Guest Services Fast Pay 2023-2026

Understanding MI Form 5081 for 2023

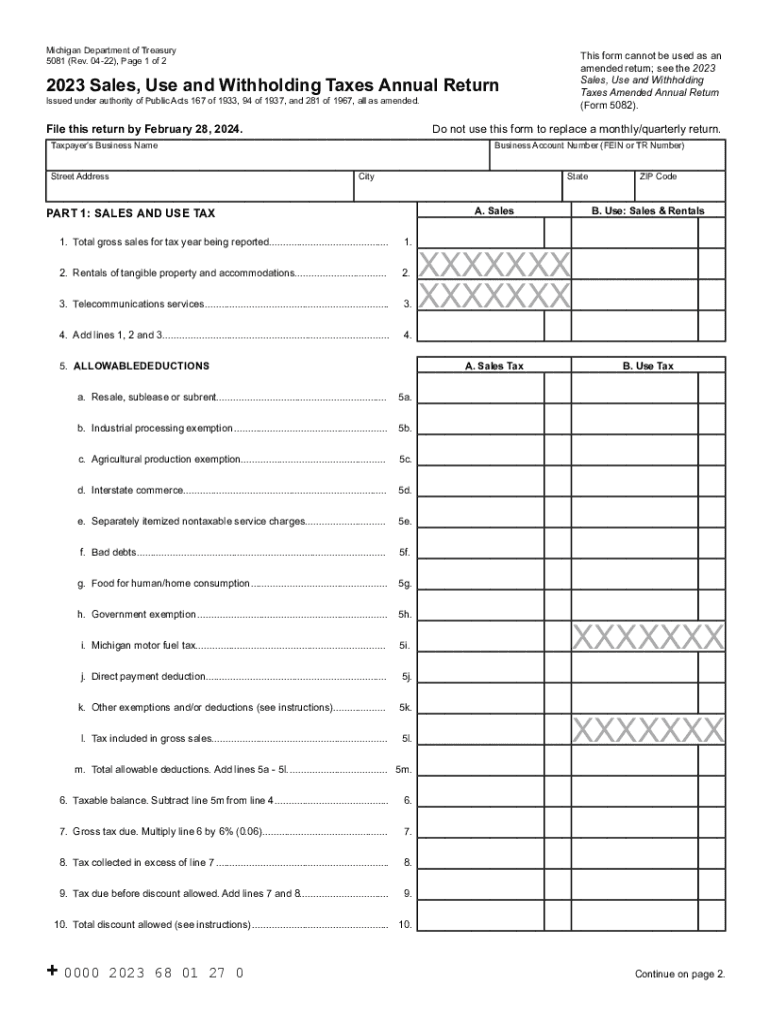

MI Form 5081, also known as the Michigan Annual Sales, Use, and Withholding Tax Form, is essential for businesses operating in Michigan. This form is used to report sales and use taxes, as well as withholding taxes, for the previous year. For 2023, it is crucial for businesses to accurately complete this form to ensure compliance with state tax regulations.

Steps to Complete MI Form 5081 for 2023

Completing MI Form 5081 involves several key steps:

- Gather all necessary financial records, including sales receipts and tax collected.

- Calculate total sales and the corresponding sales tax due for the reporting period.

- Determine any use tax owed on purchases made without paying sales tax.

- Complete each section of the form, ensuring all figures are accurate.

- Review the form for completeness and accuracy before submission.

Filing Deadlines for MI Form 5081

For 2023, the filing deadline for MI Form 5081 is typically set for January 31 of the following year. It is important for businesses to submit the form on time to avoid penalties. Keeping track of this deadline ensures compliance with Michigan tax laws and helps maintain good standing with the state.

Required Documents for Submission

When preparing to file MI Form 5081, businesses should have the following documents ready:

- Sales records for the year, including invoices and receipts.

- Documentation of any use tax paid on purchases.

- Records of withholding tax collected from employees.

- Any previous tax filings that may be relevant for reference.

Form Submission Methods

MI Form 5081 can be submitted through various methods:

- Online submission via the Michigan Department of Treasury's e-filing system.

- Mailing a paper copy of the completed form to the appropriate state address.

- In-person submission at designated state tax offices, if necessary.

Penalties for Non-Compliance

Failure to file MI Form 5081 on time or inaccuracies in reporting can lead to significant penalties. These may include:

- Late filing fees, which can accumulate over time.

- Interest on unpaid taxes.

- Potential audits by the Michigan Department of Treasury.

Eligibility Criteria for Filing MI Form 5081

To file MI Form 5081, businesses must meet specific eligibility criteria, including:

- Being registered with the Michigan Department of Treasury for sales and use tax.

- Having a physical presence or nexus in Michigan.

- Collecting sales tax from customers during the reporting period.

Quick guide on how to complete guest services fast pay

Effortlessly Prepare Guest Services Fast Pay on Any Device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, allowing you to access the necessary forms and securely store them online. airSlate SignNow provides you with all the tools required to create, edit, and eSign your documents swiftly without any delays. Manage Guest Services Fast Pay on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The easiest way to modify and eSign Guest Services Fast Pay effortlessly

- Find Guest Services Fast Pay and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Highlight crucial sections of the documents or obscure sensitive information with the tools that airSlate SignNow provides specifically for this purpose.

- Create your eSignature with the Sign tool, which takes seconds and has the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select how you wish to send your form, whether by email, SMS, invite link, or download it to your computer.

Forget about lost or mislaid documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from your preferred device. Edit and eSign Guest Services Fast Pay and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct guest services fast pay

Create this form in 5 minutes!

How to create an eSignature for the guest services fast pay

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 2015 Michigan 5081 form?

The 2015 Michigan 5081 form is a signNow tax document used for reporting various tax liabilities in the state of Michigan. It includes essential information required for accurate tax reporting and helps ensure compliance with state tax regulations.

-

How can airSlate SignNow help with the 2015 Michigan 5081 form?

airSlate SignNow simplifies the process of completing and submitting the 2015 Michigan 5081 form. With our intuitive eSigning capabilities, you can fill out the form electronically, ensuring accuracy and saving time during tax season.

-

Is there a cost associated with using the airSlate SignNow for the 2015 Michigan 5081 form?

Yes, airSlate SignNow offers various pricing plans to accommodate different needs. Our cost-effective solution provides excellent value, especially when managing documents like the 2015 Michigan 5081 form, allowing you to eSign and send documents efficiently.

-

What features does airSlate SignNow offer for the 2015 Michigan 5081 form?

airSlate SignNow includes features that make handling the 2015 Michigan 5081 form easy, such as document automation, customizable templates, and secure eSignature options. These features enable you to manage your paperwork without complexities.

-

Can I integrate airSlate SignNow with other software for the 2015 Michigan 5081 form?

Absolutely! airSlate SignNow can seamlessly integrate with various applications, making it easy to access and complete the 2015 Michigan 5081 form from your preferred business tools. This integration streamlines the workflow and maintains data accuracy.

-

Is airSlate SignNow secure for handling the 2015 Michigan 5081 form?

Yes, security is a top priority at airSlate SignNow. Our platform uses advanced encryption and compliance measures to ensure that your 2015 Michigan 5081 form and any other documents you manage are kept confidential and secure.

-

Can multiple users collaborate on the 2015 Michigan 5081 form using airSlate SignNow?

Yes, airSlate SignNow allows multiple users to collaborate on the 2015 Michigan 5081 form simultaneously. This feature makes it easier for teams to review and finalize important documents together, enhancing productivity.

Get more for Guest Services Fast Pay

- Alternative horsemanship with samantha harvey clinic form

- Stallion service contract best advice form

- Trainers facility use agreement fireline farms form

- And whereas lessee desires to lease said mare for purposes of breeding and producing a foal form

- Principal owners or officers are form

- Lion king baby shower invitation template fill online form

- Wc 200b fillable online request objection for change form

- Site map bader scott injury lawyers form

Find out other Guest Services Fast Pay

- Sign Nebraska Courts Limited Power Of Attorney Now

- eSign Car Dealer Form Idaho Online

- How To eSign Hawaii Car Dealer Contract

- How To eSign Hawaii Car Dealer Living Will

- How Do I eSign Hawaii Car Dealer Living Will

- eSign Hawaii Business Operations Contract Online

- eSign Hawaii Business Operations LLC Operating Agreement Mobile

- How Do I eSign Idaho Car Dealer Lease Termination Letter

- eSign Indiana Car Dealer Separation Agreement Simple

- eSign Iowa Car Dealer Agreement Free

- eSign Iowa Car Dealer Limited Power Of Attorney Free

- eSign Iowa Car Dealer Limited Power Of Attorney Fast

- eSign Iowa Car Dealer Limited Power Of Attorney Safe

- How Can I eSign Iowa Car Dealer Limited Power Of Attorney

- How To eSign Illinois Business Operations Stock Certificate

- Can I eSign Louisiana Car Dealer Quitclaim Deed

- eSign Michigan Car Dealer Operating Agreement Mobile

- Can I eSign Mississippi Car Dealer Resignation Letter

- eSign Missouri Car Dealer Lease Termination Letter Fast

- Help Me With eSign Kentucky Business Operations Quitclaim Deed