Michigan 5081 Form 2017

What is the Michigan 5081 Form

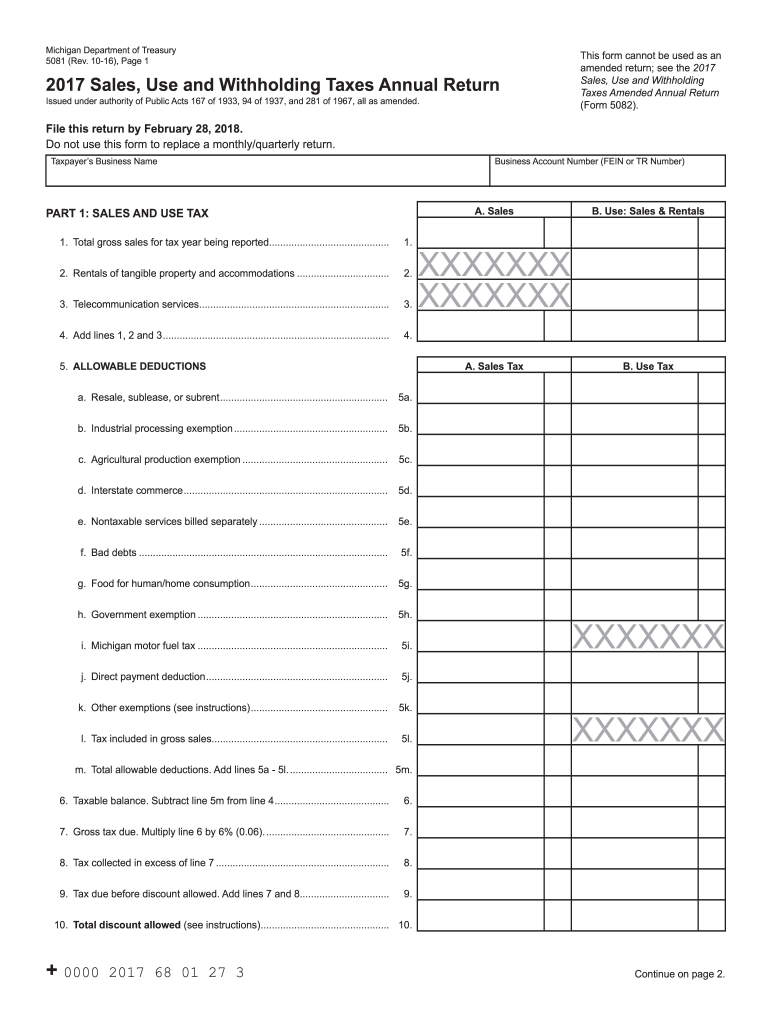

The Michigan 5081 Form is a tax document used by individuals and businesses in the state of Michigan to report certain income and tax information. This form is essential for ensuring compliance with state tax regulations and is typically required for specific tax filings. It serves to collect information that helps the Michigan Department of Treasury assess tax liabilities accurately. Understanding the purpose of the Michigan 5081 Form is crucial for taxpayers to fulfill their obligations and avoid potential penalties.

Steps to complete the Michigan 5081 Form

Completing the Michigan 5081 Form involves several key steps to ensure accuracy and compliance. First, gather all necessary financial documents, including income statements and previous tax returns. Next, fill out the form by entering your personal information, income details, and any applicable deductions or credits. It is important to double-check all entries for accuracy. After completing the form, sign it using a legally accepted eSignature or traditional signature. Finally, submit the form either online, by mail, or in person, depending on your preference and the guidelines provided by the Michigan Department of Treasury.

How to obtain the Michigan 5081 Form

The Michigan 5081 Form can be obtained through the Michigan Department of Treasury's official website. It is available for download in a fillable PDF format, allowing taxpayers to complete the form electronically. Additionally, physical copies may be available at local tax offices or through authorized tax preparers. Ensuring you have the correct version of the form is important, as updates may occur annually or in response to changes in tax law.

Legal use of the Michigan 5081 Form

The legal use of the Michigan 5081 Form is governed by state tax laws and regulations. It is essential for taxpayers to complete and submit the form accurately to avoid legal complications. The form must be signed and submitted within the specified deadlines to be considered valid. Utilizing an eSignature for submission is permissible under the Electronic Signatures in Global and National Commerce (ESIGN) Act, provided that all other requirements are met. Understanding these legal aspects ensures that taxpayers can confidently manage their tax responsibilities.

Form Submission Methods

The Michigan 5081 Form can be submitted through various methods to accommodate different taxpayer preferences. Options include:

- Online Submission: Taxpayers can submit the form electronically through the Michigan Department of Treasury's online portal.

- Mail: Completed forms can be mailed to the appropriate address listed on the form or the Michigan Department of Treasury's website.

- In-Person: Individuals may also choose to submit the form in person at designated tax offices or during tax assistance events.

Filing Deadlines / Important Dates

Filing deadlines for the Michigan 5081 Form are critical for compliance. Typically, the form must be submitted by April fifteenth for individual taxpayers, aligning with the federal tax filing deadline. However, specific deadlines may vary based on individual circumstances, such as extensions or special cases. Staying informed about these dates is essential to avoid penalties and ensure timely processing of tax returns.

Quick guide on how to complete michigan 5081 form 2017

Your assistance manual on how to prepare your Michigan 5081 Form

If you wish to understand how to finalize and submit your Michigan 5081 Form, here are several brief guidelines on making tax submission simpler.

First, you only need to create your airSlate SignNow account to transform your document handling online. airSlate SignNow is an extremely user-friendly and powerful document service that enables you to modify, generate, and complete your tax forms effortlessly. With its editor, you can toggle between text, check boxes, and eSignatures and return to update answers as needed. Optimize your tax oversight with advanced PDF editing, eSigning, and easy sharing.

Adhere to the instructions below to finalize your Michigan 5081 Form in just a few minutes:

- Establish your account and start working on PDFs in just a few minutes.

- Utilize our directory to find any IRS tax form; explore different versions and schedules.

- Select Get form to access your Michigan 5081 Form in our editor.

- Complete the necessary fields with your details (text, numbers, check marks).

- Employ the Sign Tool to insert your legally-binding eSignature (if needed).

- Review your document and rectify any errors.

- Save changes, print your copy, send it to your recipient, and download it to your device.

Utilize this manual to submit your taxes electronically with airSlate SignNow. Keep in mind that paper submissions can lead to return errors and slow down reimbursements. Additionally, before e-filing your taxes, verify the IRS website for submission guidelines specific to your state.

Create this form in 5 minutes or less

Find and fill out the correct michigan 5081 form 2017

FAQs

-

How do I fill out the CAT Application Form 2017?

CAT 2017 registration opened on August 9, 2017 will close on September 20 at 5PM. CAT online registration form and application form is a single document divided in 5 pages and is to be completed online. The 1st part of CAT online registration form requires your personal details. After completing your online registration, IIMs will send you CAT 2017 registration ID. With this unique ID, you will login to online registration form which will also contain application form and registration form.CAT Registration and application form will require you to fill up your academic details, uploading of photograph, signature and requires category certificates as per the IIMs prescribed format for CAT registration. CAT online application form 2017 consists of programme details on all the 20 IIMs. Candidates have to tick by clicking on the relevant programmes of the IIMs for which they wish to attend the personal Interview Process.

-

How do I fill out the Delhi Polytechnic 2017 form?

Delhi Polytechnic (CET DELHI) entrance examination form has been published. You can visit Welcome to CET Delhi and fill the online form. For more details you can call @ 7042426818

-

How do I fill out the SSC CHSL 2017-18 form?

Its very easy task, you have to just put this link in your browser SSC, this page will appearOn this page click on Apply buttonthere a dialog box appears, in that dialog box click on CHSL a link will come “ Click here to apply” and you will signNow to registration page.I hope you all have understood the procedure. All the best for your exam

-

How do I fill out the UPSEAT 2017 application forms?

UPESEAT is a placement test directed by the University of Petroleum and Energy Studies. This inclination examination is called as the University of Petroleum and Energy Studies Engineering Entrance Test (UPESEAT). It is essentially an essential sort examination which permits the possibility to apply for the different designing projects on the web. visit - HOW TO FILL THE UPSEAT 2017 APPLICATION FORMS

-

How do I fill out the JEE Advanced 2017 application form?

JEE Advanced Application Form 2017 is now available for all eligible candidates from April 28 to May 2, 2017 (5 PM). Registrations with late fee will be open from May 3 to May 4, 2017. The application form of JEE Advanced 2017 has been released only in online mode. visit - http://www.entrancezone.com/engi...

-

How can I fill out an improvement form of the CBSE 2017?

IN the month of August the application form will be available on cbse official website which you have to fill online then it will ask in which you subject you want to apply for improvement…you can select all subjects and additional subjects also then you have to pay the amount for improvement exam which you have to pay at bank. take the print out of the acknowledgement and the e-challan and deposit the fees at bank… you also have to change your region when you type the pin code then according to that you will get your centre as well as new region means you region will change. it don't effect anything. after all these thing you have to send a xerox copy of your marksheet e-challan acknowledgement to the regional office which you get. the address will be returned on the acknowledgement after that you have to wait to get your admit card which you will get online on month of February…and improvement marksheet will be send to you address which you fill at time of applications form filling time. if you get less marks in improvement then old marksheet will be valid soAll The Best

Create this form in 5 minutes!

How to create an eSignature for the michigan 5081 form 2017

How to generate an eSignature for the Michigan 5081 Form 2017 in the online mode

How to generate an electronic signature for the Michigan 5081 Form 2017 in Google Chrome

How to generate an electronic signature for signing the Michigan 5081 Form 2017 in Gmail

How to make an eSignature for the Michigan 5081 Form 2017 straight from your mobile device

How to make an electronic signature for the Michigan 5081 Form 2017 on iOS devices

How to create an electronic signature for the Michigan 5081 Form 2017 on Android devices

People also ask

-

What is the Michigan 5081 Form?

The Michigan 5081 Form is used for various business purposes, particularly for reporting taxes and compliance with state regulations. Understanding how to properly fill out and submit the Michigan 5081 Form is crucial for business owners in Michigan to avoid potential penalties.

-

How can airSlate SignNow help with the Michigan 5081 Form?

airSlate SignNow streamlines the process of sending and eSigning the Michigan 5081 Form, making it faster and more efficient. With our platform, you can effortlessly ensure that documents are securely signed and stored, simplifying compliance tasks.

-

Is the airSlate SignNow service cost-effective for managing the Michigan 5081 Form?

Yes, airSlate SignNow offers a cost-effective solution for managing documents like the Michigan 5081 Form. Our pricing plans are designed to fit businesses of all sizes, ensuring you get the most value without compromising on quality.

-

What features does airSlate SignNow provide for the Michigan 5081 Form?

airSlate SignNow includes features such as customizable templates, real-time tracking, and secure eSignatures, all of which enhance the efficiency of handling the Michigan 5081 Form. These features allow you to manage your documentation securely and effectively.

-

Can airSlate SignNow integrate with other software for Michigan 5081 Form submissions?

Absolutely! airSlate SignNow integrates seamlessly with various CRM and productivity applications, facilitating easy management of the Michigan 5081 Form. This integration ensures smooth workflows and enhanced productivity across different platforms.

-

What are the benefits of using airSlate SignNow for the Michigan 5081 Form?

Using airSlate SignNow for the Michigan 5081 Form offers numerous benefits, including improved turnaround times, increased document security, and enhanced compliance tracking. These advantages help businesses operate more efficiently while ensuring all documentation is handled correctly.

-

How secure is airSlate SignNow for managing the Michigan 5081 Form?

airSlate SignNow employs industry-standard security measures to safeguard documents, including the Michigan 5081 Form. Our platform utilizes encryption and secure cloud storage to ensure that your sensitive information is protected at all times.

Get more for Michigan 5081 Form

- Ssa 581 scibew neca trust funds scibew neca form

- Western dental doctors note form

- Flowchart process exclusion revocation form 3m

- Nj 1040 fileyourtaxes com form

- Applicant fingerprint transaction follow up request form

- Motion for social study lanwt form

- Business loan application 042011 form

- Fax purchase order persian tradition wine form

Find out other Michigan 5081 Form

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document

- How To Sign Nevada Legal Document

- Can I Sign Nevada Legal Form

- How Do I Sign New Jersey Legal Word

- Help Me With Sign New York Legal Document

- How Do I Sign Texas Insurance Document

- How Do I Sign Oregon Legal PDF

- How To Sign Pennsylvania Legal Word

- How Do I Sign Wisconsin Legal Form

- Help Me With Sign Massachusetts Life Sciences Presentation

- How To Sign Georgia Non-Profit Presentation

- Can I Sign Nevada Life Sciences PPT

- Help Me With Sign New Hampshire Non-Profit Presentation

- How To Sign Alaska Orthodontists Presentation

- Can I Sign South Dakota Non-Profit Word

- Can I Sign South Dakota Non-Profit Form