K 40 Individual Income Tax Return Rev 7 22 You Must File a Kansas Individual Income Tax Return to Receive Any Refund of Taxes Wi 2022

Understanding the K-40 Individual Income Tax Return

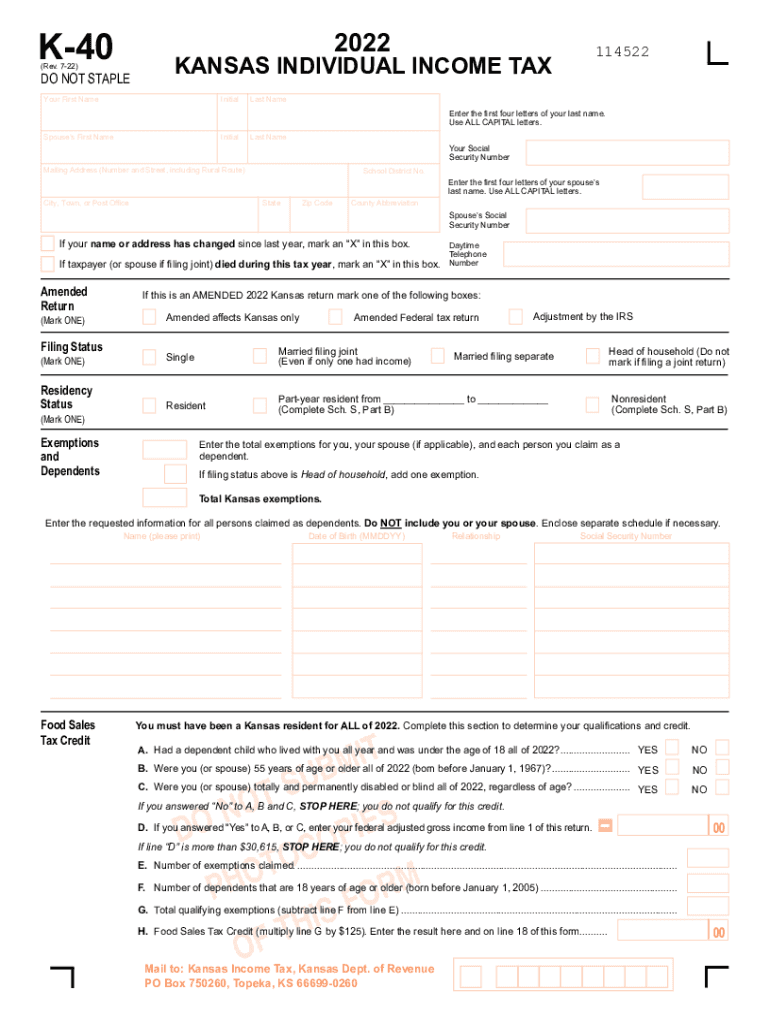

The K-40 Individual Income Tax Return is a crucial form for Kansas residents. It is required for anyone wishing to receive a refund of taxes withheld, regardless of their total income. This form ensures that individuals comply with state tax laws and allows for the accurate assessment of tax obligations. Filing this return is not only a legal requirement but also a means to reclaim any overpaid taxes.

Steps to Complete the K-40 Individual Income Tax Return

Completing the K-40 involves several key steps to ensure accuracy and compliance:

- Gather necessary documents, including W-2s and any other income statements.

- Fill out personal information, such as your name, address, and Social Security number.

- Report all sources of income, including wages, interest, and dividends.

- Claim any applicable deductions or credits to reduce taxable income.

- Calculate the total tax owed or the refund due based on the provided information.

- Sign and date the form before submission.

Legal Use of the K-40 Individual Income Tax Return

The K-40 form is legally binding when filled out correctly and submitted on time. It adheres to the regulations set forth by the Kansas Department of Revenue. Proper execution of this form ensures that taxpayers fulfill their obligations and can avoid potential penalties. Electronic signatures, when compliant with relevant laws, are also accepted, making the filing process more efficient.

Required Documents for Filing the K-40

To successfully file the K-40, certain documents are essential:

- W-2 forms from employers detailing annual earnings.

- 1099 forms for any additional income sources, such as freelance work.

- Records of any deductions or credits you plan to claim.

- Identification documents, including your Social Security number.

Filing Methods for the K-40 Tax Form

Taxpayers have several options for submitting the K-40 form:

- Online submission through the Kansas Department of Revenue's website.

- Mailing a printed copy of the completed form to the appropriate address.

- In-person submission at designated tax offices or events.

Filing Deadlines for the K-40

It is important to be aware of the filing deadlines for the K-40 to avoid penalties:

- The standard deadline for filing is April 15 of each year.

- Extensions may be available, but must be requested prior to the deadline.

Quick guide on how to complete k 40 individual income tax return rev 7 22 you must file a kansas individual income tax return to receive any refund of taxes

Effortlessly Prepare K 40 Individual Income Tax Return Rev 7 22 You Must File A Kansas Individual Income Tax Return To Receive Any Refund Of Taxes Wi on Any Device

Digital document management has become increasingly popular among businesses and individuals. It offers a superior eco-friendly substitute to conventional printed and signed papers, allowing you to access the right form and securely store it online. airSlate SignNow provides all the tools necessary to generate, modify, and electronically sign your documents swiftly without delays. Manage K 40 Individual Income Tax Return Rev 7 22 You Must File A Kansas Individual Income Tax Return To Receive Any Refund Of Taxes Wi on any device using airSlate SignNow's apps for Android or iOS and streamline any document-related task today.

The easiest method to modify and electronically sign K 40 Individual Income Tax Return Rev 7 22 You Must File A Kansas Individual Income Tax Return To Receive Any Refund Of Taxes Wi with ease

- Obtain K 40 Individual Income Tax Return Rev 7 22 You Must File A Kansas Individual Income Tax Return To Receive Any Refund Of Taxes Wi and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the details and click the Done button to finalize your changes.

- Choose how you want to send your form: by email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and electronically sign K 40 Individual Income Tax Return Rev 7 22 You Must File A Kansas Individual Income Tax Return To Receive Any Refund Of Taxes Wi and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct k 40 individual income tax return rev 7 22 you must file a kansas individual income tax return to receive any refund of taxes

Create this form in 5 minutes!

How to create an eSignature for the k 40 individual income tax return rev 7 22 you must file a kansas individual income tax return to receive any refund of taxes

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is k kansas tax and how does it relate to eSigning documents?

K kansas tax refers to the taxation regulations in Kansas that may affect businesses. When using airSlate SignNow, you can easily eSign documents that pertain to tax filings or other legal agreements while ensuring compliance with k kansas tax requirements.

-

How can airSlate SignNow help with k kansas tax compliance?

AirSlate SignNow provides a secure platform for electronically signing tax documents, helping you maintain compliance with k kansas tax laws. Our features include audit trails and secure storage, ensuring your documents are always in order and accessible.

-

What are the pricing options for using airSlate SignNow for k kansas tax documents?

AirSlate SignNow offers flexible pricing plans that cater to various business needs. Whether you are handling a few k kansas tax documents or a high volume, there's a plan that fits your budget without compromising on features.

-

Can I integrate airSlate SignNow with accounting software to manage k kansas tax?

Yes, airSlate SignNow integrates seamlessly with various accounting and finance software. This integration allows you to streamline your k kansas tax document management and ensure that all your signatures are tracked and stored efficiently.

-

What features does airSlate SignNow offer for managing k kansas tax documentation?

AirSlate SignNow includes features such as customizable templates, bulk sending, and in-app notifications to keep your k kansas tax documents organized. These tools help you save time and increase accuracy in your tax-related processes.

-

Is airSlate SignNow secure for handling sensitive k kansas tax information?

Absolutely! AirSlate SignNow is committed to security and employs industry-standard encryption to protect your k kansas tax information. Our platform ensures that your documents are safe, giving you peace of mind while handling sensitive data.

-

How can I get support for questions related to k kansas tax documents?

Our customer support team is available to assist with any queries related to k kansas tax documents. You can signNow out via chat, email, or phone, and we are here to help you navigate any challenges you may face.

Get more for K 40 Individual Income Tax Return Rev 7 22 You Must File A Kansas Individual Income Tax Return To Receive Any Refund Of Taxes Wi

- Deed of trust to secure assumption texas form

- Tenant notice rent 497327496 form

- Texas possession form

- Letter tenant landlord 497327498 form

- Letter from tenant to landlord about illegal entry by landlord texas form

- Letter from landlord to tenant about time of intent to enter premises texas form

- Letter landlord rent 497327501 form

- Landlord harassment letter template form

Find out other K 40 Individual Income Tax Return Rev 7 22 You Must File A Kansas Individual Income Tax Return To Receive Any Refund Of Taxes Wi

- eSign Wisconsin Lawers LLC Operating Agreement Free

- eSign Alabama Legal Quitclaim Deed Online

- eSign Alaska Legal Contract Safe

- How To eSign Alaska Legal Warranty Deed

- eSign Alaska Legal Cease And Desist Letter Simple

- eSign Arkansas Legal LLC Operating Agreement Simple

- eSign Alabama Life Sciences Residential Lease Agreement Fast

- How To eSign Arkansas Legal Residential Lease Agreement

- Help Me With eSign California Legal Promissory Note Template

- eSign Colorado Legal Operating Agreement Safe

- How To eSign Colorado Legal POA

- eSign Insurance Document New Jersey Online

- eSign Insurance Form New Jersey Online

- eSign Colorado Life Sciences LLC Operating Agreement Now

- eSign Hawaii Life Sciences Letter Of Intent Easy

- Help Me With eSign Hawaii Life Sciences Cease And Desist Letter

- eSign Hawaii Life Sciences Lease Termination Letter Mobile

- eSign Hawaii Life Sciences Permission Slip Free

- eSign Florida Legal Warranty Deed Safe

- Help Me With eSign North Dakota Insurance Residential Lease Agreement