Ia 706 Form 2014

What is the Ia 706 Form

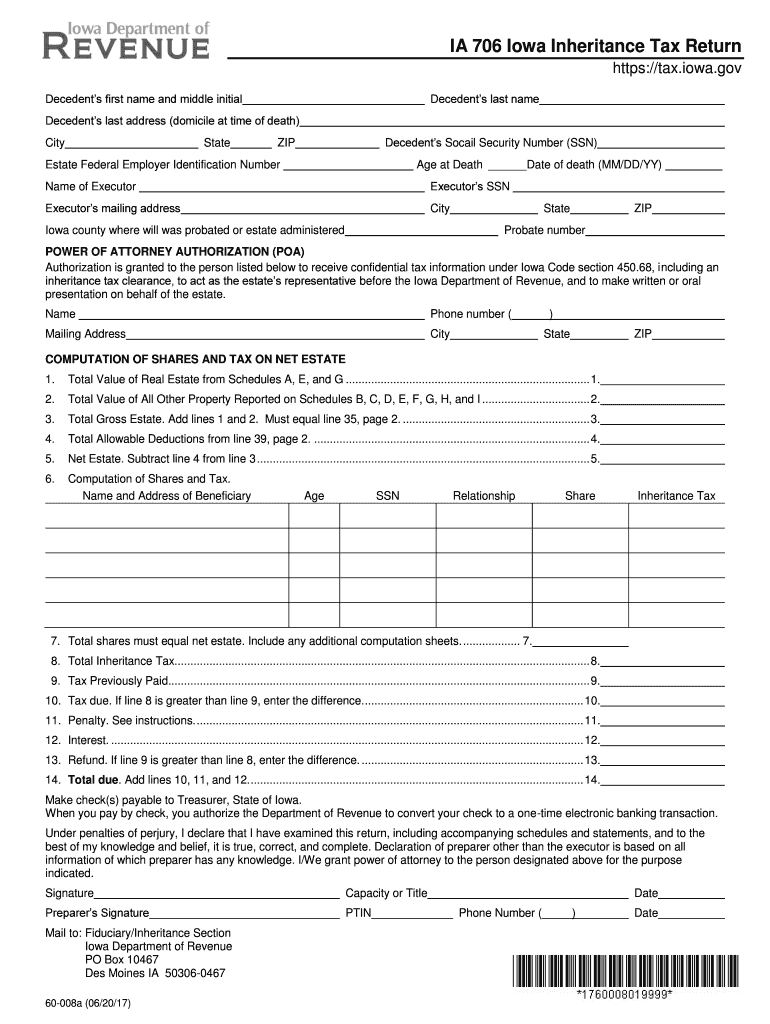

The Ia 706 Form is a tax document used primarily for estate tax purposes in the United States. It is formally known as the United States Estate (and Generation-Skipping Transfer) Tax Return. This form is essential for reporting the value of an estate and calculating any taxes owed to the Internal Revenue Service (IRS) upon the death of an individual. The form is typically required when the gross estate exceeds a certain threshold, which is adjusted periodically by the IRS. Understanding the Ia 706 Form is crucial for executors and beneficiaries to ensure compliance with federal tax laws.

How to use the Ia 706 Form

Using the Ia 706 Form involves several steps that require careful attention to detail. First, gather all necessary information regarding the deceased's assets, liabilities, and any applicable deductions. This includes real estate, bank accounts, investments, and personal property. Next, accurately fill out the form by reporting the fair market value of the estate at the time of death. It is important to follow the specific instructions provided by the IRS to avoid errors that could lead to penalties. Once completed, the form must be signed and submitted to the IRS by the designated deadline.

Steps to complete the Ia 706 Form

Completing the Ia 706 Form involves a systematic approach to ensure accuracy and compliance. Here are the key steps:

- Gather all relevant financial documents related to the deceased's estate.

- Determine the date of death and the fair market value of the estate's assets.

- Fill out the form, starting with identifying information, such as the decedent's name and Social Security number.

- Report all assets and liabilities, ensuring to include any deductions or credits applicable to the estate.

- Review the completed form for accuracy and completeness.

- Sign and date the form before submission.

Legal use of the Ia 706 Form

The Ia 706 Form serves a legal purpose in the estate tax process. It is required by the IRS to determine the estate's tax liability and ensure that the appropriate taxes are paid. Filing this form is not just a matter of compliance; it also protects the estate from potential legal disputes regarding tax obligations. Executors must ensure that the form is filed accurately and on time to avoid penalties. Legal counsel is often advisable to navigate the complexities of estate tax law and ensure proper filing.

Filing Deadlines / Important Dates

Filing deadlines for the Ia 706 Form are critical to avoid penalties. Generally, the form must be filed within nine months of the decedent's date of death. However, an extension may be requested, allowing for an additional six months to file. It is essential to keep track of these dates, as failure to file on time can result in significant penalties and interest on unpaid taxes. Executors should also be aware of any state-specific deadlines that may apply to estate tax filings.

Required Documents

To complete the Ia 706 Form, several supporting documents are necessary. These may include:

- Death certificate of the decedent.

- Documentation of all assets, including appraisals for real estate and personal property.

- Records of debts and liabilities owed by the estate.

- Previous tax returns, if applicable, to assist in determining deductions.

- Any relevant legal documents, such as wills or trusts.

Quick guide on how to complete ia 706 2014 form

Manage Ia 706 Form effortlessly on any device

Digital document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents rapidly without delays. Handle Ia 706 Form across any platform with airSlate SignNow Android or iOS applications and simplify any document-related task today.

The optimal way to adjust and eSign Ia 706 Form with ease

- Locate Ia 706 Form and click on Get Form to begin.

- Utilize the tools provided to fill out your form.

- Mark important sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Generate your eSignature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional handwritten signature.

- Verify the details and click on the Done button to save your changes.

- Choose your preferred method to deliver your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Modify and eSign Ia 706 Form to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ia 706 2014 form

Create this form in 5 minutes!

How to create an eSignature for the ia 706 2014 form

How to make an electronic signature for your Ia 706 2014 Form online

How to create an eSignature for the Ia 706 2014 Form in Chrome

How to generate an eSignature for signing the Ia 706 2014 Form in Gmail

How to make an eSignature for the Ia 706 2014 Form straight from your smart phone

How to make an electronic signature for the Ia 706 2014 Form on iOS devices

How to generate an eSignature for the Ia 706 2014 Form on Android OS

People also ask

-

What is the Ia 706 Form and why is it important?

The Ia 706 Form is a crucial document used for filing estate tax returns in Iowa. It allows executors to report the value of an estate, ensuring compliance with state tax laws. Understanding the Ia 706 Form is essential for proper estate administration and tax planning.

-

How can airSlate SignNow help in managing the Ia 706 Form?

airSlate SignNow simplifies the process of completing and submitting the Ia 706 Form by providing an easy-to-use platform for eSigning and sending documents. You can quickly gather signatures from relevant parties, ensuring that all necessary documentation is provided on time. This streamlines your estate planning process and mitigates potential delays.

-

Are there any costs associated with using airSlate SignNow for the Ia 706 Form?

Yes, while airSlate SignNow offers a cost-effective solution for eSigning and managing the Ia 706 Form, the pricing plans vary depending on the features and usage you need. You can choose a plan that best fits your needs, whether you're an individual executor or a large estate management firm.

-

What features does airSlate SignNow offer for the Ia 706 Form?

airSlate SignNow provides various features such as templates, secure cloud storage, and automatic reminders to help you manage the Ia 706 Form efficiently. These tools enhance the eSigning experience by ensuring all documentation is organized and readily accessible, thus enhancing productivity.

-

Can I integrate airSlate SignNow with other software for the Ia 706 Form management?

Absolutely! airSlate SignNow offers seamless integration with various applications, making it easier to manage the Ia 706 Form alongside your other business tools. This integration allows for smoother workflows, ensuring your estate documents are processed swiftly and securely.

-

What are the benefits of using airSlate SignNow for the Ia 706 Form?

Using airSlate SignNow for the Ia 706 Form offers multiple benefits, including faster document turnaround, enhanced security, and reduced paper usage. By digitizing the signing process, you save time and reduce the risk of errors, providing peace of mind during estate dealings.

-

Is it safe to use airSlate SignNow for the Ia 706 Form submissions?

Yes, airSlate SignNow employs advanced security measures to protect your data when completing and submitting the Ia 706 Form. This includes encryption and secure cloud storage, ensuring compliance with data protection regulations while maintaining the privacy of your sensitive information.

Get more for Ia 706 Form

Find out other Ia 706 Form

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors