Www Tax Brackets Orgrhodeislandtaxformsform RiRhode Island Tax Brackets Org Federal & State Income Tax

Understanding the Rhode Island Tax Amended Process

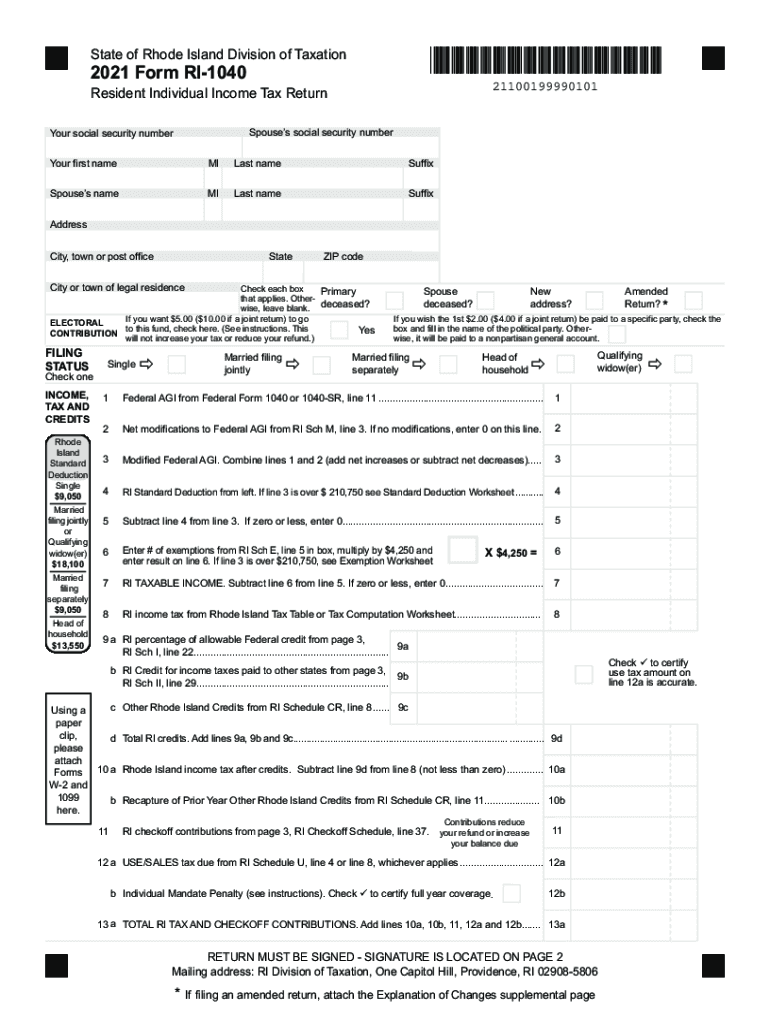

The Rhode Island tax amended process allows taxpayers to correct errors or make changes to their previously filed tax returns. This includes adjustments to income, deductions, or credits that may affect the overall tax liability. To initiate this process, taxpayers must use the RI 1040X filing form, which is specifically designed for amendments. It is essential to ensure that all information is accurate and complete to avoid delays or complications with the state tax authority.

Steps to Complete the RI 1040X Filing Form

Completing the RI 1040X filing form involves several key steps:

- Gather all necessary documents, including your original tax return and any supporting documentation for the changes you are making.

- Carefully fill out the RI 1040X form, ensuring that you clearly indicate the changes and provide explanations where necessary.

- Calculate any adjustments to your tax liability, including any additional taxes owed or refunds due.

- Review the completed form for accuracy before submission.

- Submit the amended form either electronically, if available, or by mailing it to the appropriate state tax office.

Required Documents for Filing an Amended Return

When filing an amended return using the RI 1040X, certain documents are typically required:

- Your original tax return (RI 1040 or RI 1040NR).

- Any additional forms or schedules that support your amended return.

- Documentation for any changes in income, deductions, or credits.

Filing Deadlines for Amended Returns

It is crucial to be aware of the filing deadlines for amended returns in Rhode Island. Generally, you must file your amended return within three years from the original due date of the return, including any extensions. If you are claiming a refund, ensure that you meet this deadline to avoid losing your right to the refund.

Legal Use of the RI 1040X Filing Form

The RI 1040X filing form is legally recognized for making amendments to your state tax return. To ensure the legal validity of your amended return, it is important to comply with all applicable state tax laws and regulations. This includes providing accurate information and signatures as required by the Rhode Island Division of Taxation.

Common Reasons for Filing an Amended Return

Taxpayers may choose to file an amended return for various reasons, including:

- Corrections to reported income, such as additional W-2s or 1099s received after the original filing.

- Changes to deductions or credits that were initially overlooked.

- Adjustments related to filing status or dependents.

Quick guide on how to complete wwwtax bracketsorgrhodeislandtaxformsform rirhode island tax bracketsorg federal ampamp state income tax

Effortlessly prepare Www tax brackets orgrhodeislandtaxformsform riRhode Island Tax Brackets org Federal & State Income Tax on any device

Digital document management has gained traction among businesses and individuals alike. It serves as a perfect eco-friendly substitute for conventional printed and signed documents, allowing you to locate the appropriate form and securely archive it online. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your documents swiftly and without holdups. Manage Www tax brackets orgrhodeislandtaxformsform riRhode Island Tax Brackets org Federal & State Income Tax on any device using airSlate SignNow's Android or iOS applications and enhance any document-related workflow today.

Edit and eSign Www tax brackets orgrhodeislandtaxformsform riRhode Island Tax Brackets org Federal & State Income Tax with ease

- Find Www tax brackets orgrhodeislandtaxformsform riRhode Island Tax Brackets org Federal & State Income Tax and click on Get Form to begin.

- Utilize the provided tools to complete your form.

- Emphasize important sections of your documents or obscure sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select your preferred method for sharing your form, whether by email, SMS, invite link, or by downloading it to your computer.

Say goodbye to lost or mislaid documents, tedious form searches, and the need to print new document copies due to errors. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Edit and eSign Www tax brackets orgrhodeislandtaxformsform riRhode Island Tax Brackets org Federal & State Income Tax and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the wwwtax bracketsorgrhodeislandtaxformsform rirhode island tax bracketsorg federal ampamp state income tax

The way to create an e-signature for a PDF file online

The way to create an e-signature for a PDF file in Google Chrome

The best way to create an electronic signature for signing PDFs in Gmail

The best way to make an electronic signature from your mobile device

The best way to generate an e-signature for a PDF file on iOS

The best way to make an electronic signature for a PDF file on Android devices

People also ask

-

What is the process for filing a RI tax amended return?

Filing a RI tax amended return involves completing the appropriate forms to correct any errors on your original return. You can use our airSlate SignNow platform to easily fill out and eSign these forms. Ensure all required information is included to expedite the process. It's important to check for any new updates from the RI Department of Revenue when filing your amended return.

-

How much does it cost to file a RI tax amended return using airSlate SignNow?

The cost of filing a RI tax amended return using airSlate SignNow is competitive and often more affordable than traditional methods. We offer various pricing plans that cater to both individuals and businesses. With our cost-effective solution, you can enjoy seamless eSigning and document management without breaking the bank.

-

Can airSlate SignNow help me track my RI tax amended return status?

Yes, airSlate SignNow provides tools that help you keep track of your documents, including your RI tax amended return. You'll receive notifications once your documents are signed and submitted, giving you peace of mind. This feature not only saves you time but also ensures you stay informed throughout the filing process.

-

What features does airSlate SignNow offer for RI tax amended filings?

airSlate SignNow offers a user-friendly interface designed to streamline the RI tax amended filing process. Key features include customizable templates, eSigning capabilities, and cloud storage for all your documents. These tools help simplify the paperwork involved in amending your tax returns while ensuring compliance with state regulations.

-

Is airSlate SignNow compliant with RI tax regulations?

Absolutely! airSlate SignNow is designed to meet all necessary compliance standards for RI tax regulations. Our platform provides templates and resources that are regularly updated to reflect state laws, ensuring your RI tax amended filings are accurate and compliant.

-

What benefits does airSlate SignNow provide for businesses managing RI tax amended returns?

For businesses, airSlate SignNow offers a streamlined approach to managing RI tax amended returns, saving time and reducing stress. The automation features eliminate the need for manual paperwork, allowing teams to focus on more critical tasks. Additionally, the integrated eSigning functionality enhances collaboration amongst team members, ensuring every document is signed and submitted accurately.

-

Can airSlate SignNow integrate with other accounting software for RI tax amended processes?

Yes, airSlate SignNow easily integrates with various accounting software that you may already be using for your RI tax amended process. This integration allows for seamless data transfer and ensures that your financial records remain up-to-date. You can simplify filing your amended returns by connecting your favorite tools directly with our platform.

Get more for Www tax brackets orgrhodeislandtaxformsform riRhode Island Tax Brackets org Federal & State Income Tax

- Order substituting attorney mississippi form

- Amended complaint mississippi 497314521 form

- Motion venue form

- Scheduling order purchase form

- Notice of video deposition to use at trial mississippi form

- With prejudice 497314525 form

- Defendants joint motion to dismiss mississippi form

- Motion change venue sample form

Find out other Www tax brackets orgrhodeislandtaxformsform riRhode Island Tax Brackets org Federal & State Income Tax

- Electronic signature Montana Courts Promissory Note Template Now

- Electronic signature Montana Courts Limited Power Of Attorney Safe

- Electronic signature Oklahoma Sports Contract Safe

- Electronic signature Oklahoma Sports RFP Fast

- How To Electronic signature New York Courts Stock Certificate

- Electronic signature South Carolina Sports Separation Agreement Easy

- Electronic signature Virginia Courts Business Plan Template Fast

- How To Electronic signature Utah Courts Operating Agreement

- Electronic signature West Virginia Courts Quitclaim Deed Computer

- Electronic signature West Virginia Courts Quitclaim Deed Free

- Electronic signature Virginia Courts Limited Power Of Attorney Computer

- Can I Sign Alabama Banking PPT

- Electronic signature Washington Sports POA Simple

- How To Electronic signature West Virginia Sports Arbitration Agreement

- Electronic signature Wisconsin Sports Residential Lease Agreement Myself

- Help Me With Sign Arizona Banking Document

- How Do I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form

- Can I Sign Colorado Banking PPT