 2018 2019 Form on Android devices

People also ask

-

What is the West Virginia TAS Schedule M?

The West Virginia TAS Schedule M is a unique document that allows businesses to manage their taxes effectively. It provides tax information specific to West Virginia, ensuring compliance with local regulations. Understanding this schedule is vital for accurate reporting and submission.

-

How can airSlate SignNow assist with the West Virginia TAS Schedule M?

airSlate SignNow simplifies the process of signing and sending the West Virginia TAS Schedule M. With its easy-to-use features, businesses can quickly eSign their documents and ensure timely submissions. This saves time and reduces the chances of errors in tax filings.

-

What are the costs associated with using airSlate SignNow for the West Virginia TAS Schedule M?

airSlate SignNow offers flexible pricing plans that cater to businesses of all sizes using the West Virginia TAS Schedule M. The cost-effective solution ensures that you can manage your document signing needs without breaking the bank. Explore our plans to find the best fit for your business.

-

Can airSlate SignNow integrate with my existing financial software for the West Virginia TAS Schedule M?

Yes, airSlate SignNow integrates seamlessly with various financial and tax management software. This capability enhances the efficiency of processing the West Virginia TAS Schedule M. By combining both tools, businesses can streamline their tax documentation and ensure accurate submissions.

-

What are the key features of airSlate SignNow for managing the West Virginia TAS Schedule M?

Key features of airSlate SignNow include secure eSigning, document tracking, and automated workflows tailored for the West Virginia TAS Schedule M. These tools help businesses manage their signing processes efficiently, ensuring compliance and accuracy every step of the way.

-

Is airSlate SignNow compliant with legal standards for documents like the West Virginia TAS Schedule M?

Absolutely! airSlate SignNow is designed to meet all legal standards for electronic signatures, making it a reliable choice for documents such as the West Virginia TAS Schedule M. Businesses can confidently use our platform, knowing they remain compliant with local and federal regulations.

-

How does airSlate SignNow enhance collaboration on the West Virginia TAS Schedule M?

airSlate SignNow enhances collaboration by allowing multiple users to review and sign the West Virginia TAS Schedule M in real-time. This feature streamlines communication and makes it easier for teams to finalize important documents without delays. Team members can access and update the document anytime, ensuring everyone is on the same page.

Get more for Wv It 140

Find out other Wv It 140

- How Do I Electronic signature Utah Gift Affidavit

- Electronic signature Kentucky Mechanic's Lien Free

- Electronic signature Maine Mechanic's Lien Fast

- Can I Electronic signature North Carolina Mechanic's Lien

- How To Electronic signature Oklahoma Mechanic's Lien

- Electronic signature Oregon Mechanic's Lien Computer

- Electronic signature Vermont Mechanic's Lien Simple

- How Can I Electronic signature Virginia Mechanic's Lien

- Electronic signature Washington Mechanic's Lien Myself

- Electronic signature Louisiana Demand for Extension of Payment Date Simple

- Can I Electronic signature Louisiana Notice of Rescission

- Electronic signature Oregon Demand for Extension of Payment Date Online

- Can I Electronic signature Ohio Consumer Credit Application

- eSignature Georgia Junior Employment Offer Letter Later

- Electronic signature Utah Outsourcing Services Contract Online

- How To Electronic signature Wisconsin Debit Memo

- Electronic signature Delaware Junior Employment Offer Letter Later

- Electronic signature Texas Time Off Policy Later

- Electronic signature Texas Time Off Policy Free

- eSignature Delaware Time Off Policy Online