Www Michigan Govtreasury0,4679,712175939TREASURY Treasury and Taxes Forms Michigan 2022

Understanding the Michigan Form 5081

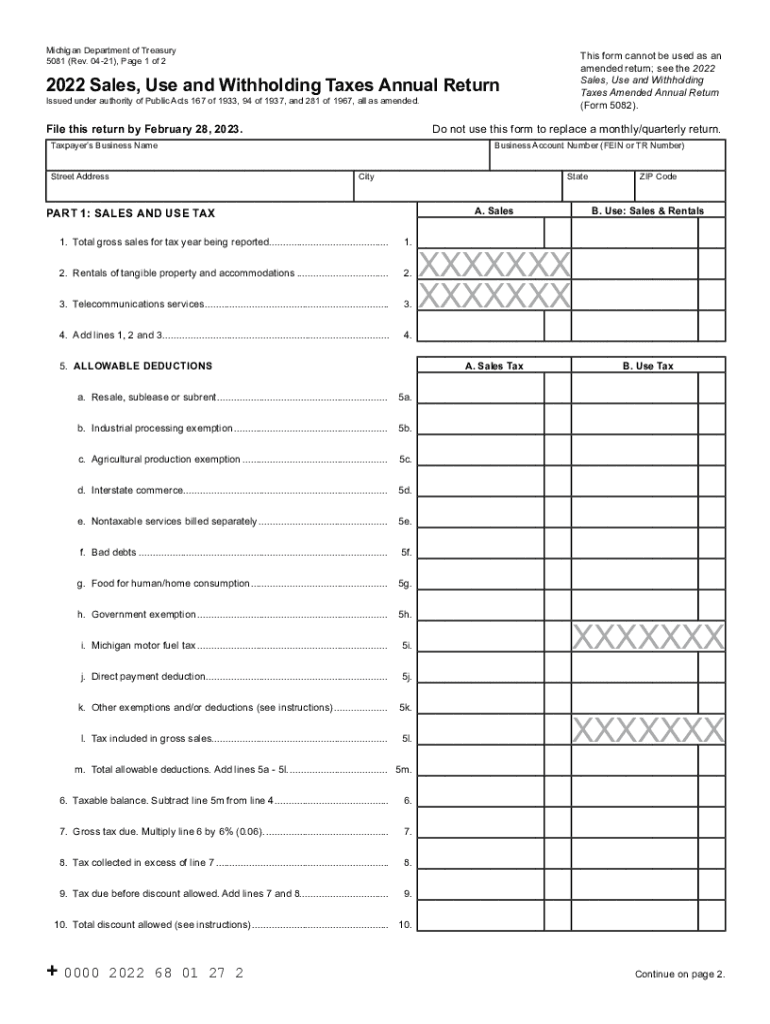

The Michigan Form 5081 is a tax-related document used primarily for reporting and remitting sales tax. This form is essential for businesses operating in Michigan, as it ensures compliance with state tax regulations. The form captures critical information regarding sales transactions, tax collected, and any exemptions that may apply. Properly completing this form is crucial for maintaining good standing with the Michigan Department of Treasury.

Steps to Complete the Michigan Form 5081

Filling out the Michigan Form 5081 involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary sales records, including receipts and invoices. Next, follow these steps:

- Identify the reporting period for which you are filing.

- Enter total sales and any exempt sales in the designated sections.

- Calculate the total sales tax collected during the reporting period.

- Complete any additional sections relevant to your business type or sales activities.

- Review the form for accuracy before submission.

Key Elements of the Michigan Form 5081

The Michigan Form 5081 includes several important components that must be filled out correctly. Key elements include:

- Business Information: Name, address, and tax identification number of the business.

- Sales Information: Total sales, exempt sales, and sales tax collected.

- Signature: An authorized representative must sign the form to validate the information provided.

Legal Use of the Michigan Form 5081

The Michigan Form 5081 serves as a legally binding document when filed correctly. It is essential to ensure that all information is accurate and submitted by the specified deadlines. Failure to comply with the legal requirements can result in penalties or audits by the Michigan Department of Treasury.

Filing Deadlines for the Michigan Form 5081

Timely submission of the Michigan Form 5081 is critical to avoid penalties. The filing deadlines typically align with the reporting period, which can be monthly, quarterly, or annually, depending on the volume of sales. It is important to check the specific deadlines for your business type to ensure compliance.

Form Submission Methods for Michigan Form 5081

The Michigan Form 5081 can be submitted through various methods to accommodate different business needs. Options include:

- Online Submission: Many businesses prefer to file electronically through the Michigan Department of Treasury's online portal.

- Mail: Completed forms can be mailed to the appropriate address provided by the state.

- In-Person: Businesses may also choose to submit the form in person at designated state offices.

Quick guide on how to complete wwwmichigangovtreasury04679712175939treasury treasury and taxes forms michigan

Complete Www michigan govtreasury0,4679,712175939TREASURY Treasury And Taxes Forms Michigan effortlessly on any device

Managing documents online has gained immense popularity among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can easily locate the necessary form and securely archive it online. airSlate SignNow provides all the resources required to create, alter, and electronically sign your documents swiftly without delays. Handle Www michigan govtreasury0,4679,712175939TREASURY Treasury And Taxes Forms Michigan on any device using the airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to alter and electronically sign Www michigan govtreasury0,4679,712175939TREASURY Treasury And Taxes Forms Michigan with ease

- Locate Www michigan govtreasury0,4679,712175939TREASURY Treasury And Taxes Forms Michigan and click Get Form to begin.

- Use the tools we offer to fill out your form.

- Emphasize signNow sections of the documents or conceal sensitive information with tools provided by airSlate SignNow designed for that purpose.

- Create your electronic signature with the Sign feature, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your modifications.

- Choose how you wish to submit your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management requirements in just a few clicks from your chosen device. Edit and electronically sign Www michigan govtreasury0,4679,712175939TREASURY Treasury And Taxes Forms Michigan and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct wwwmichigangovtreasury04679712175939treasury treasury and taxes forms michigan

Create this form in 5 minutes!

How to create an eSignature for the wwwmichigangovtreasury04679712175939treasury treasury and taxes forms michigan

How to make an e-signature for your PDF online

How to make an e-signature for your PDF in Google Chrome

The way to generate an electronic signature for signing PDFs in Gmail

How to create an electronic signature from your smartphone

The best way to make an electronic signature for a PDF on iOS

How to create an electronic signature for a PDF file on Android

People also ask

-

What is the Michigan Form 5081?

The Michigan Form 5081 is a tax form used for the reporting of various state withholding activities. It is essential for businesses to ensure compliance with Michigan tax laws. Understanding how to fill out and submit the Michigan Form 5081 correctly can save time and prevent potential penalties.

-

How can airSlate SignNow help with Michigan Form 5081?

airSlate SignNow provides an efficient platform to send, receive, and eSign the Michigan Form 5081 securely. This not only streamlines the compliance process but also reduces the time spent on document management. By using airSlate SignNow, you can ensure that your Michigan Form 5081 is completed and signed by all necessary parties quickly.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers various pricing plans to cater to different business needs, including a plan specifically tailored for users handling documents like the Michigan Form 5081. Pricing is designed to be cost-effective, ensuring that businesses can efficiently manage their document signing needs without breaking the bank. You can choose from monthly or annual subscriptions based on your requirements.

-

What features does airSlate SignNow provide for eSigning the Michigan Form 5081?

airSlate SignNow offers features such as customizable templates, multiple signing workflows, and real-time tracking for eSigning the Michigan Form 5081. These features enhance the efficiency of document handling while ensuring that all required signatures are collected promptly. It's designed to simplify the eSigning process, making compliance easier for businesses.

-

Are there any integrations available with airSlate SignNow for processing Michigan Form 5081?

Yes, airSlate SignNow integrates seamlessly with many popular applications, enhancing your workflow when processing the Michigan Form 5081. You can integrate with tools like Google Drive, Microsoft Office, and various CRM systems. This allows for smoother data transfer and documentation management, optimizing your business's efficiency.

-

Is airSlate SignNow compliant with Michigan regulations for the Form 5081?

airSlate SignNow is designed to adhere to the requirements set forth by Michigan regulations for the Form 5081. The platform employs robust security measures to ensure that all eSignatures and documents are legally binding. Compliance with state regulations is a priority to help you avoid any legal issues with your forms.

-

What are the benefits of using airSlate SignNow for Michigan businesses?

Using airSlate SignNow offers numerous benefits for Michigan businesses, including efficiency, security, and ease of use when dealing with forms like the Michigan Form 5081. The platform enhances collaboration by allowing multiple signers to seamlessly engage with documents. Additionally, businesses can save costs associated with traditional document management methods.

Get more for Www michigan govtreasury0,4679,712175939TREASURY Treasury And Taxes Forms Michigan

- Mississippi beneficiary form

- Quitclaim deed from husband and wife to an individual mississippi form

- Warranty deed from husband and wife to an individual mississippi form

- Mississippi probate form

- Petition to close estate and discharge executrix mississippi form

- Conservators oath for co conservators mississippi form

- Retainer form agreement

- Mississippi husband form

Find out other Www michigan govtreasury0,4679,712175939TREASURY Treasury And Taxes Forms Michigan

- Sign Maine Applicant Appraisal Form Questions Secure

- Sign Wisconsin Applicant Appraisal Form Questions Easy

- Sign Alabama Deed of Indemnity Template Later

- Sign Alabama Articles of Incorporation Template Secure

- Can I Sign Nevada Articles of Incorporation Template

- Sign New Mexico Articles of Incorporation Template Safe

- Sign Ohio Articles of Incorporation Template Simple

- Can I Sign New Jersey Retainer Agreement Template

- Sign West Virginia Retainer Agreement Template Myself

- Sign Montana Car Lease Agreement Template Fast

- Can I Sign Illinois Attorney Approval

- Sign Mississippi Limited Power of Attorney Later

- How Can I Sign Kansas Attorney Approval

- How Do I Sign New Mexico Limited Power of Attorney

- Sign Pennsylvania Car Lease Agreement Template Simple

- Sign Rhode Island Car Lease Agreement Template Fast

- Sign Indiana Unlimited Power of Attorney Online

- Can I Sign Idaho Affidavit of No Lien

- Sign New York Affidavit of No Lien Online

- How To Sign Delaware Trademark License Agreement