Pub KS 1510 Sales Tax and Compensating Use Tax Rev 7 15 Form

What is the Pub KS 1510 Sales Tax and Compensating Use Tax Rev 7 15

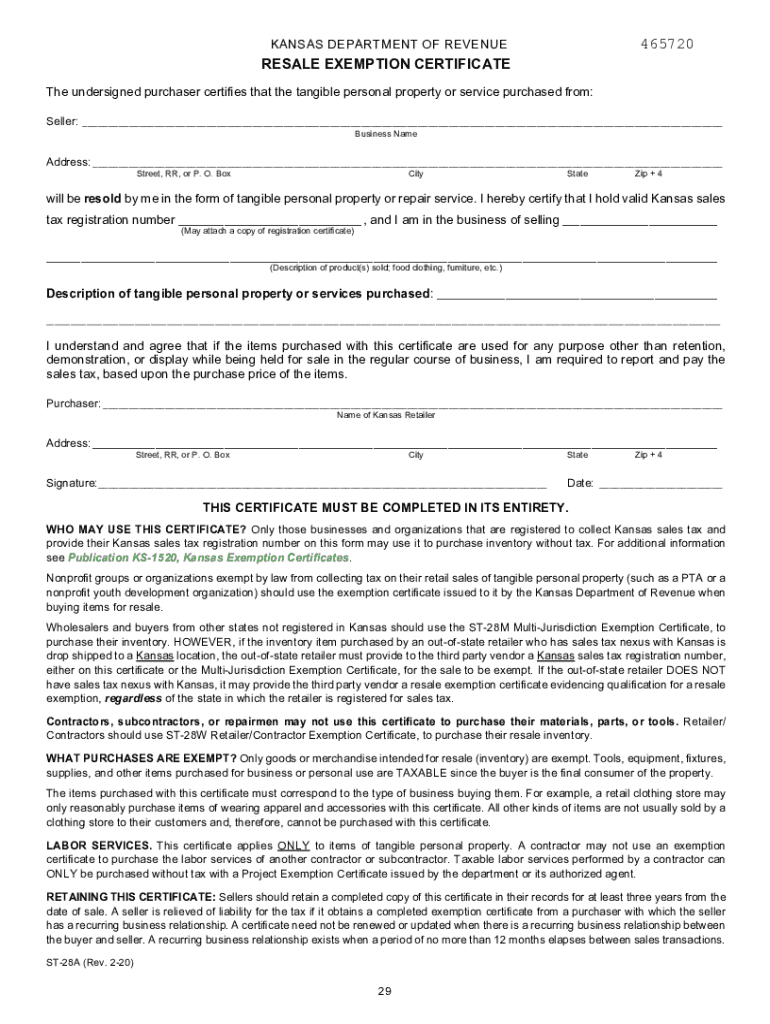

The Pub KS 1510 Sales Tax and Compensating Use Tax Rev 7 15 is a critical document used in Kansas for reporting sales tax and compensating use tax. This form is essential for businesses and individuals who engage in taxable transactions within the state. It outlines the tax obligations related to sales made and goods purchased for use in Kansas. Understanding this form helps ensure compliance with state tax regulations and contributes to accurate tax reporting.

Steps to Complete the Pub KS 1510 Sales Tax and Compensating Use Tax Rev 7 15

Completing the Pub KS 1510 requires careful attention to detail. Here are the steps to follow:

- Gather all necessary documentation, including sales records and receipts.

- Identify the total sales made during the reporting period.

- Calculate the total sales tax collected from customers.

- Determine any compensating use tax owed on purchases made for use in Kansas.

- Fill out the form accurately, ensuring all figures are correct.

- Review the completed form for any errors before submission.

Legal Use of the Pub KS 1510 Sales Tax and Compensating Use Tax Rev 7 15

The legal use of the Pub KS 1510 is governed by Kansas tax laws. Businesses must use this form to report and remit sales tax collected from customers and compensating use tax on items purchased without paying sales tax. Proper use of this form ensures compliance with state regulations, helping to avoid potential penalties or audits. It is crucial to understand the legal implications of the information reported on this form.

Key Elements of the Pub KS 1510 Sales Tax and Compensating Use Tax Rev 7 15

Several key elements are essential for accurately completing the Pub KS 1510:

- Taxpayer Information: This includes the name, address, and identification number of the business or individual filing the form.

- Sales Information: Detailed records of total sales and tax collected during the reporting period.

- Compensating Use Tax: Amount of tax owed on items purchased for use in Kansas without prior tax payment.

- Signature: The form must be signed by the taxpayer or an authorized representative to validate the information provided.

Examples of Using the Pub KS 1510 Sales Tax and Compensating Use Tax Rev 7 15

Understanding practical applications of the Pub KS 1510 can clarify its importance. For instance, a retail business selling goods in Kansas must report the sales tax collected from customers on this form. Similarly, an individual who purchases equipment online for business use without paying sales tax must report this on the form as compensating use tax. These examples illustrate how various transactions require accurate reporting through the Pub KS 1510.

Filing Deadlines / Important Dates

Timely filing of the Pub KS 1510 is crucial to avoid penalties. The filing deadlines typically align with the end of the reporting period, which can be monthly, quarterly, or annually, depending on the business's tax obligations. It is essential to stay informed about these deadlines to ensure compliance and avoid unnecessary fees.

Quick guide on how to complete pub ks 1510 sales tax and compensating use tax rev 7 15

Effortlessly Prepare Pub KS 1510 Sales Tax And Compensating Use Tax Rev 7 15 on Any Device

Digital document management has gained traction among businesses and individuals alike. It offers an excellent environmentally friendly alternative to conventional printed and signed documents, as you can easily locate the necessary form and securely save it online. airSlate SignNow equips you with all the tools needed to create, edit, and electronically sign your documents swiftly without any hassles. Manage Pub KS 1510 Sales Tax And Compensating Use Tax Rev 7 15 from any device using airSlate SignNow's Android or iOS applications and enhance any document-related operation today.

The simplest method to edit and electronically sign Pub KS 1510 Sales Tax And Compensating Use Tax Rev 7 15 with ease

- Locate Pub KS 1510 Sales Tax And Compensating Use Tax Rev 7 15 and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Mark pertinent sections of the documents or conceal sensitive details with tools that airSlate SignNow specifically offers for that purpose.

- Create your electronic signature with the Sign feature, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and then click the Done button to save your updates.

- Choose your preferred method to send your form, whether by email, SMS, invitation link, or download it to your computer.

Put aside concerns about lost or misplaced documents, laborious form searching, or mistakes that require printing new document copies. airSlate SignNow manages all your document handling needs in just a few clicks from a device of your choice. Modify and electronically sign Pub KS 1510 Sales Tax And Compensating Use Tax Rev 7 15 to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the pub ks 1510 sales tax and compensating use tax rev 7 15

The way to create an e-signature for your PDF file online

The way to create an e-signature for your PDF file in Google Chrome

The best way to make an e-signature for signing PDFs in Gmail

The way to create an e-signature right from your mobile device

The best way to generate an electronic signature for a PDF file on iOS

The way to create an e-signature for a PDF on Android devices

People also ask

-

What is ks ks use in airSlate SignNow?

The term 'ks ks use' refers to the practical applications of airSlate SignNow in streamlining document signing processes. With this tool, businesses can automate workflows and enhance their productivity through easy electronic signatures.

-

How does airSlate SignNow pricing work?

airSlate SignNow offers flexible pricing plans designed to accommodate various business needs. The 'ks ks use' of airSlate SignNow ensures that you get the best value for your investment, with features tailored to improve operational efficiency without breaking the bank.

-

What features are included with airSlate SignNow?

airSlate SignNow provides a comprehensive suite of features, including custom workflows, document templates, and advanced security measures. These features enhance the 'ks ks use' by simplifying the entire document management process, making it more efficient for users.

-

How can airSlate SignNow benefit my business?

By utilizing airSlate SignNow, businesses can experience faster turnaround times and improved document management. The 'ks ks use' of this platform means that you'll streamline operations, reduce paperwork, and ultimately save both time and money.

-

Does airSlate SignNow integrate with other applications?

Yes, airSlate SignNow seamlessly integrates with popular applications like Google Drive, Salesforce, and others. This capability enables businesses to enhance their 'ks ks use' by connecting their existing tools, making document management more cohesive.

-

Is airSlate SignNow secure for sensitive documents?

Absolutely! airSlate SignNow implements state-of-the-art security measures including encryption and compliance with industry standards. This commitment to security enhances the 'ks ks use' by ensuring that your sensitive documents are protected throughout the signing process.

-

Can I customize documents in airSlate SignNow?

Yes, airSlate SignNow allows users to customize document templates to fit their specific needs. This flexibility contributes to the 'ks ks use' by enabling businesses to create personalized experiences for their clients.

Get more for Pub KS 1510 Sales Tax And Compensating Use Tax Rev 7 15

Find out other Pub KS 1510 Sales Tax And Compensating Use Tax Rev 7 15

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement

- eSignature New Hampshire High Tech Lease Agreement Template Mobile

- eSignature Montana Insurance Lease Agreement Template Online

- eSignature New Hampshire High Tech Lease Agreement Template Free

- How To eSignature Montana Insurance Emergency Contact Form

- eSignature New Jersey High Tech Executive Summary Template Free

- eSignature Oklahoma Insurance Warranty Deed Safe

- eSignature Pennsylvania High Tech Bill Of Lading Safe

- eSignature Washington Insurance Work Order Fast

- eSignature Utah High Tech Warranty Deed Free

- How Do I eSignature Utah High Tech Warranty Deed

- eSignature Arkansas Legal Affidavit Of Heirship Fast

- Help Me With eSignature Colorado Legal Cease And Desist Letter

- How To eSignature Connecticut Legal LLC Operating Agreement

- eSignature Connecticut Legal Residential Lease Agreement Mobile

- eSignature West Virginia High Tech Lease Agreement Template Myself

- How To eSignature Delaware Legal Residential Lease Agreement

- eSignature Florida Legal Letter Of Intent Easy

- Can I eSignature Wyoming High Tech Residential Lease Agreement