Kentucky Inheritance Tax Return Department of Revenue 2022-2026

Understanding the IA 706 Inheritance Tax Return

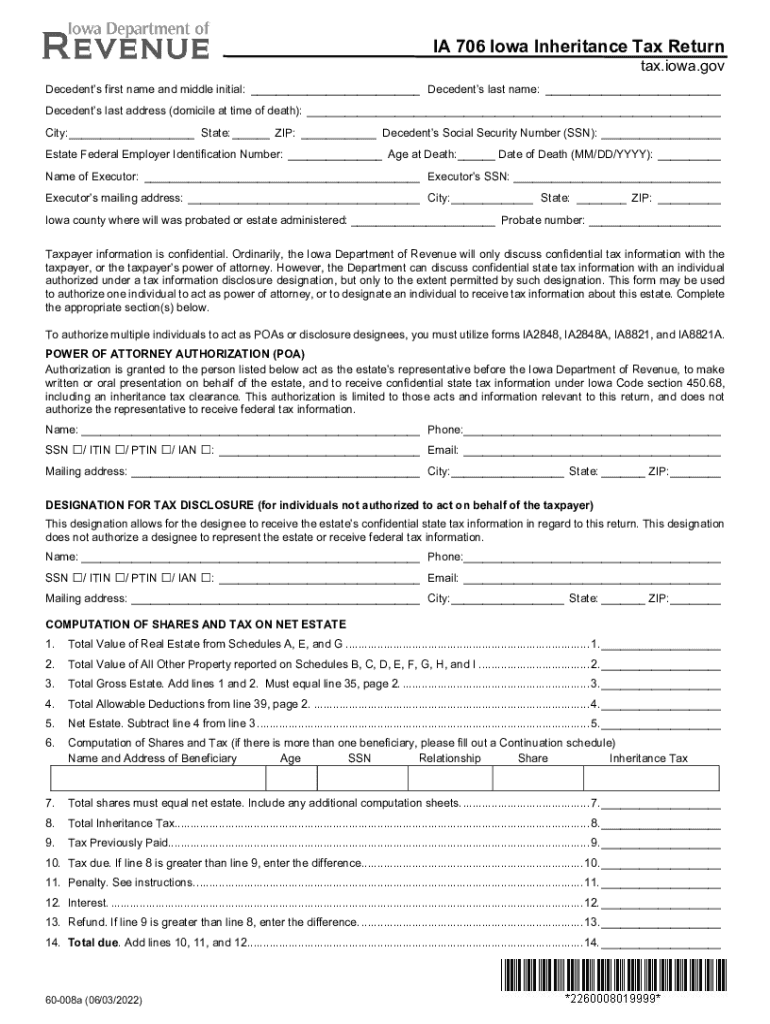

The IA 706 is an essential form used in Iowa for reporting inheritance tax obligations. It is required when an individual inherits property or assets from a deceased person. The form collects information about the decedent, the beneficiaries, and the value of the inherited assets. Proper completion of the IA 706 ensures compliance with Iowa state tax laws and helps in determining the tax liability that may arise from the inheritance.

Steps to Complete the IA 706

Completing the IA 706 involves several key steps to ensure accuracy and compliance:

- Gather necessary documents, including the decedent's will, death certificate, and asset valuations.

- Fill out the form with accurate details about the decedent and beneficiaries.

- Calculate the total value of the estate and any deductions applicable under Iowa law.

- Review the completed form for accuracy before submission.

- Submit the IA 706 to the Iowa Department of Revenue by the specified deadline.

Required Documents for the IA 706

To complete the IA 706, certain documents are essential:

- The decedent's death certificate, which verifies the date of death.

- A copy of the will, if available, to determine the distribution of assets.

- Documentation of asset values, including appraisals or bank statements.

- Any previous tax returns that may affect the current tax obligations.

Filing Deadlines for the IA 706

Timely filing of the IA 706 is crucial to avoid penalties. The form must be submitted within nine months of the decedent's date of death. If additional time is needed, an extension may be requested, but it is essential to adhere to the original deadline to ensure compliance with Iowa tax laws.

Legal Use of the IA 706

The IA 706 serves a legal purpose in the inheritance process. It is used to report the value of the estate and calculate the inheritance tax owed to the state of Iowa. Properly filing this form protects the rights of beneficiaries and ensures that the estate is settled according to Iowa law. Failure to file can result in penalties and interest on unpaid taxes.

Examples of Using the IA 706

Understanding how to use the IA 706 can be illustrated through various scenarios:

- A surviving spouse inherits a home and investments from their deceased partner and must report these assets on the IA 706.

- A child receiving a cash inheritance from a parent must complete the form to determine any tax obligations.

- Beneficiaries of a trust may need to file the IA 706 if the trust assets exceed the exemption limits set by Iowa law.

Quick guide on how to complete kentucky inheritance tax return department of revenue

Effortlessly Complete Kentucky Inheritance Tax Return Department Of Revenue on Any Device

Digital document management has become increasingly popular among businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to easily find the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly without delays. Manage Kentucky Inheritance Tax Return Department Of Revenue on any device using the airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to Modify and Electronically Sign Kentucky Inheritance Tax Return Department Of Revenue with Ease

- Find Kentucky Inheritance Tax Return Department Of Revenue and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of the documents or obscure sensitive data with features that airSlate SignNow provides specifically for that purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose your preferred method of sending your form, whether by email, SMS, invite link, or downloading it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choosing. Alter and electronically sign Kentucky Inheritance Tax Return Department Of Revenue to ensure seamless communication throughout your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct kentucky inheritance tax return department of revenue

Create this form in 5 minutes!

How to create an eSignature for the kentucky inheritance tax return department of revenue

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the ia 706 in the context of airSlate SignNow?

The ia 706 is a key feature within airSlate SignNow that allows users to efficiently manage and execute electronic signatures on important documents. This feature ensures compliance and security while streamlining the signing process, making it easier for businesses to achieve their goals.

-

How much does the ia 706 feature cost with airSlate SignNow?

The cost of accessing the ia 706 feature is included in the subscription plans of airSlate SignNow. Various pricing tiers cater to different business sizes and needs, ensuring that you get the best value for such powerful eSigning capabilities.

-

What are the main benefits of using the ia 706 with airSlate SignNow?

By utilizing the ia 706, businesses can signNowly reduce the time spent on document signing and improve workflow efficiency. It also enhances the security and legality of signed documents, ensuring that all electronic transactions are compliant with necessary regulations.

-

What types of documents can I sign using the ia 706 feature?

The ia 706 feature in airSlate SignNow supports a wide range of document types, including contracts, agreements, and forms. This versatility allows users to streamline the signing process for various legal and business documents, regardless of industry.

-

Does the ia 706 integrate with other software applications?

Yes, the ia 706 feature seamlessly integrates with numerous third-party applications and platforms, enhancing your overall productivity. These integrations allow you to connect airSlate SignNow with tools that your business already uses, ensuring a smooth workflow.

-

Is the ia 706 feature suitable for businesses of all sizes?

Absolutely! The ia 706 feature is designed to cater to businesses of all sizes, from startups to large enterprises. Its user-friendly interface and powerful capabilities make it a valuable tool for any organization seeking efficient document signing.

-

Can I customize my document templates when using the ia 706?

Yes, with the ia 706 feature in airSlate SignNow, users can easily create and customize document templates to suit their specific needs. This flexibility allows businesses to standardize their contracts and forms while maintaining a professional appearance.

Get more for Kentucky Inheritance Tax Return Department Of Revenue

- New state resident package south dakota form

- Commercial property sales package south dakota form

- General partnership package south dakota form

- Statutory living will south dakota form

- South dakota contract deed form

- South dakota will form

- Power of attorney forms package south dakota

- Revised uniform anatomical gift act donation south dakota

Find out other Kentucky Inheritance Tax Return Department Of Revenue

- eSign California Business Operations LLC Operating Agreement Myself

- Sign Courts Form Mississippi Secure

- eSign Alabama Car Dealer Executive Summary Template Fast

- eSign Arizona Car Dealer Bill Of Lading Now

- How Can I eSign Alabama Car Dealer Executive Summary Template

- eSign California Car Dealer LLC Operating Agreement Online

- eSign California Car Dealer Lease Agreement Template Fast

- eSign Arkansas Car Dealer Agreement Online

- Sign Montana Courts Contract Safe

- eSign Colorado Car Dealer Affidavit Of Heirship Simple

- eSign Car Dealer Form Georgia Simple

- eSign Florida Car Dealer Profit And Loss Statement Myself

- eSign Georgia Car Dealer POA Mobile

- Sign Nebraska Courts Warranty Deed Online

- Sign Nebraska Courts Limited Power Of Attorney Now

- eSign Car Dealer Form Idaho Online

- How To eSign Hawaii Car Dealer Contract

- How To eSign Hawaii Car Dealer Living Will

- How Do I eSign Hawaii Car Dealer Living Will

- eSign Hawaii Business Operations Contract Online