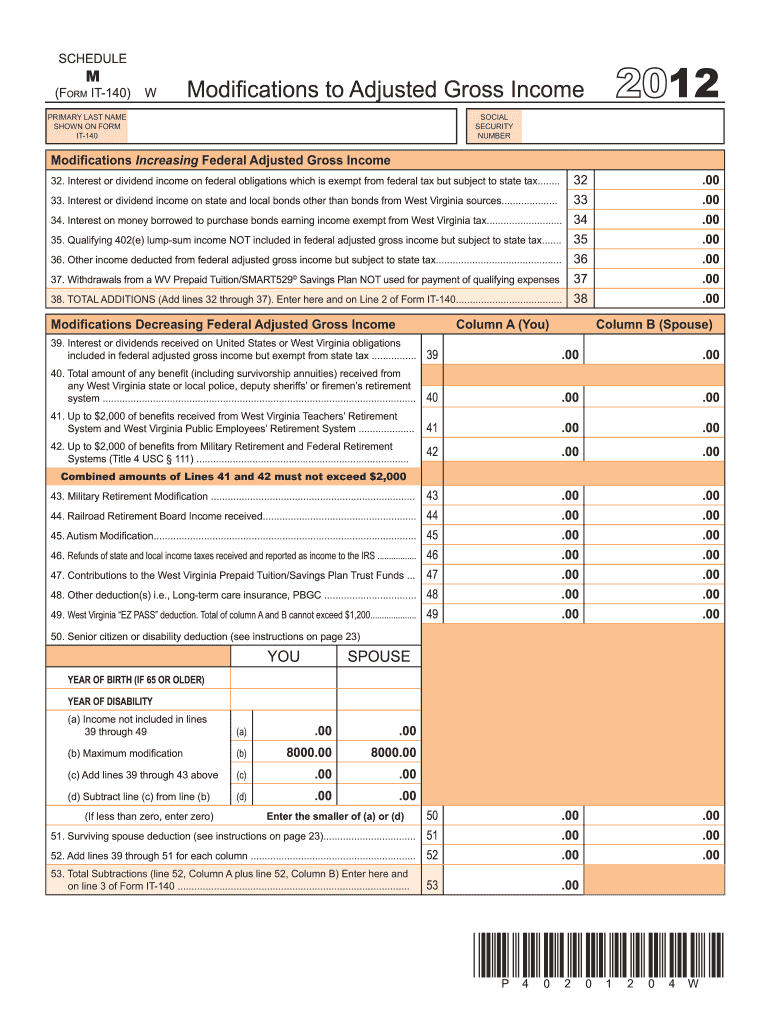

Scedule M it 140 Line 52 Form 2012

What is the Scedule M It 140 Line 52 Form

The Scedule M It 140 Line 52 Form is a specific tax form used by residents of Massachusetts to report certain tax credits and adjustments. This form is part of the Massachusetts state income tax filing process and is essential for accurately calculating tax liabilities. It allows taxpayers to claim various deductions and credits that can significantly reduce their overall tax burden. Understanding the purpose of this form is crucial for ensuring compliance with state tax regulations and maximizing potential refunds.

How to use the Scedule M It 140 Line 52 Form

Using the Scedule M It 140 Line 52 Form involves several key steps. First, gather all necessary financial documents, including income statements and previous tax returns. Next, carefully read the instructions provided with the form to understand the specific requirements and calculations needed. Fill out the form accurately, ensuring that all information is complete and correct. After completing the form, review it for any errors before submitting it along with your Massachusetts state tax return. Utilizing digital tools can simplify this process, allowing for easier completion and submission.

Steps to complete the Scedule M It 140 Line 52 Form

Completing the Scedule M It 140 Line 52 Form involves several steps:

- Gather necessary documents, including W-2s and 1099s.

- Review the form instructions to understand the required information.

- Fill in personal information, including your name, address, and Social Security number.

- Report your income and any applicable deductions or credits.

- Double-check all entries for accuracy.

- Sign and date the form before submission.

Legal use of the Scedule M It 140 Line 52 Form

The Scedule M It 140 Line 52 Form is legally recognized by the Massachusetts Department of Revenue as a valid document for reporting tax information. It must be completed in accordance with state tax laws to ensure compliance. Failure to accurately complete and submit this form can result in penalties or delays in processing your tax return. It is important to use the most current version of the form and adhere to all guidelines set forth by the state to maintain legal standing.

Filing Deadlines / Important Dates

Filing deadlines for the Scedule M It 140 Line 52 Form align with the Massachusetts state tax filing schedule. Typically, individual income tax returns are due on April fifteenth, unless this date falls on a weekend or holiday. In such cases, the deadline may be extended to the next business day. Taxpayers should be aware of any changes to deadlines, especially during tax season, to avoid late fees or penalties.

Form Submission Methods (Online / Mail / In-Person)

The Scedule M It 140 Line 52 Form can be submitted through various methods, providing flexibility for taxpayers. Options include:

- Online submission through the Massachusetts Department of Revenue website, which offers a secure and efficient way to file.

- Mailing a paper copy of the completed form to the appropriate state address.

- In-person submission at designated tax offices, which may offer assistance for those needing help with the filing process.

Quick guide on how to complete scedule m it 140 line 52 2012 form

Your assistance manual on how to prepare your Scedule M It 140 Line 52 Form

If you’re wondering how to complete and submit your Scedule M It 140 Line 52 Form, here are some brief instructions on how to simplify the tax filing process.

First, you just need to sign up for your airSlate SignNow account to revolutionize how you handle documents online. airSlate SignNow is an exceptionally user-friendly and powerful document management solution that enables you to modify, create, and finalize your tax papers effortlessly. With its editor, you can toggle between text, check boxes, and eSignatures and revisit to change responses as necessary. Optimize your tax handling with advanced PDF editing, eSigning, and seamless sharing.

Follow these steps to complete your Scedule M It 140 Line 52 Form in just a few minutes:

- Create your account and start editing PDFs within a short time.

- Utilize our directory to find any IRS tax form; browse through variations and schedules.

- Press Get form to access your Scedule M It 140 Line 52 Form in our editor.

- Complete the necessary fillable sections with your details (text, numbers, check marks).

- Employ the Sign Tool to add your legally-recognized eSignature (if required).

- Examine your document and correct any mistakes.

- Preserve changes, print your version, send it to your intended recipient, and download it to your device.

Utilize this manual to submit your taxes online with airSlate SignNow. Please be aware that filing in hard copy may increase return mistakes and delay refunds. Naturally, before e-filing your taxes, verify the IRS website for filing regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct scedule m it 140 line 52 2012 form

FAQs

-

How can I make it easier for users to fill out a form on mobile apps?

I’ll tell you a secret - you can thank me later for this.If you want to make the form-filling experience easy for a user - make sure that you have a great UI to offer.Everything boils down to UI at the end.Axonator is one of the best mobile apps to collect data since it offers powerful features bundled with a simple UI.The problem with most of the mobile form apps is that they are overloaded with features that aren’t really necessary.The same doesn’t hold true for Axonator. It has useful features but it is very unlikely that the user will feel overwhelmed in using them.So, if you are inclined towards having greater form completion rates for your survey or any data collection projects, then Axonator is the way to go.Apart from that, there are other features that make the data collection process faster like offline data collection, rich data capture - audio, video, images, QR code & barcode data capture, live location & time capture, and more!Check all the features here!You will be able to complete more surveys - because productivity will certainly shoot up.Since you aren’t using paper forms, errors will drop signNowly.The cost of the paper & print will be saved - your office expenses will drop dramatically.No repeat work. No data entry. Time & money saved yet again.Analytics will empower you to make strategic decisions and explore new revenue opportunities.The app is dirt-cheap & you don’t any training to use the app. They come in with a smooth UI. Forget using, even creating forms for your apps is easy on the platform. Just drag & drop - and it’s ready for use. Anyone can build an app under hours.

-

I have created a registration form in HTML. When someone fills it out, how do I get the filled out form sent to my email?

Are you assuming that the browser will send the email? That is not the way it is typically done. You include in your registration form a and use PHP or whatever on the server to send the email. In PHP it is PHP: mail - Manual But if you are already on the server it seems illogical to send an email. Just register the user immediately.

Create this form in 5 minutes!

How to create an eSignature for the scedule m it 140 line 52 2012 form

How to create an electronic signature for the Scedule M It 140 Line 52 2012 Form in the online mode

How to generate an electronic signature for the Scedule M It 140 Line 52 2012 Form in Chrome

How to create an eSignature for signing the Scedule M It 140 Line 52 2012 Form in Gmail

How to generate an electronic signature for the Scedule M It 140 Line 52 2012 Form from your mobile device

How to create an electronic signature for the Scedule M It 140 Line 52 2012 Form on iOS

How to create an eSignature for the Scedule M It 140 Line 52 2012 Form on Android devices

People also ask

-

What is the Scedule M It 140 Line 52 Form?

The Scedule M It 140 Line 52 Form is a specific tax form used for reporting certain income and deductions in the Massachusetts income tax return. It is crucial for taxpayers to accurately complete this form to avoid penalties and ensure compliance with state regulations. Using airSlate SignNow can streamline the process of filling out and eSigning this form.

-

How can airSlate SignNow help with the Scedule M It 140 Line 52 Form?

airSlate SignNow provides a user-friendly platform that allows you to easily complete, edit, and eSign the Scedule M It 140 Line 52 Form. The software integrates templates and allows for easy sharing, making it simple to gather necessary signatures while ensuring that all information is accurate and up-to-date. This can signNowly reduce the time spent on tax preparation.

-

What are the pricing options for using airSlate SignNow?

airSlate SignNow offers various pricing plans to accommodate different business needs, including a free trial to explore the platform. Plans are designed to provide cost-effective solutions based on the number of users and features required for handling documents like the Scedule M It 140 Line 52 Form. This ensures you only pay for what you need.

-

Are there any integrations available for the Scedule M It 140 Line 52 Form?

Yes, airSlate SignNow integrates with popular applications such as Google Drive, Dropbox, and Microsoft Office, enabling seamless document management. These integrations make it easy to access and share the Scedule M It 140 Line 52 Form with collaborators or tax professionals for added convenience. This enhances workflow efficiency and productivity.

-

What are the key benefits of using airSlate SignNow for tax forms?

Using airSlate SignNow for tax forms like the Scedule M It 140 Line 52 Form offers numerous benefits, including increased accuracy, reduced turnaround times, and enhanced security for sensitive information. eSigning your documents digitally also provides a legally binding way to sign, streamlining the entire tax filing process while maintaining compliance.

-

Is airSlate SignNow secure for handling sensitive tax documents?

Absolutely, airSlate SignNow prioritizes security with features like secure encryption, auditing capabilities, and compliance with industry standards. This makes it safe to handle sensitive tax documents such as the Scedule M It 140 Line 52 Form. Rest assured that your data is protected while you manage your tax obligations.

-

Can I access the Scedule M It 140 Line 52 Form on mobile devices?

Yes, airSlate SignNow is mobile-friendly, allowing you to access and complete the Scedule M It 140 Line 52 Form from any device. This flexibility ensures that you can manage your documents on-the-go, making it easier to stay organized and comply with tax deadlines. The mobile app further enhances your experience, allowing for quick eSigning wherever you are.

Get more for Scedule M It 140 Line 52 Form

Find out other Scedule M It 140 Line 52 Form

- eSign Louisiana Notice of Rent Increase Mobile

- eSign Washington Notice of Rent Increase Computer

- How To eSign Florida Notice to Quit

- How To eSign Hawaii Notice to Quit

- eSign Montana Pet Addendum to Lease Agreement Online

- How To eSign Florida Tenant Removal

- How To eSign Hawaii Tenant Removal

- eSign Hawaii Tenant Removal Simple

- eSign Arkansas Vacation Rental Short Term Lease Agreement Easy

- Can I eSign North Carolina Vacation Rental Short Term Lease Agreement

- eSign Michigan Escrow Agreement Now

- eSign Hawaii Sales Receipt Template Online

- eSign Utah Sales Receipt Template Free

- eSign Alabama Sales Invoice Template Online

- eSign Vermont Escrow Agreement Easy

- How Can I eSign Wisconsin Escrow Agreement

- How To eSign Nebraska Sales Invoice Template

- eSign Nebraska Sales Invoice Template Simple

- eSign New York Sales Invoice Template Now

- eSign Pennsylvania Sales Invoice Template Computer