5081, Sales, Use and Withholding Taxes Annual Return 2020

What is the 5081, Sales, Use And Withholding Taxes Annual Return

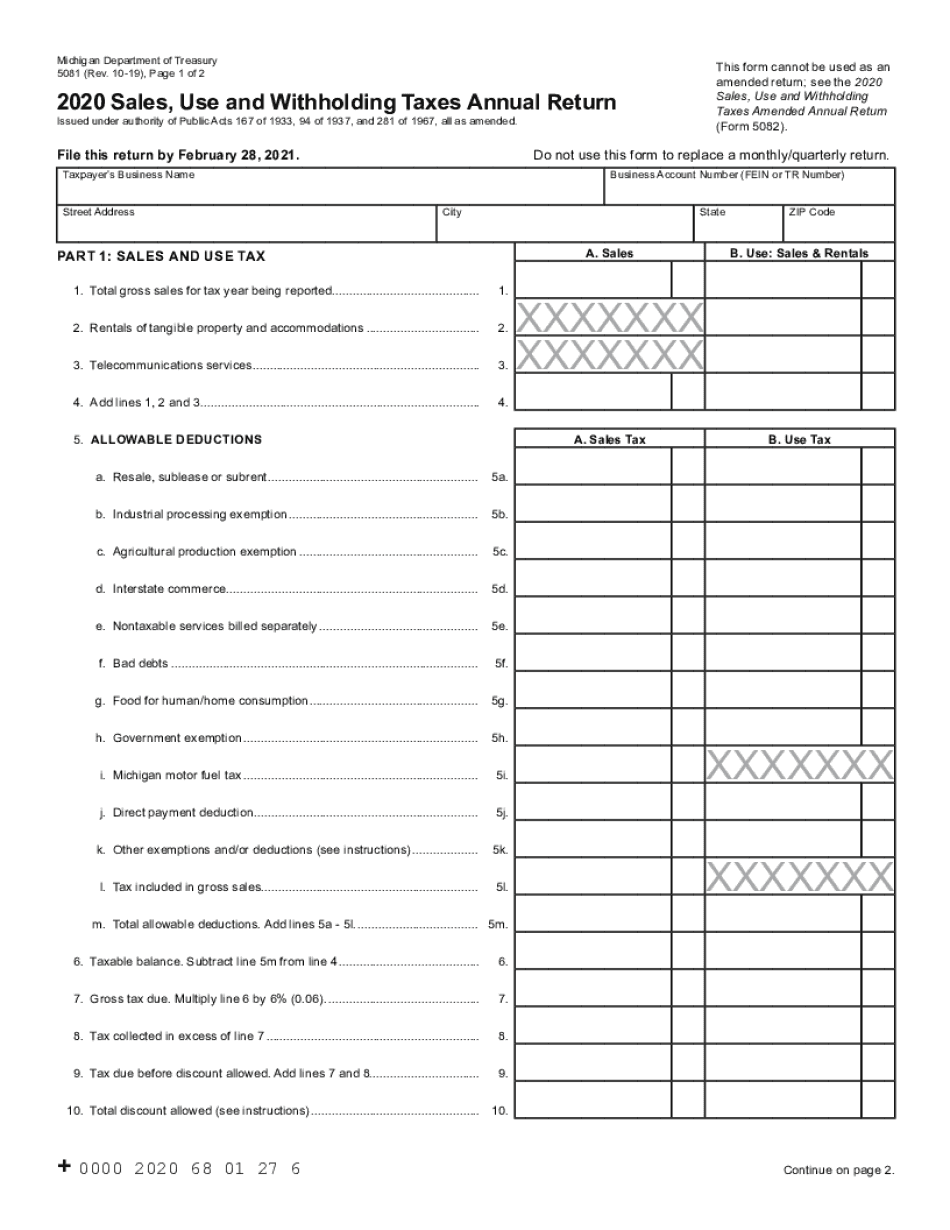

The state of Michigan form 5081, also known as the Sales, Use And Withholding Taxes Annual Return, is a crucial document for businesses operating within the state. This form is designed to report sales, use, and withholding taxes collected over the previous year. It provides the Michigan Department of Treasury with essential information regarding a business's tax obligations, ensuring compliance with state tax laws. The 5081 form is typically required for businesses that have collected sales tax, use tax, or withholding tax from their customers or employees.

Steps to Complete the 5081, Sales, Use And Withholding Taxes Annual Return

Completing the Michigan form 5081 involves several key steps to ensure accuracy and compliance. First, gather all necessary financial records, including sales receipts and tax collected. Next, accurately fill out each section of the form, detailing the total sales, use tax, and withholding tax amounts. Be sure to double-check all calculations to avoid errors. After completing the form, review it for completeness and accuracy before submitting it to the Michigan Department of Treasury. Finally, retain a copy of the submitted form for your records.

Legal Use of the 5081, Sales, Use And Withholding Taxes Annual Return

The legal use of the Michigan form 5081 is governed by state tax regulations. This form must be completed and submitted by businesses that meet specific criteria, such as collecting sales tax or withholding tax. The information provided on the 5081 form is legally binding, and inaccuracies can lead to penalties or audits by tax authorities. It is essential for businesses to ensure that they are using the most current version of the form and adhering to all filing requirements to maintain compliance with Michigan tax laws.

Filing Deadlines / Important Dates

Filing deadlines for the Michigan form 5081 are crucial for businesses to note. Typically, the form must be submitted annually, with the due date falling on January 31 of the following year for the previous calendar year's tax activity. It is important for businesses to stay informed about any changes to these deadlines, as late submissions can result in penalties and interest charges. Keeping a calendar of important tax dates can help ensure timely filing and compliance.

Form Submission Methods (Online / Mail / In-Person)

Businesses have several options for submitting the Michigan form 5081. The form can be filed online through the Michigan Department of Treasury's e-filing system, which offers a convenient and efficient way to submit tax returns. Alternatively, businesses may choose to mail the completed form to the designated address provided by the department. In-person submissions are also accepted at local treasury offices. Each submission method has its own processing times, so businesses should plan accordingly to ensure timely compliance.

Penalties for Non-Compliance

Failure to comply with the filing requirements for the Michigan form 5081 can lead to significant penalties. Businesses that do not submit the form by the deadline may incur late fees and interest on any unpaid taxes. Additionally, repeated non-compliance can result in more severe consequences, including audits and potential legal action by the state. It is essential for businesses to understand these penalties and take proactive steps to ensure timely and accurate filing to avoid unnecessary financial burdens.

Quick guide on how to complete 5081 sales use and withholding taxes annual return

Finish 5081, Sales, Use And Withholding Taxes Annual Return effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers a fantastic environmentally friendly substitute for traditional printed and signed documents, as you can easily locate the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, modify, and eSign your documents quickly without interruptions. Handle 5081, Sales, Use And Withholding Taxes Annual Return on any device with airSlate SignNow Android or iOS applications and streamline any document-related process today.

The easiest way to modify and eSign 5081, Sales, Use And Withholding Taxes Annual Return seamlessly

- Locate 5081, Sales, Use And Withholding Taxes Annual Return and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Select important sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Decide how you'd like to send your form, via email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow fulfills all your document management needs within a few clicks from any device you choose. Modify and eSign 5081, Sales, Use And Withholding Taxes Annual Return and guarantee excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 5081 sales use and withholding taxes annual return

Create this form in 5 minutes!

How to create an eSignature for the 5081 sales use and withholding taxes annual return

The best way to create an eSignature for a PDF file online

The best way to create an eSignature for a PDF file in Google Chrome

The best way to create an electronic signature for signing PDFs in Gmail

The way to generate an electronic signature from your mobile device

The way to generate an eSignature for a PDF file on iOS

The way to generate an electronic signature for a PDF file on Android devices

People also ask

-

What is the state of michigan form 5081?

The state of michigan form 5081 is a specific form used for various government purposes. It typically relates to the filing and documentation requirements in Michigan. Utilizing airSlate SignNow, you can easily fill out, eSign, and submit this form online, streamlining your experience.

-

How can I access the state of michigan form 5081 through airSlate SignNow?

You can access the state of michigan form 5081 directly through airSlate SignNow's user-friendly platform. Simply log in or create an account, navigate to the forms section, and search for 'state of michigan form 5081.' This enables quick access and efficient management of your document needs.

-

Are there any costs associated with using airSlate SignNow for the state of michigan form 5081?

airSlate SignNow offers various pricing plans, including a free trial, making it easy for you to start using the platform for the state of michigan form 5081 without any upfront costs. Once you're ready, you can choose a plan that meets your business needs and budget.

-

What features does airSlate SignNow offer for managing the state of michigan form 5081?

airSlate SignNow provides a range of features to manage the state of michigan form 5081 efficiently, including customizable templates, eSignature capabilities, and secure cloud storage. These features allow for easy editing, signing, and tracking of your forms all in one place.

-

Can I integrate airSlate SignNow with other software for handling the state of michigan form 5081?

Yes, airSlate SignNow offers seamless integrations with various software solutions, enhancing your ability to manage the state of michigan form 5081 alongside your existing tools. This integration capability allows for a streamlined workflow and improved efficiency.

-

What benefits does airSlate SignNow provide for signing the state of michigan form 5081?

Using airSlate SignNow to sign the state of michigan form 5081 comes with several benefits, including convenience, speed, and legal compliance. The eSignature feature ensures that your documents are securely signed and can be completed from anywhere, saving you time and resources.

-

How does airSlate SignNow ensure the security of my state of michigan form 5081?

airSlate SignNow prioritizes your security by implementing robust encryption protocols and secure storage solutions for the state of michigan form 5081. This means that your sensitive information is well-protected and only accessible to authorized individuals.

Get more for 5081, Sales, Use And Withholding Taxes Annual Return

- Full satisfaction of claim for lien by individual wisconsin form

- Landlord tenant notice 497430578 form

- Landlord tenant remove 497430579 form

- Letter from tenant to landlord containing notice that premises in uninhabitable in violation of law and demand immediate repair 497430580 form

- Wisconsin landlord notice form

- Wi letter landlord form

- Letter tenant landlord agreement 497430583 form

- Wisconsin tenant landlord form

Find out other 5081, Sales, Use And Withholding Taxes Annual Return

- Electronic signature Alabama High Tech Stock Certificate Fast

- Electronic signature Insurance Document California Computer

- Electronic signature Texas Education Separation Agreement Fast

- Electronic signature Idaho Insurance Letter Of Intent Free

- How To Electronic signature Idaho Insurance POA

- Can I Electronic signature Illinois Insurance Last Will And Testament

- Electronic signature High Tech PPT Connecticut Computer

- Electronic signature Indiana Insurance LLC Operating Agreement Computer

- Electronic signature Iowa Insurance LLC Operating Agreement Secure

- Help Me With Electronic signature Kansas Insurance Living Will

- Electronic signature Insurance Document Kentucky Myself

- Electronic signature Delaware High Tech Quitclaim Deed Online

- Electronic signature Maine Insurance Quitclaim Deed Later

- Electronic signature Louisiana Insurance LLC Operating Agreement Easy

- Electronic signature West Virginia Education Contract Safe

- Help Me With Electronic signature West Virginia Education Business Letter Template

- Electronic signature West Virginia Education Cease And Desist Letter Easy

- Electronic signature Missouri Insurance Stock Certificate Free

- Electronic signature Idaho High Tech Profit And Loss Statement Computer

- How Do I Electronic signature Nevada Insurance Executive Summary Template