Get the Form 8949 Department of the Treasury Internal 2021

What is Form 8949?

Form 8949 is a tax form used by individuals and businesses in the United States to report sales and exchanges of capital assets. This form is essential for accurately calculating capital gains and losses, which are necessary for determining tax liability. The Internal Revenue Service (IRS) requires taxpayers to complete Form 8949 when they sell stocks, bonds, or other investments. It is crucial for taxpayers to understand the specific instructions related to this form to ensure compliance with tax regulations.

Steps to Complete Form 8949

Completing Form 8949 involves several key steps:

- Gather necessary documentation, including records of all transactions involving capital assets.

- Identify whether the transactions are short-term or long-term. Short-term transactions involve assets held for one year or less, while long-term transactions involve assets held for more than one year.

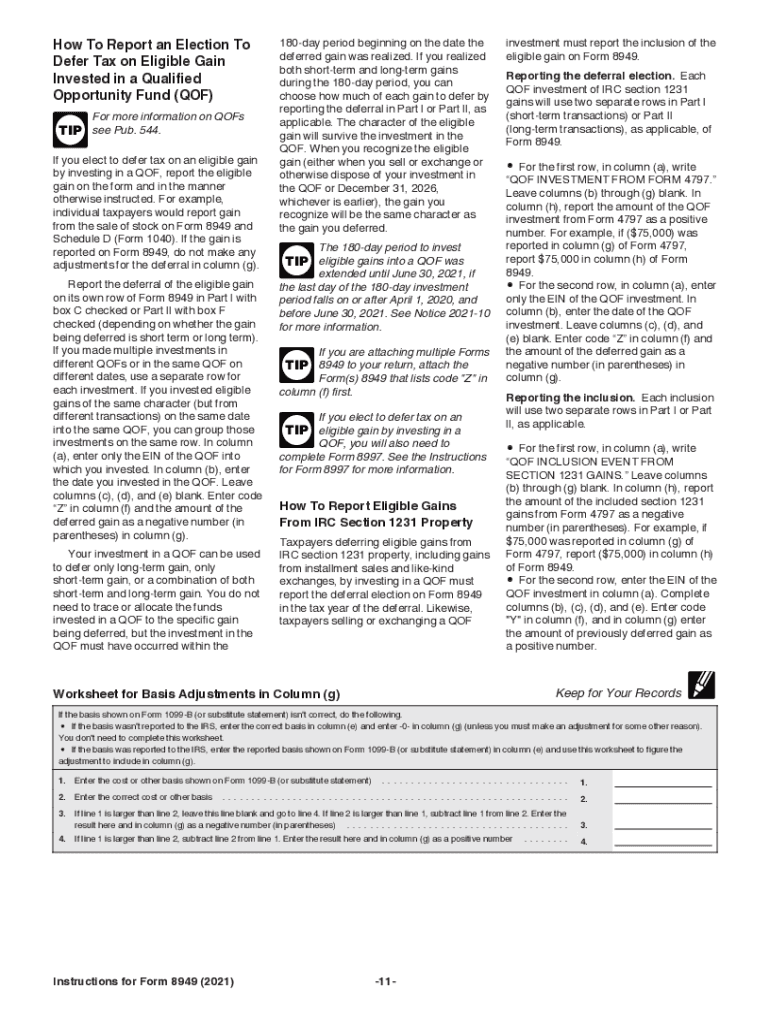

- Fill out the form by entering the details of each transaction, including the date acquired, date sold, proceeds, cost or other basis, and any adjustments.

- Calculate the gain or loss for each transaction and summarize the totals at the end of the form.

- Transfer the totals from Form 8949 to Schedule D, which is used to report overall capital gains and losses.

IRS Guidelines for Form 8949

The IRS provides specific guidelines for completing Form 8949. Taxpayers must ensure that they accurately report all transactions and follow the instructions carefully. Key guidelines include:

- Use separate sections for short-term and long-term transactions.

- Report transactions on a first-in, first-out (FIFO) basis unless another method is chosen and documented.

- Ensure all necessary information is included, as incomplete forms may lead to delays or penalties.

Filing Deadlines for Form 8949

Filing deadlines for Form 8949 align with the general tax filing deadlines in the United States. Typically, taxpayers must file their forms by April 15 of the following tax year. If April 15 falls on a weekend or holiday, the deadline may be extended to the next business day. It is important to stay informed about any changes to deadlines, especially in light of potential extensions that may be granted by the IRS.

Form Submission Methods

Taxpayers can submit Form 8949 through various methods, including:

- Online submission via tax preparation software that supports e-filing.

- Mailing a paper form to the appropriate IRS address based on the taxpayer's location.

- In-person submission at designated IRS offices, though this option may be limited.

Penalties for Non-Compliance

Failure to comply with the requirements for Form 8949 can result in penalties. Common penalties include:

- Fines for late filing or underreporting income.

- Interest on unpaid taxes, which accrues over time.

- Potential audits by the IRS, which can lead to further scrutiny of financial records.

Quick guide on how to complete get the free form 8949 department of the treasury internal

Effortlessly Prepare Get The Form 8949 Department Of The Treasury Internal on Any Device

Digital document management has gained popularity among organizations and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to obtain the required form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without hold-ups. Control Get The Form 8949 Department Of The Treasury Internal on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to Alter and eSign Get The Form 8949 Department Of The Treasury Internal with Ease

- Find Get The Form 8949 Department Of The Treasury Internal and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of your documents or redact sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Generate your signature using the Sign feature, which only takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and then click the Done button to save your modifications.

- Choose how you wish to share your form, either via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or mislaid files, tedious form searches, and mistakes that require printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Modify and eSign Get The Form 8949 Department Of The Treasury Internal to ensure exceptional communication at every step of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct get the free form 8949 department of the treasury internal

Create this form in 5 minutes!

How to create an eSignature for the get the free form 8949 department of the treasury internal

How to make an electronic signature for your PDF in the online mode

How to make an electronic signature for your PDF in Chrome

The best way to generate an electronic signature for putting it on PDFs in Gmail

How to create an e-signature right from your smart phone

The best way to generate an electronic signature for a PDF on iOS devices

How to create an e-signature for a PDF on Android OS

People also ask

-

What is Form 8949 and why is it important?

Form 8949 is a tax document used to report sales and exchanges of capital assets. Completing Form 8949 accurately is crucial for tax compliance, as it helps the IRS track your capital gains and losses. Using airSlate SignNow makes it easy to prepare and eSign this form promptly.

-

How does airSlate SignNow help with filling out Form 8949?

airSlate SignNow offers an intuitive platform that simplifies the process of filling out Form 8949. You can easily add your information, adjust details, and ensure everything is accurate before eSigning. This streamlines your paperwork and reduces the risk of errors.

-

Is there a cost associated with using airSlate SignNow for Form 8949?

Yes, airSlate SignNow has various pricing plans that cater to different business needs, making it a cost-effective solution for managing Form 8949. Each plan provides features that enhance document management and signing capabilities. You get great value that is aligned with your workflow.

-

What features does airSlate SignNow offer for managing Form 8949?

airSlate SignNow provides features like templates, document sharing, and secure eSigning specifically designed for documents like Form 8949. Additionally, it includes tracking capabilities to monitor the status of your form in real-time. These features streamline the document process for better efficiency.

-

Can I integrate airSlate SignNow with other tools for Form 8949?

Absolutely! airSlate SignNow offers integrations with various platforms, allowing you to manage Form 8949 alongside your existing tools. This ensures that you can seamlessly transfer data and maintain your workflow without unnecessary interruptions.

-

How secure is my data when using airSlate SignNow for Form 8949?

Security is a top priority at airSlate SignNow. When preparing and signing Form 8949, your data is encrypted and stored securely, ensuring that sensitive information remains protected. Our platform meets industry standards for security, giving you peace of mind.

-

What support options are available for airSlate SignNow users regarding Form 8949?

airSlate SignNow offers various support options, including a comprehensive help center, live chat, and email support. If you have questions about filling out Form 8949 or using the platform, our team is ready to assist you efficiently. We are dedicated to ensuring that you have a smooth experience.

Get more for Get The Form 8949 Department Of The Treasury Internal

- Contract for sale and purchase of real estate with no broker for residential home sale agreement mississippi form

- The check list to write a sms form

- Sellers information for appraiser provided to buyer mississippi

- Subcontractors agreement mississippi form

- Mississippi witnesses form

- Order approving caveat to alleged last will and testament mississippi form

- Motion stay form

- Gc335 attorney or party without attorneystate bar form

Find out other Get The Form 8949 Department Of The Treasury Internal

- How Can I Sign New York Real Estate Memorandum Of Understanding

- Sign Texas Sports Promissory Note Template Online

- Sign Oregon Orthodontists Last Will And Testament Free

- Sign Washington Sports Last Will And Testament Free

- How Can I Sign Ohio Real Estate LLC Operating Agreement

- Sign Ohio Real Estate Quitclaim Deed Later

- How Do I Sign Wisconsin Sports Forbearance Agreement

- How To Sign Oregon Real Estate Resignation Letter

- Can I Sign Oregon Real Estate Forbearance Agreement

- Sign Pennsylvania Real Estate Quitclaim Deed Computer

- How Do I Sign Pennsylvania Real Estate Quitclaim Deed

- How Can I Sign South Dakota Orthodontists Agreement

- Sign Police PPT Alaska Online

- How To Sign Rhode Island Real Estate LLC Operating Agreement

- How Do I Sign Arizona Police Resignation Letter

- Sign Texas Orthodontists Business Plan Template Later

- How Do I Sign Tennessee Real Estate Warranty Deed

- Sign Tennessee Real Estate Last Will And Testament Free

- Sign Colorado Police Memorandum Of Understanding Online

- How To Sign Connecticut Police Arbitration Agreement