PDF Instructions Kentucky Department of Revenue Form

What is the Kentucky Form K-765?

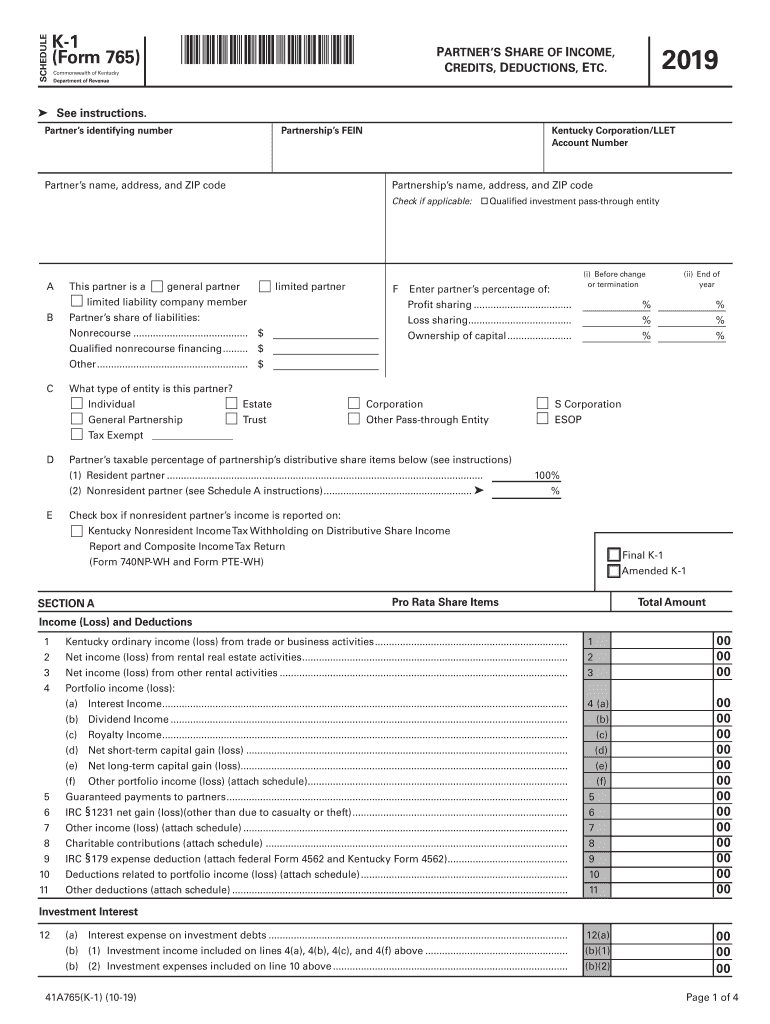

The Kentucky Form K-765 is a tax document used for reporting income received by partners in a partnership. This form is essential for individuals who are part of a partnership and need to report their share of income, deductions, and credits on their personal tax returns. It is part of the Kentucky income tax filing process and ensures that partners accurately report their earnings to the Kentucky Department of Revenue.

Key Elements of the Kentucky Form K-765

The Kentucky Form K-765 includes several important sections that must be completed accurately. Key elements include:

- Partner Information: This section requires the names, addresses, and Social Security numbers of all partners involved.

- Income Reporting: Partners must report their share of the partnership's income, losses, and other relevant financial details.

- Deductions and Credits: This section allows partners to claim any applicable deductions or credits that may reduce their overall tax liability.

- Signature Section: Each partner must sign the form to validate the information provided.

Steps to Complete the Kentucky Form K-765

Completing the Kentucky Form K-765 involves several steps to ensure accuracy and compliance:

- Gather necessary documents, including partnership agreements and financial statements.

- Fill out the partner information section with accurate details for each partner.

- Report income, losses, and deductions as per the partnership's financial records.

- Review the form for accuracy, ensuring all required sections are completed.

- Obtain signatures from all partners to validate the form.

- Submit the completed form to the Kentucky Department of Revenue by the specified deadline.

Form Submission Methods for the Kentucky K-765

The Kentucky Form K-765 can be submitted through various methods to accommodate different preferences:

- Online Submission: Partners may be able to file the form electronically through the Kentucky Department of Revenue's online portal.

- Mail Submission: The completed form can be printed and mailed to the appropriate address provided by the Kentucky Department of Revenue.

- In-Person Submission: Partners may also choose to submit the form in person at designated tax offices.

Filing Deadlines for the Kentucky Form K-765

Timely filing of the Kentucky Form K-765 is crucial to avoid penalties. The filing deadline typically aligns with the federal tax return due date, which is usually April 15. However, if the due date falls on a weekend or holiday, the deadline may be extended to the next business day. It is important for partners to stay informed about any changes to these deadlines to ensure compliance.

Legal Use of the Kentucky Form K-765

The Kentucky Form K-765 is legally binding and must be completed in accordance with state tax laws. Failure to accurately report income or submit the form on time can result in penalties, including fines and interest on unpaid taxes. It is essential for partners to understand their legal obligations when completing and submitting this form to avoid any complications with the Kentucky Department of Revenue.

Quick guide on how to complete pdf instructions kentucky department of revenue

Complete PDF Instructions Kentucky Department Of Revenue effortlessly on any device

Online document management has gained signNow traction among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to access the correct form and securely save it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Manage PDF Instructions Kentucky Department Of Revenue on any platform using the airSlate SignNow Android or iOS applications and simplify any document-related procedure today.

How to edit and eSign PDF Instructions Kentucky Department Of Revenue with ease

- Obtain PDF Instructions Kentucky Department Of Revenue and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature using the Sign tool, which takes just seconds and holds the same legal validity as a traditional ink signature.

- Review the information and click on the Done button to save your changes.

- Select your preferred method to send your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Put an end to lost or mislaid documents, frustrating form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Edit and eSign PDF Instructions Kentucky Department Of Revenue and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the pdf instructions kentucky department of revenue

The best way to generate an electronic signature for your PDF document in the online mode

The best way to generate an electronic signature for your PDF document in Chrome

The way to make an electronic signature for putting it on PDFs in Gmail

How to make an electronic signature straight from your mobile device

The way to make an electronic signature for a PDF document on iOS devices

How to make an electronic signature for a PDF document on Android devices

People also ask

-

What is the ky 765 form?

The ky 765 form is a specific document used in Kentucky for various formal transactions. It is essential for businesses and individuals to understand how to correctly fill out and submit this form to ensure compliance with state regulations.

-

How does airSlate SignNow simplify the usage of the ky 765 form?

airSlate SignNow provides an intuitive platform for eSigning and sending documents like the ky 765 form. With user-friendly features, you can easily upload, complete, and send the form, eliminating the hassle of manual paperwork.

-

Is there a cost associated with using airSlate SignNow for the ky 765 form?

Yes, there is a pricing structure for using airSlate SignNow that varies based on the features you need. However, the service is known for being cost-effective, especially when handling documents like the ky 765 form frequently.

-

Can I integrate airSlate SignNow with other software for handling the ky 765 form?

Absolutely! airSlate SignNow offers integrations with various popular applications. This allows you to easily manage the ky 765 form alongside your other important documents and workflows.

-

What are the security features for the ky 765 form in airSlate SignNow?

airSlate SignNow prioritizes security, ensuring that your ky 765 form and any other documents are protected. It includes encryption, user authentication, and compliance with regulatory standards to safeguard your data.

-

Can I track the status of my ky 765 form after sending it through airSlate SignNow?

Yes, airSlate SignNow provides real-time tracking for all documents sent, including the ky 765 form. You can easily monitor when the document is viewed, signed, or completed, keeping you informed throughout the process.

-

What are the benefits of using airSlate SignNow for the ky 765 form?

Using airSlate SignNow for the ky 765 form streamlines your document management process. It helps save time, reduce errors, and enhances overall efficiency, making it easier to complete important transactions.

Get more for PDF Instructions Kentucky Department Of Revenue

- Judicial review form

- Complaint for alienation of affections mississippi form

- Mississippi probate will form

- Petition for forfeiture of auto 41 29 101 mississippi form

- Dismissal without prejudice mississippi form

- Dismissal without form

- Mississippi mechanics 497314030 form

- Complaint against official for ethics violation mississippi form

Find out other PDF Instructions Kentucky Department Of Revenue

- Help Me With eSign Florida New employee checklist

- How To eSign Illinois Rental application

- How To eSignature Maryland Affidavit of Identity

- eSignature New York Affidavit of Service Easy

- How To eSignature Idaho Affidavit of Title

- eSign Wisconsin Real estate forms Secure

- How To eSign California Real estate investment proposal template

- eSignature Oregon Affidavit of Title Free

- eSign Colorado Real estate investment proposal template Simple

- eSign Louisiana Real estate investment proposal template Fast

- eSign Wyoming Real estate investment proposal template Free

- How Can I eSign New York Residential lease

- eSignature Colorado Cease and Desist Letter Later

- How Do I eSignature Maine Cease and Desist Letter

- How Can I eSignature Maine Cease and Desist Letter

- eSignature Nevada Cease and Desist Letter Later

- Help Me With eSign Hawaii Event Vendor Contract

- How To eSignature Louisiana End User License Agreement (EULA)

- How To eSign Hawaii Franchise Contract

- eSignature Missouri End User License Agreement (EULA) Free