Indiana Form E 6, Estimated Quarterly Income Tax Returns 2020-2026

What is the Indiana Form E-6, Estimated Quarterly Income Tax Returns

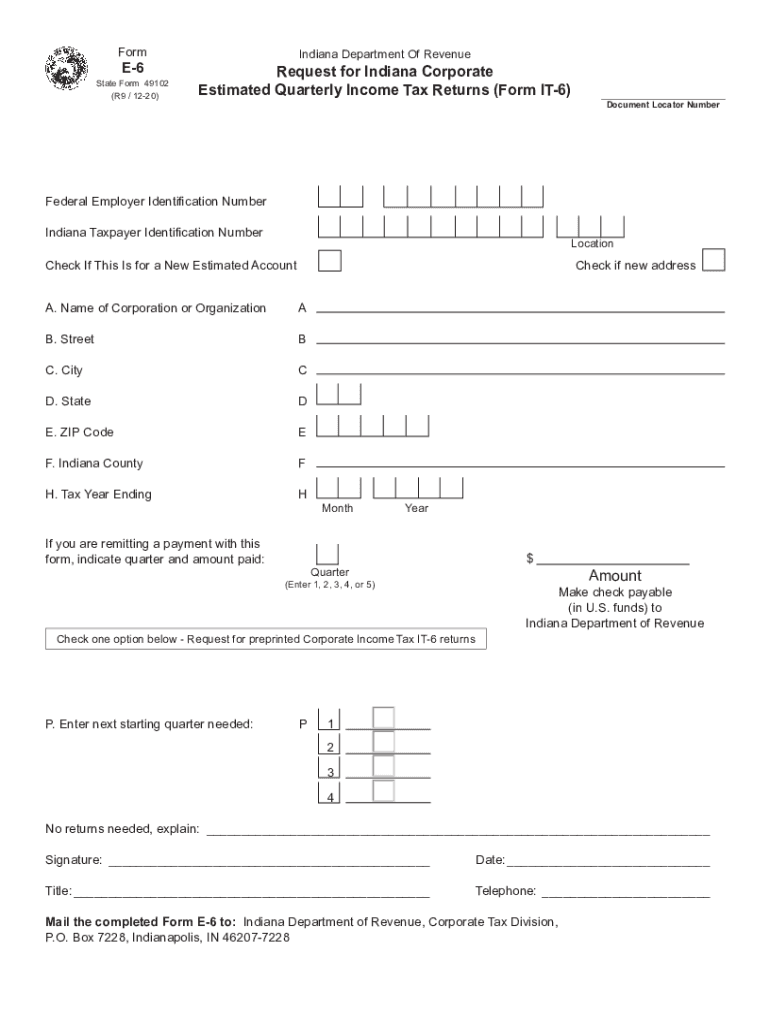

The Indiana Form E-6 is a crucial document for individuals and businesses who need to report their estimated income tax liabilities on a quarterly basis. This form is specifically designed for taxpayers who expect to owe more than $1,000 in state income tax for the year. It helps ensure that taxpayers are making timely payments to avoid penalties and interest charges. The E-6 form is essential for maintaining compliance with Indiana tax laws and is part of the state's effort to streamline tax collection and management.

Steps to Complete the Indiana Form E-6, Estimated Quarterly Income Tax Returns

Completing the Indiana Form E-6 involves several key steps:

- Gather Financial Information: Collect your income records, including wages, self-employment income, and any other earnings.

- Estimate Your Tax Liability: Use your anticipated income to calculate your estimated tax for the year. This figure will guide your quarterly payments.

- Fill Out the Form: Enter your personal information, estimated income, and tax calculations on the E-6 form.

- Review for Accuracy: Double-check all entries to ensure they are correct and complete.

- Submit the Form: File the form by the designated deadlines, either online or via mail, to ensure compliance.

Filing Deadlines / Important Dates

Understanding the filing deadlines for the Indiana Form E-6 is essential for avoiding penalties. The estimated tax payments are typically due on the following dates:

- April 15 for the first quarter

- June 15 for the second quarter

- September 15 for the third quarter

- January 15 of the following year for the fourth quarter

It is important to adhere to these dates to prevent incurring late fees or interest charges on unpaid taxes.

Legal Use of the Indiana Form E-6, Estimated Quarterly Income Tax Returns

The Indiana Form E-6 serves a legal purpose in the tax system. When completed accurately and submitted on time, it acts as a formal declaration of estimated income and tax liability. This form is legally binding and can be used by the Indiana Department of Revenue to assess compliance with state tax laws. Proper use of the form ensures that taxpayers fulfill their obligations and can protect them from potential legal issues related to tax evasion or underreporting income.

Who Issues the Form

The Indiana Form E-6 is issued by the Indiana Department of Revenue. This state agency is responsible for tax collection and enforcement in Indiana. Taxpayers can obtain the form directly from the department's official website or through authorized tax preparation services. It is important to use the most current version of the form to ensure compliance with any updates to tax regulations.

Penalties for Non-Compliance

Failing to file the Indiana Form E-6 or making insufficient payments can result in significant penalties. Taxpayers may face:

- Late Filing Penalties: A percentage of the unpaid tax may be charged for each month the form is late.

- Interest Charges: Interest accrues on any unpaid tax amount from the due date until payment is made.

- Additional Fees: The state may impose further fees for repeated non-compliance or failure to respond to notices.

To avoid these consequences, it is crucial to adhere to filing requirements and deadlines.

Quick guide on how to complete indiana form e 6 estimated quarterly income tax returns

Complete Indiana Form E 6, Estimated Quarterly Income Tax Returns effortlessly on any device

Digital document management has gained popularity among organizations and individuals. It serves as an ideal environmentally-friendly alternative to traditional printed and signed documents, as you can easily locate the correct form and securely keep it online. airSlate SignNow provides all the necessary tools to create, adjust, and electronically sign your documents quickly without interruptions. Handle Indiana Form E 6, Estimated Quarterly Income Tax Returns on any device with airSlate SignNow Android or iOS applications and enhance any document-centric process today.

The simplest way to modify and electronically sign Indiana Form E 6, Estimated Quarterly Income Tax Returns with ease

- Locate Indiana Form E 6, Estimated Quarterly Income Tax Returns and click Get Form to begin.

- Utilize the tools we provide to submit your document.

- Mark important sections of the documents or redact sensitive information with tools specially designed by airSlate SignNow for that purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet signature.

- Review the information carefully and click on the Done button to save your changes.

- Select your preferred method to share your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or mislaid documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your needs in document management with just a few clicks from any device you prefer. Modify and electronically sign Indiana Form E 6, Estimated Quarterly Income Tax Returns and guarantee excellent communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct indiana form e 6 estimated quarterly income tax returns

Create this form in 5 minutes!

How to create an eSignature for the indiana form e 6 estimated quarterly income tax returns

The way to create an electronic signature for your PDF file online

The way to create an electronic signature for your PDF file in Google Chrome

How to make an e-signature for signing PDFs in Gmail

The best way to make an e-signature straight from your mobile device

The best way to create an electronic signature for a PDF file on iOS

The best way to make an e-signature for a PDF document on Android devices

People also ask

-

What is Indiana estimated income, and how can airSlate SignNow assist with it?

Indiana estimated income refers to projected earnings calculated for tax purposes in Indiana. airSlate SignNow provides a seamless eSigning solution that allows businesses to manage necessary documents efficiently, ensuring accuracy when reporting Indiana estimated income for tax returns.

-

How does airSlate SignNow handle document security while managing Indiana estimated income documents?

airSlate SignNow prioritizes security by offering advanced encryption and compliance with industry standards. This ensures that your documents related to Indiana estimated income are not only securely stored but also safely shared, protecting sensitive information.

-

What are the subscription costs for using airSlate SignNow for Indiana estimated income documentation?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of businesses managing Indiana estimated income. Each plan provides unique features, ensuring you get the best value for your money while streamlining your documentation process.

-

Can airSlate SignNow integrate with accounting software for Indiana estimated income management?

Yes, airSlate SignNow integrates seamlessly with various accounting software, making it easier to manage your Indiana estimated income. These integrations enable automatic data entry and document synchronization, ensuring you always have up-to-date information at your fingertips.

-

What features does airSlate SignNow offer for tracking Indiana estimated income documentation?

airSlate SignNow includes features like real-time tracking, automated reminders, and audit trails for all documents. These tools are particularly beneficial for tracking Indiana estimated income documentation, ensuring you never miss a deadline.

-

How does eSigning with airSlate SignNow simplify the process of reporting Indiana estimated income?

eSigning with airSlate SignNow simplifies the process of reporting Indiana estimated income by allowing you to sign documents electronically, reducing time spent on manual signatures. This efficiency ensures you can quickly submit all necessary forms and stay on top of your tax obligations.

-

Is there customer support available for businesses using airSlate SignNow in relation to Indiana estimated income?

Absolutely! airSlate SignNow offers dedicated customer support to assist businesses with any inquiries regarding Indiana estimated income documentation. Whether you need help with onboarding or troubleshooting, their support team is ready to help you succeed.

Get more for Indiana Form E 6, Estimated Quarterly Income Tax Returns

Find out other Indiana Form E 6, Estimated Quarterly Income Tax Returns

- Help Me With eSignature Wisconsin Pet Custody Agreement

- eSign Virginia Stock Transfer Form Template Easy

- How To eSign Colorado Payment Agreement Template

- eSign Louisiana Promissory Note Template Mobile

- Can I eSign Michigan Promissory Note Template

- eSign Hawaii Football Registration Form Secure

- eSign Hawaii Football Registration Form Fast

- eSignature Hawaii Affidavit of Domicile Fast

- Can I eSignature West Virginia Affidavit of Domicile

- eSignature Wyoming Affidavit of Domicile Online

- eSign Montana Safety Contract Safe

- How To eSign Arizona Course Evaluation Form

- How To eSign California Course Evaluation Form

- How To eSign Florida Course Evaluation Form

- How To eSign Hawaii Course Evaluation Form

- How To eSign Illinois Course Evaluation Form

- eSign Hawaii Application for University Free

- eSign Hawaii Application for University Secure

- eSign Hawaii Medical Power of Attorney Template Free

- eSign Washington Nanny Contract Template Free