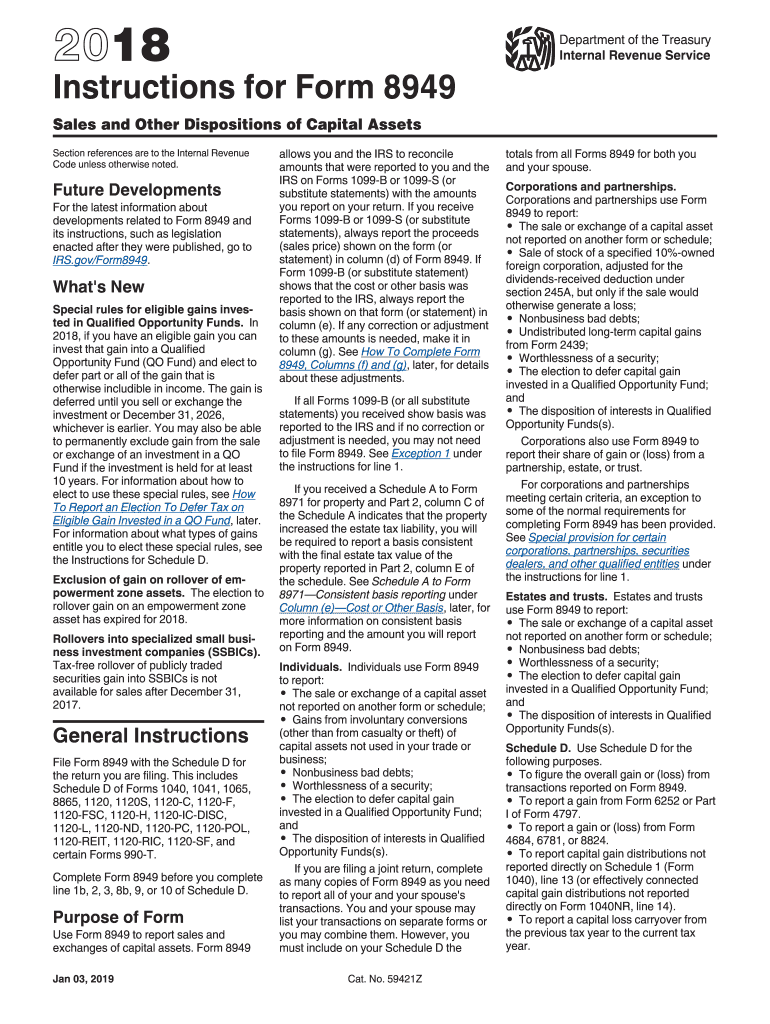

Form 8949 Tax Form 2018

What is the Form 8949 Tax Form

The Form 8949 is a tax form used by individuals and businesses in the United States to report capital gains and losses from the sale of stocks, bonds, and other capital assets. It is essential for accurately calculating the amount of taxable income derived from these transactions. The IRS requires taxpayers to complete this form as part of their annual tax return, specifically when filing Form 1040. Understanding the purpose of Form 8949 is crucial for ensuring compliance with tax regulations and avoiding potential penalties.

Steps to complete the Form 8949 Tax Form

Completing the Form 8949 involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary documentation related to your stock transactions, including purchase and sale dates, amounts, and any associated costs. Next, categorize your transactions into short-term and long-term, as this distinction affects the tax rate applied to your gains or losses. Enter the details of each transaction in the appropriate sections of the form, ensuring that all required fields are filled out correctly. Finally, review your entries for accuracy before submitting the form with your tax return.

IRS Guidelines

The IRS provides specific guidelines for completing the Form 8949, which include instructions on how to report different types of transactions, such as those involving wash sales or inherited assets. Taxpayers must follow these guidelines closely to ensure that their reported information aligns with IRS requirements. It is important to refer to the latest IRS publications or instructions for Form 8949 to stay updated on any changes that may affect your filing. Adhering to these guidelines helps in minimizing errors and potential audits.

Key elements of the Form 8949 Tax Form

Key elements of the Form 8949 include sections for reporting transaction details, such as the date acquired, date sold, proceeds, cost basis, and adjustments. Each transaction is categorized based on whether it is short-term or long-term, influencing the applicable tax rate. Additionally, taxpayers must indicate whether they have any adjustments to their gains or losses, which may arise from factors like wash sales. Understanding these key elements is essential for accurately reporting capital gains and losses.

Form Submission Methods (Online / Mail / In-Person)

Form 8949 can be submitted through various methods, including online, by mail, or in-person. For online submissions, taxpayers typically file their Form 1040 electronically, which includes the information from Form 8949. When submitting by mail, ensure that you send the completed form along with your tax return to the appropriate IRS address. In-person submissions may be possible at local IRS offices, although this method is less common. Choosing the right submission method can help streamline the filing process.

Filing Deadlines / Important Dates

Filing deadlines for Form 8949 align with the annual tax return due date, which is typically April 15 for most taxpayers. However, if this date falls on a weekend or holiday, the deadline may be extended. It is crucial to be aware of these important dates to avoid late filing penalties. Additionally, taxpayers should consider any extensions they may need to file their returns, which can also affect the submission timeline for Form 8949.

Quick guide on how to complete form 8949 instructions 2018 2019

Discover the most efficient method to complete and endorse your Form 8949 Tax Form

Are you still spending time preparing your official documents on paper instead of online? airSlate SignNow presents a superior approach to complete and endorse your Form 8949 Tax Form and similar forms for public services. Our intelligent eSignature platform provides you with everything necessary to handle documents swiftly and in accordance with formal stipulations - robust PDF editing, management, security, signing, and sharing tools all readily available within a user-friendly interface.

Only a few steps are needed to finalize filling out and endorsing your Form 8949 Tax Form:

- Upload the editable template to the editor using the Get Form button.

- Review what information you need to enter in your Form 8949 Tax Form.

- Move between the fields using the Next button to avoid missing anything.

- Utilize Text, Check, and Cross tools to complete the fields with your information.

- Enhance the content with Text boxes or Images from the top toolbar.

- Emphasize what truly matters or Conceal areas that are no longer signNow.

- Click on Sign to generate a legally valid eSignature using your preferred method.

- Add the Date next to your signature and finish your work by clicking the Done button.

Store your finalized Form 8949 Tax Form in the Documents folder in your profile, download it, or transfer it to your preferred cloud storage. Our platform also offers flexible file sharing. There’s no requirement to print your forms when submitting them to the appropriate public office - do it via email, fax, or by requesting a USPS “snail mail” delivery from your account. Give it a try today!

Create this form in 5 minutes or less

Find and fill out the correct form 8949 instructions 2018 2019

FAQs

-

Can I use broker statements to fill out form 8949 instead of a 1099-B?

Yes you can. Should you? Perhaps, but remember that the 1099 is what the IRS is going to receive. There could be differences.You may receive a 1099 which is missing basis information. You will indicate that, and use your records to fill in the missing information.My suggestion is to use the 1099, cross-referencing to your statements.

-

Which ITR form should an NRI fill out for AY 2018–2019 to claim the TDS deducted by banks only?

ITR form required to be submitted depends upon nature of income. As a NRI shall generally have income from other sources like interest, rental income therefore s/he should file ITR 2.

-

Which ITR form should an NRI fill out for AY 2018–2019 for salary income?

File ITR 2 and for taking credit of foreign taxes fill form 67 before filling ITR.For specific clarifications / legal advice feel free to write to dsssvtax[at]gmail or call/WhatsApp: 9052535440.

-

Can I fill the form for the SSC CGL 2018 which will be held in June 2019 and when will the form for 2019 come out?

No, you can’t fill the form for SSC CGL 2018 as application process has been long over.SSC CGL 2019 : No concrete information at this time. Some update should come by August-September 2019.Like Exambay on facebook for all latest updates on SSC CGL 2018 , SSC CGL 2019 and other upcoming exams

-

How do I fill out the IIFT 2018 application form?

Hi!IIFT MBA (IB) Application Form 2018 – The last date to submit the Application Form of IIFT 2018 has been extended. As per the initial notice, the last date to submit the application form was September 08, 2017. However, now the candidates may submit it untill September 15, 2017. The exam date for IIFT 2018 has also been shifted to December 03, 2017. The candidates will only be issued the admit card, if they will submit IIFT application form and fee in the prescribed format. Before filling the IIFT application form, the candidates must check the eligibility criteria because ineligible candidates will not be granted admission. The application fee for candidates is Rs. 1550, however, the candidates belonging to SC/STPWD category only need to pay Rs. 775. Check procedure to submit IIFT Application Form 2018, fee details and more information from the article below.Latest – Last date to submit IIFT application form extended until September 15, 2017.IIFT 2018 Application FormThe application form of IIFT MBA 2018 has only be released online, on http://tedu.iift.ac.in. The candidates must submit it before the laps of the deadline, which can be checked from the table below.Application form released onJuly 25, 2017Last date to submit Application form(for national candidates)September 08, 2017 September 15, 2017Last date to submit the application form(by Foreign National and NRI)February 15, 2018IIFT MBA IB entrance exam will be held onNovember 26, 2017 December 03, 2017IIFT 2018 Application FeeThe candidates should take note of the application fee before submitting the application form. The fee amount is as given below and along with it, the medium to submit the fee are also mentioned.Fee amount for IIFT 2018 Application Form is as given below:General/OBC candidatesRs 1550SC/ST/PH candidatesRs 775Foreign National/NRI/Children of NRI candidatesUS$ 80 (INR Rs. 4500)The medium to submit the application fee of IIFT 2018 is as below:Credit CardsDebit Cards (VISA/Master)Demand Draft (DD)Candidates who will submit the application fee via Demand Draft will be required to submit a DD, in favour of Indian Institute of Foreign Trade, payable at New Delhi.Procedure to Submit IIFT MBA Application Form 2018Thank you & Have a nice day! :)

Create this form in 5 minutes!

How to create an eSignature for the form 8949 instructions 2018 2019

How to create an eSignature for the Form 8949 Instructions 2018 2019 online

How to create an electronic signature for your Form 8949 Instructions 2018 2019 in Google Chrome

How to make an electronic signature for signing the Form 8949 Instructions 2018 2019 in Gmail

How to make an electronic signature for the Form 8949 Instructions 2018 2019 straight from your mobile device

How to create an eSignature for the Form 8949 Instructions 2018 2019 on iOS devices

How to create an electronic signature for the Form 8949 Instructions 2018 2019 on Android OS

People also ask

-

What is the Form 8949 Tax Form used for?

The Form 8949 Tax Form is used by taxpayers to report capital gains and losses from sales of securities. This form helps you detail each transaction, ensuring accurate reporting to the IRS. By utilizing airSlate SignNow, you can easily eSign and submit your Form 8949 Tax Form, streamlining your tax filing process.

-

How can airSlate SignNow help with my Form 8949 Tax Form?

airSlate SignNow simplifies the process of filling out and signing your Form 8949 Tax Form. Our platform allows you to upload, fill, and eSign documents securely and efficiently. This means you can handle all your tax forms, including the Form 8949 Tax Form, in one convenient location.

-

Is there a cost associated with using airSlate SignNow for the Form 8949 Tax Form?

Yes, airSlate SignNow offers pricing plans that cater to various business needs. You can choose from different subscription levels based on the volume of documents you handle, including the Form 8949 Tax Form. We provide cost-effective solutions that save you time and resources.

-

Can I integrate airSlate SignNow with my accounting software for the Form 8949 Tax Form?

Absolutely! airSlate SignNow seamlessly integrates with popular accounting software, making it easy to manage your Form 8949 Tax Form and other tax documents. This integration helps you maintain accurate records and simplifies the overall process of preparing your taxes.

-

What features does airSlate SignNow offer for managing the Form 8949 Tax Form?

airSlate SignNow provides a variety of features designed to enhance your experience with the Form 8949 Tax Form. Key features include customizable templates, secure cloud storage, and robust eSigning capabilities. These tools ensure that you can efficiently manage your tax documents while maintaining compliance.

-

Can I securely store my completed Form 8949 Tax Form with airSlate SignNow?

Yes, airSlate SignNow offers secure cloud storage for all your documents, including the Form 8949 Tax Form. Our platform uses advanced encryption to protect your sensitive information, giving you peace of mind that your tax documents are safe and accessible whenever you need them.

-

How long does it take to complete the Form 8949 Tax Form using airSlate SignNow?

Completing the Form 8949 Tax Form using airSlate SignNow is quick and efficient. Depending on your familiarity with the form and the number of transactions, you can fill it out and eSign it in just a few minutes. Our user-friendly interface guides you every step of the way.

Get more for Form 8949 Tax Form

- St tel 16 kansas retailers sales telefile worksheet form

- Osrap vendor search form

- Wampr rpl 2 rpl application and pre screening form section a

- Paratransit print application merced county form

- Dish network sample bill form

- Lab tracking sheet form

- Ipc medical review request form

- Class vii english worksheet modals indian school muscat form

Find out other Form 8949 Tax Form

- eSignature South Carolina Charity Confidentiality Agreement Easy

- Can I eSignature Tennessee Car Dealer Limited Power Of Attorney

- eSignature Utah Car Dealer Cease And Desist Letter Secure

- eSignature Virginia Car Dealer Cease And Desist Letter Online

- eSignature Virginia Car Dealer Lease Termination Letter Easy

- eSignature Alabama Construction NDA Easy

- How To eSignature Wisconsin Car Dealer Quitclaim Deed

- eSignature California Construction Contract Secure

- eSignature Tennessee Business Operations Moving Checklist Easy

- eSignature Georgia Construction Residential Lease Agreement Easy

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy

- eSignature Business Operations Document Washington Now

- How To eSignature Maine Construction Confidentiality Agreement

- eSignature Maine Construction Quitclaim Deed Secure

- eSignature Louisiana Construction Affidavit Of Heirship Simple

- eSignature Minnesota Construction Last Will And Testament Online

- eSignature Minnesota Construction Last Will And Testament Easy

- How Do I eSignature Montana Construction Claim

- eSignature Construction PPT New Jersey Later