Get the Inheritance Tax Checklist Iowa Department 2021

What is the Iowa Form 706?

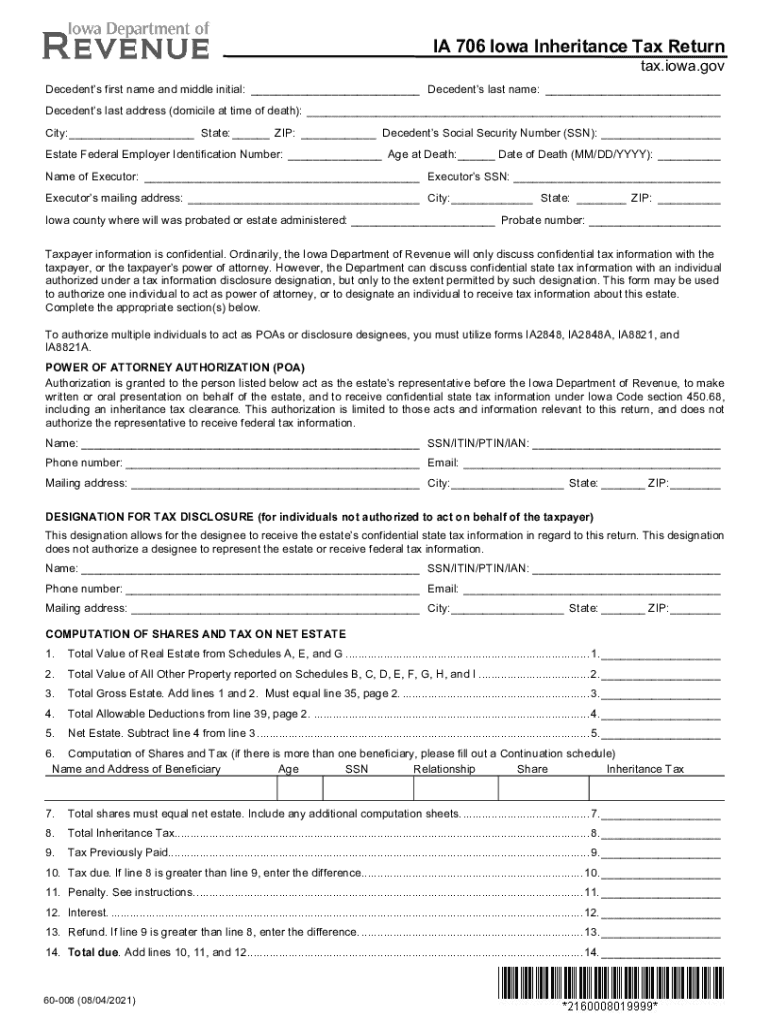

The Iowa Form 706, commonly referred to as the 706 tax return, is a form used to report inheritance tax in the state of Iowa. This form is required when an individual passes away and their estate is subject to Iowa inheritance tax. The form captures essential information regarding the deceased's assets, debts, and the beneficiaries who will inherit the estate. Understanding the details of this form is crucial for both executors and beneficiaries to ensure compliance with state tax laws.

Key Elements of the Iowa Form 706

The Iowa Form 706 includes several key components that must be accurately completed. These components typically consist of:

- Decedent Information: This includes the name, date of birth, and date of death of the deceased.

- Asset Valuation: A detailed listing of the decedent's assets, including real estate, bank accounts, and personal property, along with their fair market values.

- Debts and Liabilities: Any outstanding debts or liabilities that the estate must settle before distribution to beneficiaries.

- Beneficiary Information: Names and relationships of all individuals or entities receiving assets from the estate.

Steps to Complete the Iowa Form 706

Completing the Iowa Form 706 involves several important steps to ensure accuracy and compliance:

- Gather necessary documents, including the decedent's will, asset valuations, and debt statements.

- Fill out the decedent's information section, ensuring all details are correct.

- List all assets and their values, providing supporting documentation where necessary.

- Detail any debts and liabilities that must be paid from the estate.

- Identify all beneficiaries and their respective shares of the estate.

- Review the completed form for accuracy before submission.

Filing Deadlines for the Iowa Form 706

It is important to be aware of the filing deadlines associated with the Iowa Form 706. The form must typically be filed within nine months of the decedent's date of death. If additional time is needed, an extension may be requested, but it is crucial to ensure that the request is made before the original deadline to avoid penalties.

Required Documents for Filing the Iowa Form 706

When filing the Iowa Form 706, certain documents are required to support the information provided on the form. These documents may include:

- The decedent's will or trust documents.

- Death certificate.

- Appraisals for real estate and other significant assets.

- Statements for bank accounts and investment portfolios.

- Documentation of debts and liabilities.

Penalties for Non-Compliance with Iowa Inheritance Tax Laws

Failure to file the Iowa Form 706 or inaccuracies in the submitted information can result in penalties. These may include fines and interest on unpaid taxes. It is essential for executors and beneficiaries to ensure that the form is completed accurately and submitted on time to avoid these consequences.

Quick guide on how to complete get the free inheritance tax checklist iowa department

Complete Get The Inheritance Tax Checklist Iowa Department effortlessly on any gadget

Virtual document management has gained signNow traction among businesses and individuals. It offers an excellent eco-friendly substitute for conventional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your files promptly without interruptions. Manage Get The Inheritance Tax Checklist Iowa Department on any gadget using airSlate SignNow Android or iOS applications and enhance any document-related operation today.

How to modify and eSign Get The Inheritance Tax Checklist Iowa Department with ease

- Locate Get The Inheritance Tax Checklist Iowa Department and click on Get Form to begin.

- Utilize the tools we provide to finish your document.

- Emphasize pertinent sections of your documents or obscure sensitive data with tools that airSlate SignNow offers specifically for this purpose.

- Generate your signature with the Sign tool, which takes mere seconds and possesses the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Select your preferred method to share your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow caters to your requirements in document management in just a few clicks from a device of your preference. Modify and eSign Get The Inheritance Tax Checklist Iowa Department and ensure exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct get the free inheritance tax checklist iowa department

Create this form in 5 minutes!

How to create an eSignature for the get the free inheritance tax checklist iowa department

The way to generate an e-signature for a PDF file online

The way to generate an e-signature for a PDF file in Google Chrome

How to create an electronic signature for signing PDFs in Gmail

The way to generate an e-signature right from your mobile device

The way to create an e-signature for a PDF file on iOS

The way to generate an e-signature for a PDF on Android devices

People also ask

-

What is a 706 tax return?

A 706 tax return, commonly referred to as the United States Estate (and Generation-Skipping Transfer) Tax Return, is required for estates with a gross value exceeding the threshold set by the IRS. The return serves to calculate the total estate tax owed and must be filed within nine months after the date of the decedent's death. Understanding what is 706 tax return is crucial for executors managing estate finances.

-

Who needs to file a 706 tax return?

Typically, a 706 tax return must be filed by estates of individuals whose gross assets exceed the estate tax exemption limit. This includes all assets owned at death, such as real estate and financial investments. It’s essential for estate executors to determine if they are required to file based on the total value of the estate when considering what is 706 tax return.

-

What are the fees associated with filing a 706 tax return?

Filing a 706 tax return might incur costs, including potential legal and accounting fees for preparing the return. Fees can vary signNowly based on the complexity of the estate and the professionals engaged. Understanding these costs is vital to know how they relate to what is 706 tax return and the overall estate settlement process.

-

What information is required for a 706 tax return?

To file a 706 tax return, executors must gather comprehensive information about the deceased's assets, liabilities, and the value of property at the date of death. This includes appraisals of real property and documentation of all financial accounts. Knowing what is 706 tax return involves being prepared with this detailed financial information to ensure compliance.

-

What are the penalties for not filing a 706 tax return?

Failing to file a 706 tax return when required can lead to signNow penalties, including interest on the unpaid tax amount and additional fines. The IRS may impose costs based on the duration of the delay in filing. It is crucial for executors to understand the implications of not addressing what is 706 tax return properly to avoid these repercussions.

-

Can deductions be claimed on a 706 tax return?

Yes, a 706 tax return allows for various deductions including funeral expenses, debts, and administration costs before determining the taxable estate value. Properly claiming these deductions can signNowly affect the taxable amount due. Knowing how to navigate these deductions is a key aspect of what is 706 tax return for estate planning.

-

What is the process for filing a 706 tax return?

The process for filing a 706 tax return involves completing the form with accurate information about the estate, then submitting it to the IRS. Executors may want to consult tax professionals to ensure the return is filled out correctly and to maximize any potential exemptions or deductions. Familiarity with what is 706 tax return is beneficial during this process to simplify compliance.

Get more for Get The Inheritance Tax Checklist Iowa Department

Find out other Get The Inheritance Tax Checklist Iowa Department

- How Can I eSignature Colorado Insurance Presentation

- Help Me With eSignature Georgia Insurance Form

- How Do I eSignature Kansas Insurance Word

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation