K 40 Individual Income Kansas Department of Revenue 2021

What is the K-40 Individual Income Kansas Department of Revenue

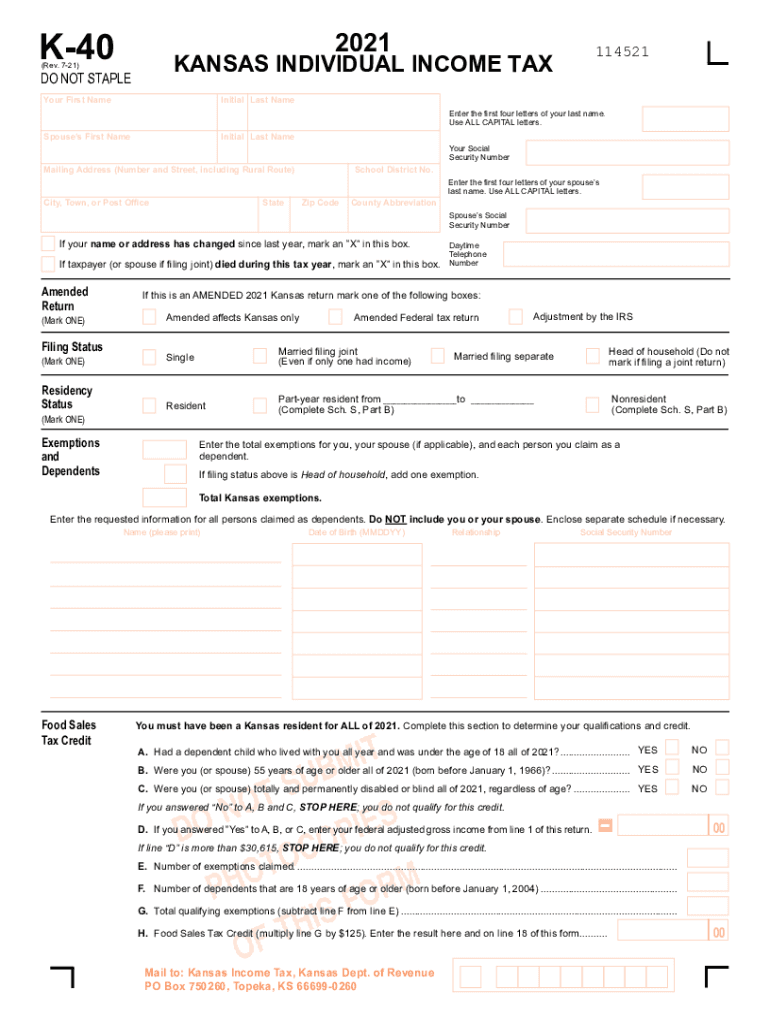

The K-40 form is the primary tax form used by residents of Kansas to report their individual income tax to the Kansas Department of Revenue. This form is essential for calculating the state income tax owed based on various income sources, including wages, salaries, and other earnings. It is designed to ensure that taxpayers accurately report their income and claim any applicable deductions or credits. The K-40 form is crucial for maintaining compliance with state tax laws and for determining the amount of tax liability for the tax year.

How to Obtain the K-40 Individual Income Kansas Department of Revenue

To obtain the K-40 form, taxpayers can visit the Kansas Department of Revenue's official website, where the form is available for download in PDF format. Additionally, physical copies may be requested at local revenue offices or through mail. It is advisable to ensure that you are using the correct version of the form for the applicable tax year, as forms may change annually. Taxpayers should also verify that they have all necessary supporting documents before beginning the completion process.

Steps to Complete the K-40 Individual Income Kansas Department of Revenue

Completing the K-40 form involves several key steps:

- Gather all necessary documents, including W-2s, 1099s, and any other income statements.

- Fill out personal information, such as your name, address, and Social Security number.

- Report all sources of income in the designated sections, ensuring accuracy in figures.

- Claim any deductions or credits you may be eligible for, which can reduce your taxable income.

- Calculate your total tax liability based on the provided tax tables or instructions.

- Sign and date the form to certify that the information is correct before submission.

Legal Use of the K-40 Individual Income Kansas Department of Revenue

The K-40 form is legally binding once completed and submitted to the Kansas Department of Revenue. It is essential to ensure that all information provided is accurate and truthful, as any discrepancies can lead to penalties or audits. The form must be signed by the taxpayer, affirming the validity of the information. Additionally, e-signatures are accepted, provided they comply with the legal standards set forth by the state and federal regulations.

Filing Deadlines / Important Dates

Taxpayers should be aware of the filing deadlines for the K-40 form to avoid penalties. Typically, the deadline for filing individual income tax returns in Kansas is April 15 of each year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. It is important to check for any updates or changes to these dates each tax year to ensure timely submission.

Form Submission Methods

The K-40 form can be submitted through various methods:

- Online: Taxpayers can file electronically through the Kansas Department of Revenue's e-filing system.

- Mail: Completed forms can be mailed to the appropriate address provided in the form instructions.

- In-Person: Taxpayers may submit their forms at local revenue offices during business hours.

Quick guide on how to complete k 40 individual income kansas department of revenue

Complete K 40 Individual Income Kansas Department Of Revenue effortlessly on any device

Online document management has gained traction among businesses and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed papers, as you can easily locate the necessary form and securely store it in the cloud. airSlate SignNow equips you with all the resources needed to create, edit, and eSign your documents swiftly without any hold-ups. Handle K 40 Individual Income Kansas Department Of Revenue on any system with airSlate SignNow’s Android or iOS applications and simplify any document-related tasks today.

The easiest way to modify and eSign K 40 Individual Income Kansas Department Of Revenue with ease

- Locate K 40 Individual Income Kansas Department Of Revenue and click Get Form to begin.

- Use the tools we provide to finalize your document.

- Emphasize signNow sections of your documents or obscure sensitive information with features that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you'd like to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searching, or errors that require new document copies. airSlate SignNow meets your document management needs with just a few clicks from any device you choose. Edit and eSign K 40 Individual Income Kansas Department Of Revenue and ensure effective communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct k 40 individual income kansas department of revenue

Create this form in 5 minutes!

How to create an eSignature for the k 40 individual income kansas department of revenue

The way to create an e-signature for a PDF online

The way to create an e-signature for a PDF in Google Chrome

The best way to create an e-signature for signing PDFs in Gmail

The best way to make an electronic signature from your smartphone

The best way to generate an e-signature for a PDF on iOS

The best way to make an electronic signature for a PDF file on Android

People also ask

-

What are Kansas tax forms, and why do I need them?

Kansas tax forms are official documents required by the state of Kansas to accurately report income, deductions, and taxes owed. Completing these forms is essential for compliance with state tax regulations and to avoid penalties. Understanding how to properly fill out your Kansas tax forms can help ensure a smooth tax filing process.

-

How can airSlate SignNow help me with my Kansas tax forms?

airSlate SignNow offers an intuitive platform that simplifies the process of filling out and eSigning Kansas tax forms. Our solution allows you to easily access, edit, and submit these forms electronically, ensuring greater efficiency and accuracy. By minimizing paperwork, airSlate SignNow saves you time during tax season.

-

What features does airSlate SignNow offer for handling Kansas tax forms?

airSlate SignNow provides a variety of features tailored to help you manage Kansas tax forms effectively. Users can utilize customizable templates, secure eSignature options, and integration with cloud storage services for seamless document handling. These features enhance workflow and make managing your forms straightforward.

-

Is there a cost associated with using airSlate SignNow for Kansas tax forms?

Yes, airSlate SignNow offers various pricing plans to cater to different user needs, including individuals and businesses needing Kansas tax forms. Each plan is designed to provide excellent value, ensuring you have all the necessary tools at an affordable price. You can choose a plan that fits your budget and requirements.

-

Can I integrate airSlate SignNow with other applications for my Kansas tax forms?

Absolutely! airSlate SignNow supports integration with many popular applications, streamlining the management of your Kansas tax forms. Whether you're using accounting software, email platforms, or cloud storage solutions, our integrations help create a seamless workflow to enhance productivity.

-

What are the benefits of eSigning Kansas tax forms with airSlate SignNow?

eSigning Kansas tax forms with airSlate SignNow offers several advantages, including enhanced security and faster turnaround times. Electronic signatures are legally binding, ensuring your forms are valid and compliant. This convenience allows you to submit your tax documents swiftly and with confidence.

-

How secure is airSlate SignNow for handling my Kansas tax forms?

airSlate SignNow takes security very seriously, employing advanced encryption and compliance measures to protect your data while handling Kansas tax forms. Our platform is designed to ensure that all transactions are secure and that your sensitive information remains confidential. You can trust us to safeguard your tax documents.

Get more for K 40 Individual Income Kansas Department Of Revenue

Find out other K 40 Individual Income Kansas Department Of Revenue

- Sign Virginia Banking Profit And Loss Statement Mobile

- Sign Alabama Business Operations LLC Operating Agreement Now

- Sign Colorado Business Operations LLC Operating Agreement Online

- Sign Colorado Business Operations LLC Operating Agreement Myself

- Sign Hawaii Business Operations Warranty Deed Easy

- Sign Idaho Business Operations Resignation Letter Online

- Sign Illinois Business Operations Affidavit Of Heirship Later

- How Do I Sign Kansas Business Operations LLC Operating Agreement

- Sign Kansas Business Operations Emergency Contact Form Easy

- How To Sign Montana Business Operations Warranty Deed

- Sign Nevada Business Operations Emergency Contact Form Simple

- Sign New Hampshire Business Operations Month To Month Lease Later

- Can I Sign New York Business Operations Promissory Note Template

- Sign Oklahoma Business Operations Contract Safe

- Sign Oregon Business Operations LLC Operating Agreement Now

- Sign Utah Business Operations LLC Operating Agreement Computer

- Sign West Virginia Business Operations Rental Lease Agreement Now

- How To Sign Colorado Car Dealer Arbitration Agreement

- Sign Florida Car Dealer Resignation Letter Now

- Sign Georgia Car Dealer Cease And Desist Letter Fast