Form INDIANA DEPARTMENT of REVENUE E 6 Request for Indiana 2011

What is the Form INDIANA DEPARTMENT OF REVENUE E 6 Request For Indiana

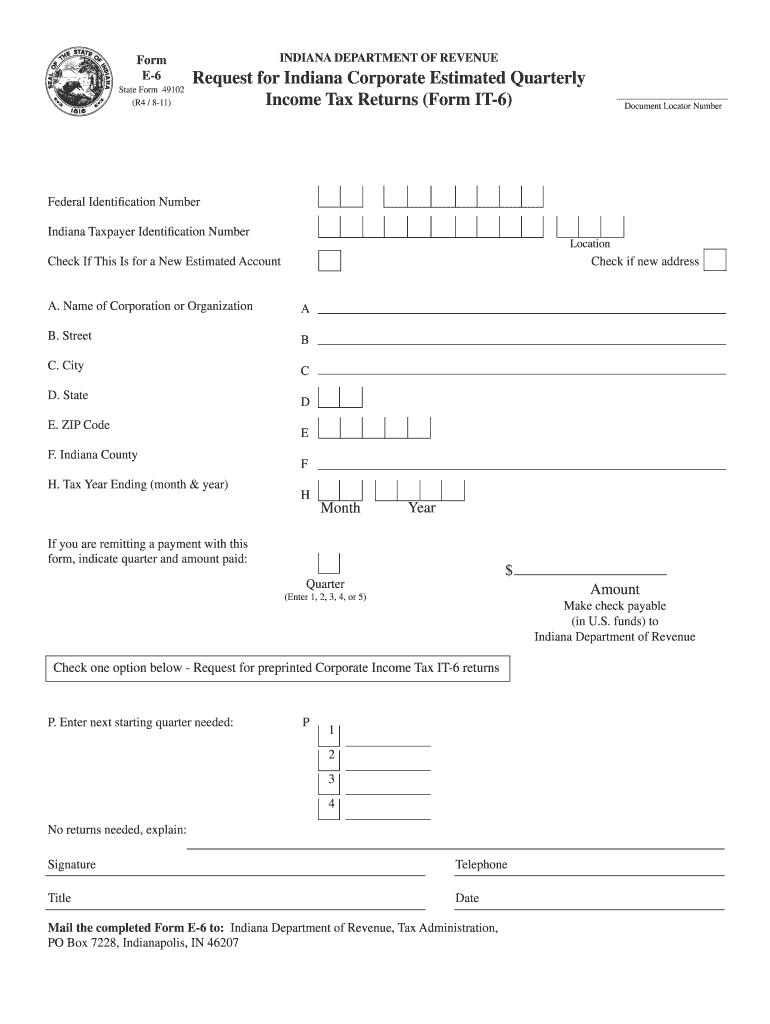

The Form INDIANA DEPARTMENT OF REVENUE E 6 Request For Indiana is a specific document used by taxpayers in Indiana to request certain tax-related information or adjustments. This form is essential for individuals or businesses seeking clarity on their tax obligations or needing to amend previously submitted tax returns. Understanding the purpose of this form helps ensure compliance with Indiana tax regulations and facilitates smoother interactions with the Indiana Department of Revenue.

How to use the Form INDIANA DEPARTMENT OF REVENUE E 6 Request For Indiana

Using the Form INDIANA DEPARTMENT OF REVENUE E 6 involves several straightforward steps. First, obtain the form from the Indiana Department of Revenue's official website or through authorized distribution channels. Next, fill out the required fields accurately, providing all necessary information related to your tax situation. Once completed, the form can be submitted electronically or via traditional mail, depending on the submission guidelines provided by the state. Ensuring that all information is correct and complete is vital to avoid delays or complications in processing.

Steps to complete the Form INDIANA DEPARTMENT OF REVENUE E 6 Request For Indiana

Completing the Form INDIANA DEPARTMENT OF REVENUE E 6 requires careful attention to detail. Follow these steps:

- Download the form from the Indiana Department of Revenue website.

- Fill in your personal information, including your name, address, and taxpayer identification number.

- Provide details regarding the specific request or adjustment you are making.

- Review the form for accuracy and completeness before signing it.

- Submit the form electronically through the designated portal or mail it to the appropriate address.

Legal use of the Form INDIANA DEPARTMENT OF REVENUE E 6 Request For Indiana

The legal use of the Form INDIANA DEPARTMENT OF REVENUE E 6 is governed by Indiana tax laws and regulations. This form serves as an official request to the Indiana Department of Revenue, and its proper completion and submission are crucial for maintaining compliance. Using this form correctly ensures that taxpayers can address any discrepancies or seek necessary adjustments without facing legal repercussions.

Key elements of the Form INDIANA DEPARTMENT OF REVENUE E 6 Request For Indiana

Key elements of the Form INDIANA DEPARTMENT OF REVENUE E 6 include:

- Taxpayer identification information.

- Description of the request or adjustment being made.

- Signature of the taxpayer or authorized representative.

- Date of submission.

These components are essential for the form's validity and ensure that the request is processed efficiently.

Form Submission Methods (Online / Mail / In-Person)

The Form INDIANA DEPARTMENT OF REVENUE E 6 can be submitted through various methods. Taxpayers have the option to submit the form online via the Indiana Department of Revenue's secure portal, which allows for faster processing. Alternatively, the form can be printed and mailed to the appropriate address provided by the department. In some cases, in-person submissions may also be accepted at designated state offices. Choosing the right submission method can impact the speed and efficiency of the request processing.

Quick guide on how to complete form indiana department of revenue e 6 request for indiana

Your assistance manual on how to prepare your Form INDIANA DEPARTMENT OF REVENUE E 6 Request For Indiana

If you're curious about completing and submitting your Form INDIANA DEPARTMENT OF REVENUE E 6 Request For Indiana, here are some straightforward guidelines to make tax reporting easier.

First, you need to create your airSlate SignNow account to transform how you manage documents online. airSlate SignNow is a user-friendly and powerful document management system that enables you to edit, generate, and finalize your tax forms without hassle. With its editing tools, you can toggle between text, check boxes, and electronic signatures and revisit to amend responses as needed. Enhance your tax oversight with advanced PDF editing, eSigning, and seamless sharing.

Follow these steps to complete your Form INDIANA DEPARTMENT OF REVENUE E 6 Request For Indiana in just a few minutes:

- Create your account and start working with PDFs in no time.

- Utilize our library to find any IRS tax form; browse various types and schedules.

- Click Get form to access your Form INDIANA DEPARTMENT OF REVENUE E 6 Request For Indiana in our editor.

- Populate the necessary fillable fields with your information (text, numbers, check marks).

- Employ the Sign Tool to affix your legally-binding electronic signature (if required).

- Review your document and rectify any errors.

- Save your changes, print your version, send it to your recipient, and download it to your device.

Utilize this guide to file your taxes electronically with airSlate SignNow. Keep in mind that submitting by hand can lead to increased errors and delayed refunds. Additionally, before e-filing your taxes, review the IRS website for submission regulations specific to your state.

Create this form in 5 minutes or less

Find and fill out the correct form indiana department of revenue e 6 request for indiana

FAQs

-

How do I respond to a request for a restraining order? Do I need to fill out a form?

As asked of me specifically;The others are right, you will likely need a lawyer. But to answer your question, there is a response form to respond to a restraining order or order of protection. Worst case the form is available at the courthouse where your hearing is set to be heard in, typically at the appropriate clerk's window, which may vary, so ask any of the clerk's when you get there.You only have so many days to respond, and it will specify in the paperwork.You will also have to appear in court on the date your hearing is scheduled.Most courts have a department that will help you respond to forms at no cost. I figure you are asking because you can't afford an attorney which is completely understandable.The problem is that if you aren't represented and the other person is successful in getting a temporary restraining order made permanent in the hearing you will not be allowed at any of the places the petitioner goes, without risking arrest.I hope this helps.Not given as legal advice-

-

How do I fill out Form 16 if I'm not eligible for IT returns and just want to receive the TDS cut for the 6 months that I've worked?

use File Income Tax Return Online in India: ClearTax | e-Filing Income Tax in 15 minutes | Tax filing | Income Tax Returns | E-file Tax Returns for 2014-15It is free and simple.

-

How can I get a lot of people to fill out my Google form survey for a research paper?

First of all, to get a lot of responses for your survey don't forget to follow main rules of creating a survey. Here are some of them:Create and design an invitation page, sett the information about why it is so important for you to get the answers there; also write the purpose of your survey.Make your survey short. Remember that people spend their time answering questions.Preset your goal, decide what information you want to get in the end. Prepare list of questions, which would be the most important for you.Give your respondents enough time to answer a survey.Don't forget to say "Thank you!", be polite.Besides, if you want to get more responses, you can use these tips:1.The first one is to purchase responses from survey panel. You can use MySurveyLab’s survey panel for it. In this case you will get reliable and useful results. You can read more about it here.2.If you don’t want to spent money for responses, you can use the second solution. The mentioned tool enables sharing the survey via different channels: email (invitations and e-mail embedded surveys, SMS, QR codes, as a link.You can share the link on different social media, like Twitter, Facebook, Facebook groups, different forums could be also useful, Pinterest, LinkedIn, VKontakte and so on… I think that if you use all these channels, you could get planned number of responses.Hope to be helpful! Good luck!

Create this form in 5 minutes!

How to create an eSignature for the form indiana department of revenue e 6 request for indiana

How to create an electronic signature for your Form Indiana Department Of Revenue E 6 Request For Indiana in the online mode

How to create an electronic signature for the Form Indiana Department Of Revenue E 6 Request For Indiana in Google Chrome

How to create an electronic signature for signing the Form Indiana Department Of Revenue E 6 Request For Indiana in Gmail

How to create an electronic signature for the Form Indiana Department Of Revenue E 6 Request For Indiana from your smartphone

How to create an eSignature for the Form Indiana Department Of Revenue E 6 Request For Indiana on iOS devices

How to generate an electronic signature for the Form Indiana Department Of Revenue E 6 Request For Indiana on Android OS

People also ask

-

What is the Form INDIANA DEPARTMENT OF REVENUE E 6 Request For Indiana?

The Form INDIANA DEPARTMENT OF REVENUE E 6 Request For Indiana is a specific document required for certain tax compliance purposes. It allows individuals and businesses to request information or submit necessary data to the Indiana Department of Revenue. Understanding its requirements can help in avoiding potential penalties or delays.

-

How do I fill out the Form INDIANA DEPARTMENT OF REVENUE E 6 Request For Indiana?

Filling out the Form INDIANA DEPARTMENT OF REVENUE E 6 Request For Indiana involves providing accurate personal and business information, details of your request, and any supporting documentation. AirSlate SignNow can assist in simplifying this process with its intuitive interface, ensuring that you correctly complete and eSign the document.

-

What are the benefits of using airSlate SignNow for the Form INDIANA DEPARTMENT OF REVENUE E 6 Request For Indiana?

Using airSlate SignNow to manage the Form INDIANA DEPARTMENT OF REVENUE E 6 Request For Indiana offers several advantages, including the ability to eSign documents quickly and securely. Additionally, it streamlines the submission process and provides tracking features, ensuring your request is properly submitted and documented.

-

Is airSlate SignNow cost-effective for handling the Form INDIANA DEPARTMENT OF REVENUE E 6 Request For Indiana?

Yes, airSlate SignNow provides a cost-effective solution for handling the Form INDIANA DEPARTMENT OF REVENUE E 6 Request For Indiana. With affordable pricing plans and a range of features, it allows businesses to save time and money while ensuring compliance with state regulations.

-

Can I integrate airSlate SignNow with other software for processing the Form INDIANA DEPARTMENT OF REVENUE E 6 Request For Indiana?

Absolutely! airSlate SignNow offers robust integrations with various business applications, enabling you to seamlessly process the Form INDIANA DEPARTMENT OF REVENUE E 6 Request For Indiana alongside your existing workflows. This integration capability enhances efficiency and minimizes duplication of efforts.

-

What features does airSlate SignNow offer to enhance the submission of the Form INDIANA DEPARTMENT OF REVENUE E 6 Request For Indiana?

airSlate SignNow comes equipped with features that simplify the submission of the Form INDIANA DEPARTMENT OF REVENUE E 6 Request For Indiana, including customizable templates, automated reminders, and real-time collaboration tools. These features ensure that your requests are submitted accurately and promptly.

-

How secure is the process of using airSlate SignNow for the Form INDIANA DEPARTMENT OF REVENUE E 6 Request For Indiana?

The security of your data is a top priority for airSlate SignNow. When using the platform for the Form INDIANA DEPARTMENT OF REVENUE E 6 Request For Indiana, you can trust that your information is protected with advanced encryption and compliance with industry-standard security protocols.

Get more for Form INDIANA DEPARTMENT OF REVENUE E 6 Request For Indiana

- Delaware release form

- Partial release of property from mortgage by individual holder delaware form

- Affidavit of mailing guardianship delaware form

- Medical statements guardianship form

- Delaware assignment form

- Final order guardianship delaware form

- Inventory form court

- Physicians affidavit guardianship delaware form

Find out other Form INDIANA DEPARTMENT OF REVENUE E 6 Request For Indiana

- Electronic signature Colorado Charity Promissory Note Template Simple

- Electronic signature Alabama Construction Quitclaim Deed Free

- Electronic signature Alaska Construction Lease Agreement Template Simple

- Electronic signature Construction Form Arizona Safe

- Electronic signature Kentucky Charity Living Will Safe

- Electronic signature Construction Form California Fast

- Help Me With Electronic signature Colorado Construction Rental Application

- Electronic signature Connecticut Construction Business Plan Template Fast

- Electronic signature Delaware Construction Business Letter Template Safe

- Electronic signature Oklahoma Business Operations Stock Certificate Mobile

- Electronic signature Pennsylvania Business Operations Promissory Note Template Later

- Help Me With Electronic signature North Dakota Charity Resignation Letter

- Electronic signature Indiana Construction Business Plan Template Simple

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template