Httpsapi1 Ilovepdf Comv1pdfrender Form

IRS Guidelines

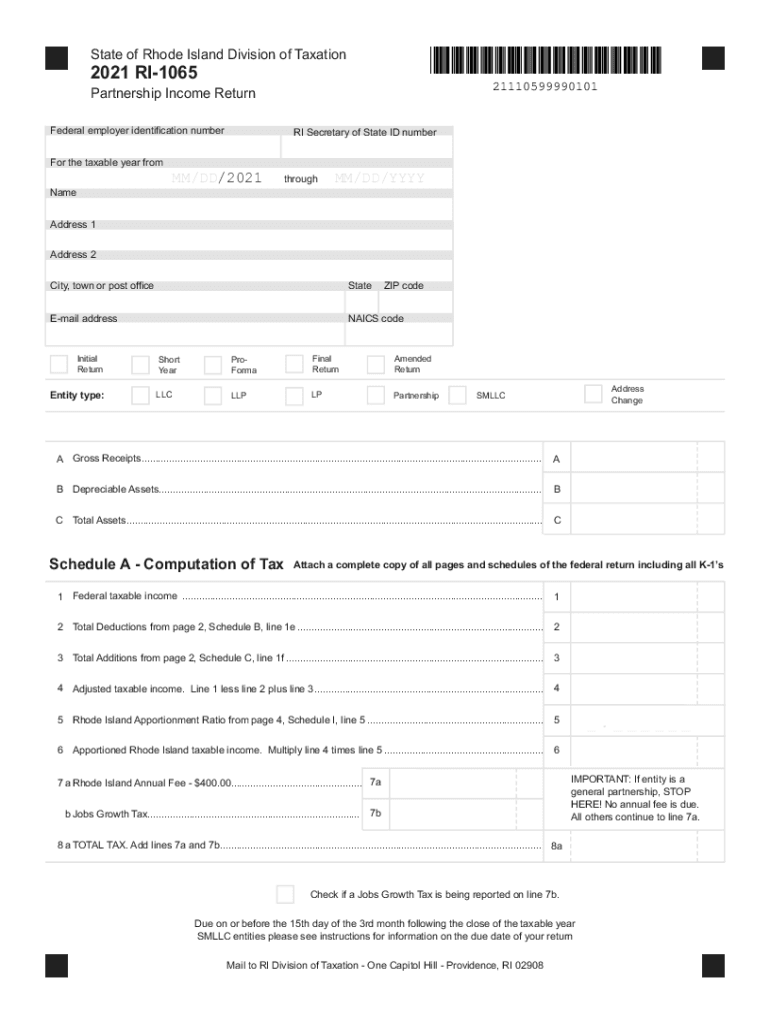

The 2021 RI 1065 form, also known as the Rhode Island Partnership Return, is essential for partnerships operating in Rhode Island. This form is used to report the income, deductions, and credits of the partnership. According to IRS guidelines, partnerships must file this form annually, providing a comprehensive overview of the partnership's financial activities for the tax year. The form must be completed accurately to ensure compliance with both state and federal tax regulations.

Filing Deadlines / Important Dates

For the 2021 RI 1065 form, the filing deadline is typically the fifteenth day of the fourth month following the close of the partnership's tax year. For partnerships operating on a calendar year basis, this means the form is due by April 15, 2022. If the deadline falls on a weekend or holiday, it is extended to the next business day. It is crucial for partnerships to adhere to these deadlines to avoid penalties and interest on late filings.

Required Documents

To complete the 2021 RI 1065 form, partnerships must gather several key documents. These include:

- Financial statements detailing income and expenses

- Records of partnership contributions and distributions

- Supporting documentation for deductions and credits claimed

- Information on each partner's share of income, loss, and capital

Having these documents readily available ensures a smoother filing process and helps maintain compliance with tax regulations.

Form Submission Methods (Online / Mail / In-Person)

The 2021 RI 1065 form can be submitted through various methods to accommodate different preferences. Partnerships can file the form electronically via approved e-filing services, which is often the quickest and most efficient method. Alternatively, partnerships may choose to mail a paper copy of the completed form to the Rhode Island Division of Taxation. In-person submissions are also accepted, though this option may require scheduling an appointment. Each method has its own advantages, and partnerships should select the one that best fits their needs.

Penalties for Non-Compliance

Failing to file the 2021 RI 1065 form on time can result in significant penalties. The Rhode Island Division of Taxation imposes a late filing penalty, which can accumulate daily until the form is filed. Additionally, partnerships may face interest on any unpaid taxes. It is essential for partnerships to understand these penalties and ensure timely filing to avoid unnecessary financial burdens.

Digital vs. Paper Version

When deciding between the digital and paper versions of the 2021 RI 1065, partnerships should consider the benefits of each format. The digital version allows for quicker processing and often includes features such as error-checking and automatic calculations. Conversely, the paper version may be preferred by those who are more comfortable with traditional filing methods. Regardless of the chosen format, ensuring accuracy and compliance with state regulations remains paramount.

Quick guide on how to complete httpsapi1ilovepdfcomv1pdfrender

Effortlessly Prepare Httpsapi1 ilovepdf comv1pdfrender on Any Device

Online document management has gained popularity among businesses and individuals alike. It offers an ideal environmentally friendly substitute for traditional printed and signed paperwork, enabling you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents promptly without delays. Manage Httpsapi1 ilovepdf comv1pdfrender on any device using the airSlate SignNow applications for Android or iOS and enhance any document-centric process today.

The Easiest Way to Edit and Electronically Sign Httpsapi1 ilovepdf comv1pdfrender Smoothly

- Access Httpsapi1 ilovepdf comv1pdfrender and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Select important sections of the documents or obscure sensitive information using specialized tools that airSlate SignNow offers for this purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and holds the same legal standing as a conventional ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose your preferred method of delivering your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious document searches, or errors that require new document copies to be printed. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and electronically sign Httpsapi1 ilovepdf comv1pdfrender and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the httpsapi1ilovepdfcomv1pdfrender

The way to generate an electronic signature for your PDF file online

The way to generate an electronic signature for your PDF file in Google Chrome

The way to make an e-signature for signing PDFs in Gmail

The way to create an electronic signature from your mobile device

The best way to make an electronic signature for a PDF file on iOS

The way to create an electronic signature for a PDF file on Android devices

People also ask

-

What is the 2021 ri 1065 form used for?

The 2021 ri 1065 form is used by partnerships to report income, deductions, gains, and losses to the state of Rhode Island. It is essential for ensuring compliance with state tax laws and providing accurate financial information to the IRS.

-

How can airSlate SignNow help with the 2021 ri 1065?

AirSlate SignNow simplifies the process of signing and sending the 2021 ri 1065 form. Our platform ensures that your documents are eSigned quickly and securely, allowing for smooth communication between partners and tax professionals.

-

What are the pricing options for airSlate SignNow in relation to the 2021 ri 1065?

AirSlate SignNow offers flexible pricing plans tailored to your business needs. Whether you are a small partnership or a larger entity, our cost-effective solutions ensure that you can manage the 2021 ri 1065 efficiently without breaking the bank.

-

Are there any integrations available for handling the 2021 ri 1065?

Yes, airSlate SignNow integrates seamlessly with various accounting software, streamlining the preparation and filing of the 2021 ri 1065. This ensures that you can easily manage your documents without disrupting your existing workflow.

-

What features does airSlate SignNow offer for the 2021 ri 1065 process?

AirSlate SignNow provides features such as customizable templates, bulk sending, and secure storage, all designed to facilitate the 2021 ri 1065 submission process. These tools enhance productivity and ensure that you meet deadlines efficiently.

-

Is airSlate SignNow user-friendly for new users handling the 2021 ri 1065?

Absolutely! AirSlate SignNow is designed with user experience in mind, making it easy for anyone to navigate. New users can quickly learn how to complete and eSign the 2021 ri 1065 form without any technical expertise.

-

What are the benefits of using airSlate SignNow for the 2021 ri 1065?

Using airSlate SignNow for the 2021 ri 1065 offers numerous benefits, including faster processing times, enhanced security for sensitive information, and increased collaboration among partners. Our solution helps ensure that you stay organized and compliant.

Get more for Httpsapi1 ilovepdf comv1pdfrender

Find out other Httpsapi1 ilovepdf comv1pdfrender

- Help Me With Sign Washington Government Presentation

- How To Sign Maine Healthcare / Medical PPT

- How Do I Sign Nebraska Healthcare / Medical Word

- How Do I Sign Washington Healthcare / Medical Word

- How Can I Sign Indiana High Tech PDF

- How To Sign Oregon High Tech Document

- How Do I Sign California Insurance PDF

- Help Me With Sign Wyoming High Tech Presentation

- How Do I Sign Florida Insurance PPT

- How To Sign Indiana Insurance Document

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document

- How To Sign Michigan Lawers Document

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document

- How To Sign Nevada Legal Document